Bitcoin dropped below $100,000 in the Asian trading session as a result of widespread volatility on both stock and crypto markets.

According to CryptoSlate’s data, BTC declined by more than 6% during the last 24 hours to as low as the $97,000 level before recovering to $99,290 as of press time.

The drop breaks the momentum that pushed Bitcoin to its all-time high of $109,000 ahead of US President Donald Trump’s inauguration. Analysts say that the current decline signals an end to the Trump-induced market rally of late 2024.

Arthur Hayes is the co-founder and CEO of BitMEX. He warned about further drops. He said Bitcoin may briefly fall to $75,000 and $70,000 but remain bullish in the long-term.

Hayes predicts that Bitcoin’s value will reach $250,000 by the end of this year, citing financial instability as a key driver.

Meanwhile, other major cryptocurrencies mirrored Bitcoin’s trajectory. Ethereum, BNB Solana XRP Dogecoin Cardano and Cardano all lost between 4% to 9%. This reflects the general market caution.

Even the stock market can fall.

The ripple effect from the decline in the crypto markets was evident also on US stock indexes. Futures for Nasdaq 100 fell over 2%.

Kobeissi Letter, which estimated that US stock markets may lose up to $1 trillion worth of market value in the near future, highlights investor concern.

The firm attributed the market turbulence to DeepSeek’s growing popularity, which propelled it to the top spot in the App Store and fueled concerns over its impact on major US tech firms.

DeepSeek is a Chinese artificial intelligence company whose free and open-source R1 model has overtaken OpenAI’s ChatGPT performance. Marc Andreessen of Venture Capital described it as:

“AI’s Sputnik moment.”

Liquidation frenzy

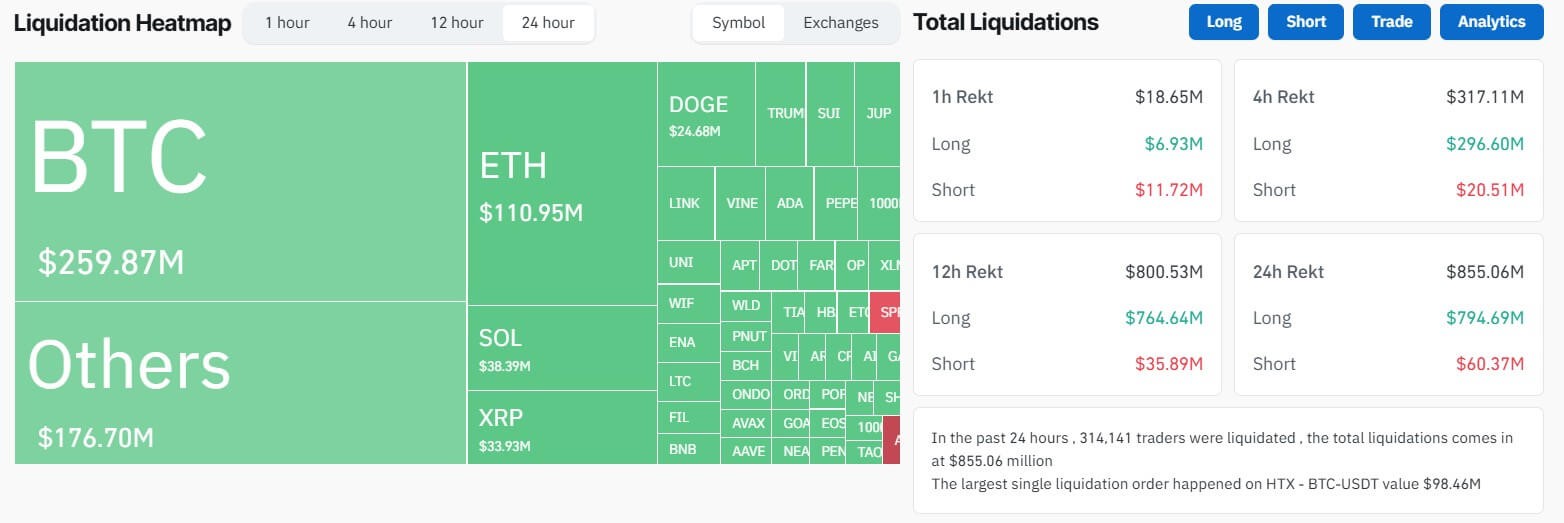

Data from CoinGlass shows that over $855 billion was lost due to the widespread volatility of crypto markets. More than 313,000 traders were affected.

According to the data, long traders—those betting on price increases—suffered the heaviest losses, accounting for $794 billion. Short traders lost $59m on the other hand.

Bitcoin traders were the worst hit, as they suffered losses of around $259 Million, including $247.5 millions from their long positions. Ethereum traders were next, registering $110 in losses, including $104.8 from long positions.

The biggest single liquidation took place on HTX. It involved a BTC/USDT long of $98 millions.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.