Decentralized finance (DeFi) has opened up new alternatives for customers to earn yield on their belongings, nevertheless it nonetheless faces important challenges.

Many platforms supply solely variable yields, leaving customers uncovered to market volatility and rate of interest fluctuations. Moreover, belongings locked in yield-bearing protocols typically cut back liquidity, limiting the power to pursue different funding alternatives. DeFi additionally lacks superior instruments for managing danger, forcing customers to just accept uncertainty of their returns.

That is the place Pendle Finance steps in, providing an answer that addresses these points by permitting customers to tokenize and commerce future yields, unlock liquidity, and handle danger extra successfully.

This Pendle Finance assessment will discover how the platform addresses key challenges in DeFi, comparable to yield volatility, restricted liquidity, and the shortage of danger administration instruments. We’ll dive into Pendle's resolution of yield tokenization, the mechanics of how Pendle works, its core options, and the position of the PENDLE token within the ecosystem.

Pendle Finance Review Abstract

Pendle Finance is an modern DeFi protocol specializing in yield tokenization and buying and selling. It introduces a novel framework permitting customers to tokenize and commerce future yields of yield-generating belongings, successfully making a marketplace for rates of interest within the DeFi area. By enabling the separation and buying and selling of yield and principal parts of an asset, Pendle unlocks new potentialities for yield optimization, danger administration, and speculative alternatives inside the DeFi ecosystem.

The Key Options of Pendle Finance Are:

- Yield Tokenization: Pendle permits customers to tokenize yield-bearing belongings, separating them into Principal Tokens (PT) and Yield Tokens (YT).

- Fastened and Variable Yields: By tokenizing future yields, Pendle permits customers to lock in fastened yields, providing safety in opposition to market fluctuations. Merchants can even speculate on yield adjustments by buying and selling YT, benefiting from potential yield will increase.

- Unlocking Liquidity: Pendle allows customers to unlock liquidity from their locked belongings by promoting the longer term yield part (YT) whereas retaining possession of the principal (PT).

- Automated Market Maker (AMM): Pendle's customized AMM is designed for time-decaying belongings like Yield Tokens, providing optimized pricing and minimal slippage. Customers can commerce PT and YT, offering liquidity and incomes charges whereas benefiting from Pendle's dynamic payment construction.

- Threat Administration Instruments: Pendle brings danger administration to DeFi by enabling customers to hedge in opposition to rate of interest volatility. Customers can promote their YT to lock in fastened returns or purchase YT to take a position on future yield actions, providing larger management over their investments.

What’s Pendle Finance?

