The Ethereum Merge represents one of the vital upgrades to the Ethereum community since its inception. This transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism marked a revolutionary shift for Ethereum and the broader blockchain panorama. The Merge successfully eradicated Ethereum's reliance on energy-intensive mining. The Merge has additionally catalyzed the event of assorted area of interest industries and utilities inside the Ethereum ecosystem. Within the transient interval since its implementation, many of those use instances have turn into defining traits of Ethereum.

One notable end result of the Merge is the rise of Staking-as-a-Service (SaaS), an idea that differs from the normal Software program-as-a-Service mannequin. Staking-as-a-Service permits customers to stake their Ethereum with out having to handle the technical complexities concerned in operating a validator node. This service has shortly gained recognition because it lowers the limitations to entry for collaborating in Ethereum staking, enabling extra customers to contribute to community safety and earn staking rewards.

This evaluation focuses on Lido Protocol, a number one challenge within the Staking-as-a-Service area. Lido has quickly ascended to turn into the most important protocol by Whole Worth Locked (TVL) in Ethereum, boasting over $25 billion in TVL as of September 2024, based on DefiLlama. Lido's success might be attributed to its user-friendly strategy to staking, permitting customers to take part in staking without having the technical information or the total quantity of 32 ETH required to run a private validator.

On this Lido Finance evaluation, we’ll discover each facet of the Lido Protocol, together with its distinctive options, its impression on the Ethereum ecosystem, and its potential future developments. We'll additionally assess the professionals and cons of utilizing Lido for staking, offering readers with a complete understanding of its function inside the quickly evolving Ethereum panorama.

What’s Liquid Staking?

Liquid staking is an revolutionary strategy to staking on proof-of-stake (PoS) blockchains. In contrast to conventional staking, the place tokens are locked up and inaccessible for a set interval, liquid staking permits customers to stake their property whereas nonetheless retaining liquidity. Customers obtain a spinoff token representing their staked property, which can be utilized in decentralized finance (DeFi) functions, enabling them to earn further yields or commerce their positions with out ready for the staking interval to finish.

Liquid Staking Derivatives (LSDs)

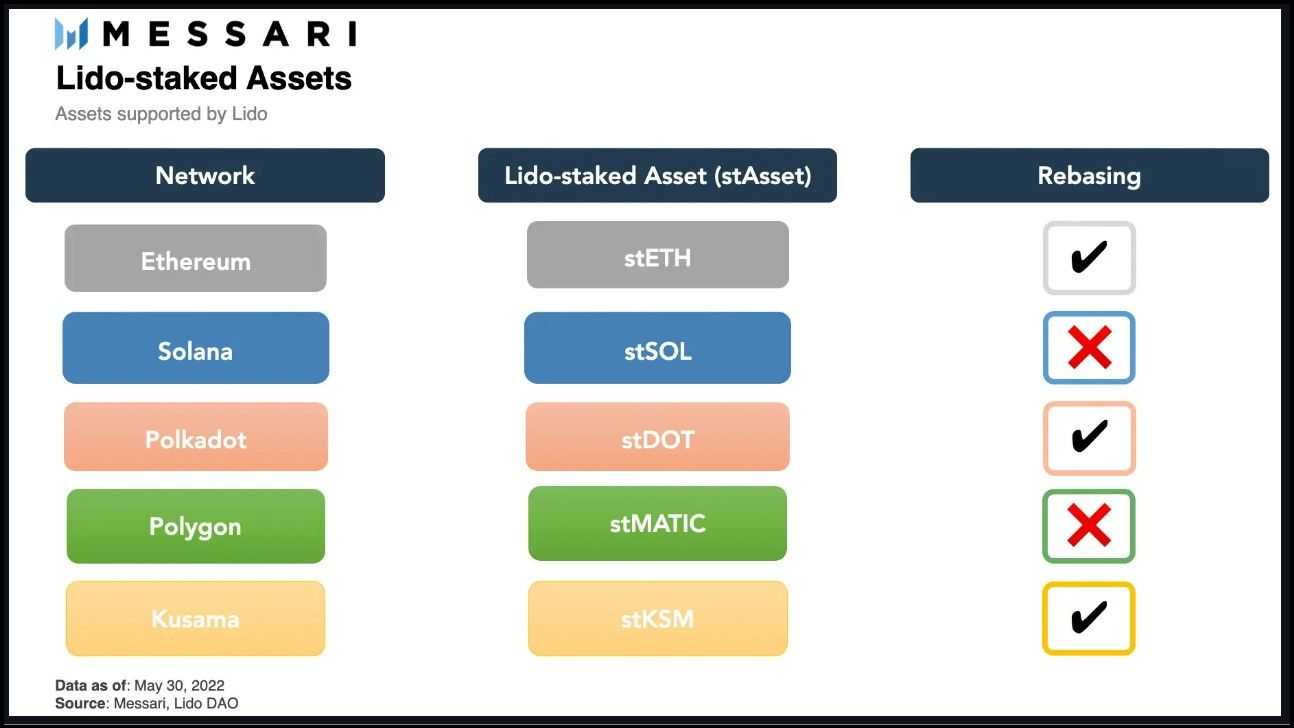

Liquid staking derivatives (LSDs) are tokens issued to customers once they stake their property by liquid staking platforms. These tokens, corresponding to stETH for Ethereum or stMATIC for Polygon, characterize the staked asset and accrue staking rewards over time. They permit customers to take care of flexibility and liquidity, using their staked property throughout numerous DeFi protocols whereas nonetheless collaborating in staking. They’re extra generally often known as Liquid Staking Tokens (LSTs).

