The world of cryptocurrency can really feel like a maze, particularly with over 1,600 exchanges accessible in the present day, in line with Blockspot.io. For newcomers, the choices may be overwhelming.

Every alternate provides its personal mix of options, buying and selling pairs, and charge buildings, so it’s essential you’re taking the time to judge your decisions earlier than diving in. Key elements like safety, consumer expertise, liquidity, and the number of property on provide are essential for making a secure and environment friendly buying and selling atmosphere.

With safety breaches and regulatory hurdles popping up ceaselessly, assessing an alternate's reliability is paramount. It's not nearly security, both — having a various vary of buying and selling choices, a user-friendly interface, and responsive buyer assist can enormously improve your buying and selling expertise.

Bybit is one alternate that checks all of those packing containers. Nevertheless, can Bybit actually be trusted?

On this Bybit evaluate, we offers you every thing you could know concerning the alternate.

Bybit Review Abstract:

Bybit is a well-liked cryptocurrency alternate recognized for its high-leverage buying and selling choices, providing as much as 100x on derivatives and a user-friendly platform with superior options like copy buying and selling, buying and selling bots, and Bybit Earn. It boasts robust safety measures, together with chilly storage and multi-signature wallets, making certain a safe buying and selling atmosphere.

Bybit Key Options:

- Nice Collection of Tradeable Property- Bybit provides a variety of buying and selling devices together with derivatives, spot, and instantaneous purchase crypto options.

- Skilled Grade Buying and selling & Matching Engine- Bybit is thought for its ultra-fast matching engine and instantaneous commerce execution.

- Multilingual Help– Bybit provides good buyer assist, accessible in a number of languages.

- Leverage buying and selling accessible

- NFT Market

- Fiat Withdrawals

- Crypto Loans

- Bybit Copy Buying and selling

- Bybit crypto debit card

Notice: Customers positioned within the US and UK usually are not supported.

👉Signal as much as Bybit Exchange!

Bybit Overview

| HEADQUARTERS: | Dubai |

| YEAR ESTABLISHED: | 2018 |

| REGULATION: | Granted an in principal license as a Digital Asset Service Supplier in Dubai. Regulated by the authorities in Cyprus |

| SPOT CRYPTOCURRENCIES LISTED: | 100+ |

| NATIVE TOKEN: | The Bybit alternate doesn’t have a local token. Nevertheless, it has launched the BIT token for BitDAO. |

| MAKER/TAKER FEES: | Spot Buying and selling – From 0.1% maker/0.1% taker Perpetual and Futures Contract- 0.02% maker/ 0.055% taker charges Choices- 0.03% Maker/ 0.03% Taker Customers with VIP standing unlock charge reductions |

| SECURITY: | 2FA, Chilly Storage of Property, Multi-Sig wallets, Insurance coverage Fund |

| BEGINNER-FRIENDLY: | Sure |

| KYC/AML VERIFICATION: | Required |

| FIAT CURRENCY SUPPORT: | 20+ Fiat currencies supported through P2P alternate Deposit 16 fiat Currencies, and withdraw 11, together with USD, EUR, GBP, and extra. |

| DEPOSIT/WITHDRAW METHODS: | Financial institution switch, credit score/debit card, crypto switch, third-party fiat on and off-ramps |

Bybit is a cryptocurrency alternate specializing in derivatives and futures buying and selling, with a spot buying and selling market.

Initially primarily based in Singapore, it moved its headquarters to Dubai in 2022 and operates beneath Bybit Fintech Restricted, which is registered within the British Virgin Islands. The platform is thought for providing high-leverage buying and selling choices, as much as 100x on perpetual contracts, which has attracted each retail and institutional merchants.

Bybit has rapidly risen to turn out to be one of many high cryptocurrency exchanges, rating second in derivatives buying and selling behind Binance in line with CoinGecko. The alternate's important merchandise embody perpetual futures, nevertheless it additionally helps spot buying and selling with leverage as much as 10x.

Notice: Whereas the leverage function on Bybit is widespread, the usage of excessive leverage is extremely dangerous and is advisable for knowledgeable merchants solely. Be sure you perceive the dangers of leverage earlier than using it.

To make sure safety, Bybit makes use of chilly storage options, multi-signature addresses, SSL encryption, and extra consumer safety measures comparable to two-factor authentication (2FA) and anti-phishing codes. It has a high-security ranking from exterior audits.

Bybit additionally provides a number of distinctive options, together with an insurance coverage fund to guard merchants from shortfalls in liquidation occasions, superior order varieties, a strong matching engine, and customizable buying and selling interfaces. Along with buying and selling, Bybit supplies merchandise like Bybit Earn, copy buying and selling, choices buying and selling, and an NFT market. It helps fiat deposits and withdrawals for varied currencies and provides a cellular app for buying and selling on the go.

Bybit has turn out to be a well-liked alternate globally however is restricted in sure jurisdictions, comparable to america, Syria, and Quebec.

If you’re fascinated about Man's take, be at liberty to take a look at the information he put collectively under:

Getting Began with Bybit

Getting began with Bybit is a breeze. You’ve got two choices for signing up:

- By means of your e mail tackle

- Through your cell phone quantity

To kick issues off, simply head over to the Bybit homepage and click on the “Sign Up” button within the top-right nook. You’ll see prompts for each sign-up strategies — decide the one which fits you greatest. If in case you have a referral code, go forward and enter it; if not, no worries — you possibly can skip that step.

Right here’s the place it will get just a little totally different: for those who determine to enroll together with your e mail, you’ll obtain a reCAPTCHA verification code in your inbox. Simply examine your e mail, seize that code, and enter it on the Bybit web site. For those who go the cellular route, the verification code will come as a textual content message as an alternative. When you enter that code, you’ll be all set to discover the platform!

Don’t overlook: For those who use our particular sign-up hyperlink, you could possibly snag as much as a $60,000 bonus.

Bybit KYC

Bybit is a centralized alternate that follows regulatory measures to forestall cash laundering, requiring customers to endure Know Your Buyer (KYC) verification to entry its services and products. The KYC course of has two ranges:

- Degree 1: Necessary for all customers, providing advantages like a every day withdrawal restrict of as much as 1 million USDT. Nevertheless, it doesn’t present entry to the Bybit Card.

- Degree 2: This degree permits customers to entry the Bybit Card and raises the every day withdrawal restrict to as much as 2 million USDT.

KYC is essential for a number of causes on Bybit:

- Regulatory Compliance: It helps Bybit meet authorized necessities.

- Fraud Prevention: KYC aids in detecting and stopping unlawful actions and suspicious habits.

- Enhanced Companies: Customers who full KYC can entry fiat providers, earn merchandise, and luxuriate in greater every day withdrawal limits.

- Unique Gives: KYC verification unlocks entry to particular promotions and occasions, comparable to Launchpads.

- Account Restoration: A KYC-verified account simplifies the method of recovering entry in case of misplaced credentials.

Funding Your Account

Bybit helps quite a lot of deposit strategies:

- Crypto deposit: Entails transferring cryptocurrency from an exterior pockets or one other alternate to your Bybit account

- Purchase crypto utilizing fiat forex: You should buy the crypto of your alternative on Bybit utilizing fiat currencies such because the US greenback and the euro.

- Credit score/debit card cost: Linking your credit score/debit card means that you can fund your account with out counting on third-party channels.

- Third-Social gathering Cost: To facilitate third-party funds, Bybit has partnered with over quite a few service suppliers.

- P2P Buying and selling: This supplies a simple peer-to-peer platform designed for the shopping for and promoting of cash between two customers.

Bybit Order Sorts

Listed below are the primary kinds of orders you should use on Bybit

- Market Order: Executes instantly on the present market value for fast entry or exit.

- Restrict Order: Lets you set a particular value at which you wish to purchase or promote an asset. For instance, you possibly can place a restrict order to purchase Bitcoin at $65,000, which can execute robotically as soon as the value reaches that degree.

- Conditional Order: Prompts when sure situations are met, comparable to reaching a set off value, and might use varied reference costs for activation.

