It has always been difficult to determine where business cycles are at since COVID shut down global economies by 2020.

It’s easy to get a sense of the typical business cycle by looking at interest rates or monetary policy.

Many economists are baffled by the recent changes.

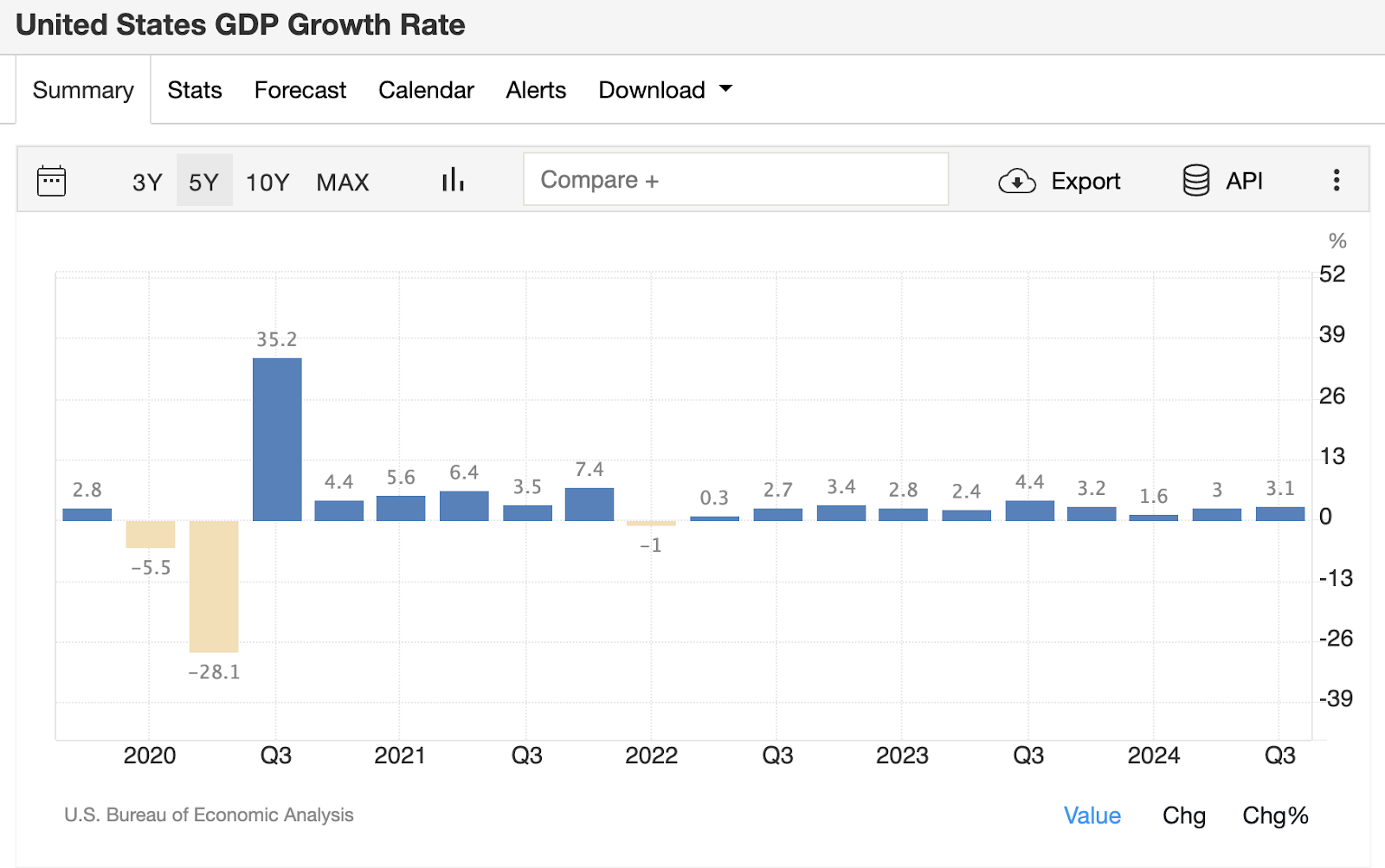

In 2022, for example, we will see a negative GDP print (originally at 2 but later revised to 1):