For extra, you may learn our full information to liquid staking.

What’s Lido Finance?

Lido Protocol was launched in December 2020 as a liquid staking resolution for proof-of-stake (PoS) cryptocurrencies. The protocol was co-founded by a bunch of buyers and builders, together with Semantic Ventures, ParaFi Capital, Terra, MakerDAO creator Rune Christensen, Aave CEO Stani Kulechov, and Synthetix founder Kain Warwick. Early help additionally got here from node operators like Stakefish and Staking Services.

Lido initially launched its staking service on Ethereum and shortly expanded to incorporate help for different networks, corresponding to Solana, Polkadot, Kusama, and Polygon, every providing an identical liquid staking mannequin.

The Lido Decentralized Autonomous Group (DAO) was established to supervise the protocol's governance and guarantee its decentralized operation. The DAO is accountable for key choices, corresponding to protocol upgrades and the allocation of staking rewards. The governance of Lido is performed utilizing the LDO token, which permits holders to take part within the decision-making processes of the protocol).

Lido Protocol Economics

The ethos of liquid staking revolves round maximizing the utility of staked tokens whereas enhancing accessibility for customers serious about Ethereum staking. Conventional staking requires customers to lock up their tokens, making them inaccessible for a selected interval, which limits their utility. Liquid staking, nonetheless, permits customers to stake any quantity of tokens and retain liquidity, offering them with flexibility and the potential for extra yield from DeFi functions.

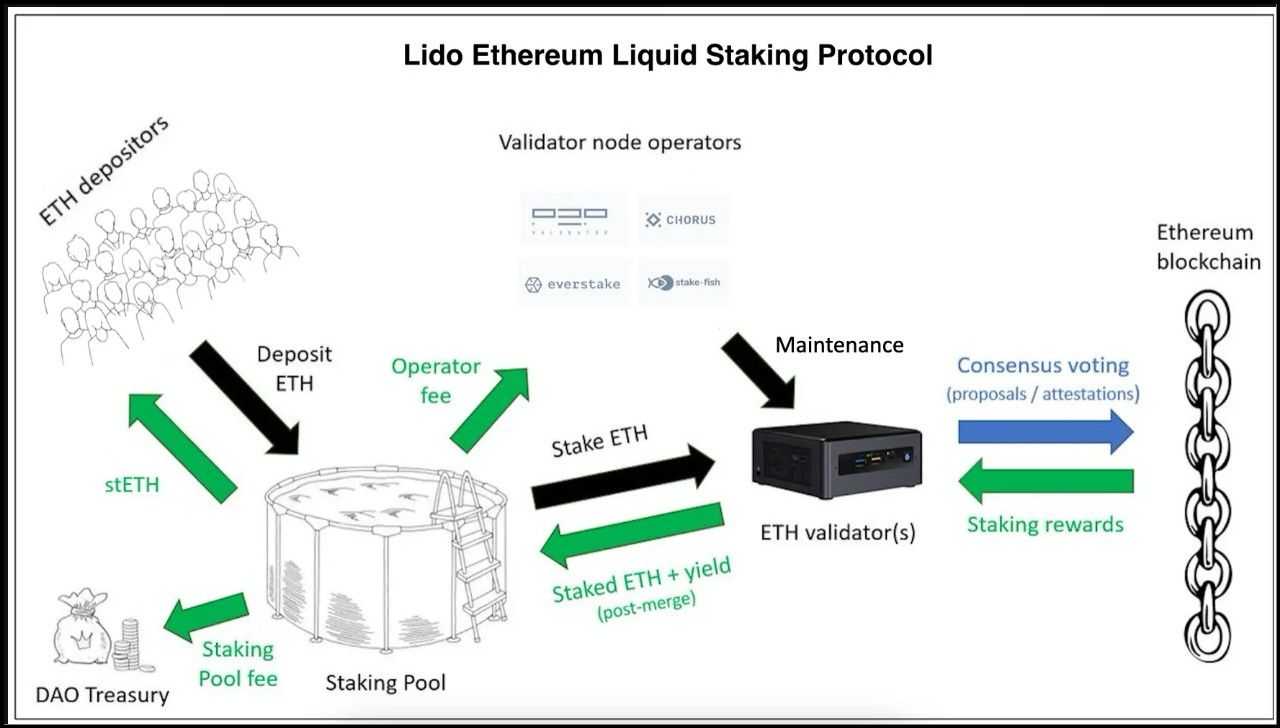

How Does Lido Work?

Lido is a liquid staking protocol designed to allow customers to take part in Ethereum staking with out coping with the technical complexities or monetary burdens historically related to it. Customers can deposit any quantity of ETH into the Lido protocol, no matter dimension, which Lido then stakes by a community of trusted validators.

