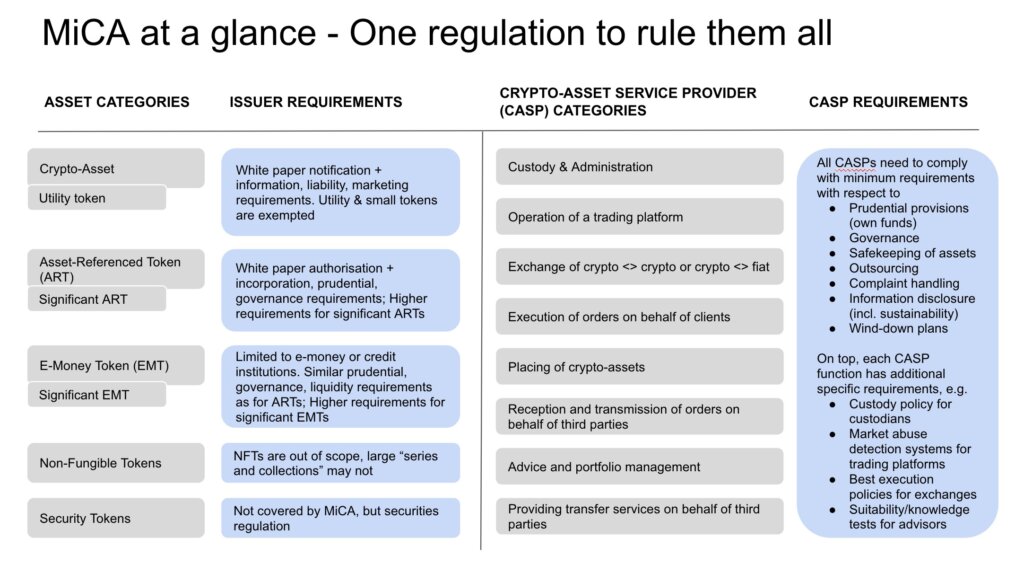

MiCA has now been implemented across the European Union. This marks a significant milestone in digital asset supervision. The industry is now operating under a EU-wide regulatory framework, which covers token issuances, stablecoins (or coins), and other services, such as exchange and custody.

According to the Bretton Woods Committee, years of negotiations and consultations culminated in a document that addressed oversight gaps, and promoted transparency.

The EU requires that companies issuing emoney tokens be either incorporated or licensed in the EU. Tokens with asset references are subject to higher governance and disclosure requirements once they have reached certain volumes or thresholds. The measures also include stricter rules on reserve management, redemption, and disclosure, signaling the bloc’s focus on financial stability in digital asset markets.

Patrick Hansen wrote an article in which he explained that issuers of stablecoins had little option but to adhere to EU regulations or they would lose their access to the EU market. Tether, the leading stablecoin issuer in the world, chose the latter option, telling CryptoSlate that the competition is frustrated by its differing approach to stablecoins. He added.

“Every day you wake up, you scratch your head and you don’t understand why these couple of Italian guys are doing a much better job than you. Of course you become frustrated, right?

So You know, if your business model is named Kill Tether, then you know, you should rethink about your product.”

Crypto companies’ expectations in the EU

Once licensed in one state, crypto-asset services providers (CASPs), who offer activities such as brokerage, exchange or custody, are required to obtain a license that allows them to work across the entire EU. This shift eliminates the patchwork of regulations that existed in the past, and allows firms to grow internationally by reducing the barriers.

It is expected that some businesses will consolidate their operations or form partnerships, as compliance requirements may be more difficult for small ventures to comply with. Trading platforms should also implement measures to prevent market manipulation and insider trade. The authorities can ban token sales if the disclosures and risk management processes appear to be incomplete.

MiCA excludes running protocols “in a fully decentralized manner”From its scope but may not be able to reach the decentralization threshold.

It is unclear how the regulations will treat large NFT collections. They may be treated as fungibles, and subject to white paper obligations. There is also uncertainty surrounding “privacy coins,”If it is impossible to identify the holder in full, then that product may be removed from the list.

MiCA is expected to have a positive impact on the economy.

Industry responses from Bretton Woods and Circle indicate a shared view that MiCA’s practical success relies on its technical standards and enforcement practices. The companies are adapting their product offering, with a focus on compliance and clarity of disclosures. As Hansen observed, the framework’s adoption may attract projects seeking certainty, especially if concerns over enforcement actions elsewhere persist.

Global adoption raises broader issues. While the U.S. is yet to adopt stablecoin regulations, enforcement practices in Asia vary greatly, despite appearing progressive. Other jurisdictions could be influenced by the European model, causing a “race to the top”Consumer protection is a priority, as well as conformity with international standards.

Bretton Woods states that a coordinated strategy would encourage passportability and reduce the risks associated with regulatory arbitrage. Some legislators have talked about a MiCA 2.0. This would indicate that DeFi or other technological features, such as non-fungible coins, could be reconsidered in a future directive. Officials note that any new iteration will depend on the law’s initial results.

Hansen points to MiCA’s similarities with other EU tech initiatives, where region-wide standards ultimately influenced commercial and legal frameworks abroad. MiCA will become the default reference for global tech initiatives based on how well it is implemented in real life, what role national agencies play, and whether the regulations are effective at protecting markets without limiting innovation. In the meantime, companies continue to make moves in order to get a MiCA licensing. Major banks and exchanges are changing their business models or purchasing smaller players.

MiCA will bring about more institution involvement. Consumer protection and uniform licensing are also expected. Cost of compliance is a major factor in shifting activity to well-capitalized platforms. Investors might see more people adopting regulated services. Smaller teams may concentrate on specific niches, or even relocate to places with less restrictive obligations. Politicians have promised to closely monitor the result, believing that an EU-wide stance towards crypto could boost capital formation as well as user protections.

Stablecoin issuers (and CASPs) will face an earlier deadline for compliance than the other market players, as the framework is implemented. Meanwhile, the remaining rules are gradually phased in throughout the year. Regulations will issue implementation standards to clarify timeframes, disclosures and conditions.

Hansen confirmed that companies planning to navigate Europe are engaging authorities and developing compliance strategies in accordance. MiCA’s clear responsibility for its participants is what Hansen believes. The ability of the organization to foster responsible growth with consistent rules and encourage responsible participation will be the measure by which it influences crypto markets.

The EU continues to refine technical guidelines while supervising licensed entities. It will be clear if MiCA can balance innovation and oversight.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.