Gemini is exploring a possible preliminary public providing (IPO) as quickly as this 12 months, Bloomberg Information reported, citing folks conversant in the matter.

Sources instructed the newswire that the change is discussing a public itemizing with potential advisers, however no closing determination has been made. Gemini didn’t instantly reply to requests for remark.

Bloomberg ETF analyst James Seyffart stated extra crypto companies are more likely to pursue IPOs within the subsequent couple of years on account of President Donald Trump’s administration, which has signaled a pro-crypto agenda.

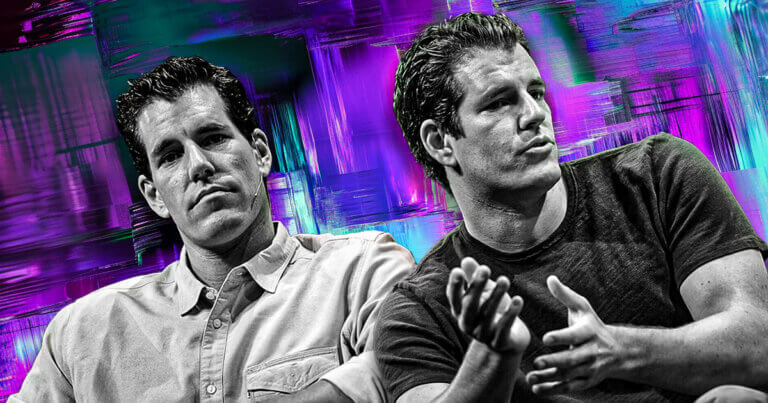

In accordance with Federal Election Fee filings, the Winklevoss twins, Cameron and Tyler, not too long ago donated Bitcoin (BTC) in extra of the utmost allowed quantity to Trump’s marketing campaign, with the excess refunded.

In accordance with the report, different crypto corporations are additionally contemplating IPOs. Bullish International, a digital asset change backed by billionaire investor Peter Thiel, is exploring a public itemizing as quickly as this 12 months.

Regulatory shifts

The IPO rumors come amid the change’s efforts to reposition its enterprise after the conclusion of multiple-year-long regulatory and authorized challenges.

On Jan. 7, the change co-founders agreed to pay a $5 million tremendous to settle a Commodity Futures Buying and selling Fee (CFTC) lawsuit. The lawsuit accused the crypto change of deceptive regulators in its bid to launch the primary US-regulated Bitcoin futures contract.

Moreover, Gemini not too long ago introduced it is going to exit the Canadian market, becoming a member of different crypto companies like Bybit, Binance, and Paxos which have cited regulatory challenges within the nation.

On the identical time, the change secured a license in Singapore to supply cross-border cash transfers and digital fee token companies, aligning with the nation’s pro-crypto stance.

Different companies, together with OKX, Upbit, Ripple, and Coinbase, have expanded in Singapore amid regulatory tightening in several areas.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.