The Tokenist Editor-in-Chief, Shane Neagle writes a guest article.

Bitcoin has pushed financial innovation in many directions. It opened the door to transparency as a distributed ledger and provided a viable banking alternative. Bitcoin’s proof-of-work algorithm created digital scarcity. The digital world is still tied to the physical realm of hardware assets and power requirements.

All of this, while still being open-source. Bitcoin’s nature of open-source has led to more than a hundred forks. These ledgers are governed by different rulesets and are so incompatible with the previous blocks that a new version of blockchain is created.

When a hard-fork is created by different visions for P2P incentives and money, a brand new version is born. Bitcoin Cash, Bitcoin SV, Bitcoin XT and Bitcoin gold are the four largest by market cap. They may not even come close to Bitcoin (BTC)’s massive $1.47 trillion market cap, but they have many interesting ideas for the future of Bitcoin.

What is Bitcoin Forks?

Bitcoin was not going to survive without major changes. A Peer-to-Peer Electronic Cash System As Satoshi Nakamoto intended originally.

Bitcoin’s networks would need to perform as well as Visa and Mastercard networks in order to make this kind of vision work. These networks are based on centralized databases, such as VisaNet. They emphasize efficiency over all else.

Visa, as an intermediary of money between banks, does not have any concern for financial sovereignty.

But how could this be done with a network of computers that is decentralized? Each transaction must be confirmed by other nodes for the proof-of work consensus to remain. Bitcoin currently performs at around 7 transactions per seconds, since it takes 10 minutes for each block to be confirmed.3,347 transactions per block at present).

This approach to ledger maintenance has several implications:

- Bitcoin transaction fees increase as transactions increase. Bitcoin miners can create friction by setting the level of fees priority. Bitcoin Mempool SpaceAs the demand for Bitcoin mining networks increases, the price of the network will increase.

- Bitcoin is a poor alternative to traditional currencies if the popularity of Bitcoin leads to higher transaction fees. “daily money” It is important that the friction of the product be as low as possible to ensure mass adoption.

- The Bitcoin network will become more centralized if the obvious solution to increase transaction block size is implemented. This would require more computing power and storage space in order to process transactions.

Bitcoin hard forks were primarily concerned about the balance between block sizes. When Mike Hearn released Bitcoin XT in August 2015 as a hard fork of Bitcoin core, this version was intended to increase the block size from 1MB to 8MB and then double every two years.

We can see that other Bitcoin hard-forks have failed in a similar way.

How do hard forks get made?

Bitcoin hard forks can be created by introducing new Bitcoin Improvement Proposals. They are also the starting point for new features, alongside bug fixes. Those new features will only be implemented if a threshold of activation is met, which represents 95% support for miners.

The last 2,016 block (roughly two weeks of mining), would need to show their support in order for a BIP to be implemented.

When Mike Hearn introduced Gavin Anderson and their BIP 101 proposal to increase maximum block size, from 1 MB to 8 MB, it failed to pass the activation threshold. Hearn claimed that “Bitcoin has failed”Only his BIP 101 was a failure. Bitcoin XT is the version that was aborted.

The forks that look like this lead to the creation of new coins unlike tokens – the latter of which are often created on pre-existing blockchains. Bitcoin Classic (BXC), a new version of Bitcoin XT whose block size had been reduced from 8 MB in XT to 2 MB was the next one to emerge. This is yet another example of how Bitcoin hard forks are a balance between block sizes.

These are some of the best ways to get started. “block wars”Bitcoin Cash (BCH), which had increased the block size from 16 MB to 32 MB, also appeared in August 2017. BCH is the most successful hard fork. Its market cap currently stands at $7.26 billion.

Even moderately popular splits come with their own forks. Craig Wright, an Australian entrepreneur, introduced a BCH split called Bitcoin Satoshi Vision BSV a year after the original fork. This was in November 2018. He claimed to be Satoshi, but was revealed by the UK High Court as a fraud.

Forged in the Crucible of Adversity

Gavin Anderson, who was a member of Bitcoin Core (the primary framework of Bitcoin), has served his purpose by submitting hard forks that failed to meet the BIP requirements.

The Block Size Wars were won by the Block Size Wars. “small blockers”The contested debate resulted in the implementation of Segregated witness (SegWit), which was activated in August 2017 at block 477.120.

SegWit, through BIPs 91, 141, and 148 made Bitcoin transactions more efficient, by separating witness metadata from main transaction. The block size was increased by 4x when block weight was introduced.

SegWit was most importantly the first step in Bitcoin’s layer 2 scaling solution Lightning Network. It enabled Schnorr signings. These make it possible for Atomic Multi-Path (AMPThe signatures are smaller and more efficient.

AMP allows users optimize payment routing via LN channels. Payers only need to know recipient’s public keys. Ultimately, the series of Bitcoin forks which failed to gain much traction led to a new type of Bitcoin scaling.

