Crypto ownership in the UK has increased to 12% of adults, up from 10%, according to the Financial Conduct Authority’s (FCA) latest research published on Nov. 26. The number of adults who are aware of cryptocurrency has also increased, with 93%.

The FCA’s study revealed that the average value of crypto holdings per person rose from £1,595 to £1,842. Families and friends were the main source of information among those who had never bought digital assets. Only one out of ten investors admitted that they did not do any research prior to investing.

Around a third believed that they could lodge a complaint to the FCA if there were any issues. They also thought it would provide recourse and financial protection. The UK has not regulated digital assets and they are considered high risk. Investors have been warned to take precautions as their funds could be lost without regulation.

FCA crypto approach hampering progress

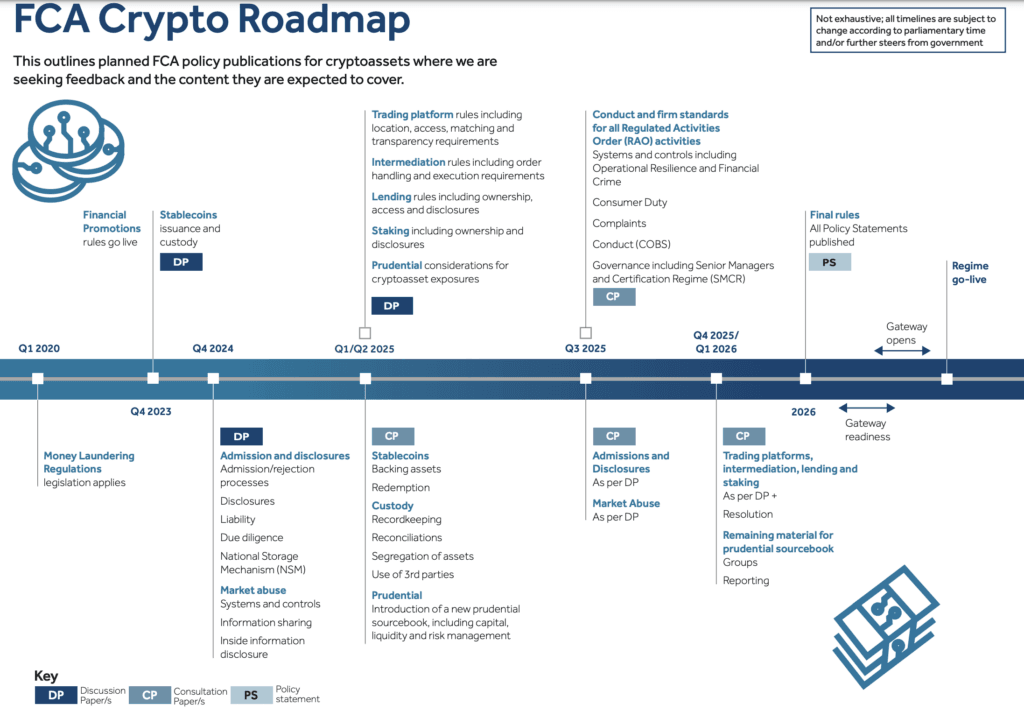

The FCA has begun outlining its approach to regulating digital assets, publishing an indicative roadmap of key dates for the development and introduction of the UK’s crypto regulatory regime. The roadmap includes a number of consultations that are aimed to promote transparency and involvement in the policy-making process.

Arun Srivastava, fintech and regulation partner at Paul Hastings, told CryptoSlate

“The UK was in danger of becoming an outlier, with the EU’s MiCA regulation coming into full force at the end of this year and the change in the US Administration in the US heralding a fresh and crypto-friendly approach in the US.

The new rules will materially change the current regulatory framework in the UK, which operates under anti-money laundering legislation focused on financial crime.”

The research also indicated shifts in consumer behavior. The research also indicated shifts in consumer behavior. According to 20% of participants, friends and families are the main reason they purchase crypto. To buy crypto, 19% of participants used long-term saving in 2022. By 2024 that number increased to 26%. Those who bought with overdrafts or credit cards rose to 14% during the same time period.

The FCA’s analysis suggests that recent events have affected consumer demand for digital assets, including the crypto market crash in 2022, the cost-of-living crisis, criminal charges against CEOs of major exchanges, and rising crypto valuations since the end of 2023.

Noteworthy, 26% non-crypto users said they’d be more inclined to invest in the crypto market if it were regulated. FCA is aware that regulations can affect consumer behavior. It’s working on ways to reduce the risks of digital assets.

FCA crypto roadmap by 2026

Per the FCA’s roadmap, the planned regulatory framework for digital assets includes multiple phases spanning from 2023 to 2026. The FCA’s roadmap includes a number of milestones, including implementing rules on financial promotion, stabilcoin custody and regulation, as well as introducing new prudential rules and comprehensive trading platform, intermediation and lending rules.

Matthew Long, director of payments and digital assets at the FCA, stated:

“Our research results highlight the need for clear regulation that supports a safe, competitive, and sustainable crypto sector in the UK. We want to develop a sector that embraces innovation and is underpinned by market integrity and consumer trust.”

Following legislative changes, the FCA has been responsible for regulating digital asset promotions since October 2023. In the first year under this regime, the FCA has issued 1,702 alerts, taken down over 900 scam crypto websites, and removed more than 50 apps to combat illegal promotions targeting UK consumers.

Posted In: UK, Featured, Legal, Regulation Author ![]()

![]()

Liam ‘Akiba’ Wright

Also known as “Akiba,” Liam Wright is a reporter, podcast producer, and Editor-in-Chief at CryptoSlate. He believes that decentralized technology has the potential to make widespread positive change.

@akibablade LinkedIn Email Liam Editor

News Desk

CryptoSlate is a comprehensive and contextualized source for crypto news, insights, and data. Focusing on Bitcoin, macro, DeFi and AI.

@cryptoslate LinkedIn Email Editor

CryptoSlate on Substack cryptoslate.substack.com

CryptoSlate on Substack cryptoslate.substack.com

Get the latest crypto news and expert insights. Delivered to you daily.

Join 90k+ subscribers

Latest UK Stories

UK to introduce comprehensive crypto regulations in 2025 as global competition heats up

Regulation 4 days ago

The UK’s draft framework aims to redefine stablecoins and staking with rules that foster both innovation and safety.

Agant’s GBPA aims to transform UK’s digital finance landscape with regulatory-first approach

Stablecoins 5 days ago

British stablecoin startup Agant aims to revolutionize UK’s digital finance landscape with GBPA, with a view to offering a regulatory-compliant alternative to existing stablecoins while tackling remittance costs and cross-border transactions.

Judge may call Craig Wright back to the UK so he cannnot ‘hide behind a keyboard from a closet in Thailand’

Legal 4 weeks ago

Wright pushes for courtroom absence from Singapore, but judge cites UK residency and case importance.

London Satoshi reveal unsurprisingly fails to convince anyone of his identity amid fraud charges

Culture 4 weeks ago

Stephen Mollah’s attempt to prove he’s Satoshi Nakamoto falls flat in London.

Latest Alpha Market Report  Available exclusively via

Available exclusively via

Polymarket: A revolution in prediction markets

Andjela Radmilac · 3 days ago

CryptoSlate’s latest report dives deep into Polymarket’s evolution, its pivotal role in high-stakes prediction events like US elections, and the implications of its controversies on its market position.

Latest Press Releases

View All

Request Finance acquires Pay.so Lithuania; launches revolutionary one-click crypto/fiat payment solution

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.