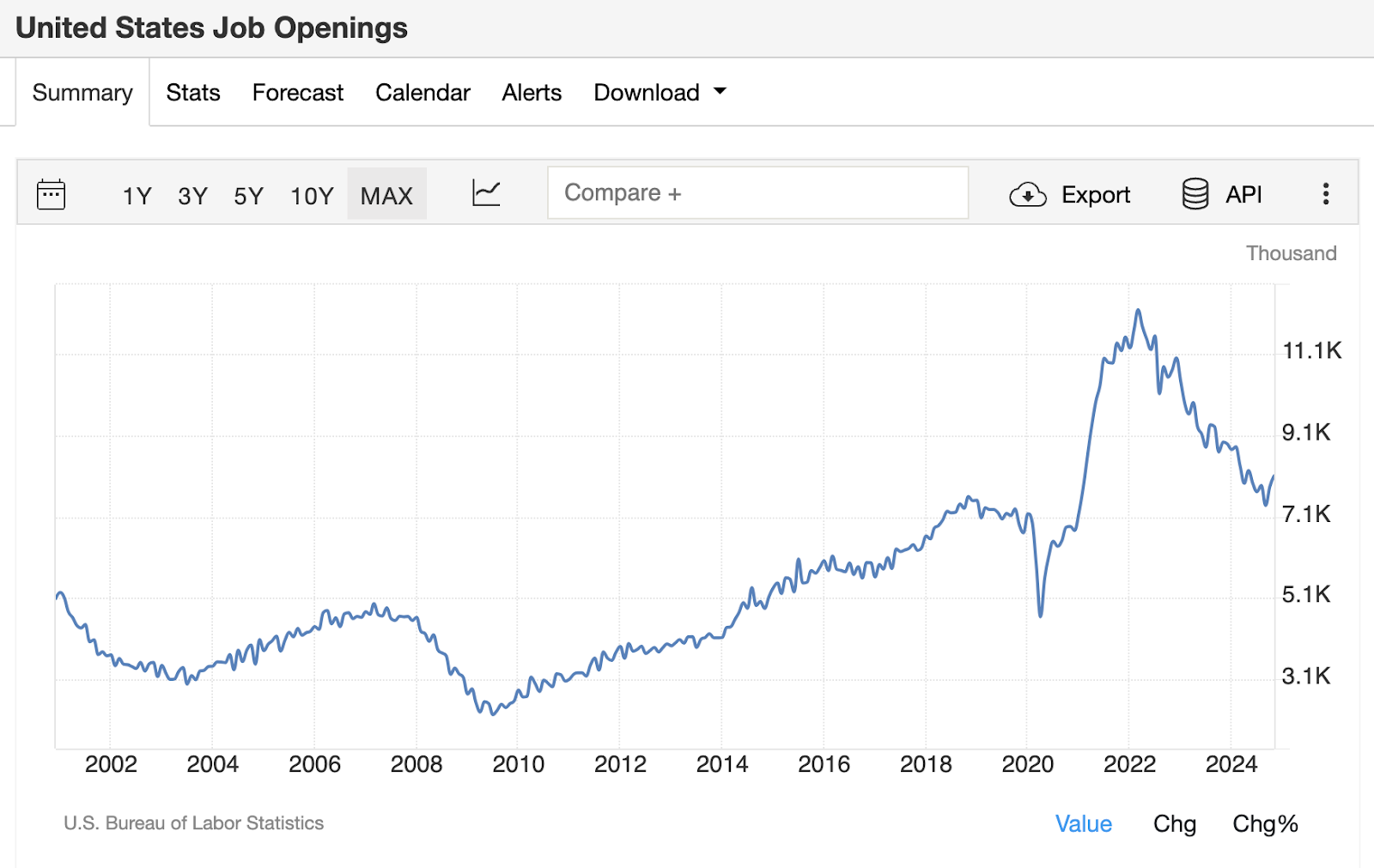

As per the JOLTS statistics, this was also a time when we had one of our hottest jobs markets ever.

A labor market so strong makes it hard to believe that we are in a downturn.

We’ve also seen the Fed raise rates in a big way since 2022. However, the Fed’s rate hikes haven’t pushed the economy into recession. Stocks reached new highs daily, while labor market was resilient and cooled. GDP growth also accelerated.