- Cease-Entry Order: Triggers a market or restrict order when a predetermined value is reached, with purchase cease orders set above and promote cease orders set under the final traded value.

- Take Revenue and Cease Loss Orders: Robotically shut a place at a specified revenue (take revenue) or loss (cease loss) degree.

- Iceberg Order: Splits bigger orders into smaller ones to scale back market influence and slippage, hiding the full order dimension.

- One-Cancels-the-Different Order: Pairs two conditional orders in order that if one is executed, the opposite is robotically canceled.

- Submit-Solely Order: Ensures {that a} restrict or conditional restrict order is positioned within the order guide until there’s a direct match, stopping market execution.

- Cut back-Solely Order: Lets you lower your place dimension with out growing it.

- Shut on Set off: Robotically closes a place when a specified situation is met.

- Trailing Cease Order: Follows the market value at a set distance, adjusting the cease value because the market strikes.

- Time-Weighted Common Worth (TWAP) Order: Executes a big order regularly over a specified time to attenuate market influence.

- Scaled Order: An algorithmic method to executing massive orders with out inflicting important value fluctuations.

- Chase Restrict Order: Repeatedly adjusts its entry value to remain at the perfect bid or ask till crammed, canceled, or reaching a set most chase distance.

For a step-by-step information funding your account and putting your first order, take a look at our Bybit buying and selling information article. We even have an in depth Bybit sign-up information, which additionally touches on how full Bybit KYC.

Bybit Review: Merchandise and Options

Bybit provides a wide selection of merchandise and options that cater to each novice and seasoned merchants alike. Let's take a better take a look at what makes Bybit an interesting alternative for cryptocurrency fanatics.

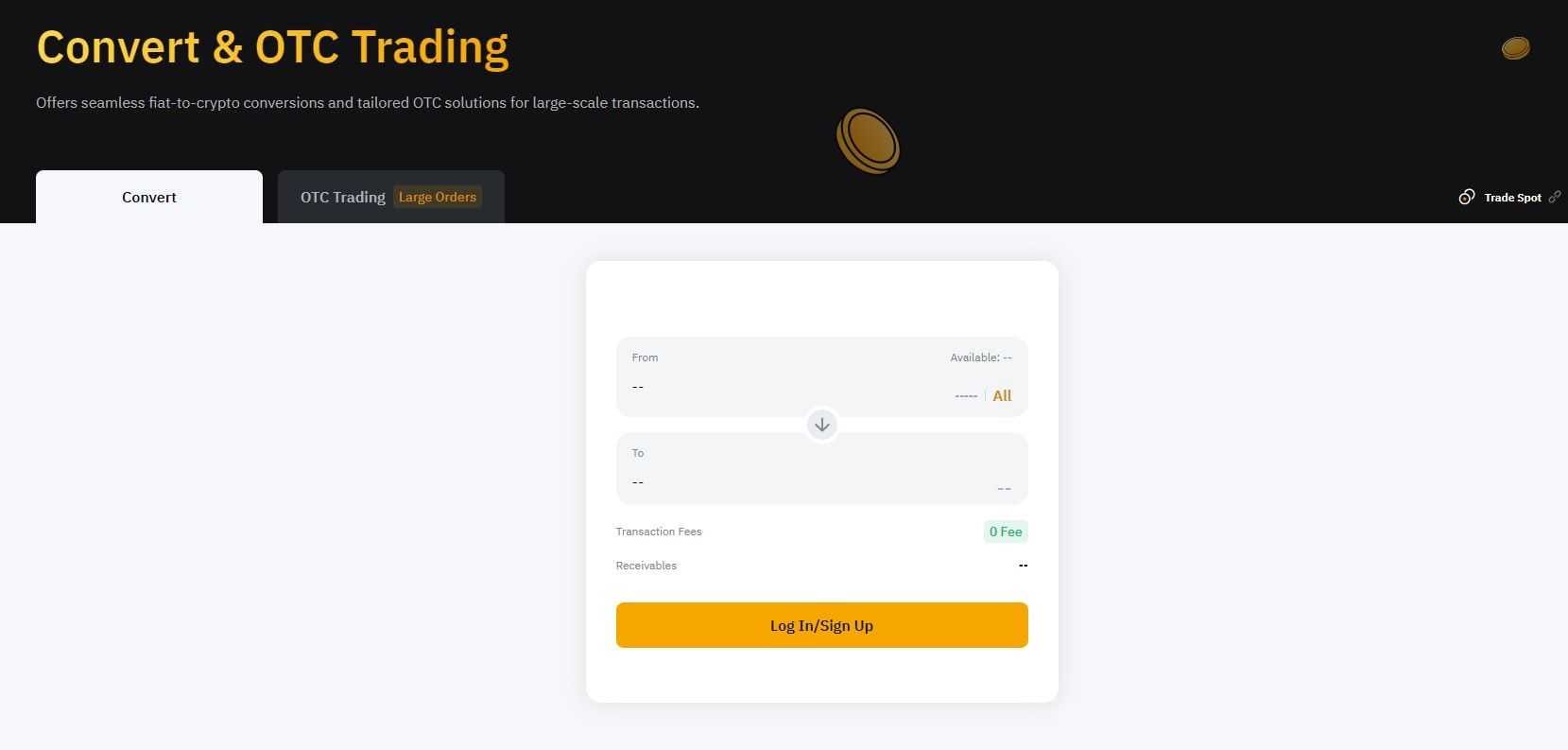

Bybit Convert

Bybit Convert is all about simplicity and comfort. It permits customers to swap between fiat currencies and varied cryptocurrencies with only a click on, making it extremely user-friendly — particularly for many who are put by advanced charts or market evaluation.

The function helps a broad vary of buying and selling pairs, permitting you to simply convert your property as wanted. Most conversions occur immediately, permitting you to make the most of market fluctuations in actual time. This function spans throughout totally different account varieties, together with spot, funding, and derivatives, which implies you should use it flexibly.

Be mindful: Bonus balances can’t be transformed, so it's a good suggestion to familiarize your self with the foundations surrounding your funds.

Bybit Earn

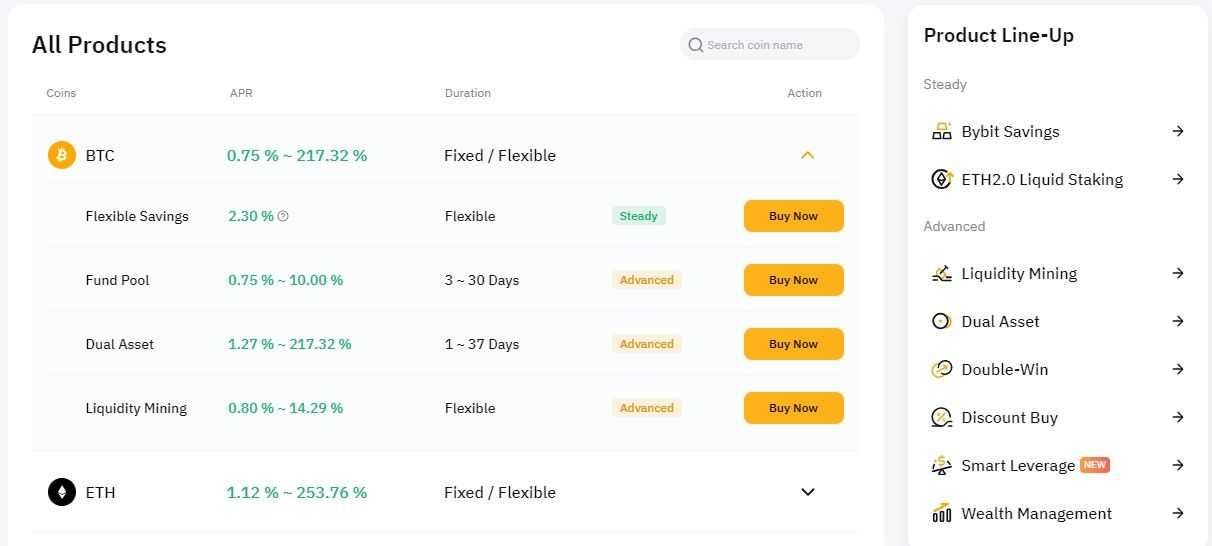

Bybit Earn isn't only a single product; it’s a set of seven totally different monetary instruments.

