Fiat foreign money was one the primary main Actual-World Asset (RWA) that was tokenized within the blockchain business. Stablecoins are the cornerstone of worth alternate in DeFi, and I’ve seen them in use for so long as I can keep in mind listening to about blockchain expertise.

Because the identify suggests, stablecoins are cryptocurrencies that keep a steady worth pegged to a central bank-issued fiat foreign money. USD-backed stablecoins are among the many most prominently held and traded belongings in DeFi.

We Use Stablecoins and Fiat Very In another way

For a lot of DeFi's historical past, stablecoins have solely transferred worth from one deal with to a different. Stablecoins are handy for immediate on-chain settlements, worldwide transfers, and high-frequency buying and selling. Whereas we do all these actions with fiat alike, the distinction lies in how we retailer the 2 belongings.

In case you observe your mum or dad's banking historical past, you can see vital cash parked in low-risk investments like fastened deposits and authorities debt. With a really slim likelihood of devaluation, these investments accrue curiosity and guarantee cash availability by promoting bonds or breaking fastened deposits.

In distinction, stablecoins sit in alternate or chilly wallets, typically don’t earn any curiosity, and regularly devalue as a result of inflation. Stablecoins do not need an inherent yield part. Yield-bearing stablecoins earn passive curiosity, bringing them nearer to the true nature of fiat currencies.

This piece will analyze yield-bearing stablecoins, clarify how they work, and focus on how they accrue curiosity. DeFi is getting as succesful as conventional monetary providers, so studying about rising asset lessons within the house is important for making essentially the most out of your investments.

What are Yield-Bearing Stablecoins?

Yield-bearing stablecoins are functionally much like fastened deposits and treasury notes in conventional finance. These low-risk and low-volatility belongings have a yield part connected to them, accruing just by holding the coin in your pockets. This asset class shares similarities with conventional fiat currencies.

Contemplate the cash you will have saved together with your financial institution, as an example. Once you deposit cash in a financial institution, it updates a digital ledger that tracks all of your transactions. Whilst you can spend, switch, or withdraw from the ledger as you want, the financial institution loans the precise cash to people searching for debt. The debt earns curiosity, a portion of which is remitted to you for storing your cash with the financial institution. Your checking account virtually displays a tokenized model of your fiat deposits that you need to use whereas the belongings earn curiosity elsewhere.

Equally, yield-bearing stablecoins function by having the bearer deposit funds into the stablecoin protocol. These deposits may be made utilizing different stablecoins like USDC or tokens like BTC and ETH. The protocol then invests these sources in varied yield methods and mints a stablecoin to symbolize your deposit. Subsequently, the yield is distributed proportionately to the stablecoin holders.

The supply of yield for these stablecoins varies. Some tasks merely lend depositors' sources to earn curiosity, akin to conventional banks. Nonetheless, current developments in blockchain expertise have launched modern yield-generation strategies.

Why Do Yield-Bearing Stablecoins Matter?

Whereas a comparatively new asset class, yield-bearing stablecoins will turn out to be a vital part of DeFi. Right here's why they’re necessary:

