Blockworks.co offers the On the Margin Newsletter today. You will receive the news in your email tomorrow. Subscribe to the On the Margin email newsletter.

Ben Strack Casey Wagner and Felix Jauvin bring you the On the Margin Newsletter. What’s in the latest edition?

- NVIDIA released its Q2 earnings. Felix breaks down some of the key takeaways.

- OpenSea could be in a difficult situation if it receives a Wells notification from the SEC.

- How specific are Harris and Trump going to be before the elections about crypto policy? An industry exec gives his opinion.

NVIDIA – Priced too perfectly?

Let’s be clear: NVIDIA is a company that achieves incredible things.

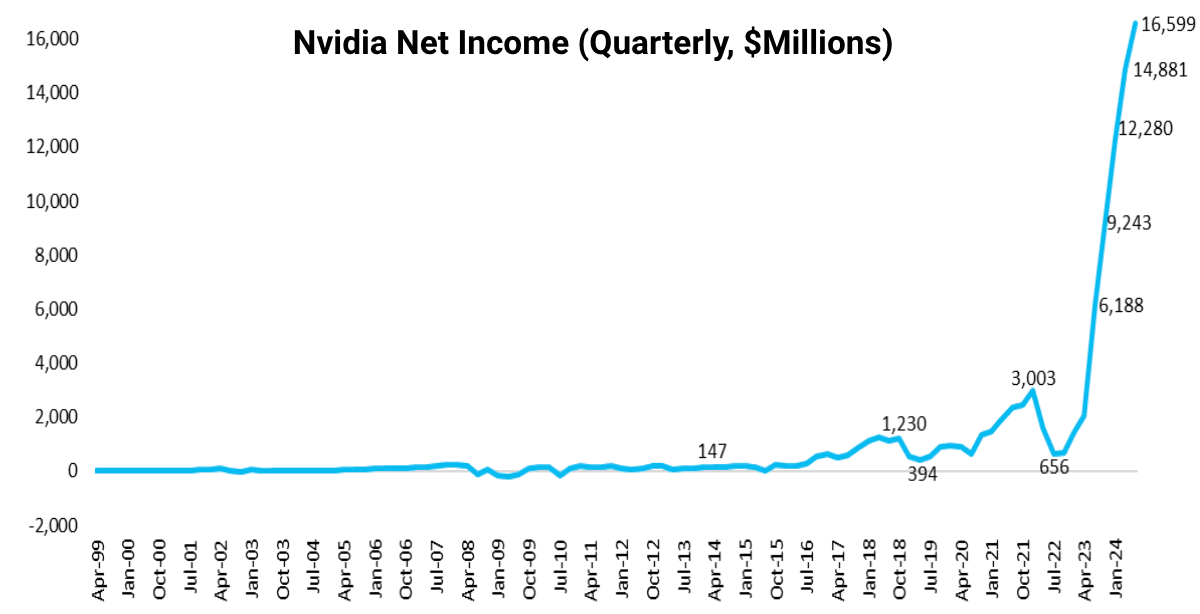

NVIDIA, at the forefront the AI revolution is emerging has seen its quarterly earnings grow at an astounding rate.

We had high expectations for yesterday’s earnings report. The price was perfect.

With that priced-for-perfection story, the outcomes quickly became one of what makes trading markets so difficult — the game between what is expected versus what the actual outcome is. This is what drives the markets.

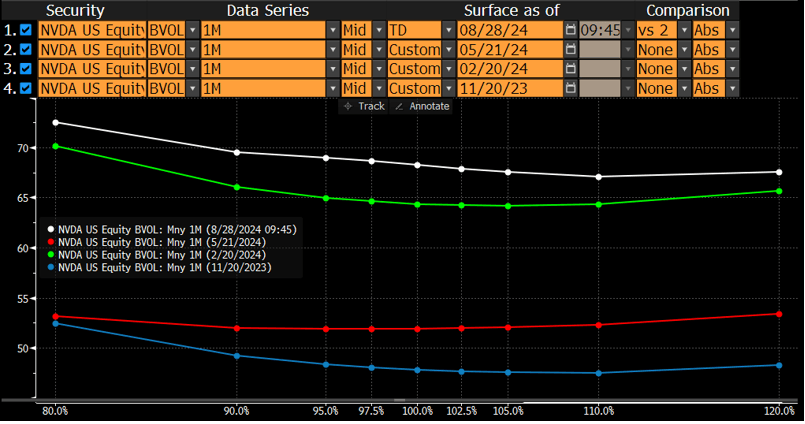

@Alpha_Ex_LLC did a great job of analyzing the implied volatility in the expected move from NVIDIA earnings.

