Christina Comben is the author of this guest post.

Mark Moss and I met at the Media Center by the Main Stage. Bitcoin in MENA In Abu Dhabi the first Bitcoin Conference in the region. He’s not someone we know, but his familiar voice, infectious personality, volumes of valuable content, (including the aforementioned a Youtube channel The best-selling book The Uncommunist ManifestoI already feel like I know him.

Mark was an entrepreneur for many years before he became a Bitcoin advocate.

“I started a business in 1999 at the height of the dot-com boom. That crashed. I started another business in 2001, an e-commerce business, it wasn’t easy,” He is apprehensive. “It was terrible timing. Everyone laughed at me and said, no one would ever buy anything online. I built that up and had a big exit on it.”

Orange County and Abu Dhabi

Why did he travel from Orange County to Dubai’s opulent Capital for Bitcoin MENA?

“I’m an educator and content creator,” “He says” “I’m also a partner at a Bitcoin Venture Capital fund, so we invest in the businesses building on and around the Bitcoin ecosystem. I also have a new company that just went public in Canada called Matador, and that’s running a Microstrategy play with Bitcoin as a balance sheet asset and investing through the Bitcoin Layer 2 space. So I’m actively educating and investing in the space to try to build the world that I want to see.”

What kind of a universe is that? Mark is firmly in the Bitcoin camp, and not the crypto crowd. Mark has been riding the altcoin wave, but he doesn’t see any other cryptocurrency with. “long-term” Staying power “I certainly made a lot of money,” He says “a lot of money,” He repeats it with more emphasis. I wait for him to share the usual cautionary tale of holding a stash down to zero or getting rugged at the sh**coin casino, but he says:

“In 2017 and 2018, we were competing for Layer 1s. Ethereum, Cardano, Litecoin, NEO… well, Bitcoin won that. So then the crypto narrative went to DeFi and that all fell apart, then crypto went to NFTs, and that all fell apart, and now it’s meme coins. No one’s pretending that’s world-changing technology.”

He acknowledges that altcoins and meme coins in particular may have some value as an alternative currency. “gateway drug” Bitcoin is a great way to introduce people. “People come for the money and they stay for the freedom,” They are embarking on their Bitcoin adventures and learning why they require permissionless money that is censorship resistant.

“I think stablecoins lead to that as well,” He says “eventually people get used to having a wallet and transferring digital assets, but then they wonder why their U.S. dollar stablecoins buy them fewer goods and services, and why Bitcoin buys them more, and I think eventually it all sort of funnels over.”

Magic Money Printer and Flawed fiat system

Mark believes that fiat has the greatest problem because it does not have a cost of capital.

“When you start to understand money, you understand that if printing money made people wealthy, why don’t we just print a lot more? Money has to have a true cost of capital. So gold, for example, I have to buy land and get equipment and spend energy and capital to get the gold, with Bitcoin, new coins are only released if you spend the money and do the work to get them. So the capital has to have a true cost. You can’t just print money out of thin air, otherwise, we’d all be rich.”

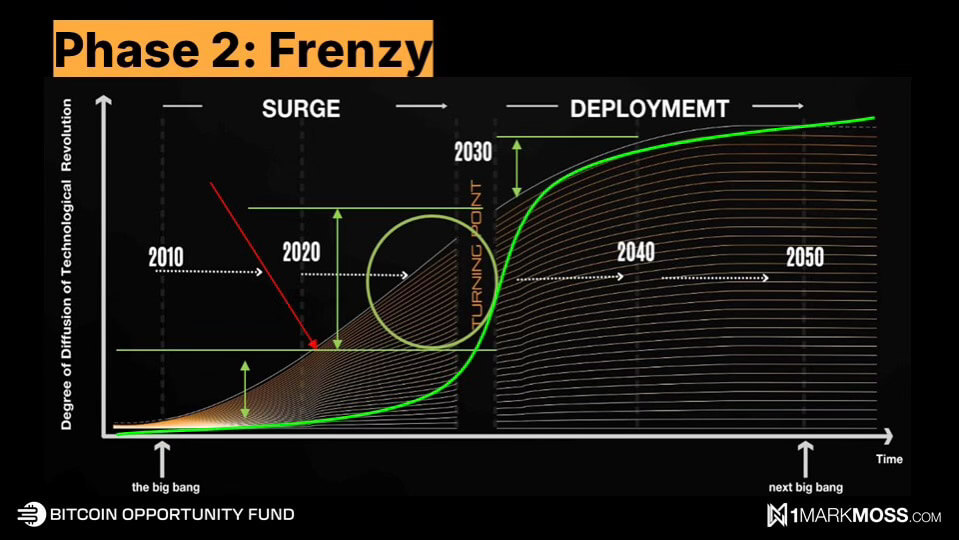

The pointer points at the Model S-curve Bitcoin Adoption Measurement

“The way an S-curve works is the time it takes to get to 10% adoption is the same time it would take to get to 80-90%. So you can see that this second phase [between 2020 and 2030] is where we get the most growth. We had retail adoption which brought [Bitcoin] to $1.2 trillion between 2010 and 2020, and then with institutional adoption, the 90% will come.”