Stablecoin Fiat Deposits as a Main Supply of Yield

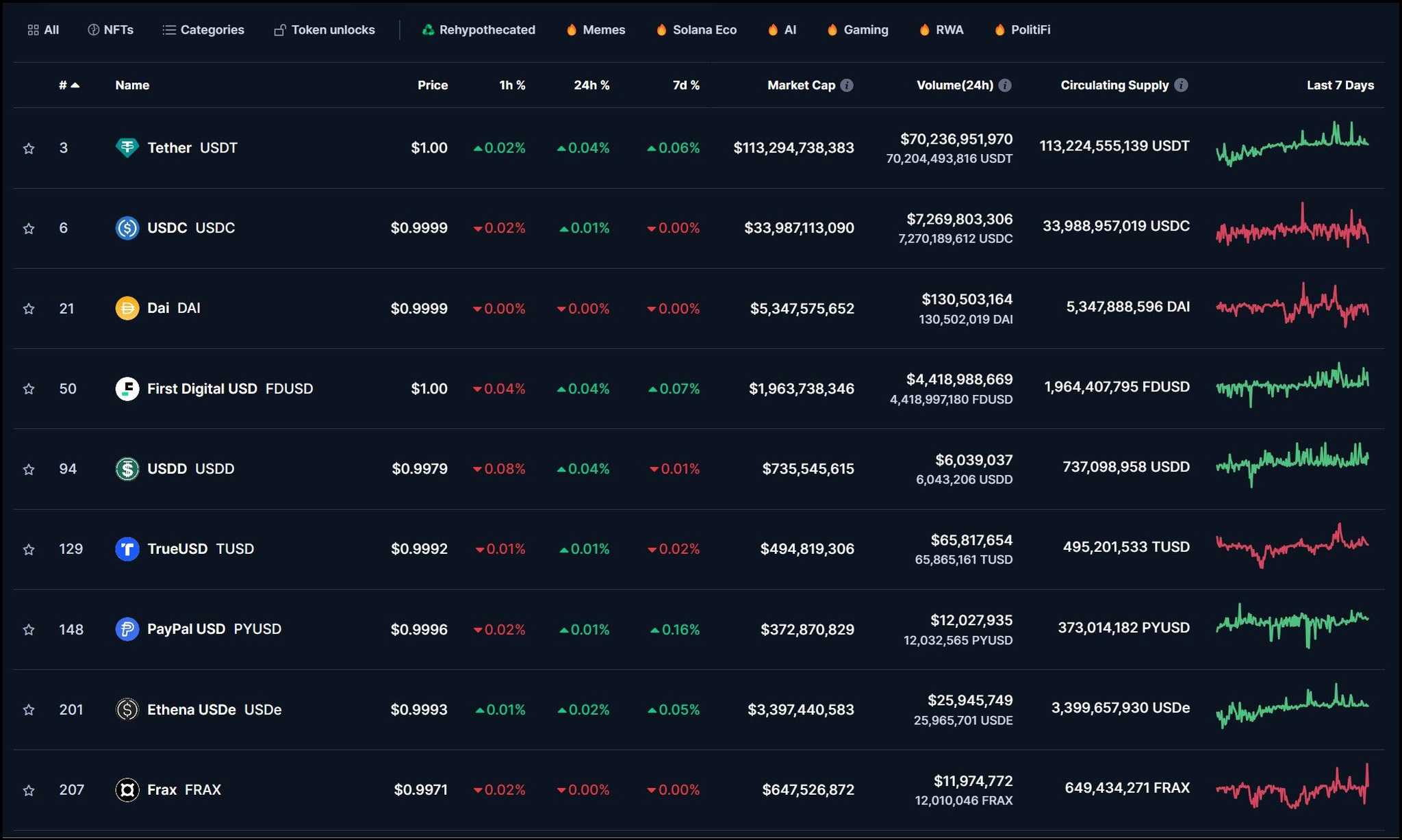

Stablecoins like USDC and USDT are pegged to fiat currencies and backed by reserves held in banks. These reserves, amounting to billions of {dollars}, generate vital yield. As of 2024, Circle, the issuer of USDC, holds $33.9 billion in reserves, whereas Tether, the issuer of USDT, holds $70 billion. These funds are saved in banks and invested in low-risk belongings like treasury payments, which generate curiosity. Nonetheless, this yield has not been handed on to USDC and USDT holders. As a substitute, it’s retained by the issuing firms.

The potential for yield technology from these reserves is immense. For instance, even a modest annual yield of two% on $72.5 billion might generate $1.45 billion in curiosity, a considerable quantity that, if distributed to stablecoin holders, might present significant returns and enhance the attractiveness of holding these belongings.

Inflation and Erosion of Worth

Between 2022 and 2024, inflation reached report highs, with the U.S. Federal Reserve elevating rates of interest considerably to fight it. The Shopper Worth Index (CPI) within the U.S. noticed annual will increase of round 7% in 2022, with charges nonetheless elevated in subsequent years . Whereas increased rates of interest on authorities debt helped curb the loss within the worth of fiat foreign money as a result of inflation, stablecoin holders didn’t profit from these increased yields. The worth of stablecoin holdings eroded sooner than the identical fiat foreign money, which might accrue curiosity in a conventional financial savings account or authorities bonds.