- Bybit Financial savings permits you to park your cryptocurrencies and earn curiosity over time.

- ETH2.0 Liquid Staking means that you can stake your Ethereum whereas preserving your property accessible.

- Liquidity Mining encourages you to contribute to liquidity swimming pools in alternate for rewards.

- Twin Asset lets you profit from value actions in two totally different property directly.

- Double-Win provides a solution to probably revenue no matter market course, making it an important hedge in opposition to volatility.

- Wealth Administration supplies personalised funding methods tailor-made to your monetary objectives.

- Launchpool offers you early entry to new token initiatives, permitting you to take a position earlier than they go mainstream.

Take a look at our full evaluate of Bybit Earn.

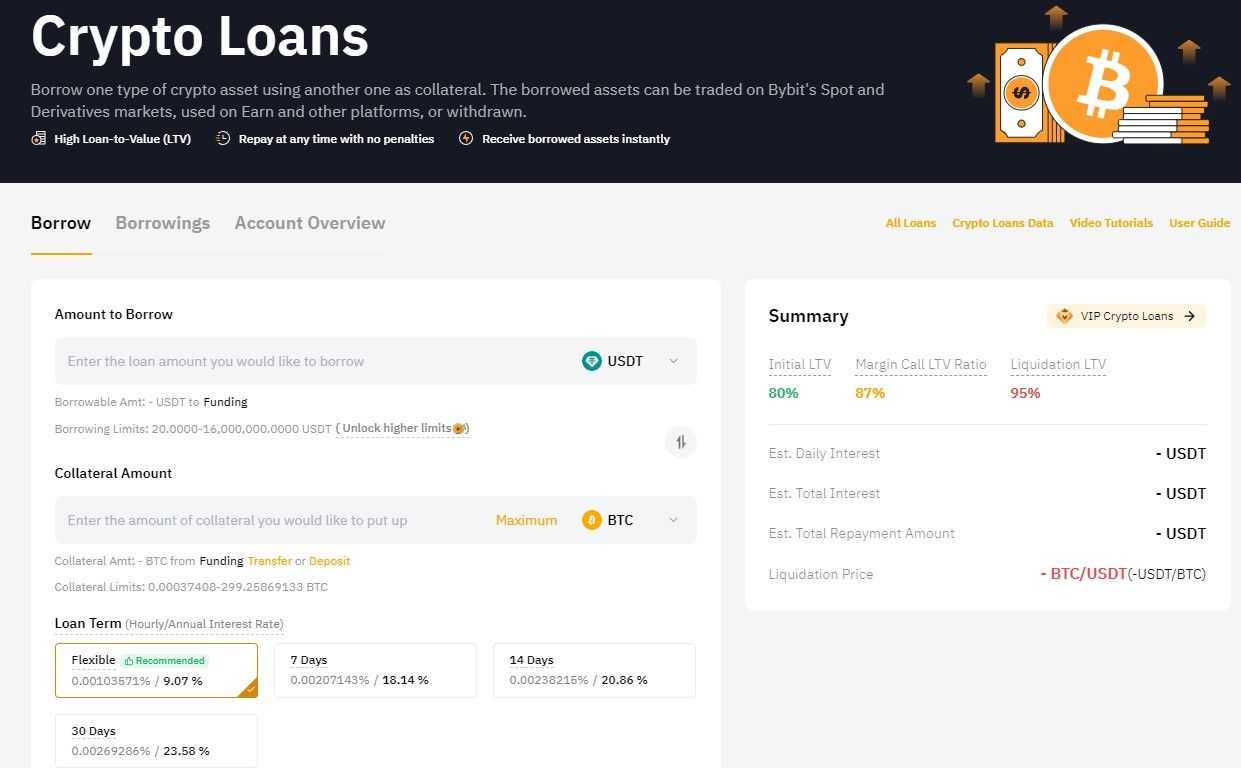

Bybit Lending and Crypto Loans

If in case you have idle cryptocurrencies simply sitting in your pockets, Bybit Lending is a good way to place them to work.

This product permits you to lend your property to different customers, incomes hourly curiosity in your contributions. Bybit matches lenders with debtors, whether or not they’re in search of funds for margin buying and selling or different wants. They take asset security significantly, using a number of danger administration methods to guard your investments.

On the flip aspect, for those who want fast entry to liquidity, Bybit Crypto Loans let you borrow funds with out promoting your crypto. You need to use your property as collateral for short-term loans with phrases starting from 7 to 180 days. Nevertheless, control the liquidation danger; if the worth of your collateral drops under a sure degree, Bybit might liquidate it to cowl your mortgage.

It’s important to remain knowledgeable concerning the phrases, particularly relating to overdue curiosity, which might escalate rapidly for those who miss compensation deadlines.

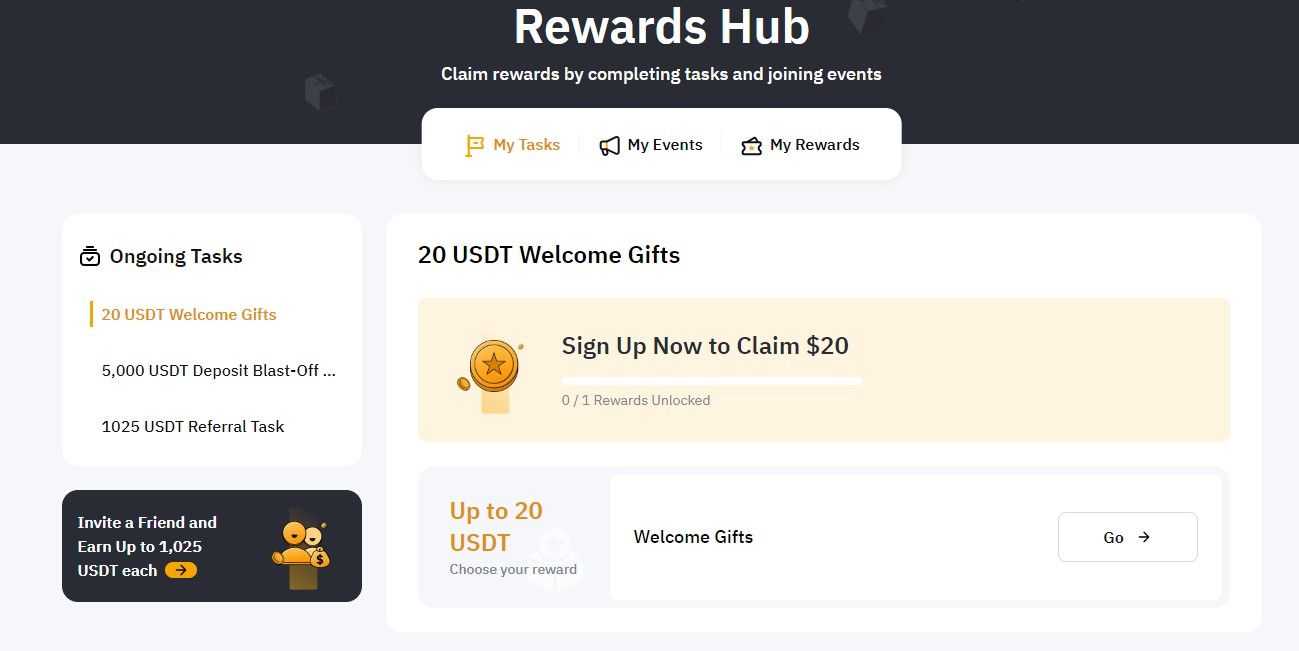

Bybit Rewards Hub

The Bybit Rewards Hub is sort of a treasure chest crammed with alternatives to earn rewards just by participating with the platform. Customers can full varied duties, comparable to signing up or inviting mates, to earn thrilling bonuses.