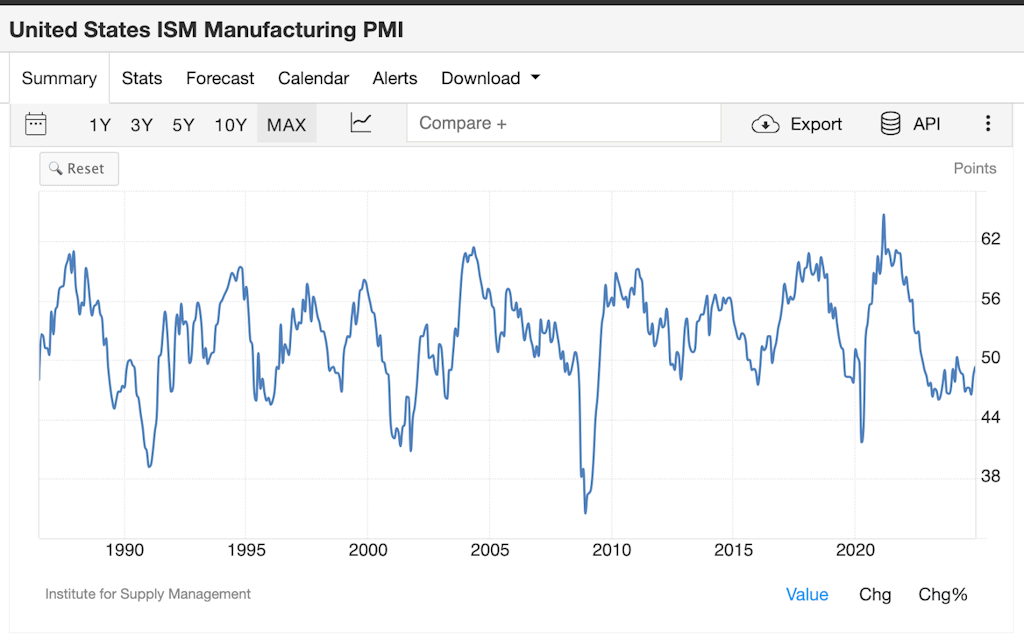

We’ve almost experienced a manufacturing slump if, during the same period, you only look at the goods and manufacturing sector, and leave out the service economy.

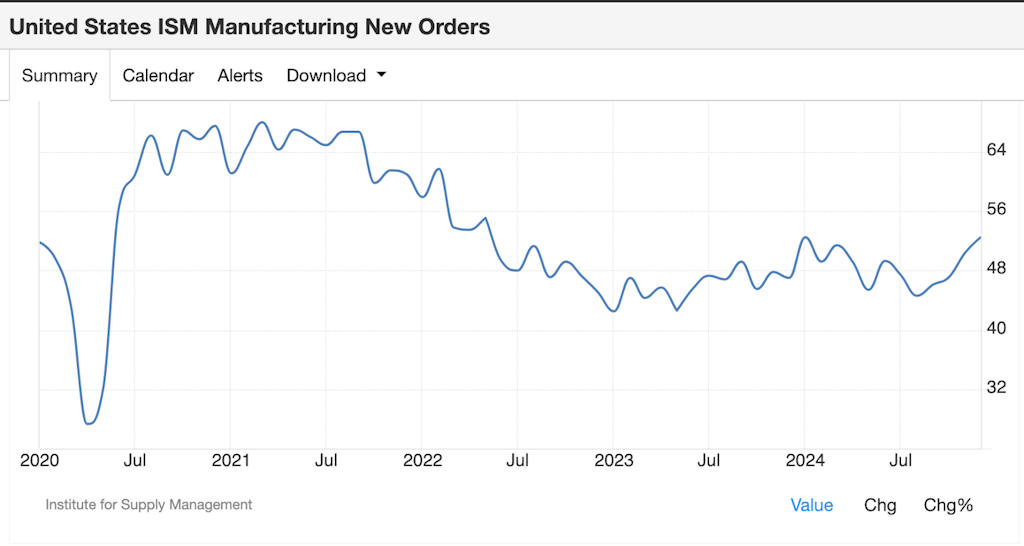

ISM Manufacturing PMIs are in contraction for the past couple of years:

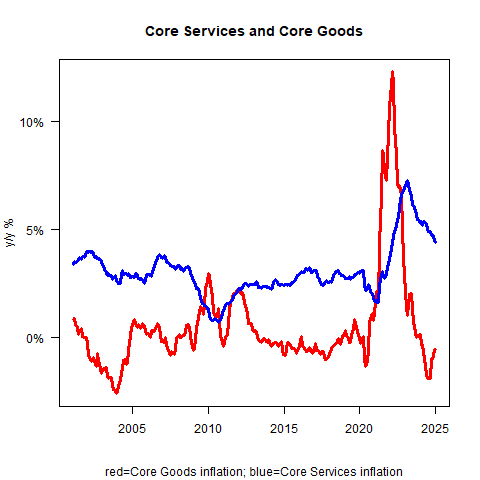

We saw a significant deflation of goods in this period:

Today, the Fed has cut interest rates in order to address concerns over the job market. They are also continuing to try to achieve a “soft landing” of the economy so that we can move to a new cycle with no recession.

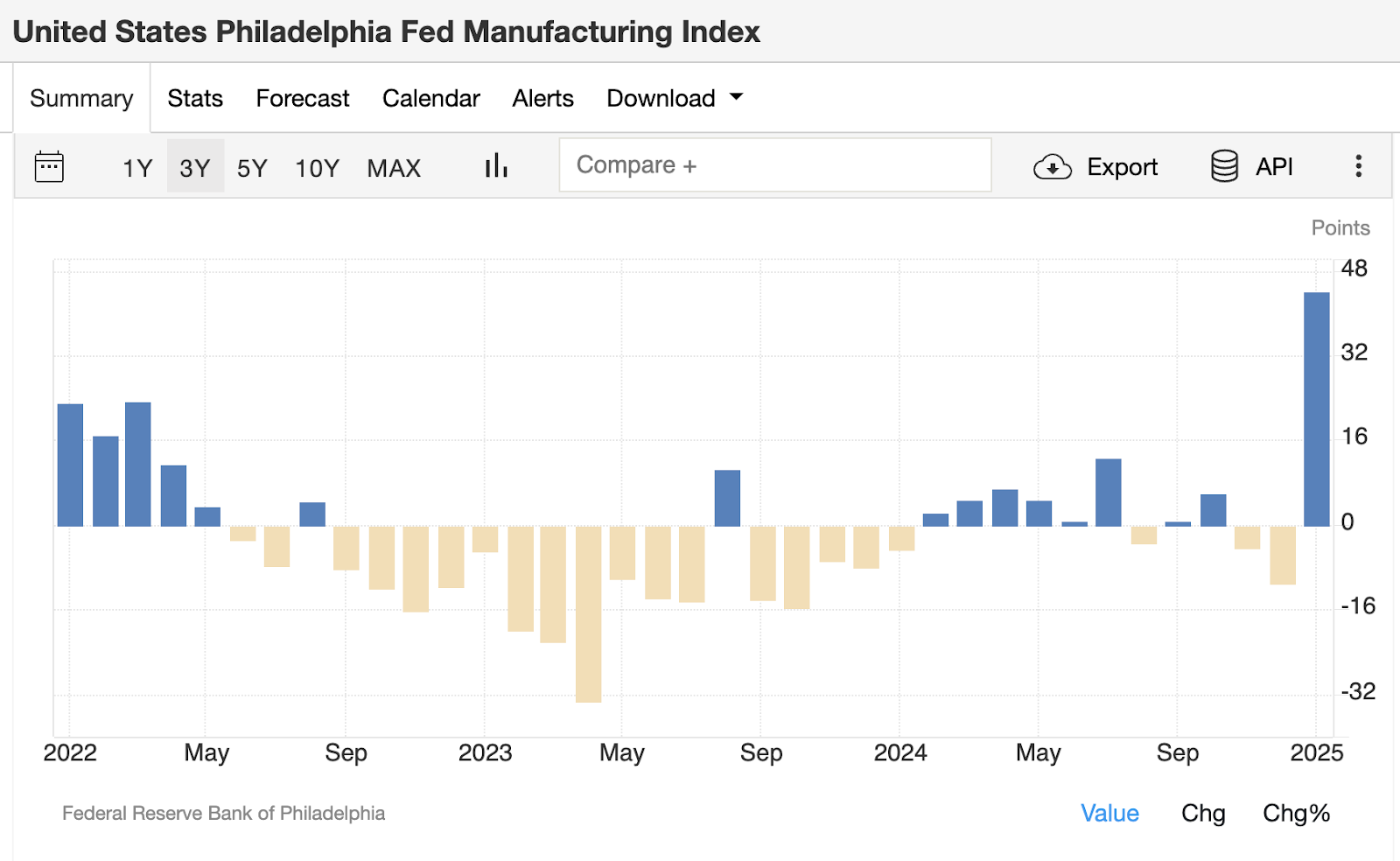

Leading indicators suggest that manufacturing is on the verge of a new boom.

