MicroStrategy executive chairman Michael Saylor has urged Microsoft to adopt Bitcoin as part of its strategy, according to a three-minute presentation to the company’s board that was shared on X (formerly Twitter).

Saylor presented Bitcoin as an important component of the coming technological revolution. He warned that failing to integrate Bitcoin into Microsoft’s operations could leave the company lagging behind competitors.

Saylor emphasized Bitcoin’s outperformance, noting it has delivered returns ten times higher than Microsoft’s stock annually. He said that re-directing resources away from Microsoft stock buybacks and towards Bitcoin investments could generate more value.

“He said:

“Microsoft can’t afford to miss the next technology wave and Bitcoin is that wave…It makes a lot more sense to buy Bitcoin than to buy your own stock back.”

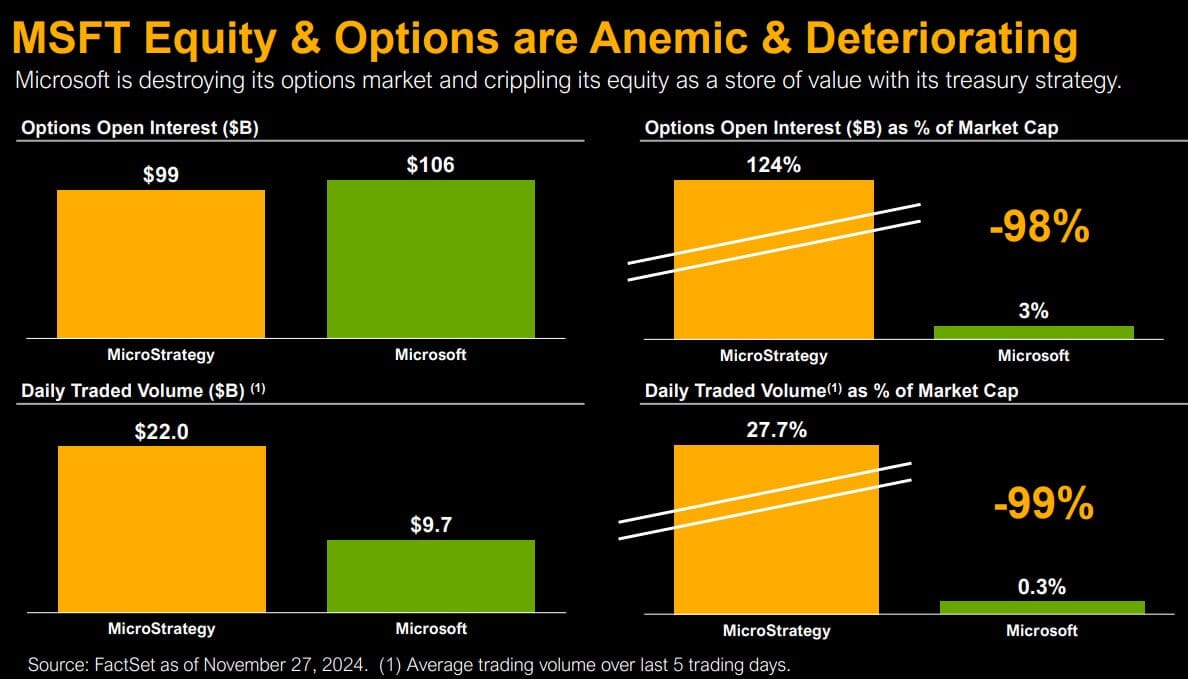

According to him, Microsoft’s current treasury strategy is weakening its equity and options markets and eroding its position as a store of value.

Saylor provided a roadmap of transformations for the Bitcoin eco-system in 2025. The list includes the widespread adoption of Bitcoin ETFs on Wall Street, fair-value accounting, a pro-crypto Congress and a change in attitudes towards regulation. This evolving environment, he believes, makes Bitcoin adoption more than just beneficial. It is essential.

He said:

“You have a choice to make: cling to the past, or embrace the future. Divest billions of dollars and slow your growth rate, invest billions of dollars and accelerate your growth rate.”

$5 trillion addition to Microsoft’s market cap

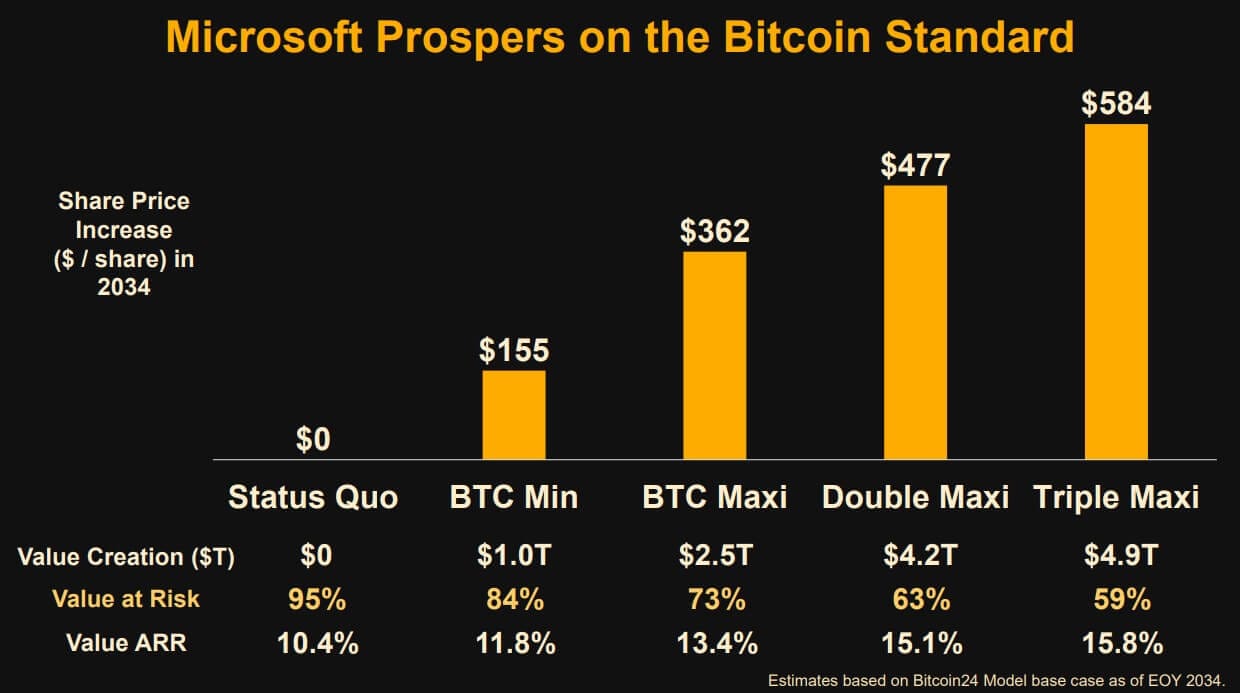

As part of his pitch, Saylor projected that an aggressive Bitcoin strategy could add around $5 trillion to Microsoft’s market cap over the next decade.

He proposed converting Microsoft’s cash flows, dividend payouts, and stock buybacks into Bitcoin. He argued that this would add hundreds of dollars to the company’s stock price while minimizing shareholder risk.

According to his predictions, Microsoft’s enterprise value could increase by $4.9 trillion if Bitcoin reached $1.7 million per coin in 2034.

Saylor suggested that $100 billion per year be invested in Bitcoin, instead of stocks or bonds. He described Bitcoins as an asset that is free of counterparty risks, and offers unmatched growth potential.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.