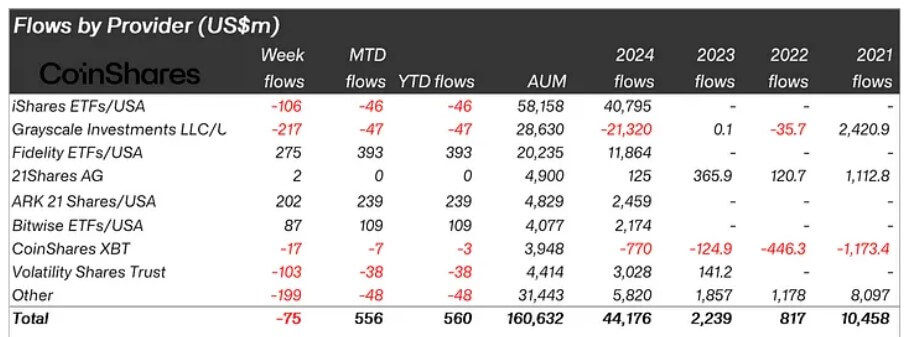

Crypto-related products recorded a remarkable $44.2 billion in inflows last year—almost four times higher than the previous all-time high of $10.5 billion set in 2021.

According to CoinShares’ latest report, this record-breaking performance is attributed to the introduction of US spot-based exchange-traded funds (ETFs), which significantly influenced global investments.

Bitcoin ETFs dominate

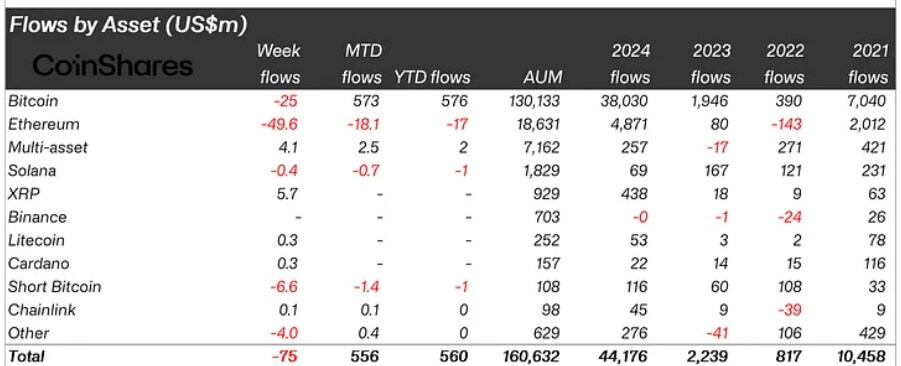

Bitcoin was the dominant currency, attracting $38 billion of inflows. It accounted for 29% total assets managed (AuM).

This significant inflow also resulted in a notable increase in Bitcoin ETFs’ holdings, which surpassed one million BTC in less than a year of their launch.

Leading products like BlackRock’s IBIT and Fidelity’s FBTC attracted the most interest. IBIT, which outperformed nearly 3,000 ETFs in the past decade, was notable for being the most successful ETF to launch over the last 10 years.

On the other hand, Grayscale’s GBTC saw the most outflows last year as investors withdrew more than $21 billion from the fund for cheaper alternatives.

Nevertheless, the ETF products’ positive flows resulted in the US leading global inflows, as it attracted almost all of the $44.4 billion, followed by Switzerland with $630 million.

However, significant outflows from Canada and Sweden—totaling $707 million and $682 million, respectively—partially offset these gains.

James Butterfill is the CoinShares research head. He pointed out that outflows from this region indicate an investment shift to US products.

The Bitcoin price reached a record high last year of over $100,000, resulting in $116,000,000 in inflows into short BTC contracts.

Ethereum Resurgence

Ethereum was another cryptocurrency that stood out, mainly for its revival in the last part of 2017.

As its ETH ETFs finished the year strong, $4.8 billion was invested in this digital asset. This 26% inflow represents 2.4 times more of AuM than the 2021 total. It also exceeds performance from 2023 by a wide margin.

Meanwhile, Ethereum’s gains outpaced its eternal rival Solana, which managed $69 million in inflows, representing just 4% of its AuM.

The combined AuM of other alternative large-cap coins like Cardano (XRP), Polkadot and others was $813 Million, which is 18%.

The 2025 Flow

This year’s start has been positive for Bitcoin-related investment products. The first two trading sessions saw inflows of $666 millions.

Farside data shows that on January 3, there was a $908-million inflow, led by Fidelity at $357-million, barely ahead of BlackRock (at $253m) and Ark Invest ($222-million).

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.