These rewards can come in several varieties:

- Bonuses that assist offset buying and selling losses

- Coupons that cut back buying and selling charges

- Airdrops of tokens you should use as you would like

- Charge reductions that lighten the load in your buying and selling prices

- APY boosters that improve your yield in Bybit Earn merchandise

- Loss cowl vouchers to cushion potential losses throughout buying and selling

Every reward comes with its personal set of situations and timeframes.

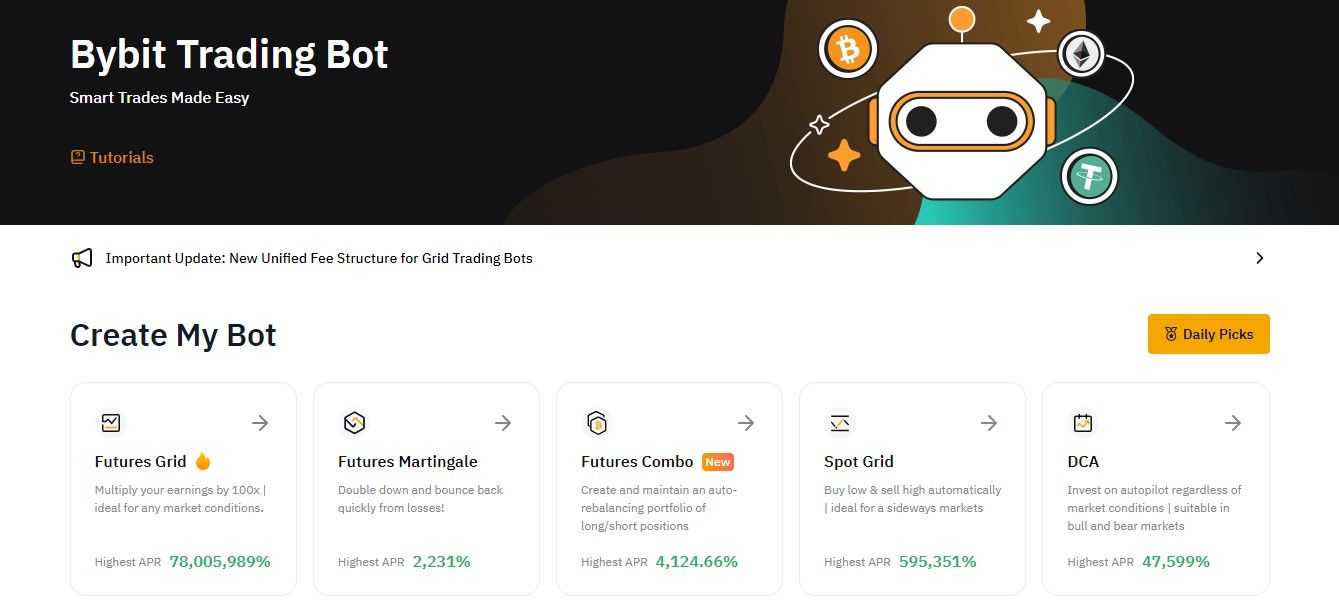

Bybit Buying and selling Bots

For many who choose a hands-off method, Bybit’s Buying and selling Bots are right here!

These automated instruments execute trades in your behalf, permitting you to take a break from fixed market monitoring. Bybit provides a number of kinds of bots, every designed to cater to totally different buying and selling methods:

- Spot Grid Bot is ideal for benefiting from value volatility. It locations purchase orders under and promote orders above a particular reference value, constantly adjusting to market modifications.

- Futures Grid Bot operates within the perpetual contract market, using leverage to maximise potential income. You possibly can select from three modes—lengthy, brief, or impartial—relying on market situations.

- DCA Bot (Greenback-Price Averaging) helps you make investments often with out worrying about market timing, which is particularly useful for long-term buyers.

Whereas these bots can improve your buying and selling expertise and aid you capitalize on alternatives, additionally they include dangers, significantly in unstable markets, so it’s sensible to method them with a very good understanding of how they work.

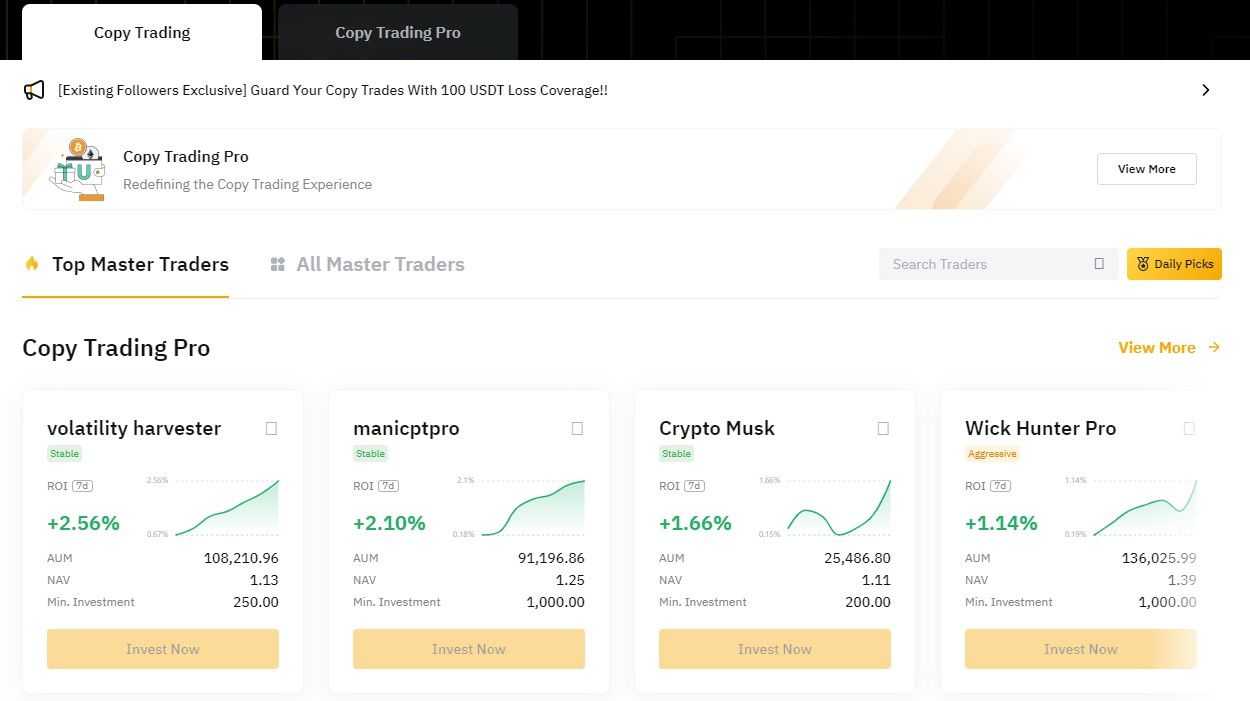

Bybit Copy Buying and selling

For those who’re new to buying and selling or just wish to profit from the experience of skilled buyers, Bybit Copy Buying and selling is a wonderful possibility. This function means that you can replicate the trades of profitable merchants on the platform.

There are two important modes:

- Good Copy Mode permits you to comply with grasp merchants with a set danger ratio primarily based in your stability, offering a degree of security.

- Superior Copy Mode offers you the flexibleness to customise your order settings, supreme for these with a bit extra expertise.

This function has turn out to be fairly widespread, because it permits customers to diversify their portfolios whereas leveraging the abilities of others, making it a win-win state of affairs for a lot of merchants.

You possibly can learn our Bybit Copy Buying and selling evaluate to be taught extra.

Bybit Crypto Card

The Bybit Card is a digital Mastercard that simplifies the method of spending your cryptocurrencies in on a regular basis transactions.

Customers can select one fiat forex (EUR or GBP) and one cryptocurrency (like BTC, ETH, XRP, USDT, or USDC) to fund their card. Whereas the digital model is free to make use of, there’s a charge for the bodily card, which takes as much as 30 days to reach. One limitation is that the Bybit Card can’t be added to digital wallets like Apple Pay or Google Pay, which can make it much less handy for some customers.