- Staking and Minting stETH: When customers stake their ETH with Lido, the protocol mints stETH tokens equal to the quantity staked. These stETH tokens characterize the consumer's staked ETH within the Lido contract and accrue staking rewards proportionally.

- Utility of stETH: stETH tokens are liquid and are helpful in numerous Web3 use instances, together with DeFi protocols, buying and selling, and even restaking to generate further yields. This versatility makes stETH priceless inside the broader Ethereum ecosystem.

Governance

Lido's governance is managed by the Lido DAO, which oversees the protocol's core ideas, together with setting charges, assigning node operators, and managing oracles. The DAO operates on the LDO token, permitting token holders to take part in decision-making processes.

Lido Charges

Lido fees a ten% charge on all staking rewards earned by the protocol. This charge is split equally, with 5% allotted to the DAO treasury and 5% rewarded to node operators for his or her companies. The remaining 90% of the staking rewards are distributed amongst Lido stakers in proportion to the quantity of stETH held of their wallets.

Strategic Implications

Combining DeFi methods with liquid staking tokens (LSTs) like stETH can considerably improve returns, as customers can leverage their staked property throughout a number of monetary merchandise and protocols. Nonetheless, this additionally comes with elevated threat, significantly the opportunity of shedding the initially deposited ETH if the stETH tokens are misplaced or mismanaged.

The following part will discover the nuances of the Lido protocol's parts in better element, shedding mild on the mechanics and intricacies that underlie this staking resolution.

Lido Structural Parts

The Lido protocol includes the next important parts:

Node Operators

Node operators are a vital element of the Lido Protocol. They’re accountable for staking customers' ETH and making certain the safety and effectivity of the staking course of. Right here's an summary of how node operators operate inside the Lido ecosystem:

- Function and Whitelisting: Lido at present has a bunch of 36 whitelisted Ethereum validator nodes. These nodes are chosen and managed by the Lido Node Operator Sub-Governance Group (LNOSG), which oversees the whitelisting course of to make sure that solely dependable and reliable validators take part within the community.

- Significance of Sincere and Environment friendly Operations: The function of node operators is crucial for sustaining the safety and integrity of the funds staked inside the Lido Protocol. Sincere and environment friendly node operators assist decrease slashing penalties, which might happen if validators behave maliciously or fail to take care of correct node operations.

In line with Lido's documentation, their node operators have maintained a strong monitor file with no slashing penalties so far, demonstrating their reliability and effectivity. - Non-Custodial Construction: Lido operates on a non-custodial foundation, which means that node operators wouldn’t have direct management over the customers' funds. As a substitute, they use a public validation key to validate transactions utilizing the staked property. This construction enhances the safety of the protocol by making certain that node operators can’t entry or mismanage the staked funds immediately.

By leveraging a community of trusted and diversified node operators, Lido ensures that the staking course of is safe and environment friendly, aligning with the broader objectives of decentralization and consumer fund safety.

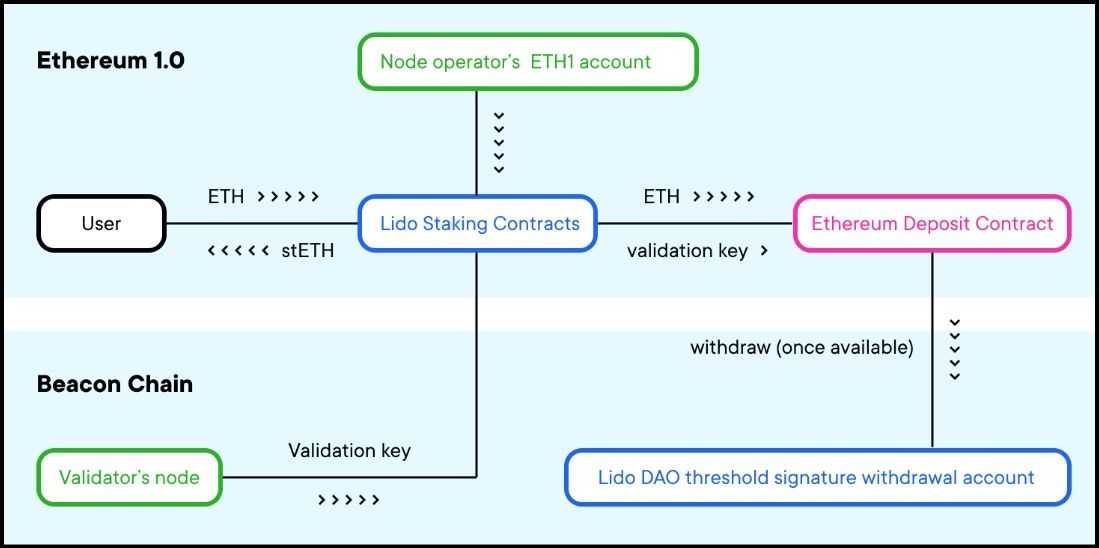

Lido Sensible Contracts

The Lido Protocol depends on a number of sensible contracts to handle its operations and preserve the integrity of its liquid staking companies. Two main sensible contracts type the core of Lido's structure: the Lido Staking Pool Contract and the Lido Oracle Contracts. Right here's an summary of their features and significance inside the protocol.

