Coinbase sits among the many prime cryptocurrency exchanges on the earth and is among the most revered companies within the crypto area. In April 2021, it was listed on the Nasdaq trade and have become the primary main cryptocurrency firm to go public. Many mark this occasion as a major milestone in enhancing the picture of blockchain as a professional business.

The trade’s reputation additionally led to a well-liked phenomenon often known as the ‘Coinbase effect,’ the place cryptocurrencies noticed an enormous surge in value following their itemizing on the trade. Coinbase has additionally been exceptionally proactive and cooperative in in search of a well-defined regulatory framework for crypto companies within the US. Coinbase is a sound alternative for merchants seeking to enter the crypto area, and that will help you determine if it’s the excellent trade for you, we current the Coinbase Review.

Coinbase Review TL; DR Verdict and Abstract

Coinbase is essentially the most beginner-friendly and regulatory-compliant centralized cryptocurrency trade. It’s accessible in restricted nations and offers the entire suite of options for blockchain investing, together with a buying and selling terminal, Earn program, debit card, NFT market, self-custody, and institutional options.

| Headquarters: | No headquarters as of Might 2020, beforehand, San Francisco, USA. |

| 12 months Established: | 2012 |

| Regulation: | Sure- Coinbase complies with all relevant legal guidelines and laws in every jurisdiction the place it operates. -Cash Transmission License -Registered with FinCEN |

| Spot Cryptocurrencies Listed: | 140+ |

| Native Token: | N/A |

| Maker/Taker Charges | Lowest: 0.04%/ 0.0% Highest: 0.50%/0.50% |

| Safety: | Excessive |

| Newbie Pleasant: | Coinbase: Very Newbie Pleasant Coinbase Superior: Slight Studying Curve |

| KYC/AML Verification: | Sure |

| Fiat Foreign money Help: | USD, GBP, EUR |

| Deposit/Withdrawal Strategies: | USA Coinbase: ACH Financial institution switch and financial institution wire, Debit/Credit score, checking account, wire switch, PayPal, Apple Pay, Google Pay

GBP Coinbase: Sooner Funds financial institution switch, SEPA, Sooner Funds, 3D Safe Card, PayPal (withdraw solely)

EUR Coinbase: SEPA financial institution switch, SEPA, 3D Safe Card, Supreme/Sofort (deposit solely), PayPal (withdraw solely), Apple Pay (purchase solely) |

Coinbase Key Options at a look

- Person-Pleasant Interface: Coinbase affords an intuitive and simple platform that simplifies shopping for, promoting, and managing cryptocurrency portfolios for customers of all expertise ranges.

- Safety Measures: Coinbase employs sturdy safety protocols resembling two-factor authentication, chilly storage for buyer funds, and insurance coverage towards sure sorts of losses, making certain a safe buying and selling atmosphere.

- Academic Sources (Coinbase Earn): Customers can find out about numerous cryptocurrencies by academic content material and earn free crypto as a reward for finishing easy quizzes and duties.

- Various Cryptoforeign money Choice: The platform helps a variety of cryptocurrencies, permitting customers to commerce widespread cash and quite a few altcoins, catering to various funding preferences.

- Staking Rewards: Coinbase offers customers with the power to earn staking rewards on sure proof-of-stake (PoS) cryptocurrencies, providing a strategy to generate passive revenue by holding eligible property on the platform.

Coinbase Review – Background and Historical past

Coinbase is the most well-liked cryptocurrency trade within the US. Brian Armstrong, a former Airbnb engineer, based Coinbase in June 2012 and nonetheless serves the corporate as its CEO. The multi-faceted trade with 100+ listed property, billions underneath administration, and an in depth suite of funding companies started operations in October 2012 by facilitating shopping for and promoting Bitcoin by financial institution transfers.

Coinbase World, Inc. was later integrated because the holding firm for the Coinbase trade. In January 2015, the corporate launched an trade for skilled merchants, which might be often known as Coinbase Professional. Whereas Professional catered to skilled merchants, Coinbase Prime was the corporate’s different leg to deal with institutional clients.

Coinbase has earned a number of feathers on its cap through the years, together with one of many first world firms to undertake a totally distant work tradition with no formal headquarters and one of many first listed firms to launch a blockchain-based DeFi community referred to as Base.

Listed here are some flagship merchandise provided by Coinbase:

- Coinbase Custody – A service supplied by Coinbase that gives safe digital asset storage for institutional buyers, offering monetary controls, audit trails, withdrawal limits, and assist for a number of signers.

- Coinbase Pockets – Launched in 2017, the Coinbase Pockets is among the most used crypto apps. It permits customers to retailer and commerce cryptocurrencies and digital collectables from their telephones.

- Coinbase Prime – It allows institutional buyers to commerce cryptocurrencies, providing extra superior options than the Pockets.

- Coinbase Commerce – It helps companies combine crypto funds of their checkout course of.

- USD Coin (USDC) – Coinbase partnered with Circle, a key participant within the cryptocurrency area, to launch the USDC stablecoin pegged to the US Greenback. USDC is among the most transacted stablecoins within the area.

Coinbase’s strategic acquisitions have been pivotal in cementing its place and resilience within the crypto ecosystem. Key acquisitions like Neutrino helped Coinbase enhance theft prevention and safety. The acquisition of Paradex and Bison Trails marked a foray into decentralized companies and sturdy blockchain infrastructure. Buying Xapo's institutional custody enterprise considerably bolstered Coinbase's asset custody capabilities, catering to institutional purchasers. The acquisition of Tagomi and Skew expanded its attain into superior buying and selling and real-time information analytics, interesting to skilled and institutional merchants.