Whereas there aren’t any annual charges, customers ought to concentrate on a 0.5% overseas alternate charge and a 0.9% crypto conversion charge, which applies for those who don’t have sufficient fiat to cowl a transaction.

Bybit Pockets

The Bybit Pockets is a custodial pockets, that means that the alternate holds your property and manages the non-public keys. This setup means that you can simply entry a spread of decentralized functions in DeFi, GameFi, and NFT marketplaces. The pockets additionally options cross-chain compatibility, making it easy to handle a number of property throughout totally different platforms.

Key functionalities embody non-public key administration, automated assortment of airdrops, and entry to DeFi merchandise, which broadens your funding horizons and enhances your engagement with the crypto ecosystem.

Bybit NFTs

Bybit’s NFT market is an thrilling house for purchasing, promoting, and buying and selling non-fungible tokens.

Supporting each Ethereum and Solana blockchains, customers can transact utilizing ETH, XTZ, and USDT. Nevertheless, it’s price noting that NFTs can solely be priced with one token at a time. {The marketplace} fees a 1% buying and selling charge for sellers, together with a royalty charge for creators, which helps assist the inventive group.

Presently, NFT deposits are solely supported on Ethereum, whereas withdrawals may be made on each Ethereum and Solana.

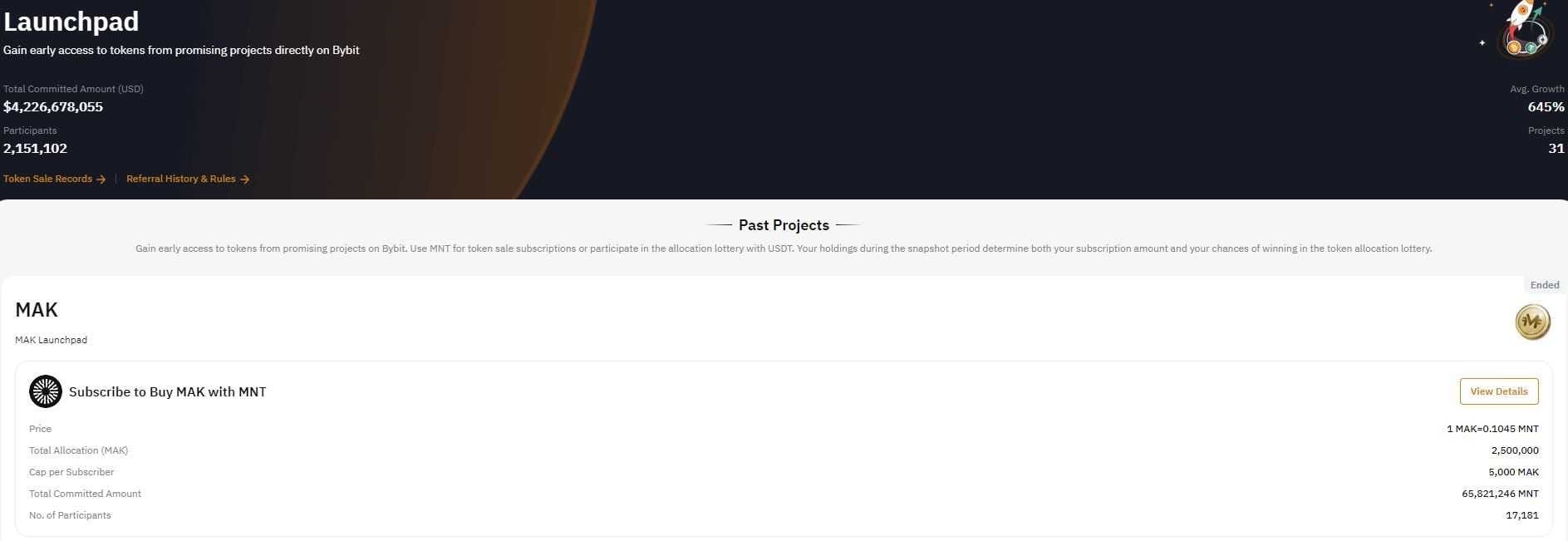

Bybit Launchpad

The Bybit Launchpad is designed for these wanting to get in on the bottom flooring of recent blockchain initiatives.

It supplies entry to token gross sales earlier than they go public, permitting you to take a position early in probably promising initiatives. Customers can take part by committing Mantle (MNT) or utilizing lottery tickets to achieve allocations for brand spanking new tokens. The method options a number of phases that embody a warmup interval, subscription, allocation choice and the announcement of outcomes.

TradeGPT

Bybit TradeGPT leverages real-time market information to supply insights and options tailor-made to your buying and selling methods.

Not like conventional chatbots, TradeGPT supplies up-to-date data on market tendencies, potential funding alternatives, and technical evaluation.

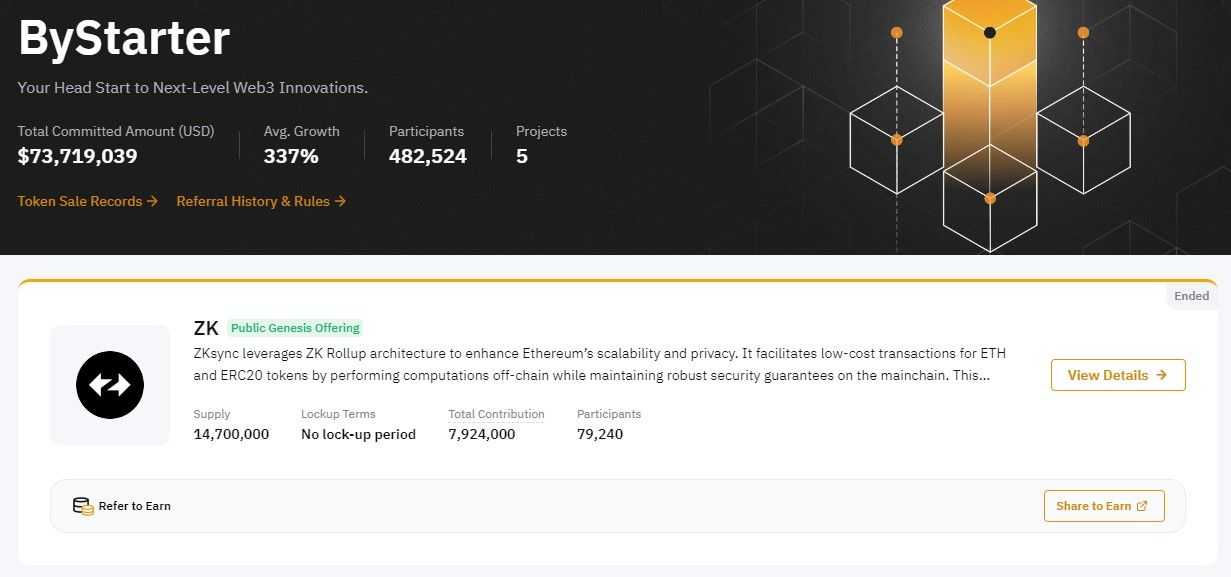

ByStarter

ByStarter serves as a platform for token gross sales, the place customers can put money into early-stage digital property.

The method unfolds in a number of phases, beginning with a warmup interval for KYC verification, adopted by a subscription section the place you commit funds. Then comes the allocation section, the place winners are randomly chosen to obtain tokens. A lock-up interval follows, throughout which token holders are prohibited from promoting their property.

VIP Program

Bybit's VIP program is designed to reward loyal merchants primarily based on their buying and selling exercise and asset holdings.

It options a number of tiers, every providing distinctive advantages comparable to decrease buying and selling charges, entry to unique campaigns, and precedence buyer assist.

Institutional Companies

For institutional purchasers, Bybit supplies a complete vary of specialised providers. These embody over-the-counter (OTC) buying and selling options, liquidity packages, and customised buying and selling methods designed to fulfill the distinctive wants of bigger buying and selling operations. These purchasers additionally get entry to a devoted assist crew making certain real-time safety alerts and sturdy danger administration.