Lido Staking Pool Contract

The Lido Staking Pool Contract is the central sensible contract accountable for dealing with the core functionalities of the Lido Protocol. Its main duties embody:

- Managing Consumer ETH Deposits and Withdrawals: The contract accepts ETH deposits from customers and processes their withdrawal requests. This ensures customers can take part in staking with out the necessity to run their very own validator nodes.

- Minting and Burning stETH Tokens: Upon receiving ETH deposits, the staking pool contract mints stETH tokens equal to the quantity of ETH deposited. These tokens characterize the staked ETH and accrue staking rewards over time. Conversely, when customers withdraw their staked ETH, the corresponding stETH tokens are burned.

- Managing the Node Operators Registry: The contract maintains a registry of node operators by the NodeOperatorsRegistry contract. It distributes ETH to node operators in a round-robin trend, making certain a good and balanced allocation of staking duties.

- Delegating Funds to Node Operators for Staking: The staking pool contract delegates the pooled ETH to a community of trusted node operators who carry out the precise staking operations on the Ethereum community. This delegation course of is essential for sustaining the protocol's non-custodial nature.

- Making use of Charges and Distributing Rewards: Lido fees a ten% charge on staking rewards, which is split equally between the DAO treasury and node operators. The remaining 90% of the rewards are distributed to stETH holders in proportion to their holdings. This charge construction ensures sustainability whereas rewarding each the DAO and the operators.

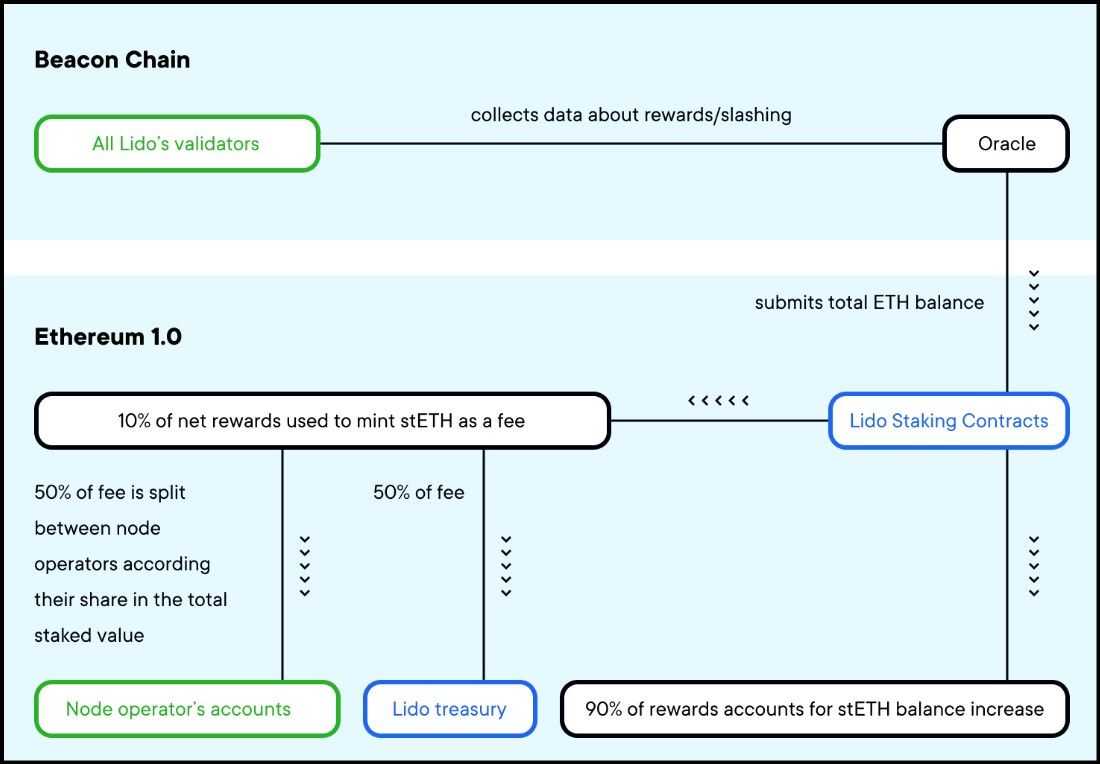

Lido Oracle Contracts

The Lido Oracle Contracts play an important function in sustaining the accuracy and safety of the protocol by offering up-to-date knowledge on the state of the community and validators. Key features of the Oracle contracts embody:

- Monitoring Validator Balances: The oracles monitor the staked ETH steadiness of every validator, reporting any adjustments attributable to block rewards or slashing penalties. This ensures the staking pool contract is at all times conscious of the correct staking state.

- Updating the Staking Pool with Rewards and Penalties: On days when validators generate web constructive rewards, the oracles report the extra ETH to the staking pool, which mints equal stETH tokens. These tokens are then distributed: 90% to stETH holders, 5% to the DAO treasury, and 5% to the node operators. This course of retains the rewards distribution clear and truthful.

- Guaranteeing Correct stETH Rebase: The oracles additionally play a crucial function within the rebase mechanism of stETH. They make sure the stETH token provide displays the present worth of the underlying staked ETH, sustaining a 1:1 peg with ETH.

