Standard Chartered reported that the initial applications of stablecoins in crypto-exchanges is shifting to broader global financial applications.

According to the study, stablecoins have become more popular for traditional financial purposes such as facilitating payments across borders and saving in U.S. dollar.

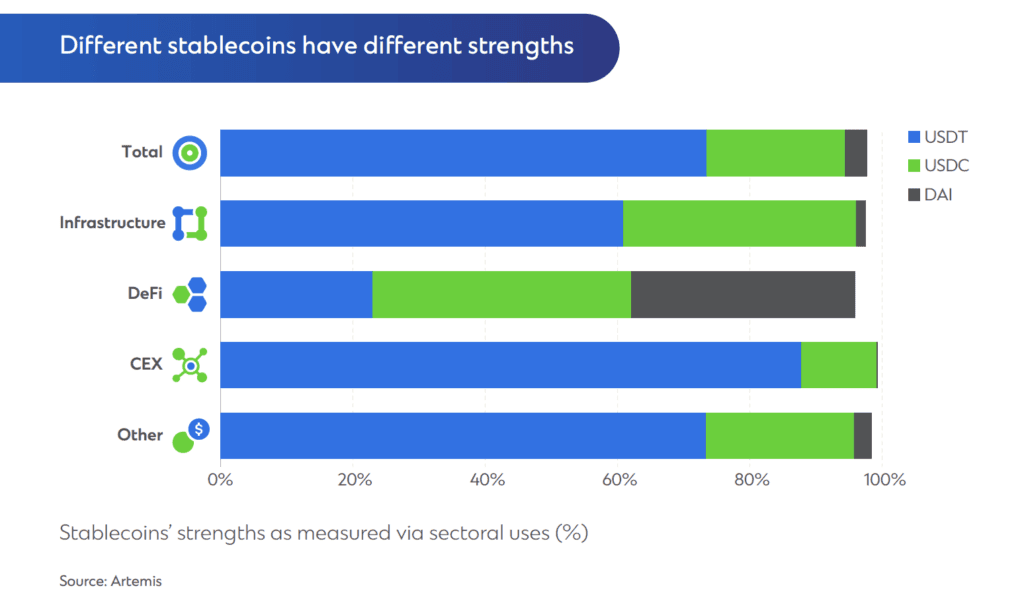

Standard Chartered comments on how stablecoins’ dominant use case is evolving.

“There is growing evidence of increasing stablecoin use for a variety of purposes akin to those provided in traditional finance.”

The report states that the need for more convenient and faster cross-border transactions is a major factor in this change. There are limitations to traditional correspondent banking, in particular for emerging markets. Stablecoins provide a solution, allowing the transfer of digital assets in the same speed as email. This bypasses the slower and less reliable traditional systems.

Report highlights the fact that stablecoins have become popular for USD saving, USD transactions, and USD to USD cross-border payments. In a survey that was cited by the study, it found that 69% of respondents in Brazil, Turkey Nigeria India and Indonesia use stablecoins to pay for goods and service, while 39% used them for payment. Another 39% were using them for cross border payments.

While U.S. dollar-pegged stablecoins dominate the market, accounting for 99.3% of the market capitalization, there’s a growing interest in non-USD stablecoins. As stablecoins are linked to different national currencies like the Turkish lira and other local currencies, it indicates that the ecosystem is moving towards a more diverse offering.

According to the report, the market cap of stablecoins is $163 Billion. While this is a relatively small figure compared to other financial markets it still has significant potential for growth. Regulations are a key factor in determining the potential expansion. This report indicates that

“We expect this use case to continue to grow, particularly if U.S. stablecoin regulation is passed, as now looks likely under a Trump administration.”

Standard Chartered argues their growing use in stablecoins as a currency for real world applications is a testament to the role they play. “first killer app” in digital assets. The unbanked can use them as an alternative and enjoy the benefits of cross-border transaction efficiency that is not available with traditional systems.

Standard Chartered’s report suggests that stablecoins have a promising future, and there are opportunities to increase adoption both in developed markets as well as emerging ones. Combining technological progress and regulatory support could make stablecoins a key component in the global financial system.

Standard Chartered has been bullish on Bitcoin and the broader crypto market recently, recommending investors purchase Bitcoin below $60,000 regardless of this month’s election outcome. Investors who followed Standard Chartered’s advice and bought Bitcoin below $60,000 have seen a significant return in just a few months.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.