The chart below is for those who are not familiar with options pricing and implied moves. It shows the implied volatility of the stock just before each earnings announcement. This most recent earnings report had the highest implied volatility (IV) in recent memory.

This meant that the options market implied an increase of 11% in the stock price after the earnings announcement. The stock price is currently down 3.4% as of the time this article was written.

You would have lost money even if your prediction was right (a degen who yoloed buying a buy or sell call), because of the IV crush. The reason is that the actual movement was less than implied premium baked into the price.

As mentioned above, the stock was perfectly priced.

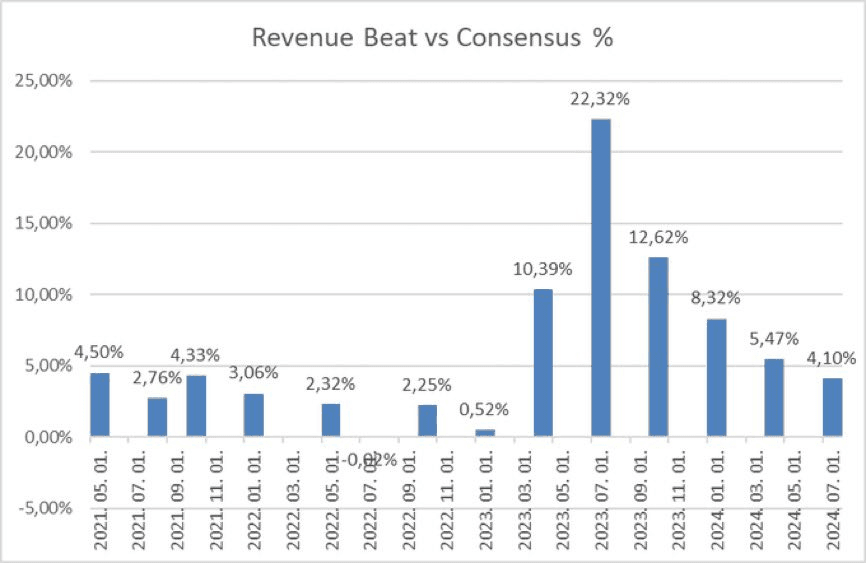

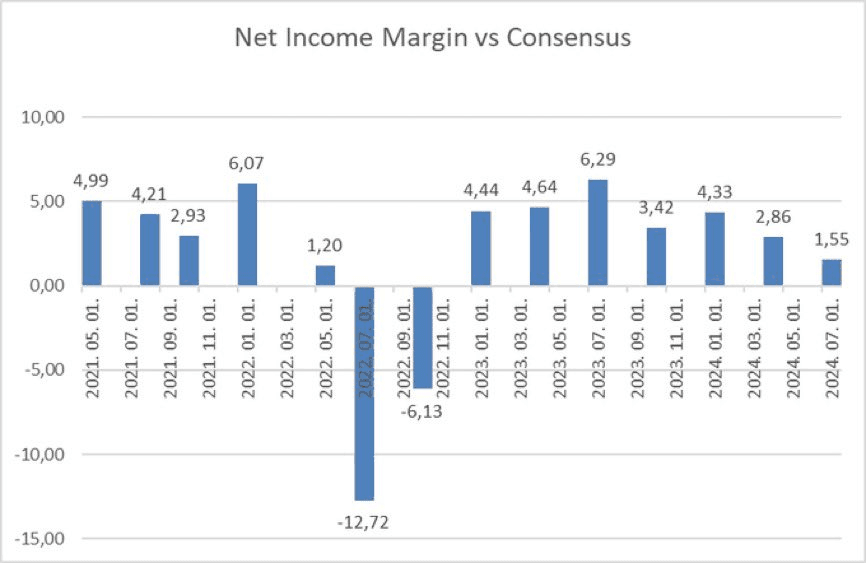

Andy Constan, a regular guest on On the Margin, has provided some excellent charts. They show that even though earnings have been beating expectations for years now, the delta is actually going down. It shows how perfectly the bull market in equity is crafted.

It’s anybody’s guess what will happen next. We do know that as we continue to look at future quarterly results, we’ll see a slower growth rate. This will lead to a reduction in the number of positive surprises.

— Felix Jauvin

58.7 millions dollars

EURC’s current market capitalization, Circle’s Euro-backed Stablecoin. EURC is nothing in comparison to USDC, its counterpart backed by dollars. However, EURC has seen a rise as MiCAR rules have come into force this summer.

EURC has seen its issuance rate increase by nearly 40% since it was launched on Base. Its market capital is also up about 70% in comparison to a month earlier.