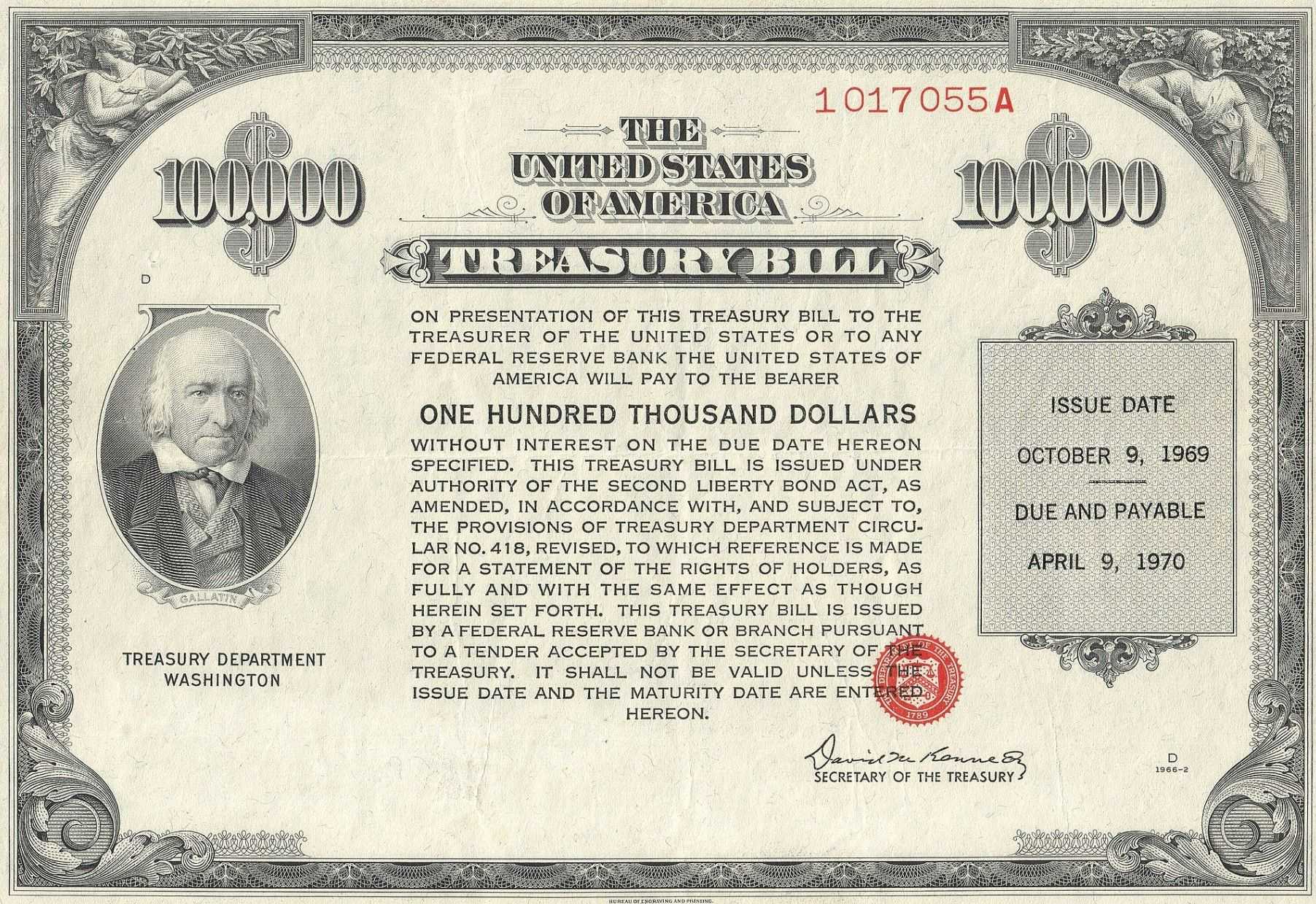

In conventional finance, devices like zero coupon bonds and rate of interest swaps permit buyers to handle rate of interest publicity and commerce future money flows individually from the principal quantity.

Let’s use a US Treasury Zero-Coupon Bond as a selected instance.

A US Treasury Zero-Coupon Bond is issued at a reduction, that means the customer pays lower than the bond’s face worth. Suppose an investor buys a 10-year US Treasury Zero-Coupon Bond for $800, with a face worth of $1,000. The bond doesn’t pay periodic curiosity (coupons), however at maturity—10 years later—the bondholder receives the total $1,000.

The important thing thought is that the bond's curiosity (yield) is embedded within the distinction between the acquisition value ($800) and the face worth ($1,000). In conventional finance, this separation permits buyers to both maintain the bond till maturity or promote it earlier than maturity primarily based on their rate of interest or liquidity wants.

How Pendle Finance Parallels this Idea:

The DeFi panorama has traditionally lacked such refined instruments. Yield-bearing belongings in DeFi—comparable to tokens representing stakes in lending protocols or liquidity swimming pools—usually lock customers into variable yields with restricted flexibility. Pendle addresses this hole by introducing fixed-income ideas to DeFi, enabling customers to take management over their yield publicity.

Pendle tokenizes yield-bearing DeFi belongings in an analogous approach. For instance, think about you might be holding an asset in a DeFi lending protocol that generates a variable yield. Pendle helps you to tokenize this asset into two parts:

- Possession of the principal (just like the bond's face worth). The Principal Token (PT).

- Future yield or curiosity (just like the distinction between a zero-coupon bond's discounted value and face worth).