Coinbase started with a humble imaginative and prescient of serving to clients purchase Bitcoin and broadened its scope by complementary acquisitions and dedication to regulatory compliance to amass tens of millions of informal merchants and institutional buyers underneath its umbrella.

Coinbase Headquarters

Initially headquartered in San Fransisco, Coinbase transitioned to a distant work tradition with the onset of Covid-19. In January 2020, over 29% of its workforce from San Fransisco have been working from dwelling.

Coinbase claims that almost all of its new hires in Q1 of 2021 have been distant, and the advantages of a decentralized workforce have outweighed its negatives. With most of its staff working remotely, together with the manager workforce, Coinbase not designates a single location as its official headquarters. Furthermore, Craft claims Coinbase maintains a number of workplace places worldwide, together with New York, Portland, Berlin, Dublin and Tokyo.

Nonetheless, being an American publicly traded firm (ticker: COIN), Coinbase World, Inc. was integrated in Delaware as a holding firm for Coinbase and its subsidiaries.

Coinbase requires all clients on their platform to adjust to Know Your Buyer (KYC) legal guidelines to substantiate their identification. First-time clients will undergo a typical KYC course of the place they supply the related government-issued identification paperwork.

Is Coinbase Protected?

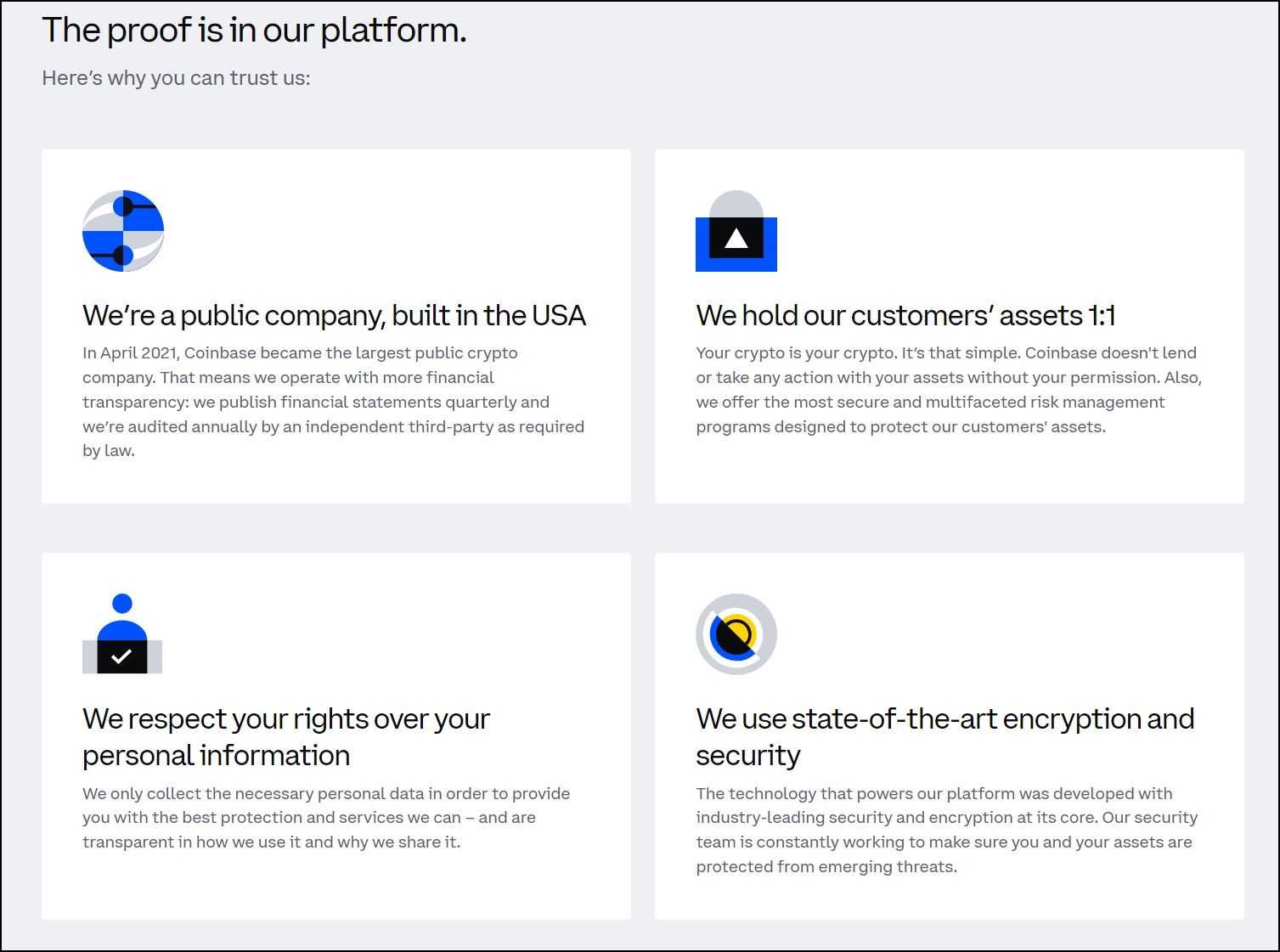

As a public firm within the US and one of many world leaders, customers contemplate Coinbase protected for conducting transactions, buying and selling, and storing cryptocurrencies. The trade implements numerous safety measures to guard accounts and person funds.

Coinbase offers 2-step verification on all accounts as an extra layer to forestall unauthorized entry. Moreover, the account passwords saved in Coinbase’s database are encrypted to be unrecognizable to the human eye. Customers can configure the Coinbase Vault to incorporate further safety steps for withdrawals.