Affiliate and Referral Program

The Bybit affiliate and referral program permits you to earn rewards by bringing mates onto the platform.

Each referrers and new customers can take pleasure in advantages by finishing particular duties — comparable to making a minimal deposit or reaching sure buying and selling volumes. The associates program includes a fee construction that rewards you primarily based on the buying and selling quantity generated by your referrals.

Is Bybit Safe?

Guaranteeing the protection of consumer funds is a high precedence for Bybit, which has maintained an ideal safety report since its launch in 2018, with no breaches even amid widespread hacks within the cryptocurrency house.

Platform Safety

Bybit employs a strong triple-layer safety method. Person funds are saved offline in chilly wallets, complemented by superior applied sciences like multi-signature, Trusted Execution Atmosphere (TEE), and Threshold Signature Schemes (TSS) to forestall unauthorized entry.

The platform conducts common Proof of Reserves audits, with outcomes made publicly accessible. Bybit adopts a privacy-first philosophy, making certain transparency about information assortment and utilization, using robust encryption, and sustaining strict entry controls. Actual-time monitoring programs detect suspicious actions, resulting in enhanced withdrawal safety measures.

Bybit has achieved a AA safety ranking from CER.

Safety and Compliance

Bybit works intently with world regulatory our bodies to fight cash laundering and employs Know Your Buyer (KYC) procedures targeted on buyer due diligence by partnerships with main resolution suppliers.

The platform collaborates with legislation enforcement to sort out cybercrime and is dedicated to selling accountable buying and selling practices, providing assets on danger administration and safety.

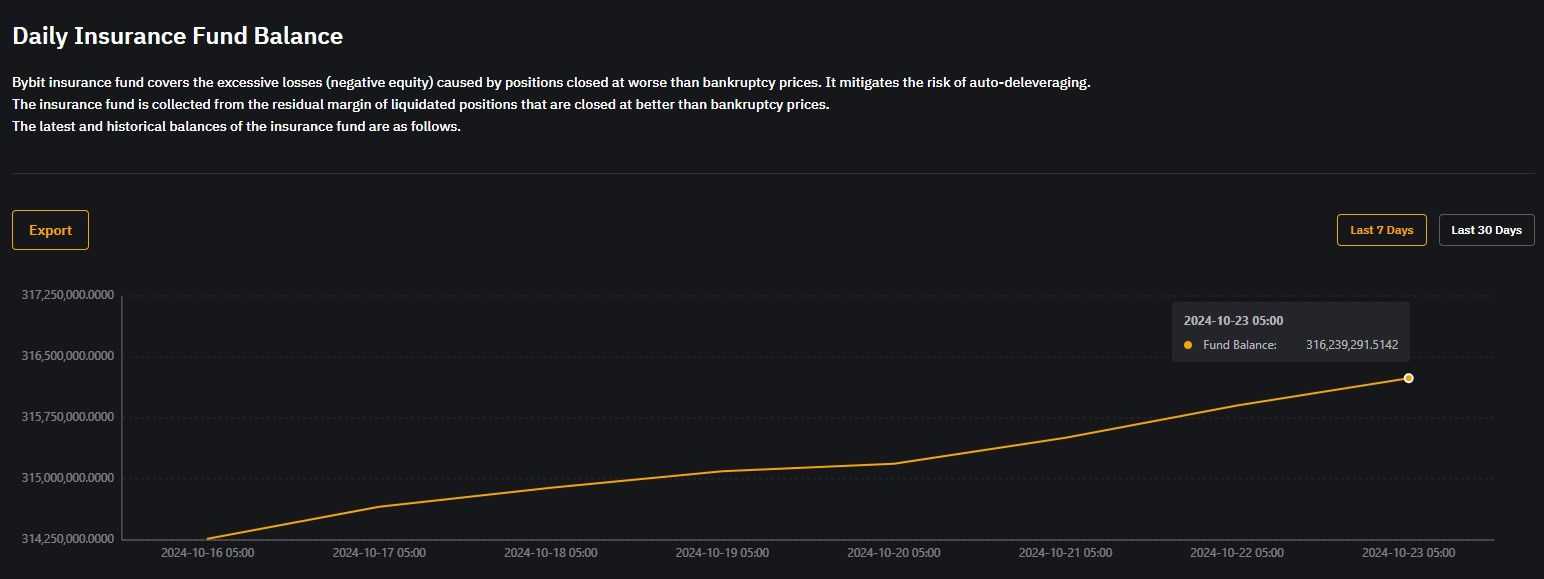

Insurance coverage Fund

Bybit’s insurance coverage fund serves as a security web for merchants participating in derivatives buying and selling, serving to to protect them from extreme losses.

Right here’s the way it works:

When a dealer’s place is liquidated, it’s settled on the chapter value — the edge the place there’s no remaining preliminary margin. This settlement happens whatever the present market value. If the closing value of the place is healthier than this chapter value, any remaining margin might be transferred to the insurance coverage fund. Which means that merchants can nonetheless contribute positively to the fund even when going through a liquidation.

However, if the closing value falls under the chapter value, leading to a loss that exceeds the dealer’s preliminary margin, the insurance coverage fund steps in to cowl the distinction. This mechanism is particularly essential because it reduces the probability of Auto-Deleveraging (ADL), which might occur when the market is unstable and positions are quickly liquidated to take care of system stability.

Primarily, the stability of the insurance coverage fund fluctuates primarily based on the result of liquidations. When liquidations happen at costs higher than the chapter value, the fund receives further contributions. Conversely, when losses are lined as a consequence of unfavorable closing costs, the fund’s stability decreases.

Leverage on Bybit

Provided that Bybit is a leveraged alternate, it implies that they permit crypto margin trades. Merchants will solely should put up a small proportion of the preliminary place as collateral for his or her trades.

Which means that you probably have the leverage of 100x, you’ll be required to place up a margin of 1% of the preliminary notional quantity of the commerce. So, if the notional on a 10BTC contract is $36,000, you’ll have to put up $360 in preliminary margin.

Main Professional 💯: With Bybit, leverage is freely adjustable, that means that it may be modified even after opening a place, which is one thing that can not be carried out on different exchanges.

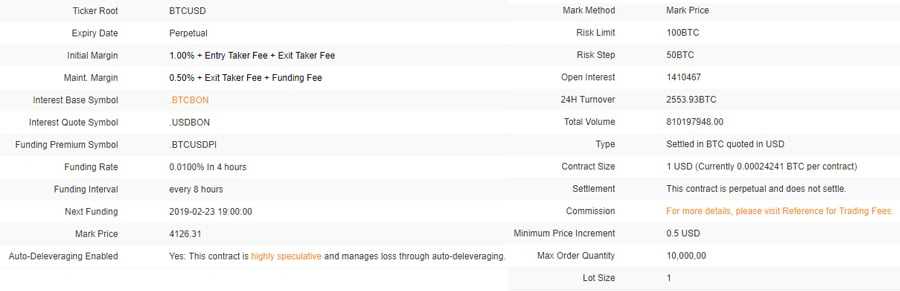

What’s shocking concerning the perpetual contracts on Bybit is their dimension. Every contract is just price 1 USD, which is far smaller than the contracts on different exchanges. Beneath is all the opposite specifics of their BTCUSD contract.

They’ve just about the identical phrases on their ETH/USD contracts. You could find extra details about the totally different contracts on the Bybit Market Overview Web page.

Whereas Bybit does provide as much as 100x leverage on their contracts, this isn’t fixed. If you’re a big dealer and are getting into sizable positions then they may carry down the leverage that you may obtain in your contract.