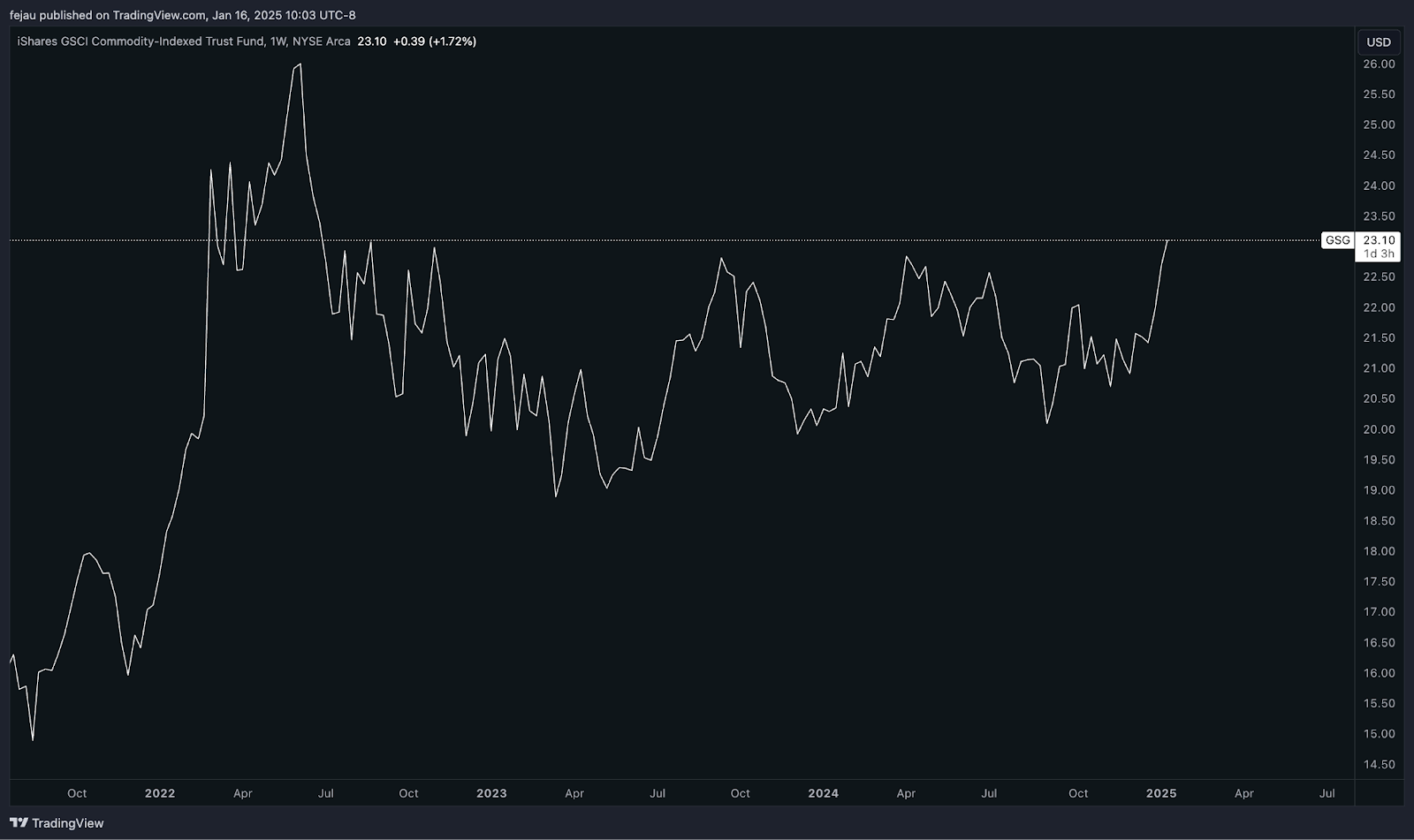

After two years of consolidation we’re beginning to see commodity prices begin to rise, indicating an increase in economic growth.