What would the world look like if 90% of Bitcoin was adopted? Does the collapse of fiat currency and Armageddon in the streets seem inevitable? Mark shakes his heads and pauses.

“I think one big misconception is people think that for Bitcoin to get to $1 million [something Mark envisions cerca 2030] or $10 million per coin, then that means that fiat is worthless and now it’s $1 million for a gallon of gas, but that’s absolutely not true.”

Re-adjustment of assets with Stores-of-Value

Bitcoin is a market disruptor like Uber or Airbnb, he says.

“Airbnb takes a little bit from the hotels. It doesn’t mean hotels go away, just like Uber continues to get more and more from taxis. Bitcoin is not taking away from the dollar. Bitcoin is taking away from other store-of-value assets, like gold, equities, bonds, and real estate.”

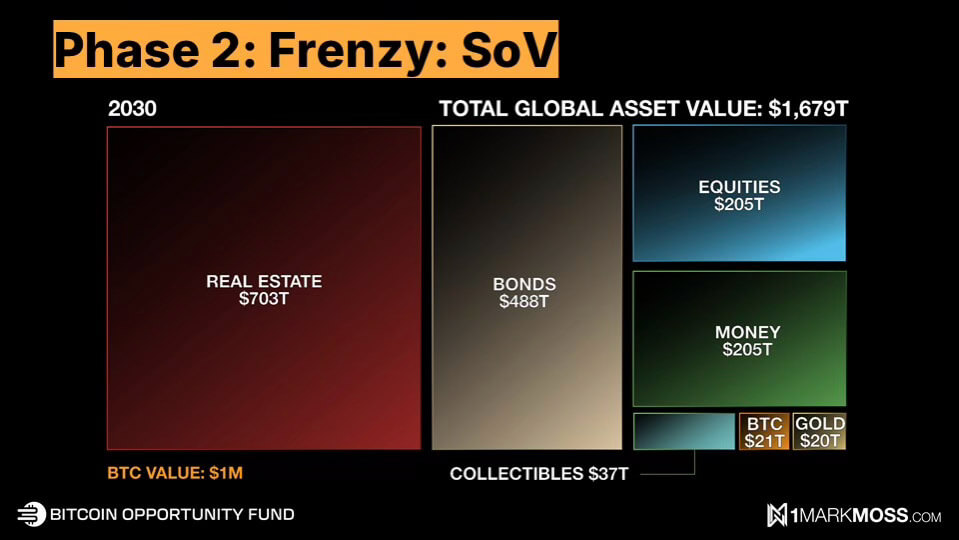

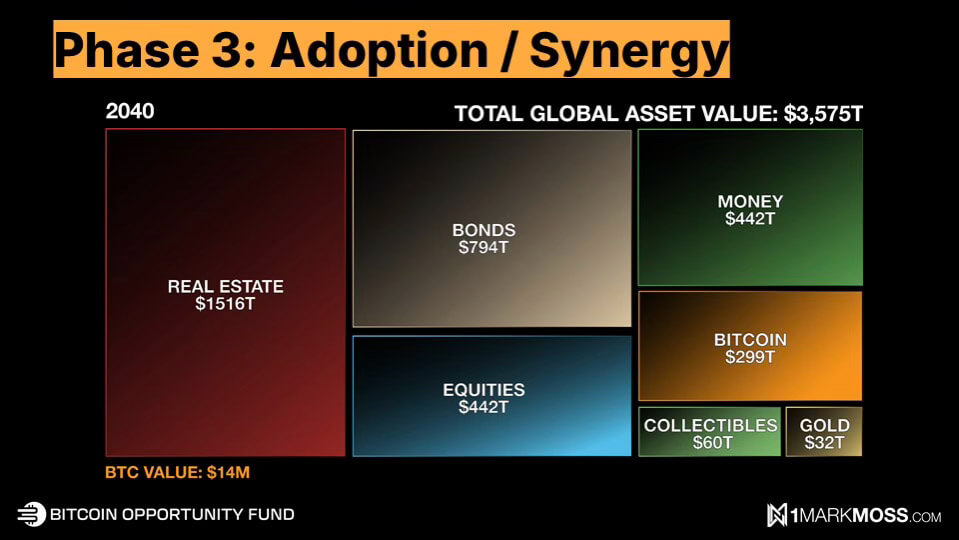

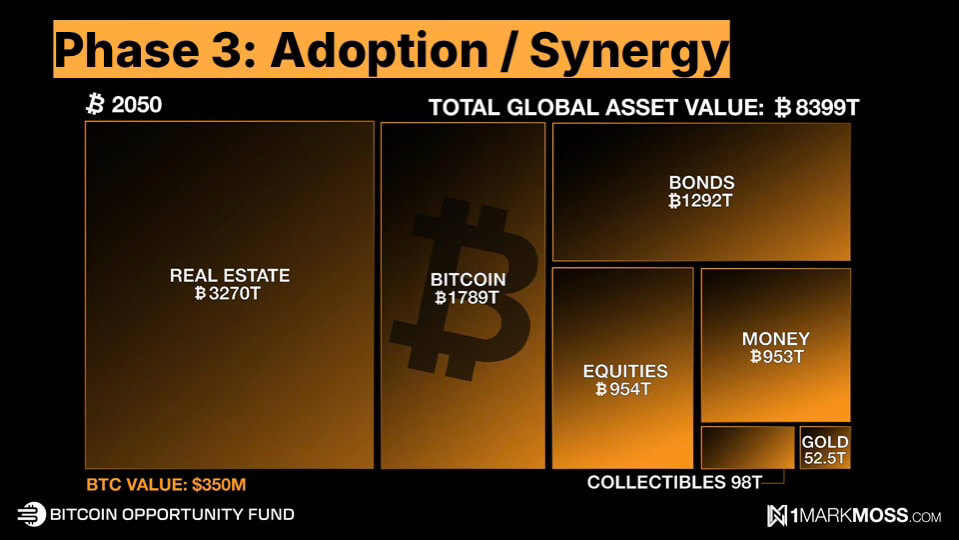

Three charts are shown, comparing Bitcoin’s price, market capitalization, and size to other assets that can be used as a store of value.

“Bitcoin could grow to $21 trillion by 2030, which means $1 million per Bitcoin, but it doesn’t mean all these other assets go away. It’s on par with gold. It’s taking a little bit from bonds, a little bit from money, and a little bit from equities.”

“If we fast forward to 2050, Bitcoin becomes the second biggest asset class, but it doesn’t mean the other asset classes go away… By 2050, I believe all the store-of-value assets will be priced in Bitcoin instead of U.S. dollars, and then one Bitcoin will be worth one Bitcoin, instead of $100,000 or $1 million.”

The man brings him up Gresham’s Law He argues for the existence of the Dollar.

“Gresham’s Law states that bad money drives out good money. So an example is in the United States, up to 1965, quarters and dimes were made of pure silver. After ‘65, they started making them out of junk metal. You can’t find a pre-65 quarter and dime in circulation anymore, and if you did, you wouldn’t spend it because it’s worth like $4. So you’d save it. The bad money drove out the good money, the pre-65s out. So I will always want to use fiat and store my Bitcoin.”

‘Good Times’ Ahead for Bitcoin

