The European Central Bank has revealed its new website. Second Progress Report On developing the digital Euro central bank digital currency, highlighting advancements during the preparation phase. A prototype is mentioned for 2025.

The ECB reaffirms in the report its commitment to provide a safe and efficient solution for digital payments that will complement cash, while maintaining monetary stability. Additionally, the digital euro is seen as a way to ensure the future competitiveness of the Eurozone’s financial system.

The digital euro aims to support the European Union’s digital economy by providing a reliable digital payment method that could be widely accepted by consumers, businesses, and governments across the region.

Findings on Digital Euro

The ECB’s progress report focused on two primary areas: technical and legal considerations, and the ongoing public consultation process.

The ECB made great strides over the last year in addressing technical issues of the digital Euro, such as improvements to infrastructure, security, and integration into existing payment systems.

The ECB also works closely with other stakeholders such as financial institutions, policymakers and academics to make sure that the digital Euro can be seamlessly integrated into current monetary, economic and societal frameworks.

This report highlighted that it was important to comply with European Union laws, including the General Data Protection Regulations (GDPR), when designing the euro digital.

The document also provides an updated on the public consultation that has generated significant interest among citizens, businesses and institutions. The ECB was contacted on a range of topics, including the way the digital currency euro might improve payments efficiency, possible risks to the financial stability as well as concerns about privacy and cybersecurity.

Look at the website

Consultation results will be crucial in shaping the future phase of the project. The ECB emphasized that the public’s input will be vital in determining the final design and implementation of the digital euro.

In the near future, the ECB’s focus will be on preparing to launch the second phase of its digital-euro project. This next stage involves more elaborate design and testing.

In 2025 the central bank intends to start testing prototypes of a digital Euro. According to the research and development results, it could launch in the next few years.

Although the ECB did not establish a timeline, they remain committed to ensuring a digital introduction that will support the stability and safety of the European financial systems.

Postings in: EU, Banking CBDCs and Featured Author ![]()

![]()

Gino Matos

Gino Matos, a graduate of law and an experienced journalist with over six years experience in cryptography. Ses expertise is primarily focused on developments within the Brazilian Blockchain ecosystem, and in Decentralized Finance (DeFi).

@pelimatos LinkedIn Email Gino Editor

Assad Jafri

AJ is a dedicated journalist who has spent over a ten-year period honing his skills around the world. Specialized in financial journalism and focusing on crypto-reporting, he is now focused on this area.

@Saajthebard Email Editor on LinkedIn Ad

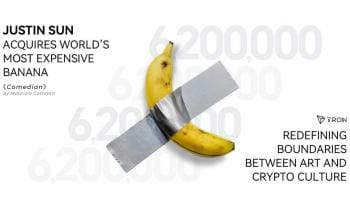

Justin Sun Honors Maurizio Cattelan’s Iconic ‘Comedian’, Bridging Art and Crypto Culture

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.