To guard the deposits, all buyer funds are held 1:1 and by no means lent out with out their consent, diminishing the chance of runs on the trade throughout acute market volatility. Coinbase retains 98% of funds in “air-gapped” chilly storage wallets operated with multi-signature mechanisms. These property are disconnected from the Internet and inaccessible to hackers, malware, and phishing assaults.

Regardless of its sturdy measures and dedication to safety, Coinbase has been the goal of a handful of assaults through the years. As an example, Coinbase customers and staff have been the goal of refined phishing and social engineering assaults. One person sued Coinbase after reportedly dropping $96,000 in a SIM card change assault.

In response to such assaults, Coinbase has at all times responded promptly by swiftly addressing the weak hyperlinks and mitigating any potential for a widespread fallout. Coinbase has not disclosed incidents of a profitable breach resulting in a widespread lack of buyer funds. Nonetheless, customers are at all times suggested to train warning and comply with greatest practices for securing their accounts and private data.

We go deeper into the safety of Coinbase in our article: Is it Protected to Maintain Crypto on Coinbase?

Proof of Reserves

Coinbase is a publicly traded firm that has to file statements to the SEC to show possession of shoppers’ property and supply proof of its cold and hot storage wallets. Whereas the trade doesn’t launch Proof of Reserves information explicitly, its standing as a listed firm is a proxy that proves that the trade doesn’t tamper with buyer’s funds with out their consent.

Coinbase Regulation

Coinbase is dedicated to regulatory compliance in all jurisdictions the place it operates. Within the United States, Coinbase, Inc., which operates the Coinbase trade and its ancillary companies, is licensed to interact in cash transmission in most US jurisdictions. Most of Coinbase’s cash transmission licenses cowl US Greenback money balances and transfers. In some states, these licenses additionally cowl cryptocurrency balances and transfers on the platform. Coinbase can also be registered as a Cash Companies Enterprise with FinCEN.

Coinbase is required to adjust to many monetary companies and shopper safety legal guidelines, together with the Financial institution Secrecy Act and the USA Patriot Act. The Financial institution Secrecy Act requires Coinbase to confirm buyer identities, keep information of foreign money transactions for as much as 5 years, and report sure transactions. The USA Patriot Act requires Coinbase to designate a compliance officer to make sure compliance with all relevant legal guidelines, create procedures and controls to make sure compliance, conduct coaching, and periodically evaluate the compliance program.

The European Union lately handed the Markets in Crypto-Property (MiCA) regulation, set to come back into impact in December 2024. Coinbase utilized for a license underneath the brand new MiCA laws, with Eire as its chief base for operations and laws within the European Union. In contrast to the US, if MiCA approves the applying, Coinbase will obtain the inexperienced mild to function in any state underneath the EU, like Germany, France, or the Netherlands, with out making use of for laws individually.

Coinbase Crypto Listings

Coinbase envisions swiftly itemizing all property that meet their strict requirements. As a vocal advocate of regulation, compliance with native legislation is the linchpin of these requirements, amongst different essential qualities like utility and commerce capability. On account of huge disparities in native legislation governing digital property, token listings differ considerably throughout the nations the place Coinbase offers trade companies.

