Intesa Sanpaolo, Italy’s largest bank, has reportedly entered the Bitcoin market by acquiring €1 million worth of the leading digital asset.

This translates to approximately 11 BTC, according to an internal email allegedly signed by Niccolo Bardoscia, the head of the bank’s digital asset trading and investment division.

Reuters and other credible news outlets have covered the story, even though Intesa is yet to confirm it.

Meanwhile, Intesa’s reported Bitcoin acquisition follows a series of strategic moves in the digital asset space.

Last year, the bank’s crypto division reportedly secured approval for spot crypto trading, adding to its existing offerings of crypto options, futures, and exchange-traded funds (ETFs).

It is not clear if the Bitcoin acquisition signals a broader expansion of its digital asset ecosystem.

Nevertheless, Pierre Rochard, Vice President of Bitcoin Miner Riot Platforms, highlighted the significance of this shift, noting that financial institutions increasingly recognize Bitcoin’s potential.

“He said:

“All of the banks need to start accumulating BTC to recapitalize their balance sheets.”

Intesa is widely recognized as a leader in digital asset adoption within Italy’s traditional finance sector. It also holds the top spot among Eurozone banks by market capitalization, valued at €69 billion—outpacing competitors like Santander (€67 billion) and BNP Paribas (€66 billion).

Bitcoin Interest Institutional

Market observers noted that Intesa’s purchase reflects a broader trend of increased Bitcoin adoption among financial institutions.

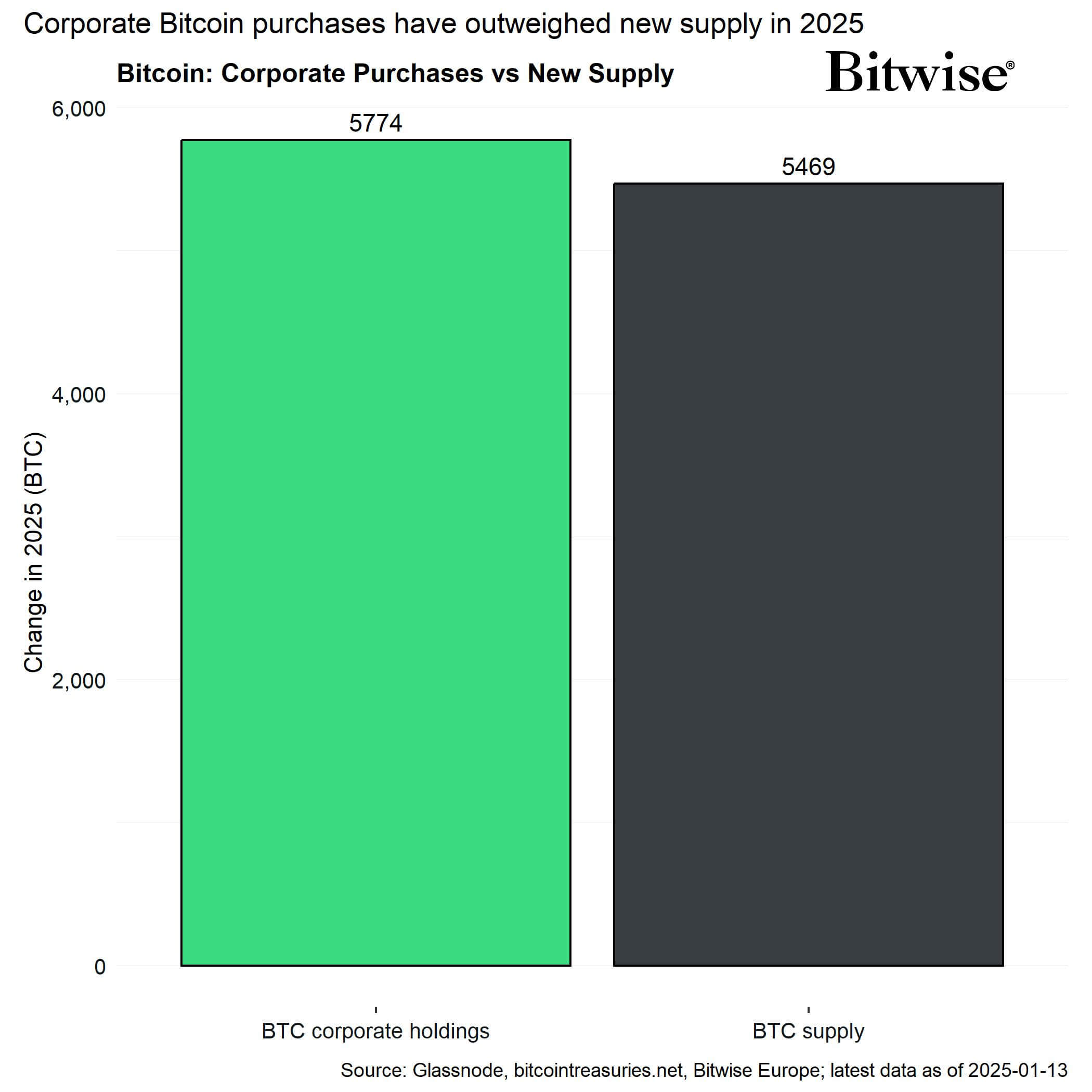

Bitwise data shows that the demand of corporations for Bitcoin by 2025 will exceed supply. Since the start of this year, companies have purchased a total of 5,774 BTC. However, only 5,469 BTC was mined in the same time period.

MicroStrategy is one of the most prominent corporations that has purchased Bitcoins. It added 3,600 BTCs to its reserve this year. Semler Scientific as well as Ming Shing Group are also using Bitcoin for their reserve and liquidity diversification.

Hunter Horsley Bitwise CEO believes that the trend is likely to continue into this year.

“Corporations buying Bitcoin is going to be a major theme of 2025.”

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.