Vincent Maliepaard writes a guest blog for IntoTheBlock.

Many expected that the Decentralized Finance (DeFi), which is based on decentralized financial systems, would experience a surge similar to Bitcoin’s. DeFi’s total value (TVL) had exceeded $100 billion, so it was the right time for institutional investors to join. The expected flood of institutional money into DeFi is slower than anticipated. This article will explore some of the main challenges that are preventing institutional DeFi adoption.

Regulations can be a barrier to success

The regulatory uncertainty may be the biggest roadblock to institutions. In major markets like the U.S. and the EU, the unclear classification of crypto assets—especially stablecoins—complicates compliance. This uncertainty increases costs, and it discourages institutions from getting involved. Some jurisdictions such as Switzerland and Singapore have clearer regulations, attracting early adopters. Lack of consistency in global regulation complicates international capital allocation and makes it difficult for institutions to move into the DeFi market with confidence.

In addition, regulations like Basel III place strict capital requirements on institutions holding crypto assets. This further discourages direct participation. To avoid these restrictions, many institutions opt for indirect exposure via subsidiaries or special investment vehicles.

However, Trump’s office is expected to prioritize innovation over restrictions, potentially reshaping U.S. DeFi regulations. Clarified guidelines may lower barriers to compliance, encourage institutional investment, and establish the U.S. in this space as a global leader.

Beyond Compliance: Structural Barriers

Other structural barriers to institutional DeFi adoption also exist, despite the fact that regulatory concerns often dominate discussions.

Lack of wallet infrastructure is a major problem. MetaMask wallets are great for retail users, but to maintain proper governance and custody, institutions need secure solutions such as Fireblocks. The need for seamless transitions from traditional finance to DeFi, as well as between the two ecosystems is crucial for capital flows. Institutions struggle to efficiently navigate between the two financial eco-systems without a robust infrastructure.

Developers with specific DeFi skills are required. Skillsets required for DeFi infrastructure are often different from those needed to develop traditional finance software and may also differ blockchain-to-blockchain. Institutions who are only interested in deploying the most liquid strategies will probably have to deploy across multiple blockchains, which increases overhead and complexity.

Liquid Fragmentation

DeFi has a persistent problem with liquidity. Liquidity fragmentation across different decentralized exchanges (DEXs), and borrowing platforms, poses risk such as bad debt and slippage. It is important for institutions to execute large transactions that do not significantly affect market prices. Weak liquidity can make this impossible.

By doing so, institutions may have to conduct transactions across multiple blockchains in order to complete a trade. The strategy becomes more complex and riskier. DeFi protocol must be able to create large liquidity pools that can support very large trades in order to attract institutional capital.

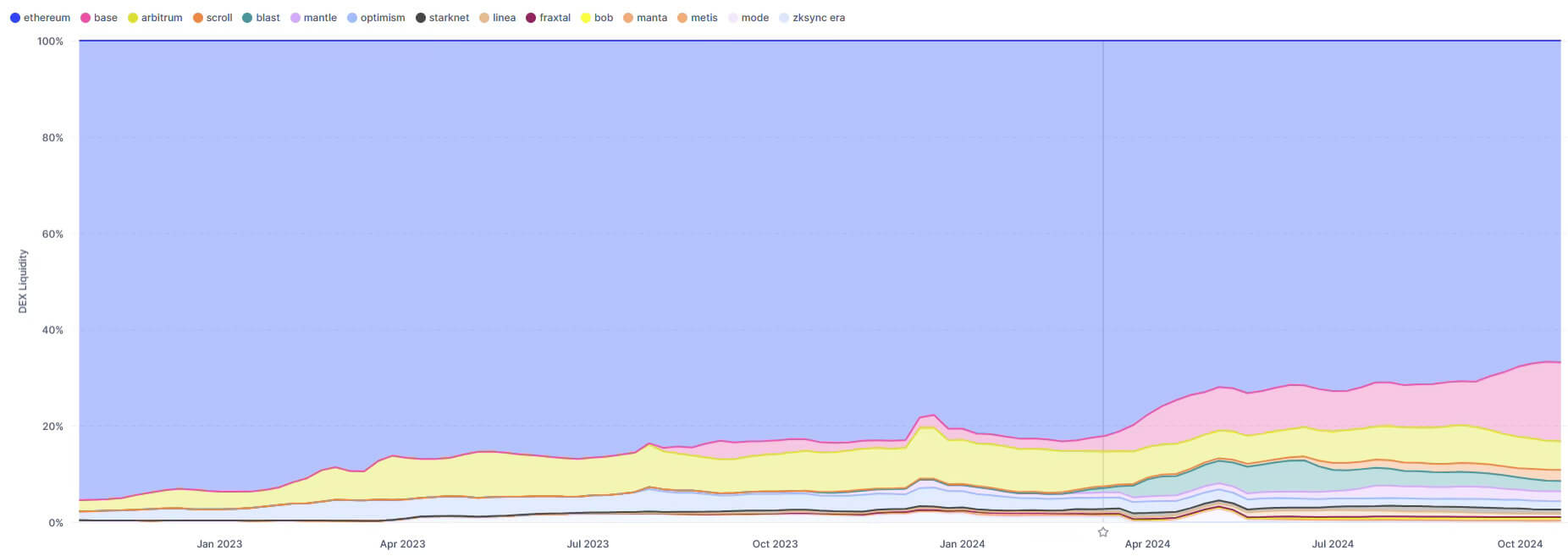

As the landscape of Layer 2 blockchains (L2) evolves, we can see a great example of how liquidity is fragmented. Liquidity has moved away from Ethereum Mainnet as L2 Blockchains are cheaper and easier to use. The mainnet has less liquidity for some assets and trading, reducing how much can be deployed by institutions.

This has been the main barrier to institutional adoption, even though technologies and improvements in infrastructure are being developed to solve many issues with liquidity fragmentation. It is particularly true when it comes to deployments on L2s, where infrastructure and liquidity issues are much more severe than mainnet.

Risk Management

The management of risk is crucial for any institution, but especially so when it comes to a new sector such as DeFi. In addition to technical security which reduces the risk of hacks and exploits for institutions, they must also understand economic risks that are inherent in DeFi protocols. Institutions are exposed to serious risks by protocol vulnerabilities in governance and tokenomics.

Complicating matters, due to the absence of institutional insurance to cover major losses like protocol exploits, only assets with a high return on investment are allocated to DeFi. This is because lower-risk funds, which may be more open to BTC exposure, aren’t able to deploy into DeFi. Furthermore, liquidity constraints—such as the inability to exit positions without triggering major market impacts—make it challenging for institutions to manage exposure effectively.

Also, institutions need to be technologically advanced Assessment of liquidity risk using toolsInclude stress tests and models. DeFi is too risky without these tools for portfolios that prioritize stability, and are able to unwind or deploy large positions of capital with minimal volatility exposure.

How to build institutional-grade DeFi

DeFi’s evolution must meet the standards of institutional investors in order to be able to attract their capital. To achieve this, DeFi must develop wallets that are institutional grade, create seamless on-and off ramps for capital, offer structured incentive programs and implement comprehensive risk management. These areas are crucial to the development of DeFi as a parallel system capable of supporting large players and their scale.

DeFi can transform the traditional financial system by building the correct infrastructure and aligning it with the needs of institutions. DeFi, as these improvements are implemented, will attract institutional capital and establish itself a foundational element of the global financial eco-system, ushering a new age of financial innovation.

The article that follows is an adaptation of The latest research from IntoTheBlock The future of DeFi institutionally

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.