Combining LN with smart contracts may lead to a breakthrough in scaling. Futures contracts As they would need to be so fast and deep in liquidity. Lightning Network is a technology that has been recognized by the Federal Reserve Bank of Cleveland. “daily money” Then, you can get in touch with us. Paper Title Lightning Network: Bitcoin to Money.

“Our findings suggest that the off-chain netting benefits of the Lightning Network can help Bitcoin to scale and function better as a means of payment. Centralization of the Lightning Network does not appear to make it much more efficient, though it may increase the proportion of low fee transactions.”

Hard forks may find a niche in the payments industry. There will always be a demand for online invoice factoring Or obtaining trade credits for small and medium business (SMBs).

In retrospect, it is not surprising that Bitcoin continued to use a conservative block-size while adding LN.

Security risks and network vulnerabilities

As a new and innovative monetary system, Bitcoin was a significant novelty. It was important to adopt a conservative approach in the early stages. Bitcoin must maintain its core features if it is to be perceived as a sound currency by the public.

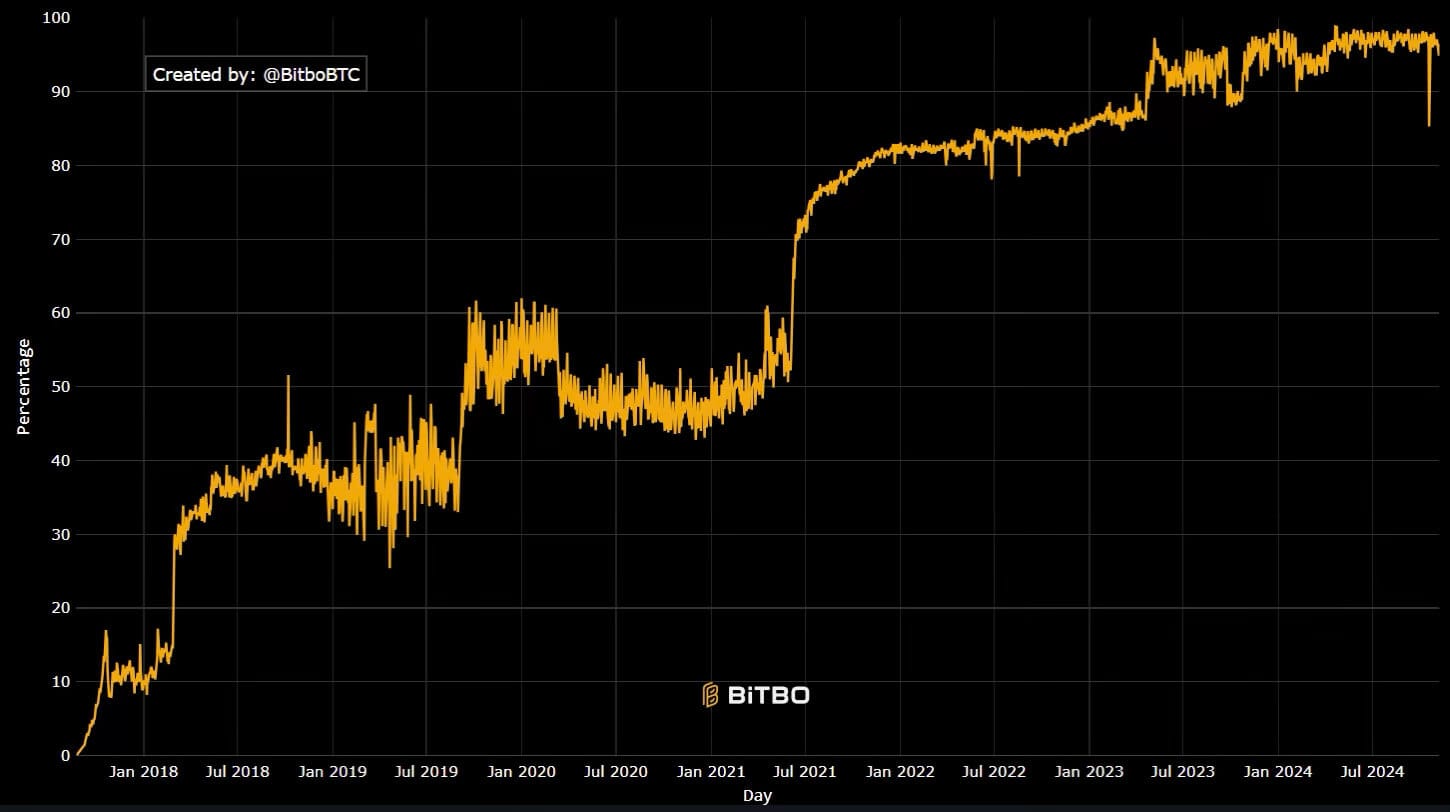

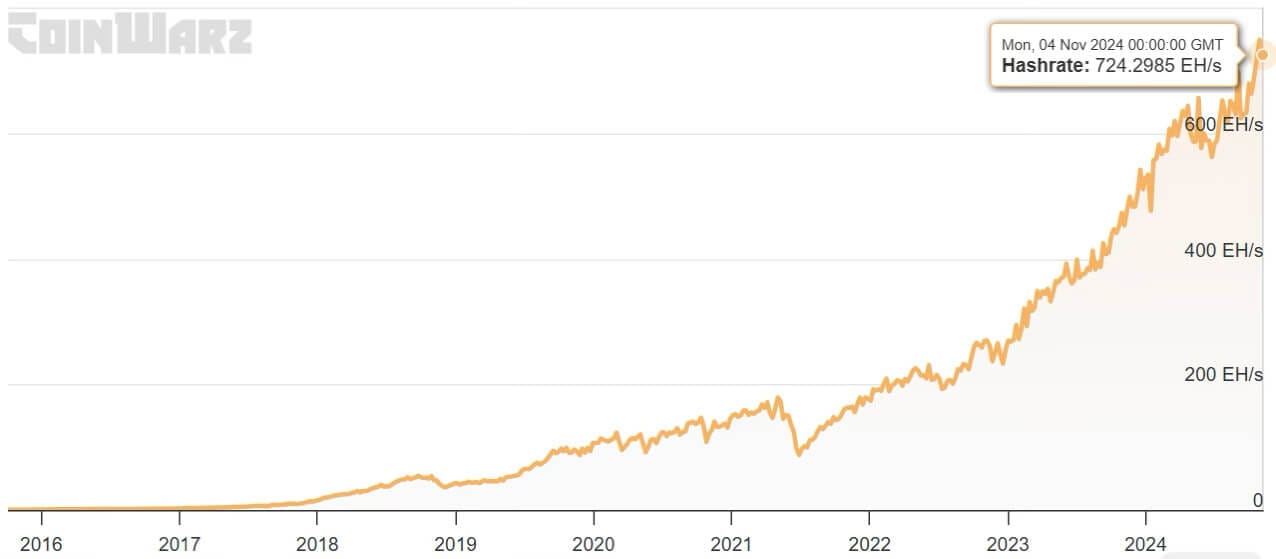

Hard forks create a vulnerability in security by reducing the hash power. Bitcoin’s value comes from its hash rate. It is the number of calculations required by mining rigs to add valid blocks and solve cryptographic puzzles, in exchange for BTC.

The hashrate of the miner will determine their chances to win BTC. Bitcoin’s network difficulty adjusts itself every 2,016 blocks or two weeks as more computing capacity is added to its network.

A decrease in hash power makes it more likely that a 51% network attack It is possible to succeed. The new hard fork will not only drain computing power but also create an increased level of risk when the new version is released.

This means that Bitcoin miners prioritize network security and innovation over each other.

In the end, even if a successful hack on the Bitcoin network is publicized once, it will serve to deflate its value forever. In that case, innovation will be put on the back burner. Accordingly, the Bitcoin hashrate has only one trajectory – up.