Now, identical to an investor can promote their zero-coupon bond earlier than maturity, you may promote your future yield on Pendle, locking in a set return. In the meantime, one other person might purchase this future yield, betting that yields will rise, thus gaining greater than they paid—simply as somebody would possibly purchase a zero-coupon bond in anticipation of future positive factors.

This construction supplies yield management and adaptability, which DeFi customers beforehand lacked. It’s just like how zero-coupon bonds give conventional buyers management over future money flows.

The Issues Pendle Solves

Pendle finance is an instance of the intensive composability attainable with sensible contracts. Conventional monetary devices are matured. They permit buyers to manage their investments and anticipated returns granularly, and DeFi is constructing in direction of that management. Listed here are some limitations of DeFi that Pendle solves:

Lack of Yield Flexibility

In conventional finance, buyers can entry refined instruments comparable to fixed-rate bonds or swaps to handle their interest-rate publicity. Nonetheless, in decentralized finance (DeFi), most platforms supply variable yields, which fluctuate primarily based on market circumstances, creating a number of points:

Fastened vs. Variable Yields:

Variable Yields: Most DeFi lending platforms, like Aave or Compound, supply variable rates of interest, which change primarily based on provide and demand for the underlying belongings. This exposes customers to rate of interest volatility—in the future, they might earn 10%, however the subsequent, it would drop to 2%.

Instance: Think about you're staking in a lending protocol that originally provides a ten% annual yield. As extra individuals enter the market, the yield drops to five%. In the event you relied on that 10% yield for future returns, you're now caught with decrease earnings. When market circumstances are favorable, you can’t lock in that authentic 10% yield.

Fastened Yields with Pendle: Pendle permits customers to lock in a set yield on their belongings by separating the yield from the principal, successfully enabling them to hedge in opposition to this rate of interest volatility. Customers can promote their future yield to lock of their present charges, making certain secure returns no matter future market adjustments.

Inefficient Capital Utilization

In DeFi, yield-bearing belongings comparable to tokens staked in lending protocols or liquidity swimming pools are sometimes locked inside these protocols, decreasing liquidity and the power to make use of that capital elsewhere. In the event you lock your tokens in a liquidity pool, these tokens are unavailable to you for different funding alternatives. When you wait to gather yield, chances are you’ll miss out on higher alternatives elsewhere out there.

Unlocking Liquidity with Pendle

Pendle solves this situation by permitting customers to tokenize their yield-bearing belongings, which might be traded on secondary markets. This implies you may unlock liquidity out of your locked belongings by promoting the longer term yield, releasing up capital for different investments.

Alternative Price: As a result of belongings are sometimes locked in protocols, customers face alternative prices—lacking out on probably higher investments elsewhere. Pendle mitigates this by making a marketplace for yield, permitting customers to realize liquidity with out sacrificing their preliminary funding.

Restricted Threat Administration Instruments

Conventional finance provides a spread of instruments to handle danger, comparable to rate of interest swaps, choices, and futures contracts. In DeFi, the shortage of devices to handle rate of interest danger has been a major limitation, forcing customers to bear all the danger of unstable returns.

Curiosity Price Threat

In conventional finance, devices like rate of interest swaps permit buyers to hedge in opposition to future adjustments in rates of interest. DeFi customers face uncertainty of their funding returns with out such instruments, as yield charges fluctuate as a consequence of market circumstances. In a DeFi protocol, if yield charges drop dramatically after you’ve dedicated your belongings, chances are you’ll face a pointy discount in returns. With out instruments to hedge in opposition to this, customers are absolutely uncovered to rate of interest danger.

Mitigating Threat with Pendle

By separating yield from principal and making a marketplace for future yield buying and selling, Pendle introduces danger administration into DeFi. Customers can lock in fastened yields and shield themselves from future fluctuations in rates of interest, bringing much-needed stability to yield-bearing belongings.

Speculative Limitations: Earlier than Pendle, it was tough for DeFi merchants to speculate on yield actions. Pendle allows customers to take lengthy or brief positions on future yield, including a speculative part that didn’t beforehand exist in DeFi.

