A recent Clear Street Report indicates that Bitcoin miners have adopted yield strategies to maximize their BTC and are diversifying in AI computing.

The report, titled ‘BTC Mining: 2025’s Key Themes Emerge,‘ outlines three themes for 2025: generating revenue on bitcoin reserves, leveraging existing infrastructure for HPC initiatives, and benefiting from a shift in US regulatory leadership.

The Bitcoin spot ETF and its yield has been upgraded

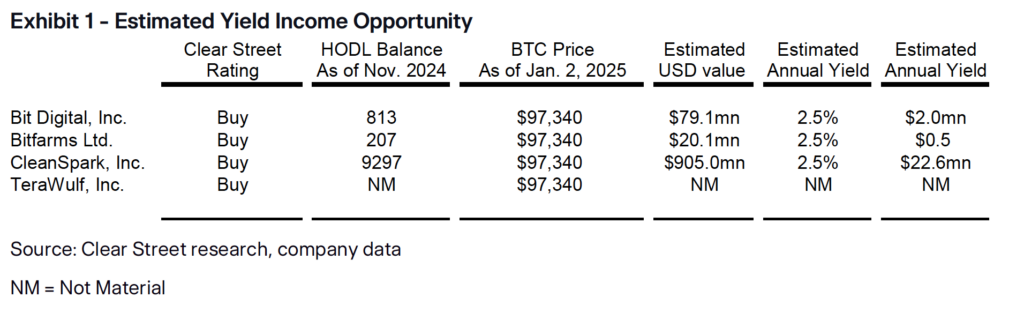

Clear Street’s authors indicate that several miner management teams are investigating ways to create income from stored BTC, with securities lending described as a potentially viable approach pending regulatory adjustments. A new SEC position could allow in-kind creations of BTC ETF shares. This would enable miners to convert bitcoin directly into ETF units, and then partner with prime broker on the share lending income. For general collateral, yields of low- to mid-single-digits have been noted. However, higher rates could apply if ETFs become more difficult to borrow.

Clear Street concludes that legal reforms would put BTC security lending at par with more traditional lending, causing sector players to concentrate on the operational details. The analysis shows that CleanSpark is a leading HODLer and will be able to earn millions per year in interest if strategies grow. Bit Digital Bitfarms and TeraWulf have been cited as having a variety of holdings or strategies, such as staking or not keeping Bitcoins at all depending on the corporate policy. Clear Street believes that yield mechanisms like this could help miner optimize their large-scale operations and unlock new revenue streams.

HPC and AI Diversification

This report highlights the growing shift towards HPC computing, as miners are repurposing their data centers, advanced equipment, and power sources to support AI workloads. Authors see companies diversifying earnings outside of mining. Bit Digital has been reported to be transforming into a Montreal data center via acquisitions. The company is reportedly aiming to attract HPC customers for stable rates and potential upside. TeraWulf has been noted for an HPC contract that may expand up to 100 MW in capacity and target demand for AI complex research. Clear Street’s figures show that HPC services can generate appealing per-megawatt revenues, with margin ranges depending on data center configuration and contract size.

According to the report, political shifts may also bolster the industry’s outlook. President Trump’s administration is portrayed as friendlier to Bitcoin interests due to potential changes at the SEC and Department of Energy and more open views on BTC products. Trump’s nominee for SEC chair, Paul Atkins, has past involvement in digital asset initiatives, and the proposed Treasury Secretary, Scott Bessent, is seen as more receptive to crypto than previous leadership.

But the study warns of possible uncertainties if federal budget cuts or changes to energy policies are made, particularly in cases where renewable energy credits have been modified. Clear Street points out that reduced government expenditures could also reduce inflationary forces, something some investors consider beneficial for Bitcoin.

Based on current HPC plans, valuations and expansion potential of companies, the analysis highlights top choices.

Clear Street suggestions for Bitcoin Miners

Bit Digital’s (BTBT), whose revenue model has shifted from asset-light mining to HPC, is rated a buy. Management cites a potential pipeline of data center tenants. CleanSpark, a pure-play miner with best-in class energy strategies as well as growth prospects through 2027 is presented by the analysts. TeraWulf’s (WULF), which has a higher multiple than others, aims to justify this with improved mining metrics and new HPC contracts. Bitfarms, a BTC specialist with stable energy contracts is reportedly ready to enter the HPC market in 2025.

Per Clear Street, these projections rest on each firm’s capacity to scale data center operations, secure or renew power agreements, and navigate final regulatory steps for securities lending. They emphasize the importance of clarity coming from SEC regarding in-kind BTC ETF shares creation.

The projections indicate that the revenue of participating miners will grow as new technologies mature and more capital is invested by institutional investors seeking to increase their exposure to digital asset. Bitfarms, Bit Digital, CleanSpark, and TeraWulf remain in focus based on Clear Street’s current forecasts.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.