ISM manufacturing index and ISM orders are both showing signs of growth.

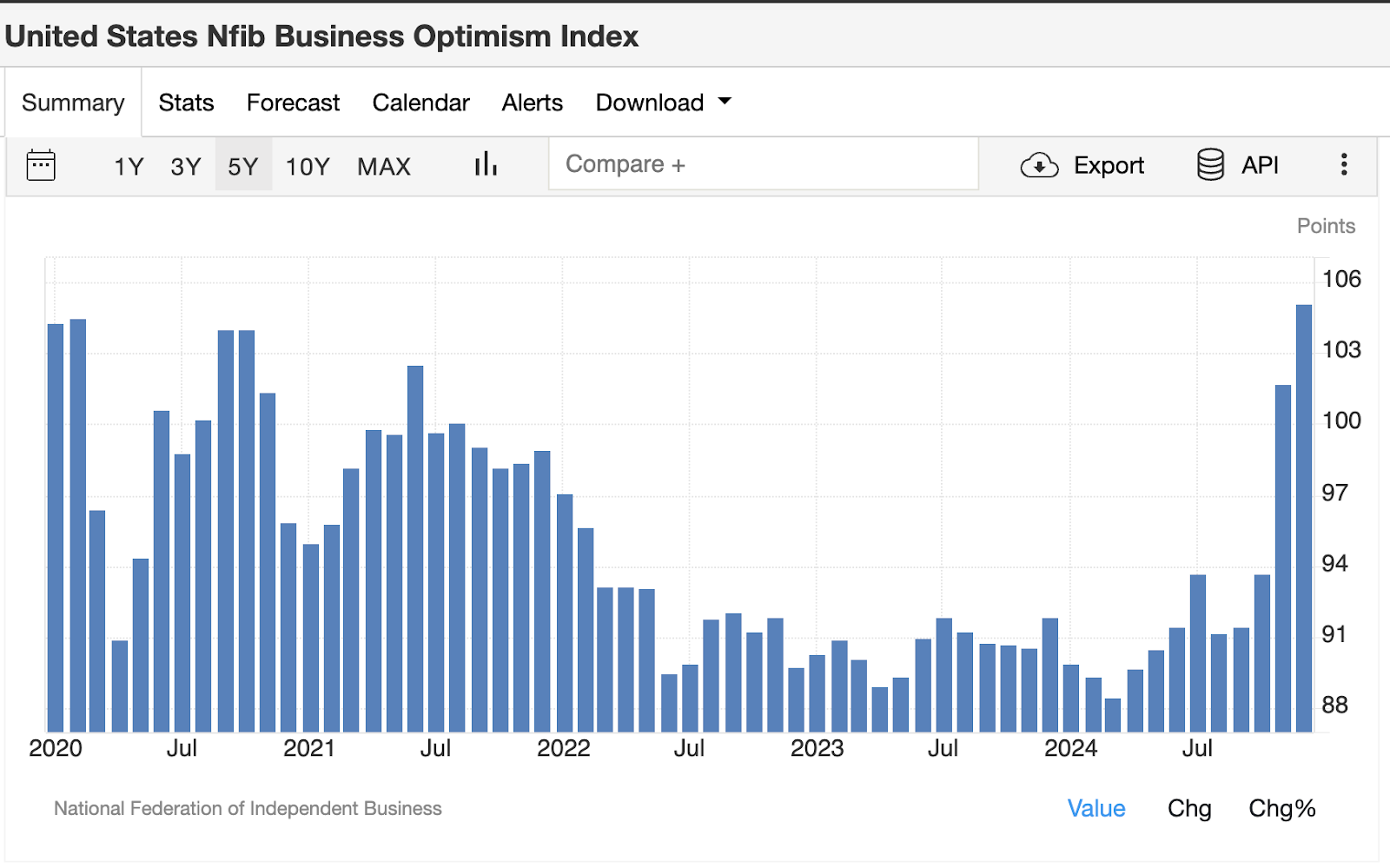

The survey shows that the majority of optimism is coming from business since the last election.

Where does our chart-surfing journey take us?

We’re still in the early stages of the business cycle, I believe. We are now in what appears to be the beginning of a brand new cycle. This is due in part to fiscal stimulus measures and the deficits that were implemented in recent years.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.