By addressing these three fundamental issues—lack of yield flexibility, inefficient capital utilization, and restricted danger administration instruments—Pendle brings a much-needed layer of economic sophistication to DeFi, enabling customers to handle their yield publicity, unlock liquidity, and hedge in opposition to rate of interest volatility.

Core Mechanism of Pendle Finance

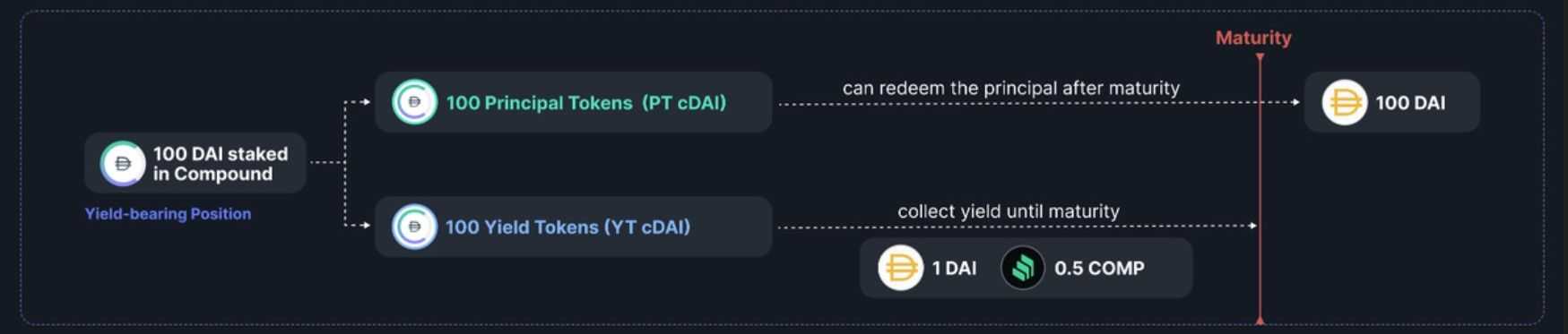

Pendle’s core innovation lies in its capability to tokenize yield-bearing belongings into two distinct, tradable tokens:

- Principal Token (PT): Represents the possession of the principal quantity of the underlying yield-generating asset. Key options:

- Non-Yield Bearing: Doesn’t accrue any future yield.

- Maturity Date: Has a specified maturity date when it may be redeemed for the underlying asset.

- Yield Token (YT): Represents the correct to obtain the longer term yield generated by the underlying asset till maturity.

- Time-Decaying Asset: Its worth diminishes because it approaches maturity since much less future yield stays.

- Tradable: May be purchased or bought independently of the principal.

As of October 2024, Pendle is reside on Ethereum, Optimism, Arbitrum and BNB Chain.

How Pendle Works: A Step-by-Step Information

Step 1: Deposit Yield-Bearing Asset

Customers begin by depositing a yield-generating asset into the Pendle protocol. Supported belongings would possibly embody:

- Liquidity Supplier (LP) Tokens: From platforms like Uniswap or SushiSwap.

- Lending Protocol Tokens: Similar to cTokens from Compound or aTokens from Aave.

- Staked Property: Like stETH (staked Ether) from Lido.

Step 2: Tokenization into PT and YT

Upon deposit:

- Minting PT and YT: The protocol mints an equal quantity of PT and YT tokens comparable to the deposited asset.

- Maturity Date Project: Each tokens are assigned a selected maturity date.

Step 3: Buying and selling and Liquidity Provision

Customers have a number of choices:

- Buying and selling PT and YT: Customers can commerce these tokens on Pendle's specialised automated market maker (AMM) or different supported exchanges.

- Offering Liquidity: Customers can present PT and YT to liquidity swimming pools to earn charges and incentives.

Step 4: Redemption at Maturity

On the maturity date:

- PT Redemption: Holders of PT can redeem them for the underlying principal asset.

- YT Expiry: YT tokens expire as all future yield has been realized.

Pendle's Automated Market Maker (AMM)

Pendle makes use of a customized AMM designed particularly for belongings with time-decaying worth, like YT tokens.

Key Options

- Time-Decaying Pricing Mannequin: Adjusts asset pricing primarily based on the lowering time to maturity.