By combining the functionalities of the staking pool contract and the oracle contracts, Lido ensures a safe, environment friendly, and decentralized staking resolution that provides liquidity to staked property, enhancing their utility throughout numerous DeFi functions.

Lido LSTs: stETH and wstETH

Lido's liquid staking ecosystem depends on two predominant tokens, stETH and wstETH, which serve distinct roles to boost flexibility and compatibility within the staking and DeFi panorama.

stETH: The Core Liquid Staking Token

- stETH is an ERC-20 token on the Ethereum community that represents ETH staked by the Lido protocol. It serves as a receipt for customers who stake their ETH, permitting them to take care of liquidity whereas incomes staking rewards.

- Illustration of Staked ETH: When customers deposit ETH into Lido, the protocol stakes this ETH by its community of validators. In return, customers obtain stETH tokens in an equal quantity, representing their staked ETH. This tokenization permits customers to retain publicity to ETH and take part in staking rewards.

- Distribution of Staking Rewards: stETH holders earn rewards derived from two sources:

- Consensus Layer Rewards: These are rewards from Ethereum's Proof-of-Stake (PoS) mechanism, reflecting the inflationary issuance of ETH.

- Execution Layer Rewards: These embody transaction charges and Maximal Extractable Worth (MEV) rewards earned by validators.

As these rewards accumulate, they’re transformed into further stETH tokens, that are proportionately distributed to all stETH holders, permitting them to profit from the staking returns.

- Rebasable Token Sustaining a 1:1 Ratio with ETH: stETH is a rebasable token that adjusts its provide to mirror the rewards earned, sustaining a 1:1 ratio with the ETH staked within the Lido pool. This rebasing ensures that the worth of stETH stays aligned with the underlying ETH, making it a pretty choice for customers looking for liquidity alongside staking rewards.

- Day by day Balances Calculated by Oracles: Lido employs a system of oracles to calculate and replace stETH balances day by day. These oracles monitor validator efficiency, together with earned rewards and slashing penalties, making certain that the stETH provide precisely displays the overall staked ETH and accrued rewards. After deducting a ten% charge (5% for the DAO treasury and 5% for node operators), the remaining rewards are distributed to stETH holders.

wstETH: The Wrapped Model of stETH

- wstETH is a wrapped model of stETH designed to offer compatibility with DeFi protocols that don’t help the rebasing characteristic of stETH.

- Token Wrapper Mechanism: In contrast to stETH, which rebases periodically to distribute staking rewards on to token holders, wstETH maintains a set steadiness. This characteristic makes it appropriate with DeFi protocols that can’t deal with rebasing tokens. For instance, if MakerDAO doesn’t help stETH's rebasing mechanism, a consumer with stETH locked in MakerDAO would possibly miss out on the rebasing rewards. To resolve this subject, Lido provides wstETH, which doesn’t rebase however as a substitute accumulates staking rewards.

- Accumulating Token: wstETH acts as an accumulating token. When customers convert stETH to wstETH, they lock within the worth of their stETH on the present price. The wstETH contract accumulates rewards by rising the intrinsic worth of every wstETH token over time. Thus, whereas stETH adjusts its provide to distribute rewards, wstETH grows in worth, reflecting the accrued staking rewards. This accumulation permits wstETH to be price greater than 1 ETH because the staking rewards enhance, whereas stETH maintains an in depth 1:1 peg with ETH.

- Conversion and Redemption: The conversion course of between stETH and wstETH is easy. Customers can mint wstETH by depositing their stETH, and conversely, they will burn wstETH to redeem stETH. This flexibility permits customers to decide on the token that most closely fits their technique, whether or not they want compatibility with non-rebasing-friendly DeFi platforms or favor the liquidity of stETH.