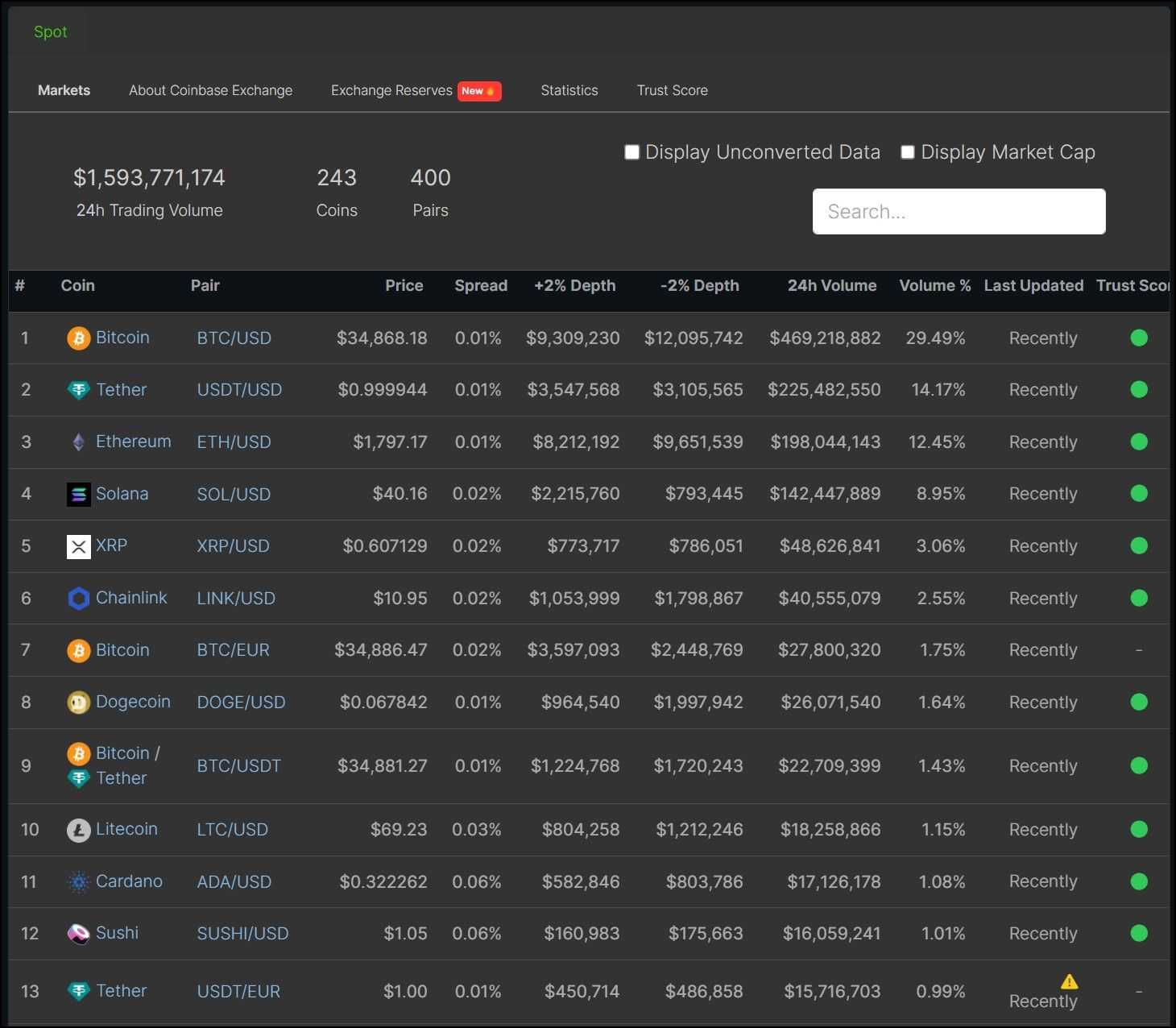

In line with Coingecko, the Coinbase trade supported 243 cash and 400 buying and selling pairs. One class noticeably absent throughout all areas is tokens like XMR. Privateness tokens are notorious for harbouring illicit transactions, main some nations to ban the possession and buying and selling of such property.

Whereas the particular variety of token listings could differ throughout nations, Coinbase allows sitewide assist for all main cryptocurrencies, which comprise the majority of worldwide buying and selling quantity. Due to this fact, most merchants won’t be hindered by restricted listings on Coinbase.

Coinbase Fiat Help

Coinbase doesn’t explicitly point out all of the fiat currencies accepted by the trade. Nonetheless, based mostly on the fiat deposit and withdrawal channels accepted by the trade, Coinbase helps the Euro (EUR), US {dollars} (USD), and British Pound Sterling (GBP).

Coinbase Pay

Coinbase Pay is a cost characteristic that helps numerous crypto and fiat foreign money cost choices. Coinbase Pay is on the Coinbase Pockets, Coinbase NFT, and a few third-party apps, supporting about 60+ fiat foreign money and several other crypto cost choices.

Coinbase Charges

Coinbase doesn’t cost any further charge for crypto deposits, and depositors solely pay the related blockchain transaction charges. Nonetheless, there are separate charge constructions for the varied Coinbase merchandise just like the trade, Coinbase Superior, and Coinbase Commerce.

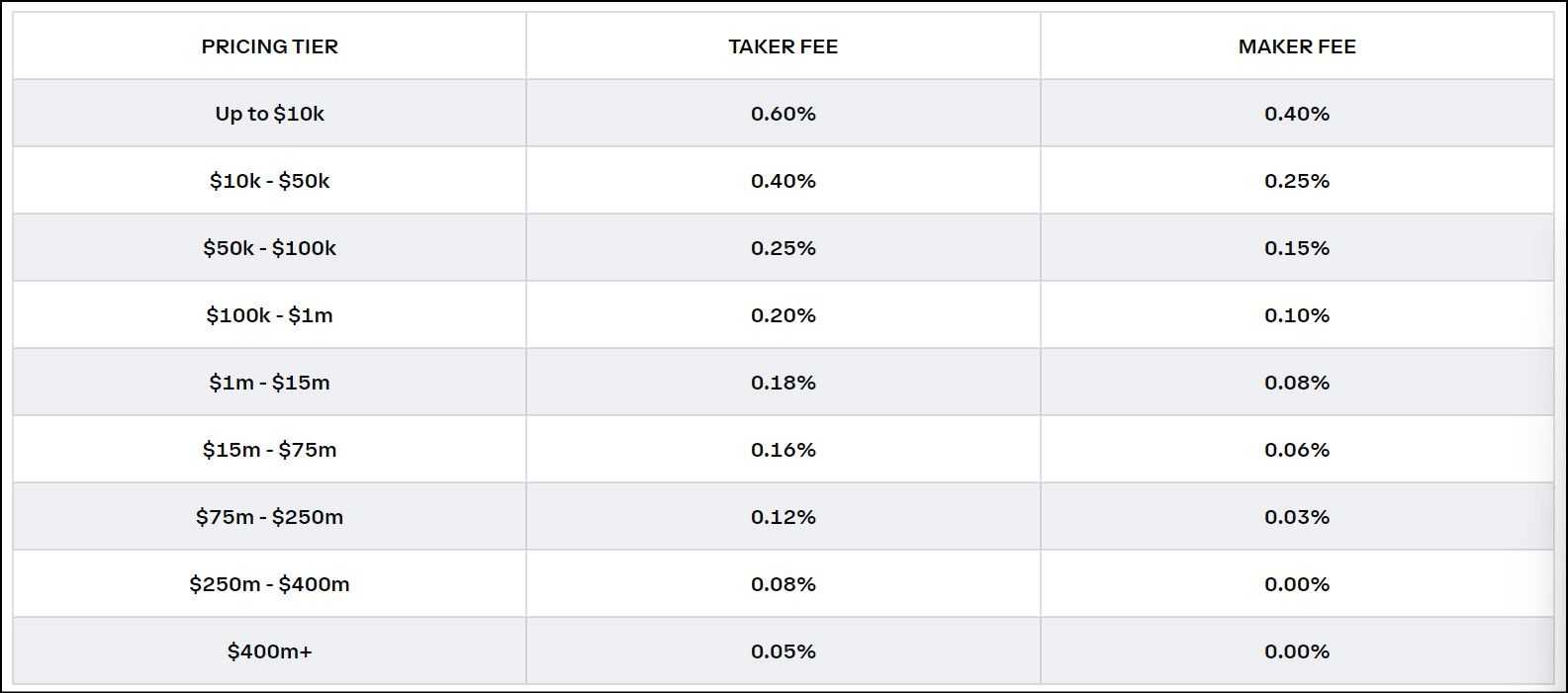

Makers and Takers

To know the charge constructions, it’s useful to know how Coinbase defines makers and takers. Takers are market members whose orders get instantly crammed from the open orders within the order ebook. If an order you place just isn’t instantly fulfilled (like when inserting orders away from the present market value), you might be thought-about a market maker. Makers are sometimes charged lower than takers.