- Dynamic Charge Construction: Charges might be adjusted to incentivize liquidity provision throughout completely different market circumstances.

- Twin Asset Assist: Facilitates buying and selling between PT, YT, and the underlying belongings.

Advantages

- Environment friendly Buying and selling: Optimizes for minimal slippage and environment friendly value discovery.

- Liquidity Incentives: Encourages customers to produce liquidity by rewards and fee-sharing mechanisms.

Pendle Use Instances

Fastened Yield for Traders

- Goal: Safe a set yield by locking in present charges.

- Mechanism:

- Promote YT: Customers deposit a yield-bearing asset, obtain PT and YT, and promote the YT.

- Consequence: The sale of YT supplies an upfront fee equal to the longer term yield, successfully fixing the yield price.

Yield Hypothesis for Merchants

- Goal: Revenue from anticipated adjustments in future yield charges.

- Mechanism:

- Purchase YT: Merchants buy YT in the event that they anticipate yield charges to extend.

- Promote YT: Conversely, they will brief YT in the event that they anticipate a lower in yields.

Yield Hedging for Threat Administration

- Goal: Mitigate publicity to yield volatility.

- Mechanism:

- Promote YT: Customers can promote YT to hedge in opposition to potential declines in future yields.

- Preserve OT: Retain possession of the principal with out yield publicity.

Enhanced Liquidity Provision

- Goal: Earn further revenue by liquidity provision.

- Mechanism:

- Present PT and YT to AMM Swimming pools: Earn buying and selling charges and probably PENDLE token rewards.

- Profit: Elevated capital effectivity and revenue diversification.

Pendle AMM

The Pendle AMM supplies liquidity swimming pools that permit customers to commerce these PT and YT tokens in a decentralized method. That is important as a result of it creates a market the place customers can simply purchase or promote their future yield or principal holdings primarily based on their technique.

Advantages of Buying and selling PT and YT on Pendle AMM:

- Yield Flexibility: Customers can promote their future yield (YT) for fast returns or purchase YT to take a position on greater future yields.

- Capital Effectivity: Merchants can unlock liquidity by promoting YT, releasing up capital that might in any other case be locked in yield-bearing belongings.

- Threat Administration: The power to commerce PT and YT permits customers to hedge in opposition to potential yield fluctuations by locking in fastened returns.

- Hypothesis Alternatives: Merchants can take lengthy or brief positions on future yield charges, enabling them to take a position on market developments.

Having a platform like Pendle AMM allows customers to seamlessly work together with these tokenized yield parts, offering extra flexibility, liquidity, and management over yield-bearing belongings in DeFi.

The PENDLE Token

The PENDLE token is the spine of the Pendle Finance protocol, offering utility and governance features inside the ecosystem. As a yield-trading platform, Pendle permits customers to separate yield-bearing belongings into principal and yield tokens, and the PENDLE token allows customers to work together with this technique meaningfully.

Tokenomics of PENDLE

- Provide Emissions: As of September 2024, PENDLE emissions stand at 216,076 tokens per week, with a scheduled 1.1% discount in emissions every week till April 2026. After this level, the protocol will implement a terminal inflation price of two% each year to keep up incentives inside the system.

- Vesting: By September 2024, all staff and investor tokens have absolutely vested, that means that future provide will increase will primarily come from incentives and ecosystem-building efforts.

vePENDLE (Vote-Escrowed PENDLE)

The vePENDLE system is impressed by the "vote-escrow" mannequin (just like Curve's veCRV). Customers can lock their PENDLE tokens to obtain vePENDLE, which decays over time. Holding vePENDLE provides a number of advantages:

- Governance Voting: vePENDLE holders take part within the governance of the protocol by voting on key choices such because the distribution of PENDLE incentives to particular liquidity swimming pools.

- Income Share: vePENDLE holders obtain 80% of the swap charges collected from the swimming pools they vote for. Moreover, a portion of the yield from unredeemed principal tokens (PTs) is distributed to vePENDLE holders.