This protects the alternate from the chance posed by massive positions. Beneath is the desk of the BTCUSD danger limits. You could find the ETHUSD, EOSUSD and XRPUSD danger limits on their Danger Restrict Ranges web page.

| Place Worth | MM* | Preliminary Margin | Max Leverage |

|---|---|---|---|

| 150 BTC | 0.5% | 1.00% | 100 |

| 450 BTC | 0.5% | 2.00% | 50 |

| 750 BTC | 2.5% | 3.00% | 33 |

| 1,050 BTC | 3.5% | 4.00% | 25 |

| 1,350 BTC | 4.5% | 5.00% | 20 |

| 1,500 BTC | 5.0% | 5.50% | 18 |

MM* stands for Upkeep Margin

As you possibly can see, the upkeep margin is fixed at 0.5% for all contract sizes. Nevertheless, for bigger positions, they may improve the minimal preliminary margin requirement such that there’s a a lot larger shortfall between the liquidation degree and the chapter degree.

Liquidation

Liquidation is what occurs when you’ve got practically depleted your preliminary margin and the mark value hits the “liquidation price”. On this occasion, the dealer might be liquidated with the remainder of their margin, if any, being despatched to the Bybit insurance coverage fund.

ADL ⚙️: Bybit operates an Auto Deleveraging system. Primarily, this occurs when a place can't be liquidated at a value that’s higher than the chapter value and the insurance coverage fund can not cowl it. The ADL system will robotically deleverage a place of an opposing dealer that’s chosen in line with their outlined standards. You possibly can learn extra concerning the ADL in Bybit's Auto Deleveraging article.

Whereas there are lots of merchants who could also be upset by a liquidation, it is a crucial danger administration software in a futures alternate and is part of margin buying and selling. Nevertheless, Bybit has quite a few instruments that may assist merchants keep away from the chance of liquidation. These embody the next:

- Twin Worth Mechanism: To be able to stop the chance of market manipulation on the alternate, Bybit makes use of a twin value mechanism because the contract reference value. That is composed of the "Mark Price" which triggers liquidation and the “Last Traded Price” which is used to calculate the value at which the place is closed. The previous is a world Bitcoin value whereas the latter is the present Bybit market value. Utilizing exterior pricing inputs reduces singular alternate manipulation.

- Auto Margin Replenishment: If you wish to guarantee that your place will at all times have enough ranges of margin then you possibly can set it to auto-replenish. Which means that at any time when your margin is near being depleted, it should draw in your funds to maintain your place open

- Cease Loss: This varieties a part of the order choices that we speak about under. Having efficient cease losses in your positions will be sure that it by no means will get all the way down to the liquidation degree.

Mark / Spot Worth 📈: For these , the Mark value is derived from the Spot value. The spot value is a Bitcoin value index that represents the worldwide value. It’s comprised of costs on Bitstamp, Coinbase Professional and Kraken. The Mark value is the spot value index plus a decaying funding foundation price

Bybit Charges

Bybit's buying and selling charges range for non-VIP and VIP customers, with VIP customers eligible for enhanced charge reductions primarily based on their ranges.

VIP ranges are decided by both asset stability or the final 30-day buying and selling quantity. Merchants want to fulfill certainly one of these standards to unlock the charge low cost equivalent to their VIP Degree.

As the main target of this text is on new merchants, we'll follow non-VIP.

Bybit presently provides two zero-fee campaigns: one for derivatives buying and selling utilizing Bybit Arbitradge and one other for EUR Spot buying and selling. Throughout these promotional durations, merchants can have interaction in particular pairs with out incurring charges. Moreover, new customers making a minimal deposit of 100 EUR may take pleasure in zero charges, and staking on Bybit is fee-free as properly.

Exchanges categorize orders as both "makers" or "takers" to find out the relevant buying and selling charges:

- Makers: These are merchants who add liquidity to the market by putting restrict orders that aren’t instantly crammed. They usually contribute to the order guide's depth. Makers sometimes pay decrease charges and should even obtain rebates; as an example, Bybit has a Market Maker Incentive Program that gives rebates of as much as 0.015%.

- Takers: In distinction, takers take away liquidity from the market by putting market orders which are crammed instantly. Takers normally incur greater charges as a consequence of their function in taking liquidity from the order guide.

For particular charges on Bybit:

- Makers in derivatives buying and selling are charged 0.01%

- Takers in derivatives buying and selling pay 0.06%

- Each makers and takers in spot buying and selling are charged 0.10%

Bybit Buying and selling Platform

Some of the essential issues for a dealer is to have an efficient buying and selling platform with superior expertise.

So, how does Bybit stack up?

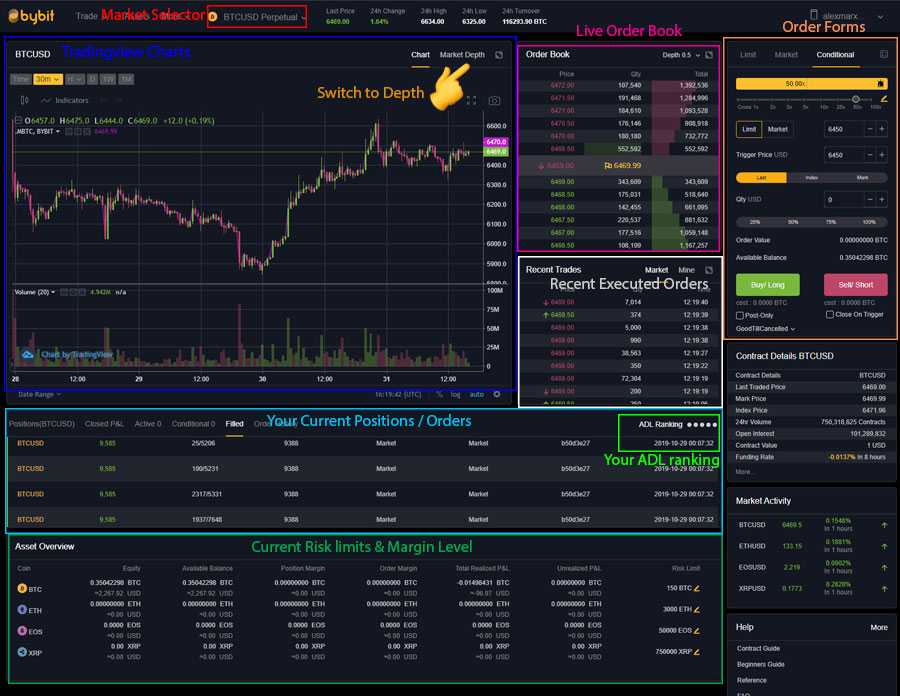

Very properly right here, consistent with the highest exchanges within the trade. The buying and selling platform is properly laid out and intuitive. On the high, you possibly can toggle between your wallets and account administration. You may also swap between the BTC and ETH futures markets.

Taking a look at the usual interface, you’ve got the chart and market depth on the left (you possibly can toggle between them). Then within the center, you’ve got the order guide and the final trades. On the proper, you’ve got the order varieties in addition to the contract particulars.

Scrolling down from the primary interface you’ve got different essential buying and selling data. This consists of issues comparable to the present market exercise and your property.

One thing that we actually appreciated about their interface is that it’s customizable and modular. You possibly can detach a few of the modules, resize them, and transfer them round such that they’re in your chosen place.

For these seasoned merchants amongst you, you’ll have seen that Bybit makes use of TradingView charting expertise. This third-party charting bundle is well-known within the trade for having essentially the most performance and options. TradingView has a number of indicators and has a clear, user-friendly interface appropriate for crypto buying and selling rookies.

Much like many shares and foreign exchange platforms, TradingView has turn out to be adopted by many crypto platforms, so it’s comparatively straightforward so that you can adapt for those who do open an account some place else.

High Tip 💯: You possibly can swap out the TradingView value charts for the market liquidity charts. These are useful for the dealer to find out market sentiment (bullish/bearish)

Additionally, you will discover that in your present place/order bar, you’ve got the "ADL ranking" indicator. This may present you the place you presently are positioned for potential deleveraging within the case that the ADL is triggered. As talked about above, that is carried out to handle danger.

One thing that Bybit seems to be fairly happy with is their order-matching engine. They declare that this buying and selling engine is ready to execute a complete of 100,000 transactions per second per contract. So for each new asset they may add, their matching engine may have a devoted 100,000 transactions per second for that asset solely.

