Bitcoin has an inflation rate positive of 0.83 %. Bitcoin’s inflation is extremely low compared to the dollar’s peak of 9.1% in 2022. However, when we compare the cumulative inflation rate for both Bitcoin and the US dollar, we see the true strength of Bitcoin’s role in preserving wealth.

Bitcoin rose by approximately 960% from 2020 to 2025. In nominal terms, the US Dollar Index DXY, which measures US dollars against a basket or other currencies rose only 12%.

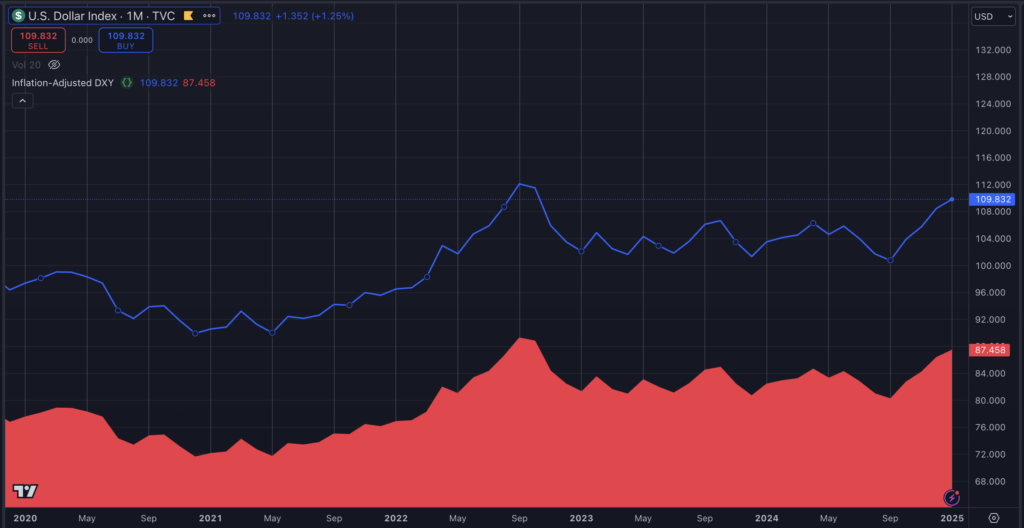

Bitcoin’s inflation-adjusted price and the DXY, normalized for inflation, provide critical insights into the real value dynamics of both assets. The nominal DXY is a measure of relative strength in the currency, but its inflation-adjusted price highlights the erosion of purchasing powers.

In the face of macroeconomic uncertainties, DXY is currently trading at 109.8. However, when adjusted for cumulative US inflation since 2020—averaging over 2% annually and peaking above 8% in 2022—the real value of the DXY drops to 87.5. This represents a 22.3-point difference, or roughly 20.3% of the nominal value, illustrating the dollar’s substantial loss of purchasing power over time despite its relative strength against other currencies.

Bitcoin’s nominal price, meanwhile, is around $91,000. Adjusted for its low supply inflation—1.74% annually from 2020–2024 and 0.83% in 2025—its inflation-adjusted price stands at approximately $84,365. The $6,635 difference represents only 7.3% of its nominal value, stressing Bitcoin’s relative stability and ability to preserve purchasing power over time compared to fiat currencies. This smaller adjustment highlights Bitcoin’s programmed scarcity and low inflation as key factors in its resilience.

The difference between inflation-adjusted DXY metrics and Bitcoin highlights a larger narrative. While fiat currencies like the dollar face significant devaluation due to inflation, Bitcoin’s controlled supply forces position it as a hedge against currency debasement. DXY has a more marked inflationary impact, which highlights how difficult it is to maintain purchasing power when using a fiat-based system.

It is important to understand the difference between nominal metrics and inflation adjusted metrics when evaluating long-term asset values. The DXY’s nominal strength masks the fundamental erosion of the dollar’s purchasing power, while Bitcoin’s inflation-adjusted price reflects its ability to maintain value over time. These insights highlight the need for inflation-adjusted macroeconomic analyses to help develop strategies that are effective.

To identify the exact divergence, it is also important to consider the inflation rate of the comparison currencies that were used in establishing the DXY. However, the above figures give a ballpark assessment of Bitcoin’s elevated strength against the dollar beyond nominal terms.

By 2020, $100 invested in Bitcoin would equal $927 in purchasing power, while $100 invested in DXY in today’s terms would amount to just $91 dollars.

Post in: Analysis, Bitcoin, US The Author ![]()

![]()

Liam ‘Akiba’ Wright

Also known as “Akiba,” Liam Wright, a journalist, is also a podcast producer and the Editor-in Chief at CryptoSlate. He is a firm believer that the decentralized technologies have the power to bring about positive changes.

Liam@akibablade.com LinkedIn Editor

News Desk

CryptoSlate provides a complete and contextualized resource for cryptocurrency news, data, and insights. Focusing on Bitcoin macro, DeFi, and AI.

Twitter Email Editor @cryptoslate

CryptoSlate for X x.com/cryptoslate

CryptoSlate for X x.com/cryptoslate

Receive the latest news on crypto and insights from experts. Daily updates.

Follow @cryptoslate Ad

The Latest US Storys

Four of the top 20 Bitcoin ETFs in AUM are celebrating their first birthday with Spot Bitcoin.

ETF Three days ago

IBIT topped the list, followed by FBTC and ARKB.

Vast majority of financial advisors’ clients asked about crypto in 2024 – Bitwise

Adoption Three days ago

Financial advisors who invest in cryptocurrency plan to increase or maintain their exposure by 2025.

North Dakota legislators want to include Bitcoin into the state Treasury

As you can see, the Crypto Currency is a good alternative to other currencies. Three days ago

North Dakota has joined a list of other states that are considering the use of digital assets as a way to protect their state treasury from economic fluctuations.

US regulator proposes rule for crypto wallets to be held accountable when they are hacked

Search for a Crypto Currency Three days ago

The rule, if approved, would make wallet providers responsible for hacks even in the case of negligence.

The Latest Bitcoin Storys

Bitcoin, XRP and other crypto investments see a modest inflow of $48 Million.

Investments Just 1 hour earlier

Bitcoin remains the most popular crypto asset as it is sensitive to changes in macroeconomic conditions.

Four of the top 20 Bitcoin ETFs in AUM are celebrating their first birthday with Spot Bitcoin.

ETF Three days ago

IBIT topped this list with FBTC, ARKB, and BITB all making it.

Vast majority of financial advisors’ clients asked about crypto in 2024 – Bitwise

Adoption Three days ago

Financial advisors who invest in cryptocurrency plan to increase or maintain their exposure by 2025.

North Dakota lawmakers want to include Bitcoin into the state Treasury

You Can Buy It Three days ago

North Dakota has joined a list of other states that are considering the use of digital assets as a way to protect their state treasury from economic fluctuations.

Recent Press Releases

View All

Qiro Finance Partners With Plume Network To Tokenize Up to $50M In Private Credit Assets Online

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.