In case you rely the launch of GOAT because the birthdate of the AI agent meta, then this subsector is about three months outdated. Over this quick span, the AI agent market has ballooned to a $20 billion market cap with comparatively few tier-1 CEX listings.

That’s nuts, particularly since AI brokers are nonetheless predicated on promised — quite than present — utility.

It’s maybe unsurprising then that the agent market corrected sharply over the weekend, exhibiting a 43.5% drawdown to $11.3 billion since its Jan. 6 prime.

The highest AI agent tokens haven’t been spared the guillotine. Within the final seven days, the biggest three AI agent tokens by marketcap — VIRTUAL, AI16Z and FARTCOIN, are down 46%, 52%, and 42%, respectively.

AIXBT, the fifth-largest agent token, confirmed the best resilience, with a drawdown of 28%.

It’s a massacre. So what? Count on brokers to proceed dominating 2025.

Crypto’s obsession with AI is plain at this level. It’s using the most popular tech sector of the last decade and nonetheless dominates Twitter sentiment amongst rabid on line casino speculators.

The billion greenback query then is: How excessive can the AI agent market go?

At $11.3 billion, AI agent tokens make up about 0.34% of the full crypto market cap right this moment.

If we assume a 40% development of the full crypto market cap to $5 trillion, and AI cash take a 5% slice of that pie (DeFi dominance peaked at 7.69% in 2022), then you possibly can count on $250 billion as a bull case, says kel.xyz.

Much less bullish estimates by David Nage of Arca fund initiatives a spread of $93 billion to $170 billion.

With this framework in thoughts, the “safe” wager is to carry the ecosystem majors of the AI meta: VIRTUAL, AI16Z and ZEREBRO… proper?

The issue is these inter-narratives rotate sooner than anybody can sustain with. There’s hardly any assure that the “blue chip” agent cash right this moment keep their dominance over months, and even weeks from now.

Within the span of a 12 months, the story of “why AI crypto” went from a beta play on Nvidia and OpenAI to AI memecoins, to AI brokers, to AI agent frameworks, AI funding DAOs and AI agent swarms.

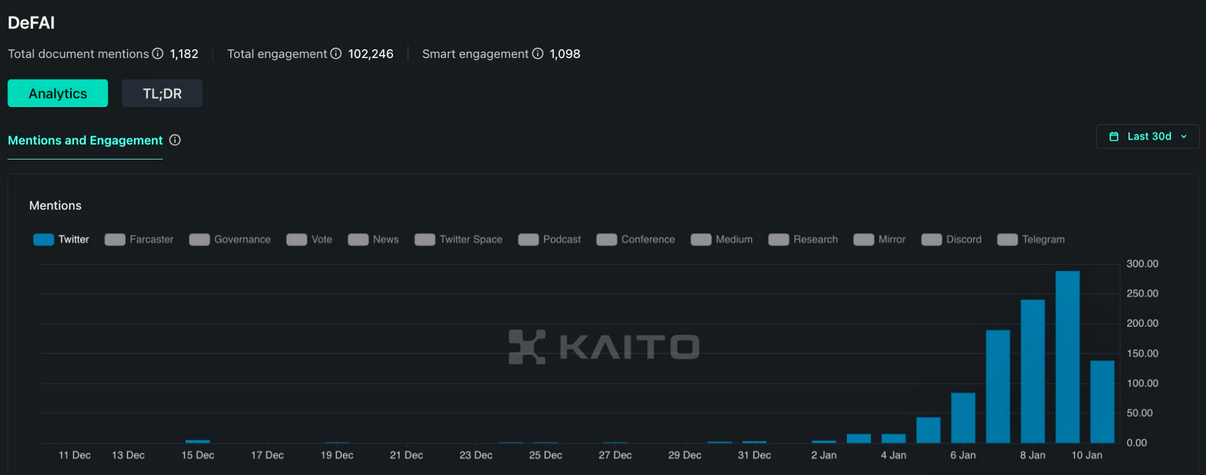

As of final week, the latest chapter on this story is “DeFAI,” i.e., DeFi + AI. I interpret this as an insistence that “AI has real utility, look to its DeFi use cases!”

I’m reminded of a tweet from Each day Ape’s founder Darren Lau. In case you’d made the daring wager that AI would sweep crypto markets and scoop up a bag of main AI tokens like TAO, RNDR and AKASH in early 2024, you’d nonetheless be sitting on a loss 12 months up to now.

Profitable on the AI agent meta then requires one to select the suitable gamers in an ever-changing playbook of questionable utility. Is it any surprise crypto merchants get rekt?

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.