Yield-bearing stablecoins deal with this situation by offering curiosity that helps offset inflation, preserving the buying energy of the belongings over time, making them a extra enticing possibility for storing worth in a high-inflation surroundings.

Custody and Yield Technology

Customers sometimes have to deposit their belongings into yield farming protocols like Aave, Maker, or Compound to earn yield on their stablecoin holdings, which requires giving up custody of their belongings and sometimes entails lock-in intervals. For example, some protocols impose a minimal lock-in interval to optimize yield technology, limiting the pliability of asset holders.

Yield-bearing stablecoins get rid of this inconvenience by permitting customers to earn curiosity on idle funds of their wallets. Customers can keep full custody of their belongings whereas benefiting from yield technology. This perform enhances safety and adaptability, making it simpler for customers to handle their belongings with out sacrificing potential earnings.

Borderless Entry to Danger-Free Returns

Danger-free returns, corresponding to these offered by the U.S. Federal Reserve, are sometimes restricted to U.S. nationals or entities with entry to U.S. monetary markets. There’s a monetary barrier for people outdoors the nation who can’t simply entry these safe yields. Yield-bearing stablecoins break down these jurisdictional limitations, permitting anybody across the globe to learn from the risk-free charges of any foreign money they want.

By tokenizing these yields, stablecoin protocols democratize entry to safe, interest-bearing belongings. They open up new alternatives for people in areas with much less steady monetary programs to earn dependable returns on their holdings, contributing to higher monetary inclusion.

Yield-bearing stablecoins symbolize a big development within the crypto house, addressing key points confronted by conventional stablecoins. By leveraging the substantial reserves of stablecoin issuers, these belongings can generate significant returns for holders, offsetting inflation and preserving worth. In addition they supply the advantages of sustaining custody and offering borderless entry to risk-free returns. Because the stablecoin market continues to evolve, yield-bearing variants are prone to play an more and more necessary position in people' and establishments' monetary methods.

How Do These Stablecoins Generate Yield?

Yield-bearing stablecoins generate yield by way of varied mechanisms, broadly categorized into three predominant sources: DeFi native yield, crypto derivatives, and conventional finance (TradFi) and real-world belongings (RWAs). Every class leverages totally different monetary methods and belongings to generate returns for stablecoin holders.

Right here's an in depth clarification of every class and examples as an instance how they work.

DeFi Native Yield

DeFi native yield is generated from decentralized finance (DeFi) platforms that leverage the provision and demand of crypto belongings like DAI, Ethereum, and Bitcoin. These platforms use lending and borrowing protocols to generate curiosity, which is distributed to stablecoin holders.

- MakerDAO sDAI: MakerDAO's DAI Financial savings Charge (DSR) permits customers to earn curiosity on their DAI holdings by depositing them into the DSR contract. sDAI is a yield-bearing stablecoin representing a deposit in DSR contract.

- Ethena Finance: Ethena Finance makes use of a delta-neutral hedging technique to generate yields on Ethereum and stabilizes the worth of its stablecoin.

Crypto Derivatives

Crypto derivatives contain the usage of liquid staking tokens and restaking tokens to generate yield. These derivatives are monetary devices whose worth is derived from the efficiency of underlying crypto belongings, corresponding to staked Ethereum (ETH).

- Prisma Finance mkUSD: Prisma Finance's mkUSD is backed by liquid staking derivatives. These derivatives earn staking rewards from underlying staked belongings like ETH, that are then handed on to mkUSD holders.

- Davos Protocol DUSD: Davos Protocol's DUSD generates yield by way of restaking derivatives, which contain staking belongings a number of instances to maximise yield.

TradFi and RWAs

TradFi and RWAs contain tokenized variations of conventional monetary belongings to generate yield. These belongings embody treasury payments, company bonds, actual property, and different monetary devices historically utilized in typical finance.

