The Tokenist’s Editor in Chief, Shane Neagle has written a guest blog.

Bitcoin’s new highs have been reached almost every week in November, since the US Presidential elections were over. Bitcoin has reinvigorated altcoins after reaching almost $100,000 in November. 1.49 trillion dollars The market capitalization of the company.

Previous trends suggest altcoins are likely to follow Bitcoin. Which altcoins will see the most significant gains? Are there any new fundamentals that we should consider?

We’ll start by reviewing the relationship of Bitcoin with altcoins. This is an important issue.

Why does Bitcoin lead the crypto market?

It took almost 9 years from the start of Bitcoin’s mainnet, in January 2009. to Bitcoin breaking through $10K in November 2017. Bitcoin became more and more popular, but it retained its status as a highly speculative, novel asset. This is understandable in a central banking system, where money is synonymous with government edicts – fiat (by decree) money.

Money’s value is based on the belief that government will enforce its edicts and on government force. It has been a common belief for many generations. There is also the issue of medium. How can Bitcoin be trusted if it is not an actual paper token issued from a central banking institution, but a digital one?

Answer: Blockchain experts already know. Federal Reserve Bank relies upon an electronic ledger which can manifest itself as tokens or paper money. But not always. Bitcoin’s ledger, on the other hand, is designed to be resistant to arbitrary diluting.

Bitcoin becomes pseudo-digital. The proof-ofwork algorithm enforces its accounting by using computing power. This bridges the gap between digital and physical. Physical assets are the hardware and energy needed to create computing power. Bitcoin, therefore, sets the alternative coin market.

- Bitcoin, the original cryptocurrency is a simple way to understand sound money.

- The Bitcoin network is a new phenomenon. Calculating power As Bitcoin grows in popularity, more holders have confidence in its accounting system (distributed leadger).

- Bitcoin is the benchmark for trading altcoins, as it’s tied to energy, hardware, and physicality.

- Holders of Bitcoin will often turn to it in times of uncertain altcoin valuations. Bitcoin can be a more secure asset.

- Similarly, when Bitcoin is rising in price, the holders will move over to smaller altcoins, as their profit potential increases. It is harder to shift a market that has such a high weight.

In an opposite way, the huge Bitcoin market cap acts as a mental cushion that is always prepared to absorb Altcoin capital when it’s in distress. In a very stressful environment, this capital could flee Bitcoin.

It is a problem that if there are enough altcoins, then the whole crypto market will crash. This is because Bitcoin has been viewed as just a different cryptocurrency.

Altcoin and Bitcoin Pullback

There is a close relationship between the Federal Reserve, the cryptocurrency market and each other. If the Federal Reserve increased its balance sheet by over Six Trillion DollarsBetween 2020 and 2022 the liquidity exploded into crypto assets. This prompted traders to use popular strategies for trading to maximise opportunities.

Previously, the crypto-liquidity boomed in the Initial Coin Offerings (ICO) era. It peaked from 2017 to 2018. At the height of this era, top altcoins were Ethereum (ETH), Cardano ADA, EOS (EOS), Tezos XTZ), Stellar XLM), Algorand ALGO), NEO NEO), Filecoin FIL), Tron TRX Chainlink LINK and many more.

All liquidity, however, is restricted. Bitcoin’s dominance in the market was eroded by the growth of altcoins. The most popular trading platform is Trading Rooms Share strategies and market insights to navigate changes in the marketplace effectively during pivotal times.

It is true that the ICO boom spawned dozens and dozens of altcoins. most were fraudulent It’s either dead or dying. Bitcoin recovered some of its lost ground before the Fed intervened in the currency market during the Pandemic Narrative.

Bitcoin’s dominance has shrunk even more after the Fed money-printing spree. The altcoin markets suffered a loss of $60 billion after the Terra (LUNA), a stablecoin algorithmically linked to TerraUSD, collapsed due to its overleverage.

The speculative urge remained, however, because altcoins performed already better than Bitcoin due to lower market cap and greater profit potential. It was a temporary decrease in Bitcoin’s dominance.

The collapse of FTX’s overleveraged exchange was a shock to the crypto market. Bitcoin, which had dropped below its price of pre-2020 at $16.5k, was caught up in the panic and collapsed.

Bitcoin recovered as a result of the big question marks that hung over the whole crypto market. In the spring 2023, there will be a regional US banking crisis. The case for helping the client Bitcoin is a fundamental asset. Bitcoin ETFs were approved in 2024, and the fourth halving was also approved. This laid the foundation for the recent record highs.

What has happened to the Altcoin Market?

It’s Memecoin that is dominating.

The majority of people are unaware that “old-guard” The altcoins focus on decentralized finance, blockchain infrastructure and tokenizing human activities via smart contract. The crypto crash of 2022 has left a psychological scar.