On Coinbase Superior, charge tiers are calculated based mostly on the person’s 30-day USD buying and selling quantity, excluding quantity from buying and selling steady pairs. The tiered charge construction on Coinbase Superior seems to be like this:

The Coinbase Exchange additionally deploys a maker-taker charge mannequin unfold throughout tiers. Whereas a maker could pay something between 0.00% and 0.40% on the trade, a taker’s charge ranges between 0.05% and 0.6%.

The Coinbase trade additionally helps fiat deposits and withdrawals, with completely different charges based mostly on the fiat foreign money. The trade helps the next currencies:

Coinbase Charges Abstract:

To sum up, the charges on Coinbase are aggressive however not the bottom within the business. Customers who worth Coinbase’s safety ensures and dedication to following acceptable licensing and laws could also be prepared to pay a better charge for its companies.

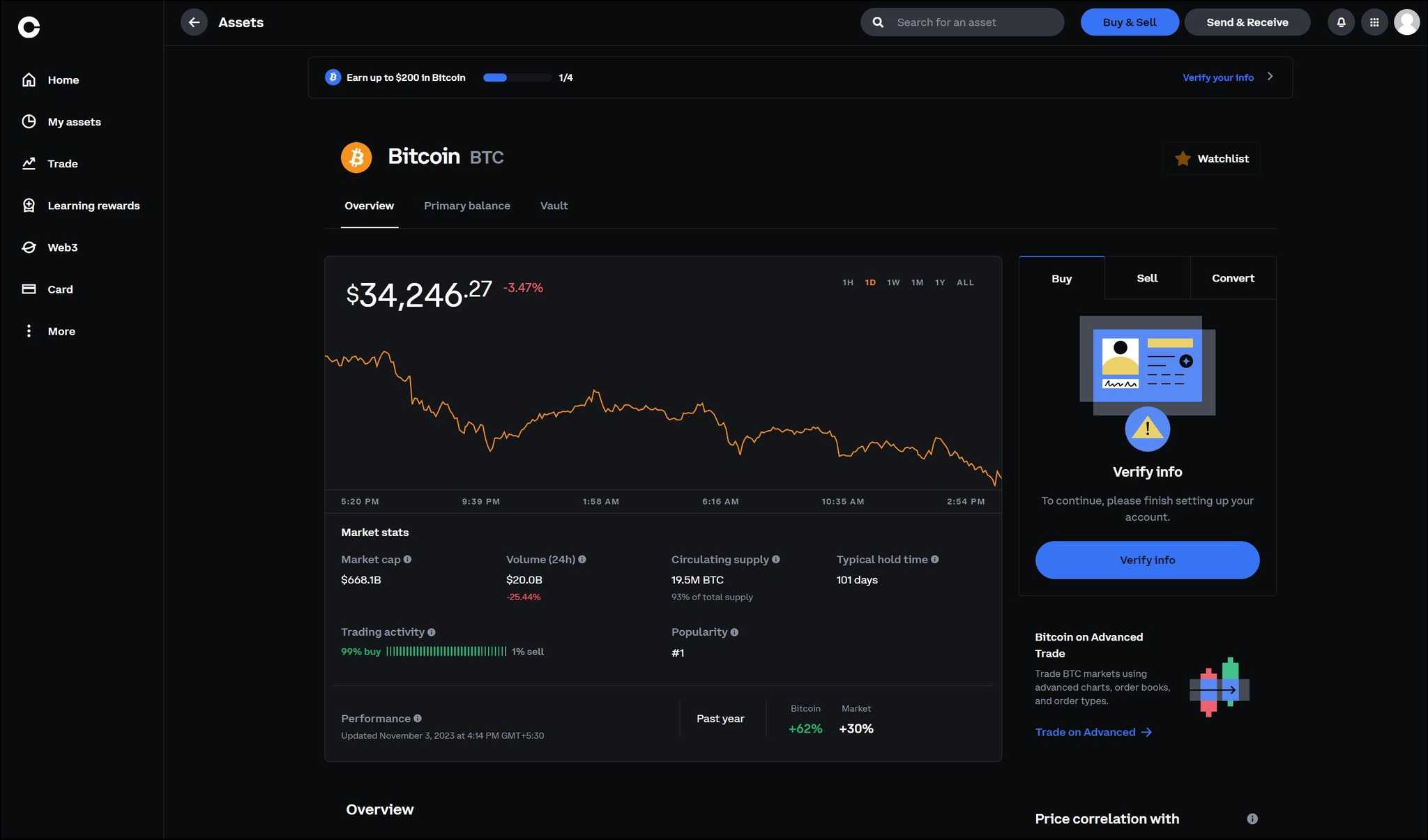

Coinbase Buying and selling Platform

The Coinbase buying and selling interface stands out by enabling customers to decide on between a easy and a complicated interface. The easy interface replaces conventional candlestick charts with easy-to-understand line charts in order that merchants not technically initiated will not be overwhelmed by a number of data without delay. The easy interface offers the required data to position simple purchase or promote trades.