Eric Trump gave the keynote speech, announcing that he would be the next President. “absolutely love Bitcoin,” Bitcoiners are congratulated on their vision. “America has to lead the way in a digital revolution,” He describes the moment that he called at 6am the day Bitcoin hit $100, which led to the now infamous “You’re welcome” Truth Social. Mark, do you expect Bitcoin to have a golden era in the United States soon? Will there be an innovation resurgence and the return of talents that left for other countries during past administrations?

“The new administration will definitely be bullish for the industry,” He says. “It’s not really that Bitcoin that was on the ballot. What was really on the ballot was freedom. The freedom to choose how you want to store your money, and how you want to transact your money.”

Trump is a he sees as a “much friendlier” The report outlines the benefits of a business-friendly environment, but does not envision mass returns by companies who left. “Once you’re gone, you’re kind of gone. Why would you come back?” He asks. “But maybe we’ll slow down the companies that are leaving and maybe more will stay.”

How about the idea of a Bitcoin national strategic reserve igniting a global Bitcoin game? He thinks the odds are up to 80%.

“I mean, RFK said he would do it and he’s now in the Trump administration. Trump said he would do it. We have a red Republican House, Senate, and Presidency, and we already have the bill that’s been submitted by Senator Lummis. It just has to be approved. Maybe it fails and they’ll resubmit, but I would say in the next 24 months that goes through.”

Mark also predicts that U.S. banks will begin to custody Bitcoin and sell Bitcoin. They may even offer Bitcoin-related products.

“Last year the banks tried to overturn an SEC rule called SAV21, which prevents banks from being able to custody Bitcoin. It got to President Biden and he vetoed it. So we know they want to. They already tried to overturn it and Biden vetoed it. I’m guessing as soon as Trump takes over they’ll resubmit it and it will get approved… it’s good times,” The man beams. “I’m optimistic. I’m very optimistic.”

Follow Mark on Twitter to find out more about Mark’s vision for Bitcoin’s global adoption and the phases involved. On XCatch his The following are some key words to remember: Bitcoin MENA or his YouTube channel to watch educational videos Youtube channel.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.