Why does this matter?

Properly, quicker order execution implies that the chance of slippage and buying and selling errors is enormously lowered. Furthermore, with an asset that strikes as rapidly as Bitcoin, it’s actually essential to have the ability to match each side of the order guide virtually instantaneously.

We’ve had members from the Coin Bureau crew check out the buying and selling execution and have heard from different high-level merchants and might attest to the claims that Bybit has an expert grade matching and commerce execution engine which are second to none within the trade. Take a look at our Bybit Buying and selling Information for a take a look at the buying and selling performance supplied.

Market Analytics Knowledge

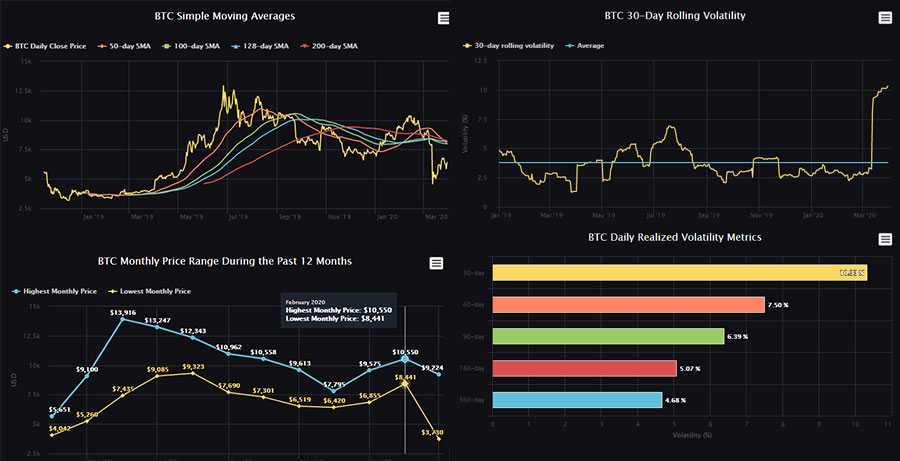

One thing else we discovered fairly neat was their market information part and significantly their superior information part. This contained some actually helpful graphs and charts that would assist inform your buying and selling.

You may also pull up a few of these charts and obtain the information. This might both be as a picture, vector file or as a csv. Right here you possibly can see an instance of us doing that with the rolling volatility chart.

Here’s a listing of the information that you’ll be able to obtain in addition to what it means:

- BTC Day by day Realised Volatility Taking a look at what the realised volatility was like over a sure time period

- Month-to-month Worth Vary Takes a take a look at month-to-month highs and lows within the value. It means that you can observe the vary the asset traded in.

- Worth Transferring Averages: This has the value of Bitcoin together with the variety of shifting common indicators of various time frames.

- Rolling Volatility The realised volatility over the previous 30 days in comparison with the common for the interval. Provides you a way of how a lot the value swung in a given interval.

There may be additionally a bunch of different information that you may look at in these tabs. That features data on the particular index value, funding information and the insurance coverage fund. You also needs to word the weights which are used to calculate the spot value.

Bybit High Advantages Reviewed

Bybit is a wonderful platform for non-US prospects in search of a derivatives alternate or these eager to commerce the spot market. It provides among the best buying and selling experiences within the trade. A few of the high advantages Bybit provides are:

Vast Vary of Property and Companies – Since 2018, Bybit has grown into one of many high exchanges that gives customers with entry to a variety of property in addition to providers. Bybit has over 300 property within the spot market and 200+ contracts within the derivatives market. It additionally provides customers providers comparable to buying and selling bots, lending, institutional providers, referral and affiliate packages, the Bybit debit card, P2P market, copy buying and selling, and extra. Bybit has carried out an important job competing with the likes of Binance as a “one-stop-shop” crypto alternate that gives every thing a crypto consumer wants beneath one roof.

Bybit Copy Buying and selling– As a result of Bybit has turn out to be a extremely revered alternate, because of its professional-grade buying and selling and matching engine and unbelievable choice of merchandise, the platform has attracted a few of the most proficient crypto merchants within the trade. This has led to their copy buying and selling platform turning into among the best within the trade as merchants can copy the trades of a few of the greatest merchants in crypto.

Excessive Leverage and Danger Administration – The alternate permits customers to commerce with as much as 100x leverage on choose property, nevertheless it additionally has quite a lot of instruments that guarantee danger is correctly contained. A few of the instruments embody Bybit’s insurance coverage fund, auto deleveraging, cross and remoted margin accounts, a spread of order choices, and so forth.

Good Buyer Help – Bybit has 24/7 customer support accessible for customers to get any points addressed.

Bybit Exchange Review: Conclusion

We discovered Bybit to be a user-friendly alternate with robust expertise, affordable charges and a comparatively intuitive consumer interface. We’re additionally glad to see Bybit has developed an insurance coverage fund to handle market danger.

Bybit is well-positioned to supply an alternative choice to the established order within the crypto derivatives buying and selling market and has loved astronomical development within the trade.

The alternate is among the quickest rising platforms round, with new merchandise and options being added on a regular basis, which has solely been fuelling its development.

So, do you have to use Bybit?

You’d be in good firm for those who selected to take action. Lots of the greatest merchants in crypto and even some institutional merchants belief Bybit they usually have a strong safety framework in place. We encourage you to do your individual analysis however on the face of it, Bybit seems to be a unbelievable alternate that ticks most of our packing containers. You possibly can be taught extra about Bybit and the way it stacks up in opposition to different exchanges in our Bybit vs KuCoin evaluate.

Warning ⚡️: Buying and selling leveraged futures merchandise is extremely dangerous. Just remember to follow enough danger administration

Regularly Requested Questions

What’s Bybit?

Bybit is a cryptocurrency and derivatives buying and selling alternate established in 2018. It provides a professional-grade, high-performance matching engine, making it a well-liked buying and selling platform with over 2 million customers. The alternate is thought and revered within the crypto group for superior buying and selling choices, good buyer assist, and its dedication to crypto training.

Is Bybit Legit?

Bybit is about as official as an unregulated “off-shore” crypto alternate may be. Due to the sturdy safety measures in place, and the truth that this alternate has been working since 2018, Bybit is among the most extremely trusted exchanges outdoors the highest 5.

Is Bybit Out there within the US?

Sadly not. Residents from america and Sanctioned nations usually are not permitted to make use of Bybit.

The place is Bybit Situated?

Bybit is headquartered in Dubai, United Arab Emirates

Why is Bybit banned within the US?

Bybit is an unregulated crypto platform and doesn’t adhere to lots of the USA authorities’s guidelines and rules.

How reliable is Bybit?

Bybit is usually thought-about reliable, particularly given its dedication to safety and transparency. The alternate makes use of sturdy safety measures comparable to chilly storage for almost all of consumer funds, multi-signature wallets, SSL encryption, and two-factor authentication (2FA).

Moreover, it has a top-tier AAA safety ranking from unbiased auditors. Bybit has rapidly gained a optimistic repute within the crypto trade for its user-friendly platform, clear charge construction, and buyer assist, in addition to its common safety audits.

Nevertheless, as with all platform, customers ought to train warning by enabling all accessible safety features and making certain they’re on the official web site.

What are the disadvantages of Bybit?

A few of the key disadvantages of Bybit embody:

- Restricted in Sure Jurisdictions: Bybit is unavailable in key markets just like the U.S., Canada (Quebec), and another areas.

- Excessive Leverage Danger: Bybit provides as much as 100x leverage, which may be engaging to superior merchants however is dangerous for rookies and will result in fast liquidation.

- Not Appropriate for Rookies: Given its give attention to derivatives buying and selling, the platform may be advanced for rookies who’re unfamiliar with margin buying and selling, liquidation dangers, and different superior options.

- No In-App Pockets Management: Bybit’s custodial pockets mannequin means customers don’t management the non-public keys to their funds, which can be a priority for these prioritizing self-custody.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.