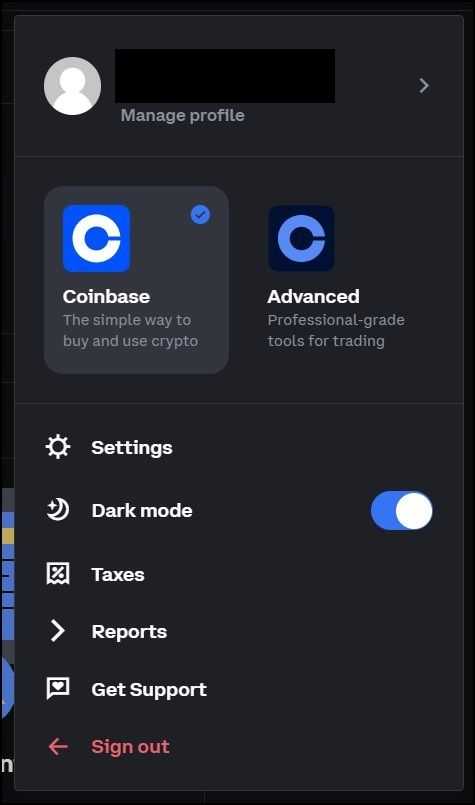

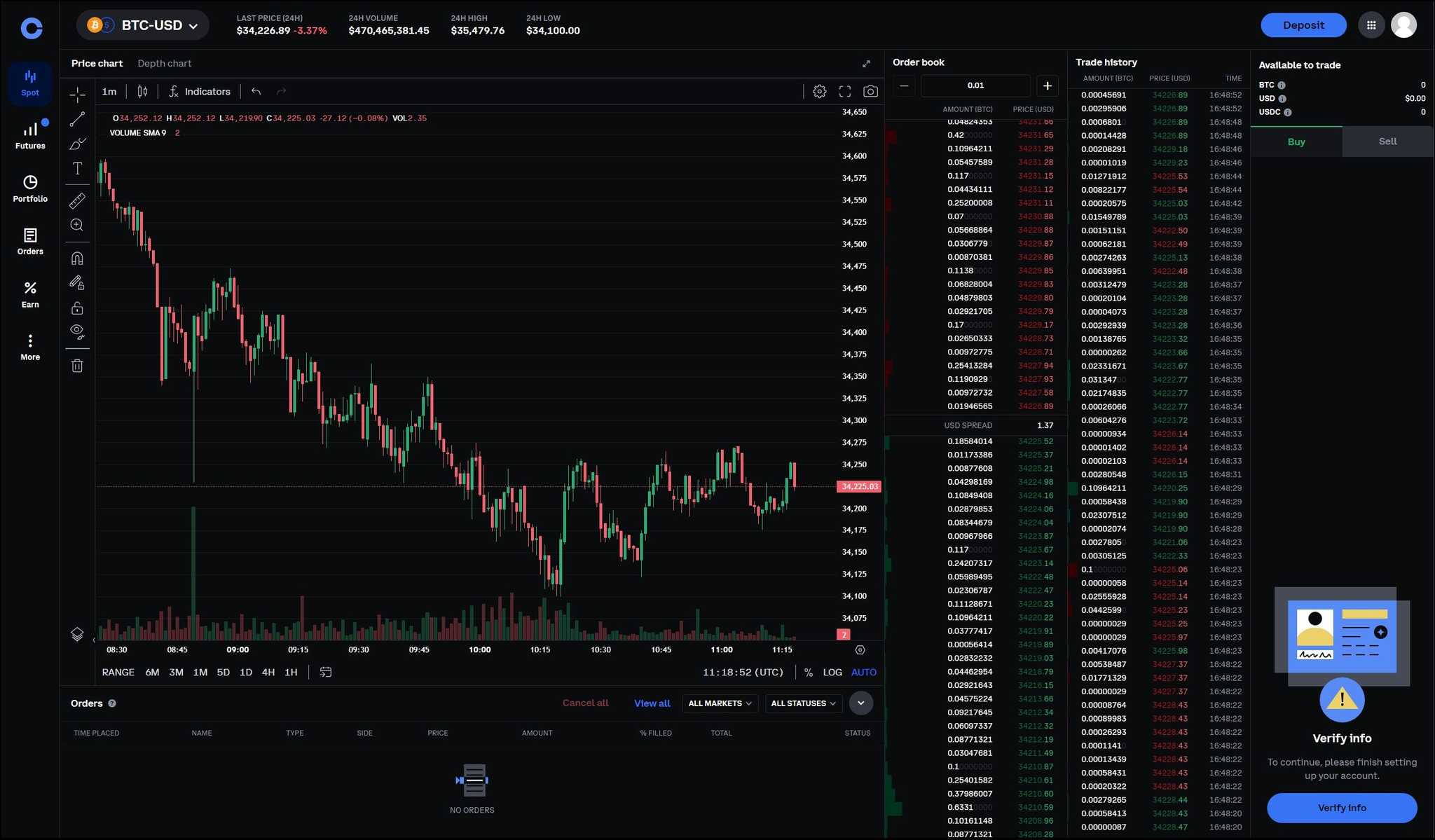

Whereas the straightforward interface is good for newcomers and novices, those that are accustomed to the standard interface or want superior buying and selling choices for technical evaluation will probably be pleased to know that entry to the “Advanced” interface is only a click on away.

To change to Coinbase Superior, click on in your profile icon and toggle Coinbase Superior. The superior interface comprises all the weather we’re accustomed to, giving merchants extra details about the market exercise of the pair they plan to commerce. Separating easy and superior interfaces could also be useful for merchants with restricted expertise utilizing technical indicators and charting instruments.