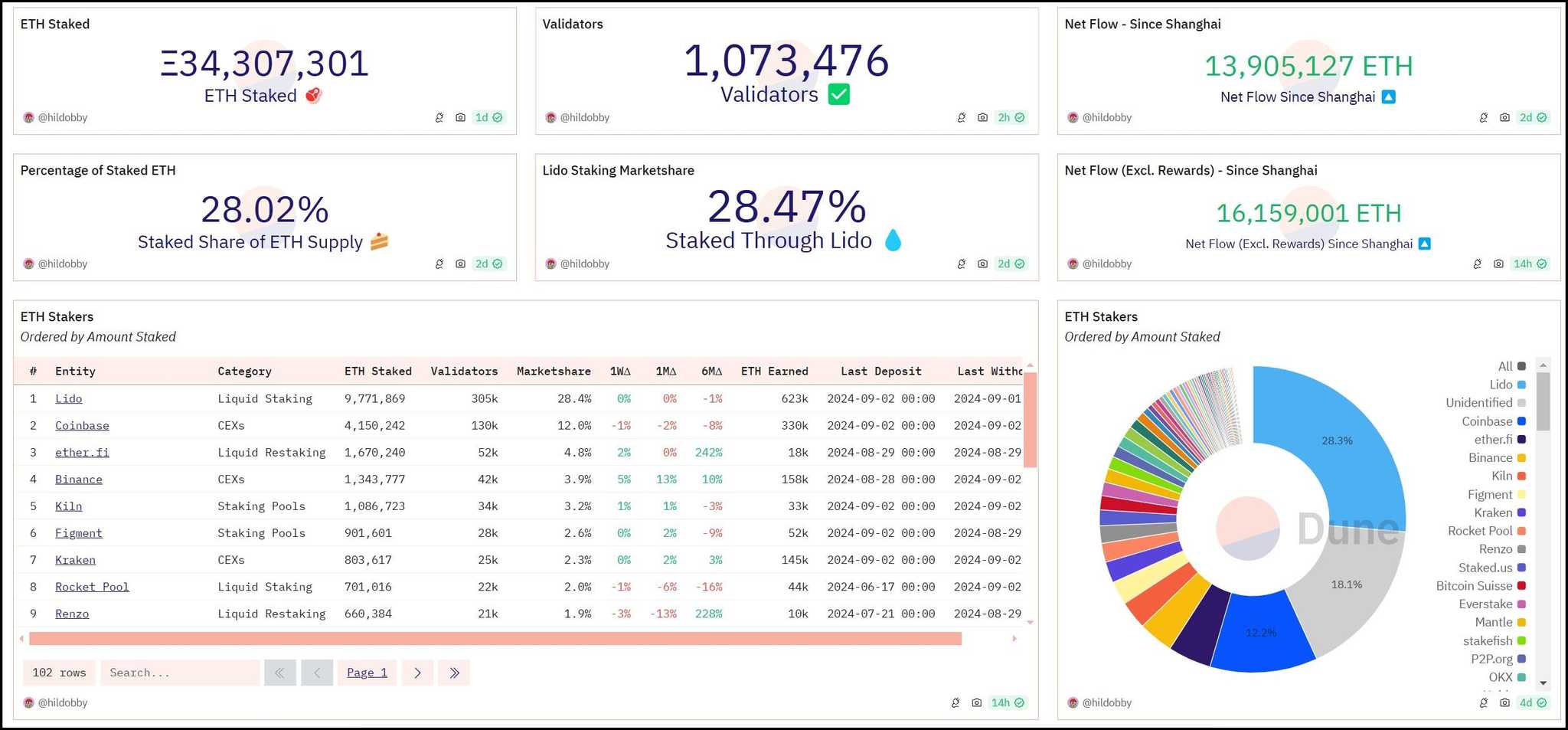

The Function of stETH and wstETH in Lido's Ecosystem

Collectively, stETH and wstETH underpin Lido's liquid staking mannequin, offering customers with choices that cater to varied DeFi methods and threat appetites. As of September 2024, Lido holds a major place within the Ethereum staking ecosystem, controlling 28.3% of the overall staked ETH, making it the most important staker on Ethereum, based on Dune Analytics. This dominant place highlights the protocol's potential to supply scalable and versatile staking options that meet the various wants of the Ethereum group.

Lido expanded its liquid staking ecosystem to many chains after Ethereum. Right here's a whole listing of networks Lido helps:

- Ethereum (stETH)

- Polygon (stMATIC)

- Solana (stSOL)

- Polkadot (stDOT)

- Kusama (stKSM)

Furthermore, at present, wstETH token is current on the next networks:

- Arbitrum

- Optimism

- Scroll

- Base

- Linea

- ZKSync

- Mantle

- Polygon PoS

- Mode

- Binance Sensible Chain (BSC)

LDO Token and the Lido DAO

The Lido DAO manages the liquid staking protocol and votes to resolve key system parameters. The first features of the DAO are:

- Determine key parameters of the liquid staking protocol, like charges, oracles and node operators.

- Scouting, assessing and qualifying node operators to make sure environment friendly protocol operations.

- Approve grants to help analysis initiatives.

- Bug bounty program.

- Conducting different operational duties.

The LDO token facilitates the DAO's governance choices. LDO is the Lido protocol's ERC-20 token. The tokenomics of the LDO token are designed to help the Lido ecosystem's progress and sustainability by strategically distributing tokens amongst numerous stakeholders and sustaining a set provide. Listed here are the important thing facets:

- Circulating and Whole Provide:

LDO has a complete provide of 1,000,000,000 tokens, with a circulating provide of 892,898,290 tokens. This capped provide construction helps preserve the token's worth by stopping inflation from a vast provide. - Token Distribution:

The allocation of LDO tokens is deliberate to make sure long-term sustainability and incentivize participation within the Lido ecosystem:- DAO Treasury: A good portion of the LDO tokens is reserved for the DAO treasury, which funds improvement, group initiatives, and different actions accepted by LDO holders.

- Founders and Group: Tokens are allotted to the founders, workforce members, and early contributors as an incentive for his or her ongoing help and improvement efforts.

- Validators and Advisors: A portion of the LDO tokens is allotted to validators working staking nodes and advisors contributing to the platform's strategic course.

- Buyers: Early buyers who offered capital for Lido's preliminary improvement are allotted a share of the tokens, aligning their pursuits with the platform's progress.

The place to Purchase LDO?

LDO tokens might be bought on each centralized and decentralized exchanges.