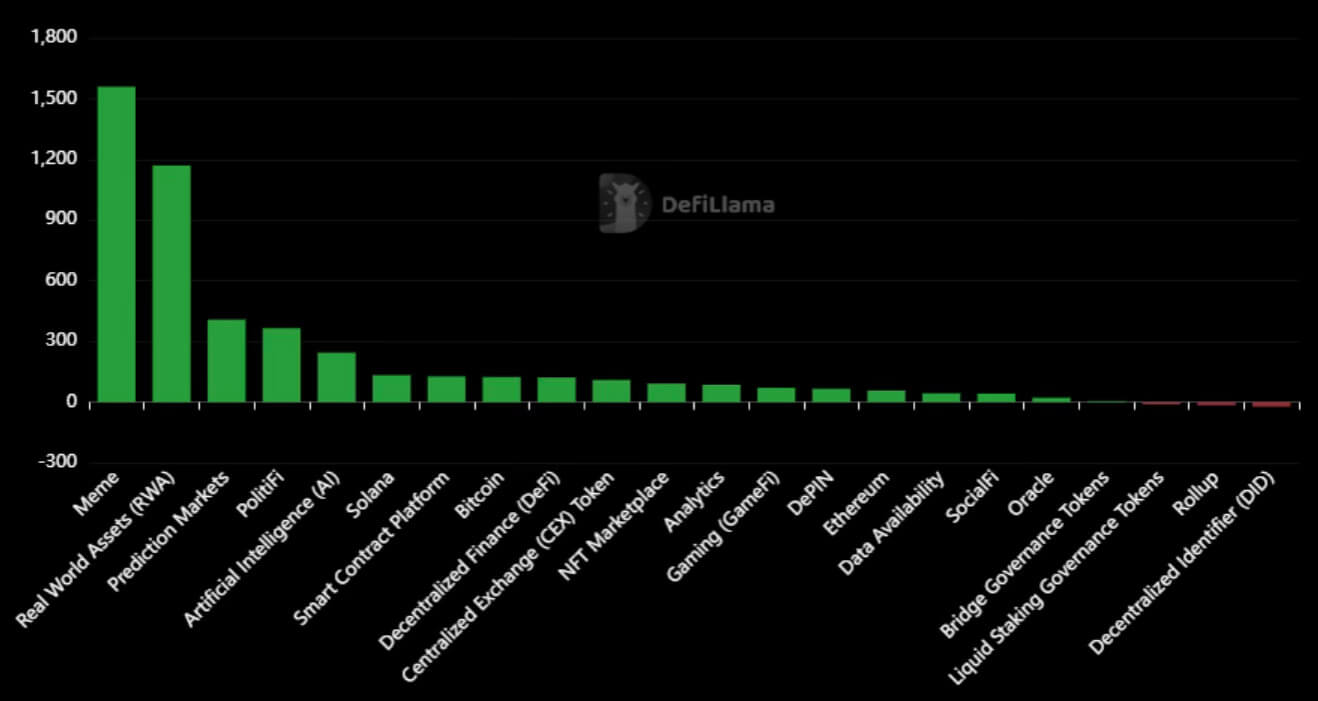

In the last cycle, hype gambling through memecoins has largely supplanted lofty narratives. Artemis shows memecoins to be the dominant crypto currency, only AI tokens are expected to surpass them in 2024.

Mid-November is the best time to start. The value of memecoins is 6x that which they were originally worth Crypto market is averaging higher than average.

Donald Trump has just been re-elected to his second term at the Oval Office. It is likely that this has led to crypto holders becoming more accustomed with social media hype cycles around community rather than fundamentals of altcoins.

AI is also still a growing revolution. Other than diverse “ChatGPT with makeup” Software and service providers offering hosted GPU serversAI cryptos have also been a popular topic. The release of AI agents, long-awaited by many, is expected to spark a new bullish phase.

Kaito AI’s market insight platform determined that one out of four crypto investors prioritise memecoin discussion. This means that the focus is on short term profits, rather than long term value. This is ideal for more energetic traders who keep up with crypto trends every day.

According to the narrative, altcoin categories such as memes, prediction markets and AI platforms, Solana, PolitiFi are performing better in comparison with Bitcoin.

Total, there are 15,713 The number of cryptocurrencies tracked in 1178 exchanges across 494 different categories. It is difficult to sort through the vast amount of digital assets across all categories.

In contrast, memecoins are a manifestation of how to manage mental overload. The simplicity of memecoins and their virality act as a filter. One way to cope is by returning to familiarity. “old guard” altcoins.

Altcoins from the past are returning to a more friendly scene

In 2022, the collapse in crypto-prices was so extreme that selling altcoins with such a steep drop made no sense. It is therefore fair to state that many unrealized losses were awaiting the next bullrun.