- Ondo Finance and Flux Finance: Ondo Finance and Flux Finance generate yield by investing in conventional monetary devices and RWAs. These investments are tokenized and managed on the blockchain, offering steady returns to stablecoin holders.

- Mountain Protocol: Mountain Protocol invests in a mixture of conventional monetary belongings and RWAs to generate yield, providing a steady return to its token holders.

- stEUR: stEUR makes use of a tokenized BAKKT EU cash market fund to generate yield, appearing as a Euro-denominated stablecoin much like MakerDAO's DAI.

- Angle.cash: Angle.cash generates yield by investing in a diversified portfolio of conventional monetary belongings, offering steady returns to its stablecoin holders.

- sUSDT and eUSDC: Tether's sUSDT and Circle's eUSDC generate yield by way of investments in fiat-backed belongings and commodities, corresponding to treasury payments and company bonds.

- Blackrock's BUILD Funds: Blackrock's BUILD funds put money into a variety of conventional monetary belongings, producing steady returns which can be tokenized and distributed to stablecoin holders.

- Paxos Carry Greenback: Paxos Carry Greenback makes use of investments in conventional monetary devices to generate yield, offering its holders with a steady and safe return.

Conclusion

Yield-bearing stablecoins leverage numerous monetary methods and belongings to generate returns. Every class gives distinctive benefits and alternatives for stablecoin holders, permitting them to generate yield whereas sustaining publicity to steady belongings. Every stablecoin class reacts to totally different market situations, producing totally different yields and getting subjected to diverse threat profiles. We are going to dedicate a separate article to grasp the implications of various yield methods and how one can leverage them to optimize your holdings.

Dangers of Yield-Bearing Stablecoins

Yield-bearing stablecoins supply the engaging prospect of incomes yield whereas sustaining the soundness of conventional stablecoins. Nonetheless, they arrive with their very own set of dangers, much like these confronted by conventional stablecoins, in addition to distinctive dangers associated to their yield-generating mechanisms. Listed below are the first dangers related to yield-bearing stablecoins:

Inconsistent Yield

The yield generated by these stablecoins might not be constant. A number of elements can have an effect on the yield, together with:

- Market Volatility: Excessive market situations can stress the yield-generating mechanisms, resulting in decreased returns.

- DeFi Protocol Dangers: If the yield comes from DeFi platforms, any points with these platforms, corresponding to sensible contract bugs, hacks, or adjustments in protocol parameters, can influence the yield.

Devaluation of Collateral

The collateral securing the yield and the stablecoin peg might severely devalue, particularly if it consists of unstable crypto belongings. This devaluation can threaten each yield technology and stablecoin stability.

- Crypto Asset Volatility: If the collateral contains unstable belongings like Ethereum or Bitcoin, sharp declines of their worth can cut back the yield and destabilize the stablecoin peg.

- Liquidation Dangers: In situations the place the collateral worth drops considerably, automated liquidation mechanisms in DeFi protocols may set off, resulting in potential losses for stablecoin holders.

Regulatory Dangers

Yield-bearing stablecoins might entice regulatory scrutiny for a number of causes:

- Competitors with Conventional Banks: If these stablecoins supply higher returns with the identical threat belongings, they may draw depositors away from conventional banks. This might disrupt the normal monetary system, prompting regulators to intervene.

- Compliance and Authorized Points: As with all monetary merchandise, yield-bearing stablecoins should adjust to present and future rules. Any regulatory adjustments or authorized challenges might influence their operation and viability.

Sensible Contract and Safety Dangers

Sensible contract dangers are inherent in any blockchain-based monetary product:

- Bugs and Vulnerabilities: Yield-bearing stablecoins that depend on sensible contracts are inclined to bugs and vulnerabilities. Exploits can result in lack of funds or yield.

- Safety Breaches: Hacks and safety breaches within the platforms offering yield can compromise the belongings backing the stablecoins, affecting each yield and stability.