Bitcoin mainnet has so much computing power that a BTC price decline would not be a problem. In this scenario, some mining operations may be able to survive. Exit the network Losses will lower the mining difficulty.

Bitcoin’s network will survive due to its conservative and security-oriented approach.

Market Volatility & Investor Sentiment

Seven years ago, Bitcoin Cash (BCH), as the first hard fork, had its highest ever price of $4355. The peak price of Bitcoin Cash (BCH) was at the end 2017 after it launched in August 2017. The pattern of Bitcoin SV and many other altcoins is well-known.

- Initial speculative booster.

- Prices are now lower and further away from previous peaks.

During the period when the Federal Reserve increased the money supply by +$6 Trillion M2 in 2020-2021 and accompanied it with stimulus checks, the hard forks also mirrored this spike. BSV and BCH were in high-risk territory after the liquidity spigot had been shut off by the Federal Reserve with the start of the interest rate hike cycle in March 2022.

Consider the following:

- There is a limited amount of capital available.

- Crypto-currency has even less capital.

- Cryptocurrencies are perceived to be riskier than stocks because they are a new digital currency.

Consequently, the beneficiary of most capital would go to the original and most secure cryptocurrency – Bitcoin.

The conclusion of the article is:

This valuation pattern will make it increasingly unlikely for Bitcoin hard-forks to gain traction in the future or over Bitcoin. Altcoins, in the eyes of investors are contrasted with stocks that are based upon companies which have hard assets and earnings.

Bitcoin’s original version is an exception, owing to its massive computing network which brings in hard assets. Even though hard forks tried to do the same thing, they paled in comparison. This puts them on par with generic proof of stake altcoins.

In that ecosystem, heavyweights such as ethereum are now the center of gravity. Bitcoin hard forks may receive a temporary price boost due to their smaller market caps than Bitcoin. It is possible to profit from this, but it also applies to the entire altcoin ecosystem.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.