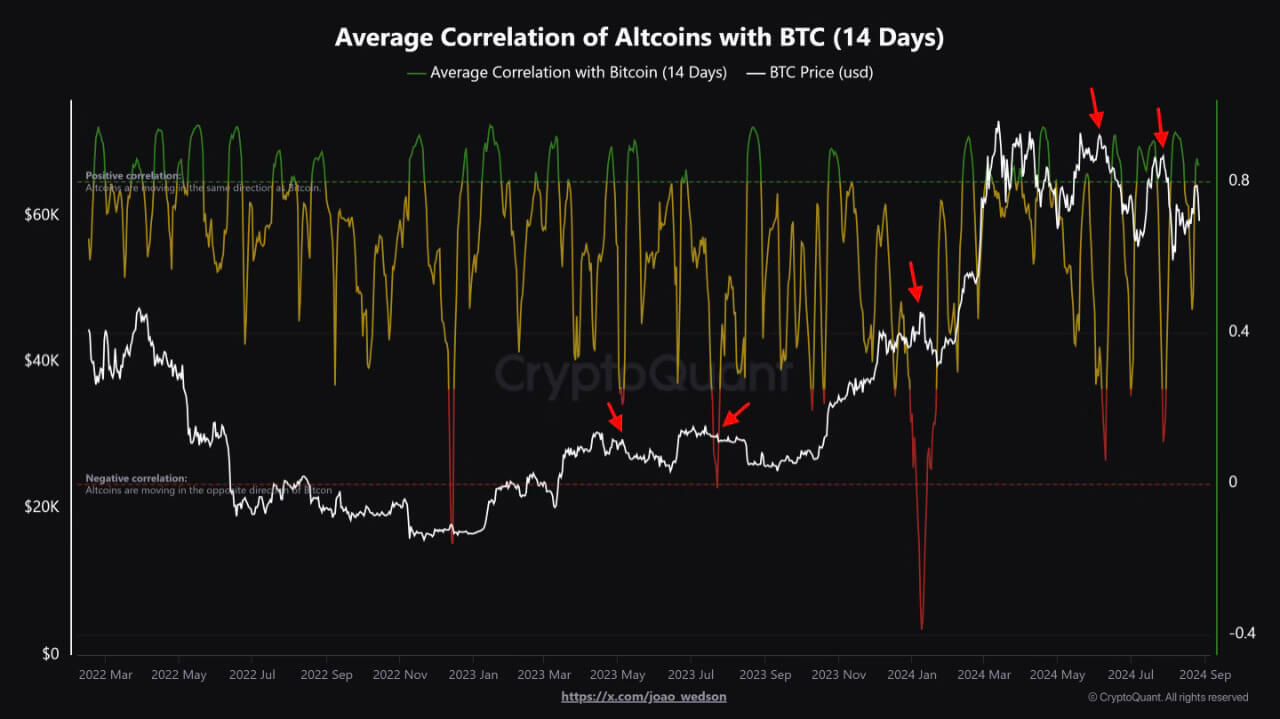

This cycle appears to be triggered by Bitcoin’s recent bullrun. Joao Wedson from CryptoQuant noted that at the end August the altcoins market was once more aligned to Bitcoin.