Another (pending) lawsuit, another day

Yesterday, OpenSea revealed that it had received a Wells Notice from the SEC. You may remember the Wells notices from our previous articles. It’s an alert from regulators about a potential lawsuit or enforcement action.

This is not the first time the SEC has taken action against NFTs.

In September 2023, the regulators will charge and settle with this project. “Stoner Cats 2.” According to the settlement, NFT issuers agreed to stop and desist offering NFTs as well as pay a $1,000,000 fine. The SEC also said that SC2 agreed to destroy any NFTs it had in its possession, and post a notice about the order on their website and social media.

OpenSea would be different because the SEC won’t be targeting issuers. The SEC would go after the platform.

Does this sound familiar to you? This should.

In 2020, the SEC filed a lawsuit against Ripple for its XRP Token. A court ruled (and after millions of dollars) that the securities regulators were partially right in their decision. They ruled that institutional XRP sales are unregistered securities. Ripple won in part too when a judge ruled that retail sales of XRP on secondary markets were not securities. Exchanges are not securities.

The SEC has changed its strategy since the Ripple lawsuit. Recently, it has been targeting exchanges. Coinbase, Binance, Kraken — the list goes on. The SEC has filed suits against each exchange, claiming that it is acting as an unregistered broker of securities for listing tokens regulators consider securities.

I asked the same question earlier, and I will ask it again. Will there be more lawsuits brought against token or NFT issuing companies?

Legal experts, if you have answers/predictions/comments, I’d love to hear them!

– Casey Wagner

Are we going to hear more about crypto from presidential candidates?

Many expect that the impact of the election on crypto will be binary. Trump and the Republicans would be good for crypto, while Harris and the Dems are more likely to be bad (or at the least not as beneficial) for the industry.

The Trump-would-be-better-for-crypto narrative has “more substance to support it” Ashley Ebersole, general counsel at 0x, stated that this is where we are.

The former president made promises in July at Bitcoin 2024, in Nashville. He also said that he would help American bitcoin miners.

It was said: “Harris is new enough that her policy positions are still being built out in a lot of areas, not just in crypto,” Ebersole tells Blockworks.

Harris is a product of the Biden administration, which has demonstrated a willingness to work with women. “relative hostility” The 0x executive, who is also a former SEC senior lawyer, argued that crypto was a good thing. President Biden has vetoed legislation that was intended to invalidate SEC Staff Accounting Bulletin (SAB), 121.

It’s all her decision.

Bloomberg News did last week ask an adviser from Kamala Harris’s camp about crypto. “She’s going to support policies that ensure that emerging technologies and that sort of industry can continue to grow.”

The burning question is: What specific policies will the candidates present on crypto before Nov. 5th?

Trump may not be compelled to provide more specific crypto policy details.

“If Vice President Harris were to come out and suddenly make a bunch of blustery statements about crypto and maybe even go a step further and say, ‘On day one I’m going to do X, Y and Z,’ then I think that would require a [fuller] response from the Trump side to at least keep things in parity.”

The first presidential discussion between Trump and Harris will take place on Sept. 10. Watchers of the crypto industry will be looking for any questions about this space. If not explicitly addressed, comments on innovation or regulatory agencies could be helpful.

At the end, “Talk is cheap and you can say a lot of things,” Ebersole said. “Actually taking action is what will be the real catalyst here for a change in policy.”

Those actions — from either candidate, if elected — could take the form of actively working with Congress to pass crypto legislation, the 0x executive noted. Or, it could be more of a “silent” The approach involves a simple stacking of agencies with leaders who are crypto-advanced (Trump has said that he will fire Gensler).

It seems that patience is the key to success, as a lot can occur in just two months.

Blockworks.co will be releasing the full version of Ebersole’s interview tomorrow.

— Ben Strack

Bulletin Board

- OpenSea is responsible for facilitating about 58% in the total NFT trade volume of $62,75 billion since August 2020. For more information on NFT activity, read the story by Blockworks editor David Canellis.

- BTC and ETH have each seen a nice bump in the past 24 hours — rising 2.4% and 1.7%, respectively, as of 1:30 pm ET. According to YouHodler’s risk manager Georgios Parfenidis, Bitcoin’s current price of $60,500 is lower than the apparent resistance level displayed last week of $65,000. “A strong breakout of this level can indicate a potential uptrend,” He noted.

- Farside Investors shows that US spot-ether ETFs experienced a slight net inflow on Wednesday of about $6 million. This net inflow ended a streak of nine days of net outflows. The “first catalyst” Grayscale’s John Hoffman, Blockworks’s CEO, told Blockworks that education is the key to attracting more money into these funds over the next few months and years.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.