- Boosting Liquidity Rewards: vePENDLE holders can increase their liquidity supplier (LP) rewards by as much as 250%, relying on the quantity of vePENDLE they maintain relative to their share of the liquidity pool.

- Incentive Channelling: By locking PENDLE, customers can direct incentives to sure liquidity swimming pools, growing the liquidity and buying and selling exercise within the swimming pools they assist.

The vePENDLE system introduces a dual-purpose mechanism that aligns each governance participation and reward maximization, making a virtuous cycle for long-term ecosystem engagement. By locking PENDLE tokens, customers cut back the circulating provide, thus contributing to the token's stability whereas having fun with varied advantages tied to their governance and staking actions.

The place to Purchase PENDLE?

You should buy PENDLE on:

- BloFin

- Bybit

- Binance

- OKX

- KuCoin

Pendle Finance Dangers and Mitigation Methods

1. Good Contract Dangers

- Threat: Potential vulnerabilities might result in lack of funds.

- Mitigation:

- Audits: Pendle supplies common audits from a number of auditing corporations to make sure protocol robustness.

- Formal Verification: Ensures contract logic is sound.

2. Market Dangers

- Threat: Volatility in underlying asset costs and yield charges.

- Mitigation:

- Diversification: Customers ought to diversify holdings.

- Keep Knowledgeable: Yield from Pendle’s merchandise is relies upon tremendously on the yield of underlying belongings, staying knowledgeable about them is important.

3. Liquidity Dangers

- Threat: Low liquidity may end up in excessive slippage or lack of ability to exit positions.

- Mitigation:

- Incentives: Pendle supplies rewards to encourage liquidity provision.

- Training: Inform customers about liquidity pool participation.

4. Regulatory Dangers

- Threat: Modifications in authorized frameworks might have an effect on operations.

- Mitigation: Decentralized governance to scale back centralized factors of failure.

Pendle Finance Review: Closing Ideas

Pendle Finance represents a major development within the DeFi panorama by enabling future yield buying and selling. Its modern method to yield tokenization permits customers to unlock liquidity, handle danger, and have interaction in new speculative alternatives. By addressing key limitations in yield administration and introducing versatile, user-centric options, Pendle is well-positioned to contribute to the continued evolution of decentralized finance.

Because the DeFi ecosystem continues to mature, protocols like Pendle will play a vital position in offering refined monetary devices that mirror conventional finance whereas leveraging the transparency, accessibility, and composability of blockchain expertise.

Ceaselessly Requested Questions

What’s Pendle Finance?

Pendle Finance is a decentralized finance (DeFi) platform that permits customers to commerce tokenized yields, introducing fixed-income methods to the DeFi ecosystem. It splits yield-bearing belongings into two tokens: Principal Tokens (PT) and Yield Tokens (YT). This separation allows customers to commerce future yield individually from the principal, permitting for extra versatile and complicated yield administration methods like locking in fastened yields or speculating on future yield actions.

What’s Yield Tokenization?

Yield tokenization is splitting a yield-bearing asset into two tradable parts: the Principal Token (PT) and the Yield Token (YT). The PT represents the unique capital or asset, whereas the YT represents the longer term yield generated by that asset. By tokenizing yield, Pendle Finance allows customers to commerce or handle future returns independently from the principal, permitting larger flexibility in yield optimization methods.

The way to Optimize Yield Utilizing Pendle Finance?

Pendle Finance optimizes yield by yield tokenization and a specialised AMM. Customers can both lock in fastened yields by promoting their Yield Tokens (YT) for an upfront return or purchase Yield Tokens to take a position on future yield will increase. Moreover, by locking PENDLE tokens to earn vePENDLE, customers can direct incentives to particular liquidity swimming pools, boosting their LP rewards and incomes swap charges from voted swimming pools.

What Property are Supported on Pendle Finance?

Pendle Finance helps a variety of yield-bearing belongings throughout main EVM-compatible chains like Ethereum, Arbitrum, and Optimism. Examples embody Lido’s stETH, Ether.fi’s eETH, and different widespread DeFi tokens. Yield-bearing stablecoins like Ethena’s USDe and Maker’s sDAI are additionally distinguished on the platform.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.