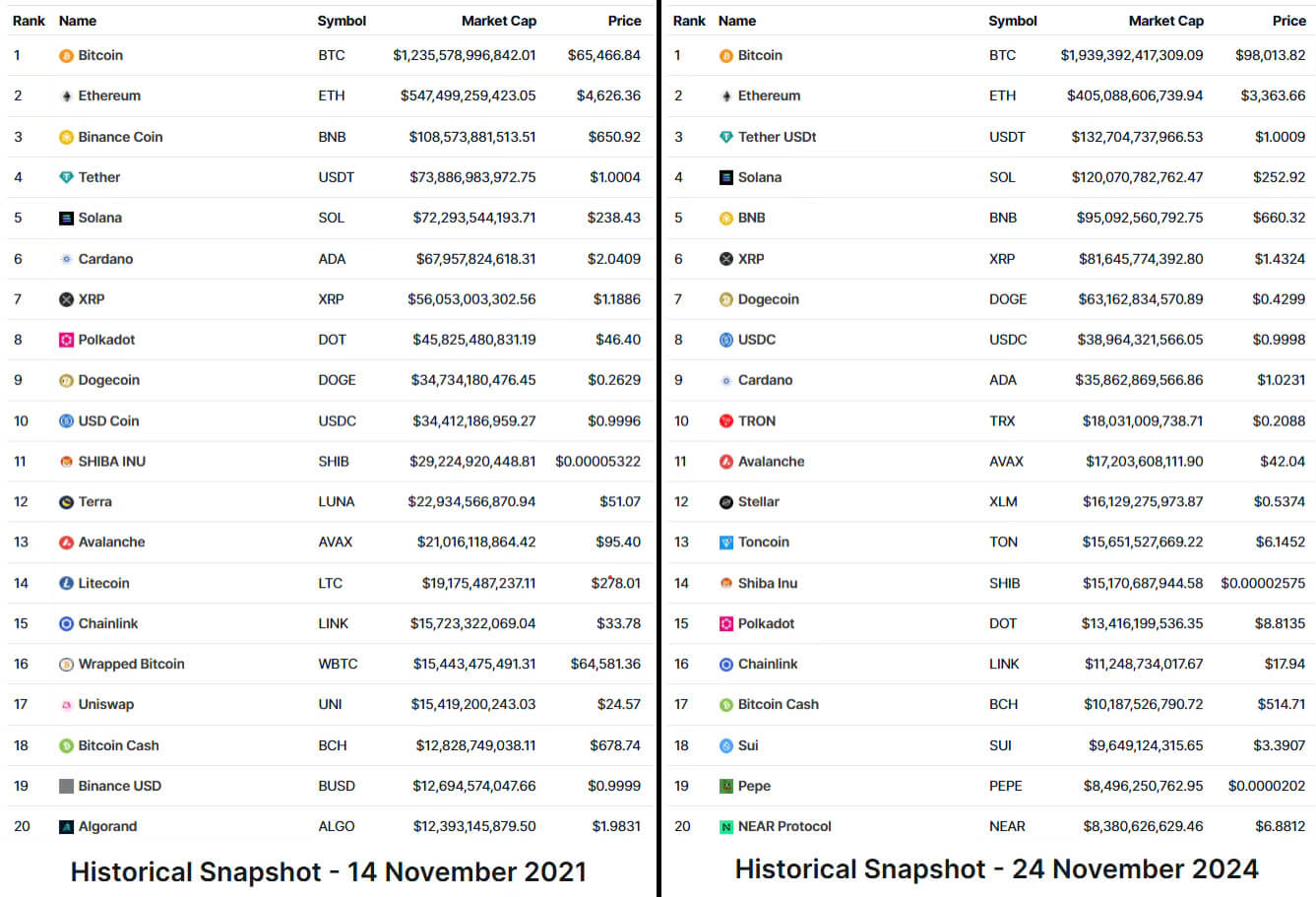

On the list of top altcoins in the cycle prior, at the height of the bull run, November 20, 2021, there are 11 that remain. Even though most are still far off the previous tops, their potential for regaining ground is high if they assume that this bullrun will continue.

It could also be true if the approval of more exchange-traded fund (ETF) is granted, as this was what sparked the Bitcoin rally earlier in the season. Consider this example. Recently, NYSE Arca filed a NYSE Arca report Bitwise 10 Crypto Index Fund includes the following coins

| Portfolio Asset | Symbol | Weight |

|---|---|---|

| Bitcoin | BTC | 75.10% |

| Ethereum | ETH | 16.50% |

| Solana | SOL | 4.30% |

| The XRP currency is a cryptocurrency that can be used to buy and sell goods. | The XRP currency is a cryptocurrency that can be used to buy and sell goods. | 1.50% |

| Cardano | ADA | 0.70% |

| Avalanche | AVAX | 0.60% |

| Chainlink | LINK | 0.40% |

| Bitcoin Cash | BCH | 0.40% |

| Polkadot | The DOT | 0.30% |

| Uniswap | UNI | 0.30% |

It is interesting to note that the current Bitcoin dominance pales in comparison with the index weight. This again points out the problem of crypto dilution. Altcoins are cheaper but there are too many to accurately gauge the value of their long-term fair market price.

Their scarcity cannot be guaranteed either. The inflation rates of these projects could change as they become more centralized. Solana has an inflation rate currently of SOL tokens that is 4.886% While the long-term proposal is 1.5%.

The crypto market will likely see its liquidity increase now that Trump’s administration, which is purportedly pro-crypto, is taking over. The recent ruling that Tornado Cash is not entitled to a sanction It is possible that this will have wide-ranging implications.

In essence, the court acknowledged that dApps were a different type of asset and did not have a sanctionable owner as a code for smart contracts. The court reaffirmed the common sense of open-source not being property.

The Bottom line

Liquidity is limited, even with the historic boost in money supply. Bitcoin was able to grab the majority of crypto liquidity as it introduced a new way to view money. Its monetary power prompted the creation of many altcoins, which expanded the functionality of smart contracts.

The crypto market did not expand due to fraud or overleveraging, but instead, it contracted. Bitcoin was also affected. Bitcoin’s bull market is about to begin with a more bullish and cleaner regulatory climate.

In the midst of altcoin noise, first-generation altcoins have resurfaced to try and anchor their value on familiarity.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.