Western Union, MoneyGram and other traditional remittance companies are struggling to stay on top of an increasingly stablecoin-dominated financial landscape.

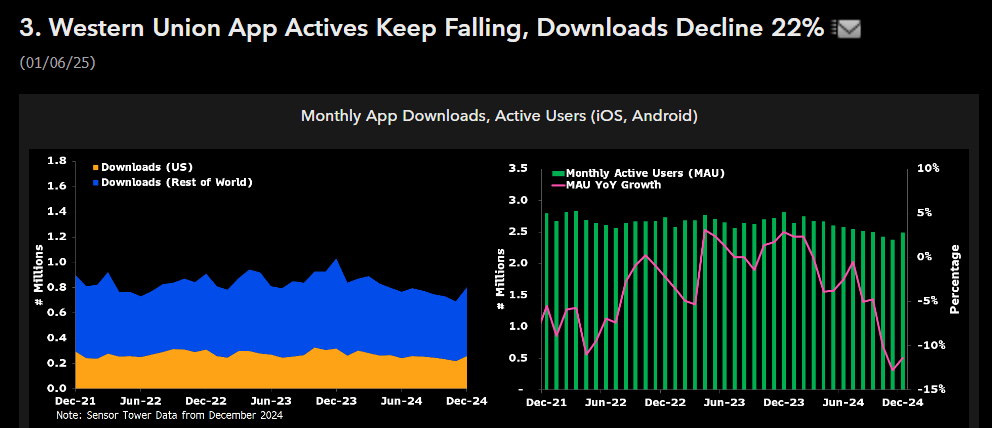

Matthew Sigel of VanEck’s Digital Assets Research says that the number of downloads from remittance apps has dropped dramatically. Western Union saw a 22 percent decline, and MoneyGram experienced a 27 percent drop.

Meanwhile, this drop isn’t limited to app downloads. Since 2021, the number of monthly users has been below 3 million. Between January and November 2024 these platforms saw a decline in the number of users, signaling an alteration in consumer behavior.

Rise of Stablecoins

Sigel said that stablecoins have emerged as an alternative to the traditional methods of remittance, offering faster and cheaper cross-border transfers.

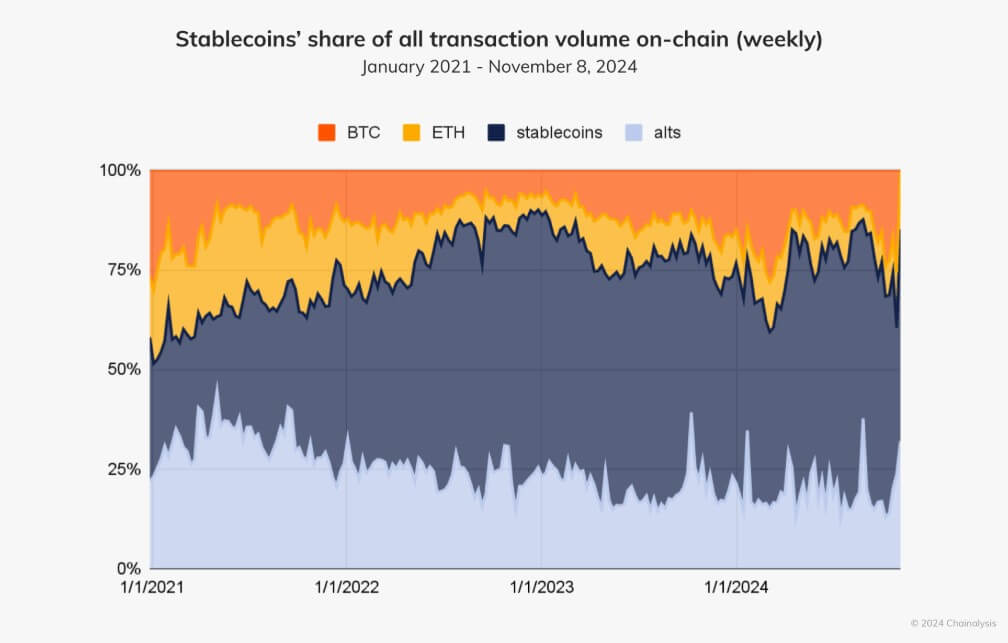

Chainalysis is a Blockchain-based analysis company that reported these digital assets have been indispensable to regions with unstable currencies or inaccessible banking systems.

Stablecoins continue to gain in popularity as they are filling the gaps that traditional financial services have left. Businesses and individuals use stablecoins to manage their liquidity, make international payments, and safeguard wealth against currency fluctuations.

Stablecoins, unlike traditional banking methods, allow instantaneous transfers. This eliminates the high costs and delays associated with older systems.

The stablecoin industry will reach a major milestone in 2024 when it surpasses $200 billion. The sector also saw the rise of innovative digital currencies like Ethena’s synthetic USDe stablecoin, which now competes with major players such as Tether (USDT) and Circle (USDC).

Moreover, the profitability of the stablecoin industry is equally notable, with issuers like Tether and Circle collectively earning over $664 million last December—representing a significant portion of the revenue generated by crypto protocols.

Chainalysis has also stated that stablecoins account for more than 75% of all crypto transactions in the last few months.

The remarkable growth of the market has drawn attention from both traditional financial institutions as well as blockchain companies such Ripple. They are looking for ways to take advantage of this growing industry.

Liz Bazurto said that the giants of traditional remittances could adopt stablecoins for their operation. She added:

“I can see a path for Western Union and MoneyGram to enable Stables. MoneyGram has enabled Stellar (USDC) for on and offramps.”

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.