Liquidity Dangers

Yield-bearing stablecoins may face liquidity points below sure situations:

- Market Circumstances: In periods of market stress, liquidity for these stablecoins may dry up, making it tough for holders to promote or redeem their belongings with out vital slippage.

- Redemption Dangers: If a lot of customers attempt to redeem their stablecoins concurrently, the underlying belongings won’t be liquid sufficient to satisfy the demand promptly, resulting in delays or losses.

Yield Sustainability

The sustainability of the yield offered by these stablecoins is one other essential threat:

- Yield Supply Reliability: The reliability of the sources producing yield can fluctuate. If the sources of yield dry up or turn out to be much less worthwhile, the stablecoin might fail to supply the anticipated returns.

- Financial Circumstances: Broader financial situations can have an effect on yield sustainability. For instance, decrease rates of interest in conventional finance can cut back the returns from real-world belongings backing the stablecoin.

Conclusion

Whereas yield-bearing stablecoins supply vital advantages, they arrive with varied dangers that potential traders should take into account rigorously. These dangers embody inconsistent yield, collateral devaluation, regulatory challenges, sensible contract vulnerabilities, liquidity points, and considerations about yield sustainability. Understanding and mitigating these dangers is essential for investing in or utilizing yield-bearing stablecoins successfully. Because the market evolves, ongoing due diligence and consciousness of the altering regulatory panorama will probably be important for managing these dangers.

Closing Ideas

The consensus amongst widespread folks is that cryptocurrencies are high-risk investments and contain a lot volatility. Yield-bearing stablecoins problem this notion by introducing risk-free returns for steady belongings, providing a compelling various to conventional monetary devices. These modern digital belongings bridge the hole between the high-risk, high-reward world of cryptocurrencies and the soundness and predictability that conventional traders search.

Yield-bearing stablecoins add one other dimension to digital asset funding, encouraging long-term participation within the Web3 area. They supply a singular alternative to earn yield whereas sustaining publicity to steady belongings, making them a lovely possibility for each seasoned traders and people new to the crypto house. By providing a safe and constant yield, these stablecoins promote monetary inclusion and democratize entry to funding alternatives beforehand restricted to conventional finance.

We are going to cowl a complete vary of yield-bearing stablecoin tasks in a separate article. We are going to analyze methods to make yields and discover how these stablecoins may be built-in right into a broader funding technique. Keep tuned as we delve deeper into the mechanisms, advantages, and potential dangers of assorted yield-bearing stablecoins, offering you with the insights wanted to make knowledgeable choices on this evolving panorama.

Often Requested Questions

What are Yield-Bearing Stableocoins, and How Do They Work?

Yield-bearing stablecoins are digital belongings that keep a steady worth whereas producing yield or curiosity for holders. They obtain this by leveraging varied monetary methods, corresponding to decentralized lending and borrowing on DeFi platforms, staking and restaking crypto belongings, and investing in tokenized conventional monetary devices like treasury payments and company bonds. The yield generated is distributed to stablecoin holders, offering a strategy to earn yield whereas sustaining the soundness and liquidity of conventional stablecoins.

What are the Potential Dangers Related With Yield-Bearing Stablecoins?

Yield-bearing stablecoins include a number of dangers, together with inconsistent yield as a result of market volatility, devaluation of the collateral backing the stablecoin, and regulatory challenges. Moreover, there are dangers associated to the underlying DeFi protocols, corresponding to sensible contract vulnerabilities and safety breaches. Liquidity dangers may come up, particularly during times of market stress. Understanding these dangers is essential for traders.

How Can Yield-Bearing Stablecoins Profit My Funding Technique?

Yield-bearing stablecoins supply a number of benefits for an funding technique. They supply a steady retailer of worth with the additional benefit of incomes yield, serving to to offset inflation and protect buying energy. These stablecoins additionally improve portfolio diversification by combining the soundness of conventional stablecoins with the yield technology of extra unstable crypto belongings. Moreover, they promote long-term participation within the crypto market and Web3 area, making them a worthwhile software for each conservative and growth-oriented traders.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.