Studying easy methods to use the superior chart could be helpful for crypto merchants who wish to purchase in and promote at higher ranges. If you’re seeking to up your crypto sport, make sure you take a look at our articles on Learn a Crypto Chart and our Information to Technical Evaluation.

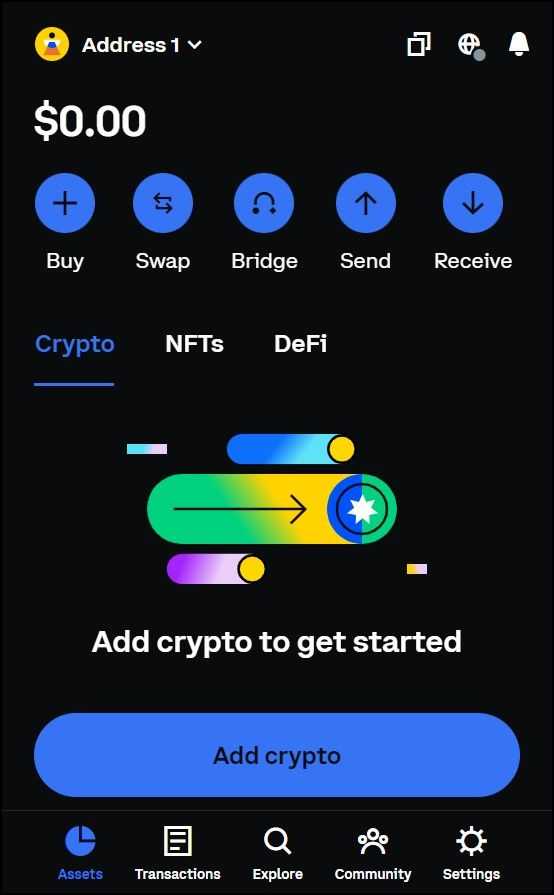

Coinbase Pockets

The Coinbase Pockets is a web based crypto pockets that customers can entry to keep up self-custody of their crypto property. Observe that the pockets is an impartial service accessible with out registering on Coinbase.com. Just like different wallets like Metamask, Coinbase Pockets customers keep self-custody of their property which might be protected with a seed phrase. It helps EVM and Solana-compatible networks by a browser extension or a cellular app, with main networks like Arbitrum, Avalanche, Polygon, Base, and BNB already pre-installed.

Aside from all ERC-20 tokens and EVM-compatible chains, the pockets stands out by supporting Bitcoin, Dogecoin, and Litecoin. You’ll be able to entry Web3 by connecting supported dApps to your Coinbase pockets. The non-custodial nature of the Pockets allows it to assist a higher variety of jurisdictions than Coinbase’s custodial companies (just like the trade).

Coinbase Earn

Like each different main cryptocurrency trade, Coinbase hosts an Earn program, the place customers can earn curiosity by investing their crypto holdings in passive revenue merchandise. Observe that one can solely entry the Earn program with their Coinbase account. The trade employs a geographical restrict on who can register on Coinbase.com. Due to this fact, Coinbase Earn is simply accessible to customers residing in a rustic the place they will create a Coinbase account and show their residential standing by finishing Coinbase’s KYC norms.

There are three passive revenue applications underneath Coinbase Earn: Staking, DeFi Yield, and Study and Earn, providing APYs as much as 6% on common, however the yields on particular property could significantly differ with time and market volatility.

Coinbase lacks the Earn options provided by most of the main exchanges and falters fairly considerably on this space. For customers on the lookout for one of the best centralized exchanges to earn yield, we suggest trying out SwissBorg, Binance, or Bybit.

Coinbase Earn – Staking

In Staking, Coinbase delegates your crypto funding to the Proof of Stake consensus of the corresponding blockchain community to earn the community’s token inflation rewards. On-chain consensus processes sometimes impose a lock-up interval earlier than you may unstake your property and cost transaction charges at each step.

Coinbase staking abstracts such sophisticated steps related to taking part in consensus manually, permitting customers to stake or unstake at any time with out worrying about transaction charges. The trade expenses a sure portion of your earnings as a fee for offering seamless staking companies. The property supported in staking differ with time and placement as Coinbase provides or removes property to stick to native legal guidelines, that are nonetheless maturing.

If you wish to be taught extra about staking, we have now a devoted article that covers what staking is and the way it works.

Coinbase Earn – DeFi Yield

Coinbase DeFi Yield is a yield farming product the place crypto investments gasoline DeFi good contracts, like lending protocols, swap companies, and Automated Marker Makers (AMMs) in trade for charges or curiosity. In DeFi Yield, Coinbase performs the mediator between such DeFi protocols that invests subscriber’s funds and forwards their proportionate rewards after its fee.

Coinbase Study and Earn

Study and Earn is an attention-grabbing initiative by Coinbase the place members obtain rewards for studying about cryptocurrencies. This system offers free academic sources to Coinbase Earn customers. Customers can then earn crypto property to show their information by passing numerous quizzes on the platform. Do do not forget that the tutorial sources are meant for newcomers, making rewards probably underwhelming for high-volume buyers.

Coinbase Earn Charges

There is no such thing as a charge for staking or unstaking on Coinbase. The trade expenses a fee based mostly on the person’s earnings. Usually, common customers incur an curiosity of 35% from earnings in DOT, ATOM, and SOL and 25% for ETH. Coinbase One members can entry Coinbase Earn at a reduction. Subscribers are charged simply 26.3% for accessing altcoin DeFi protocols.

FYI: DeFi protocols are nascent markets topic to excessive volatility. As a mere facilitator, Coinbase doesn’t assure any return from DeFi Earn merchandise.