- Centralized Exchanges: Main centralized exchanges like Binance, Coinbase, and Kraken supply LDO buying and selling pairs, permitting customers to purchase LDO utilizing fiat currencies or different cryptocurrencies. These platforms present a user-friendly interface and extra options like fiat on-ramps, making it simpler for brand spanking new customers to amass LDO.

- Decentralized Exchanges: LDO will also be bought on decentralized exchanges (DEXs) like Uniswap and SushiSwap. These platforms enable customers to commerce immediately from their wallets, offering better privateness and management over their funds. Customers can swap ETH or different ERC-20 tokens for LDO without having to create an account or endure KYC verification.

Lido DeFi Integrations

stETH, Lido's liquid staking token, has turn into an important asset within the Ethereum DeFi ecosystem, offering numerous utilities throughout completely different classes. These utilities improve the yield potential of ETH holders and contribute to Ethereum's safety and resilience. Here’s a categorized overview of stETH's integrations and their roles:

1. Decentralized Exchanges (DEX)

- Curve Finance (stETH/ETH Liquidity Pool): Curve provides a stETH/ETH liquidity pool that permits customers to earn buying and selling charges and liquidity mining rewards with low slippage. This pool is designed to take care of a steady peg between stETH and ETH, minimizing impermanent loss for liquidity suppliers. The APR for offering liquidity right here is roughly 3-5%.

- Uniswap V3 (wstETH/ETH Pool): Uniswap helps a wstETH/ETH liquidity pool. This pool is especially appropriate for wstETH attributable to its non-rebasing nature, which avoids the complexities related to rebasing tokens like stETH. The estimated APR for this pool ranges from 2-5%, relying on market circumstances.

- Balancer v2 (wstETH/ETH Composable Steady Pool): Balancer v2 gives a customizable and dynamic steady pool for wstETH/ETH. This pool provides dynamic swap charges and the pliability of Balancer's distinctive liquidity administration options, offering an APR of 2-5%. This pool permits customers to earn buying and selling charges whereas benefiting from Balancer's options like dynamic asset weights.

2. Lending Protocols

- Aave v2 Ethereum Mainnet Market: stETH is listed as an accepted collateral asset on Aave, permitting customers to borrow different property whereas retaining their publicity to staking rewards. The APR for stETH on Aave ranges from 3-8%, making it a pretty choice for customers trying to leverage their stETH with out unstaking it.

- Different Lending Platforms (Cream Finance, Compound): Just like Aave, platforms like Cream Finance and Compound settle for stETH as collateral, enabling customers to borrow different property whereas nonetheless incomes staking rewards. The yield on these platforms aligns with the charges on Aave, usually starting from 3-8%.

3. Restaking Platforms

- EigenLayer: EigenLayer permits customers to restake stETH, enhancing their yields whereas contributing to Ethereum's prolonged safety framework. With an enormous $2.19 billion in stETH restaked (898,555.15 stETH tokens), EigenLayer represents roughly 75% of the Ether staked within the protocol. This substantial determine highlights the rising significance of liquid staking tokens (LSTs) in securing Ethereum and its prolonged ecosystem.

- Blast Layer 2 Chain: Blast provides a local yield mechanism using LST tokens, with roughly $946.72 million in stETH (388,634.68 tokens) locked in its contracts to earn yield for the layer 2 protocol. This integration showcases how LSTs usually are not only for yield farming but additionally for offering safety to different blockchain layers.

4. Yield Aggregators and Different DeFi Alternatives

- Offering Liquidity on DEX Protocols: Past Curve and Uniswap, different DEXs corresponding to SushiSwap additionally supply stETH liquidity swimming pools. These swimming pools allow customers to earn buying and selling charges, liquidity mining rewards, and the underlying staking rewards from stETH. The mixed APR for offering stETH liquidity can vary from 3% to eight%, relying on the particular DEX and market circumstances.

- Yield Optimization Platforms (Yearn Finance, Convex, Idle Finance): Platforms like Yearn Finance and Convex supply superior yield optimization methods involving stETH. These methods can embody auto-compounding and leveraged positions, doubtlessly rising yields as much as 5-10% APR. Idle Finance provides risk-adjusted tranches that present yields between 1.5% and eight.5% APR, relying on the consumer's threat urge for food.

Affect of stETH within the Ethereum Ecosystem

- The widespread integration of stETH throughout a number of DeFi platforms demonstrates its crucial function within the Ethereum ecosystem. These integrations enable ETH holders to earn further yields by numerous DeFi methods whereas sustaining liquidity. Furthermore, by staking ETH by Lido, customers contribute to Ethereum's safety and resilience, incentivizing extra ETH to be staked within the protocol. This elevated staking exercise helps to safe the Ethereum community and its related layers, enhancing the general robustness of the blockchain.

Enhanced Yield on ETH By way of Liquid Staking

- Combining the bottom staking rewards from Lido with the extra yields earned by DeFi integrations considerably enhances the potential returns on ETH. For instance, staking ETH by way of Lido gives a base reward of roughly 4.8% yearly. By additional integrating stETH into DeFi platforms—whether or not by liquidity swimming pools, lending, or yield optimization methods—customers can doubtlessly obtain mixed yields starting from 8% to 10% or larger. This multi-layered yield technique leverages the pliability of liquid staking whereas optimizing returns throughout numerous DeFi protocols, albeit with the added dangers related to sensible contracts, market volatility, and impermanent loss.