Different Coinbase Options

Coinbase additionally affords quite a lot of different merchandise past cryptocurrency buying and selling and investing. They’re summarised right here:

- Coinbase Card – Permits US residents to transact money and crypto transactions by way of Visa channels. Verify the Coinbase Card assist middle to know extra about eligibility and software particulars.

- Coinbase One – It’s a subscription service providing buying and selling charge reductions, taxation, and analytics companies.

- Coinbase Superior – Previously often known as Coinbase Professional, Superior is now built-in throughout the Coinbase buying and selling terminal. Superior affords charting instruments and technical market information and lets customers place personalized orders.

- Coinbase Prime – Coinbase Prime is an built-in prime brokerage platform designed primarily for institutional buyers, together with asset managers, corporates, hedge funds, high-net-worth people, endowments, household workplaces, and personal wealth managers. It offers a unified investing expertise, combining buying and selling, financing, and custody companies in a single platform.

- Coinbase NFT – A platform for creating, discovering, buying and selling, and showcasing NFTs, that are accessible with the Coinbase Pockets.

Coinbase Base

Base is an Ethereum layer-2 scaling answer constructed by Coinbase in collaboration with Optimism. Base is an Optimistic Rollups-based layer-2 community constructed utilizing the OP Stack. With Base, Coinbase turned one of many first publicly traded firms to launch a proprietary blockchain community.

Base has attracted appreciable developer consideration since its inception. A number of DeFi purposes have already constructed good contracts on Base, together with Dexes like Curve, Uniswap, and Balancer; cross-chain protocols like Stargate and Hop Protocol; and lending protocols like Compound.

Buddy.Tech, a Social Finance (SoFi) protocol, launched on the Base community and noticed record-breaking development shortly. The protocol permits customers to commerce "keys" for entry to non-public chatrooms, positioning itself as a game-changer within the social media area. Take a look at the Base evaluate on Coin Bureau to be taught extra concerning the protocol.

Coinbase vs Competitors

Coinbase is a safe trade with a wonderful observe report of offering fault-proof companies, nevertheless it won’t be for everyone. Constraints resembling geographical availability and an absence of advanced buying and selling merchandise could steer buyers to different exchanges. We’ve bought devoted articles that evaluate Coinbase towards different well-known exchanges:

- Coinbase vs Binance

- Coinbase vs OKX

- Coinbase vs KuCoin

Coinbase is undeniably, probably the most trusted, safe and respected exchanges within the business, attracting merchants who favour simplicity and security above all else. Although, in our opinion, listed here are the exchanges that outclass Coinbase in a couple of key areas:

Finest “all-in-one” exchanges– Binance, Crypto.com, Bybit

Finest Earn part– Binance, SwissBorg

Most Safe- Kraken, SwissBorg

Lowest Charges- Binance, KuCoin, OKX

Coinbase Review – Conclusion

Probably the most obvious draw back to the Coinbase trade is its lack of worldwide availability throughout all places. Nonetheless, wherever Coinbase operates, it respects the area’s regulatory compliances, making Coinbase essentially the most excellent possibility for buyers who worth safety.

Within the Prime Cryptoforeign money Exchanges checklist curated by Coin Bureau, Coinbase is listed as one of the best trade for newcomers as a result of its easy interface. With Coinbase, newcomers can get a style of all the pieces DeFi, together with buying and selling crypto property, taking part in DeFi protocols, and even buying and selling NFTs. With the addition of Coinbase Superior, the trade offers a easy transition to extra intricate instruments for buyers seeking to dive deeper after testing the shallow waters.

Ceaselessly Requested Questions

Is Coinbase Good for Learners?

Completely! Crypto customers will usually echo my sentiment in saying Coinbase is one of the best platform for newcomers. Coinbase is among the best and most handy platforms, whereas Coinbase Superior Exchange is less complicated to make use of than most different crypto exchanges.

Is Coinbase Reliable?

Sure. Coinbase is the one publicly traded crypto trade. It’s totally compliant and controlled by the authorities within the jurisdictions through which they function.

Is Coinbase Higher Than Binance?

It’s of my opinion and most customers within the crypto area that Coinbase just isn’t higher than Binance. Binance is by far the biggest crypto trade on the earth by customers and quantity for a cause. Binance affords way more features, options, markets, property, and merchandise, to not point out affords considerably superior buying and selling merchandise together with leverage, choices, and futures.

Binance additionally has a extra useful buying and selling platform. They’ve their very own designed buying and selling display, or customers can select one powered by TradingView that’s constructed proper into the trade for final comfort.

What Are The Finest Options of Coinbase?

Coinbase is famend for its user-friendly interface, making it accessible for newcomers in cryptocurrency. It affords a variety of cryptocurrencies for buying and selling, offering customers with a various portfolio. Safety is a prime characteristic, with robust encryption and insurance coverage in case of a breach. Moreover, Coinbase offers academic sources to assist customers perceive crypto markets. Its cellular app is very rated, providing comfort for buying and selling on the go. Lastly, Coinbase has a sturdy API for builders.

Differentiate Between Coinbase Easy, Superior, and Prime.

- Coinbase (Easy): That is the usual Coinbase platform most retail customers begin with. It is designed for ease of use, permitting fast buy, sale, and administration of cryptocurrency with a simple interface.

- Coinbase Superior: Focused at skilled merchants, Coinbase Superior affords charting options, detailed transaction historical past, and decrease transaction charges. It offers extra management over trades with market, restrict, and cease orders.

- Coinbase Prime: Particularly designed for establishments, Coinbase Prime offers further companies resembling margin finance, over-the-counter (OTC) buying and selling, and devoted assist. It is constructed for larger quantity buying and selling with refined buying and selling and safety features that meet institutional necessities.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.