- By utilizing Lido's stETH, ETH holders can maximize their returns, contributing to the broader DeFi ecosystem and reinforcing the safety of Ethereum and its prolonged networks.

Lido Finance Review: Closing Ideas

Lido's liquid staking protocol has established itself as a pivotal element within the Ethereum ecosystem, providing ETH holders a versatile and rewarding technique to take part in staking. The various integration of stETH throughout numerous DeFi platforms underscores its utility, enabling customers to maximise their returns whereas contributing to the safety and stability of the Ethereum community. With alternatives starting from liquidity provision on DEXs to lending and restaking on revolutionary platforms like EigenLayer and Blast, Lido gives a number of avenues for ETH holders to boost their yields.

Nonetheless, the panorama of liquid staking is aggressive, and Lido faces vital competitors, most notably from RocketPool. RocketPool, like Lido, is a outstanding liquid staking resolution on Ethereum however differs basically in its design and strategy:

- Validator Set Design: One of many main variations between Lido and RocketPool lies of their strategy to validator set participation. Lido emphasizes an environment friendly and skilled validator set, which entails choosing a curated group of validators to make sure excessive efficiency and minimal threat. Whereas this strategy gives a dependable and safe staking setting, it introduces a level of centralization, as solely whitelisted validators can take part. In distinction, RocketPool adopts a permissionless mannequin, permitting any consumer with the required technical expertise and capital to turn into a validator. This open strategy promotes decentralization however could include elevated dangers related to much less skilled validators.

- Liquidity Incentives: One other notable distinction is the best way these protocols deal with liquidity incentives. Lido allocates a major quantity of funds to LDO-induced rewards, encouraging liquidity provision and participation by numerous incentive applications. This technique helps preserve excessive liquidity ranges for stETH and enhances its utility within the DeFi ecosystem. RocketPool, then again, doesn’t have a built-in incentive mechanism like Lido's in depth LDO rewards. Whereas this would possibly restrict RocketPool's speedy liquidity, it aligns with its ethos of fostering natural progress and lowering reliance on exterior incentives.

These variations mirror broader philosophical divergences between the 2 protocols: Lido prioritizes environment friendly, centralized management for safety and excessive liquidity, whereas RocketPool leans in the direction of a extra decentralized and permissionless strategy. As each protocols proceed to evolve, these distinctions will form their roles and affect inside the Ethereum ecosystem.

In conclusion, liquid staking is turning into more and more integral to Ethereum's future, offering new alternatives for yield and enhancing community safety. As protocols like Lido and RocketPool advance and adapt to altering market dynamics, they’ll proceed to play essential roles in shaping the panorama of Ethereum staking and DeFi. For ETH holders, understanding these nuances is vital to creating knowledgeable choices on maximize their participation and returns within the quickly increasing world of liquid staking.

Incessantly Requested Questions

What’s Lido?

Lido is a decentralized liquid staking protocol on the Ethereum community that permits customers to stake their ETH with out locking up their property or sustaining a validator node. In return for staking ETH, customers obtain stETH, a tokenized model of their staked property that accrues staking rewards and can be utilized throughout numerous DeFi platforms. Lido goals to offer liquidity to staked ETH, enhancing its utility within the Ethereum ecosystem whereas selling decentralization and enhancing community safety by broad participation in staking.

How you can Liquid Stake on Lido?

To liquid stake on Lido, go to the Lido staking platform and join your pockets (e.g., MetaMask). As soon as related, select the quantity of ETH you wish to stake and ensure the transaction. After staking, you’ll obtain an equal quantity of stETH, representing your staked ETH and accruing staking rewards. stETH can be utilized in numerous DeFi protocols for extra yield alternatives whereas sustaining the liquidity of your staked property. Lido’s interface gives a straightforward and accessible means for customers to take part in staking with out managing a validator node.

How you can Purchase the LDO Token?

LDO tokens might be bought on each centralized and decentralized exchanges. On centralized exchanges like Binance, Coinbase, and Kraken, you should purchase LDO utilizing fiat currencies or different cryptocurrencies by organising an account and finishing the required KYC verification. For decentralized exchanges like Uniswap or SushiSwap, join your pockets, choose the LDO buying and selling pair, and swap ETH or one other ERC-20 token for LDO. This course of permits customers to amass LDO immediately from their wallets with out the necessity for intermediaries or centralized controls.

What are the charges for staking with Lido?

Lido fees a ten% charge on staking rewards, which is break up between the Lido DAO treasury (5%) and the node operators (5%). The remaining 90% of rewards are distributed to stakers primarily based on the quantity of stETH they maintain.

What’s the impression of stETH within the Ethereum ecosystem?

stETH has turn into a vital asset within the Ethereum DeFi ecosystem, permitting ETH holders to earn further yields whereas contributing to Ethereum’s safety. By staking ETH by Lido, customers assist safe the Ethereum community whereas benefiting from liquid staking and enhanced returns by DeFi integrations.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.