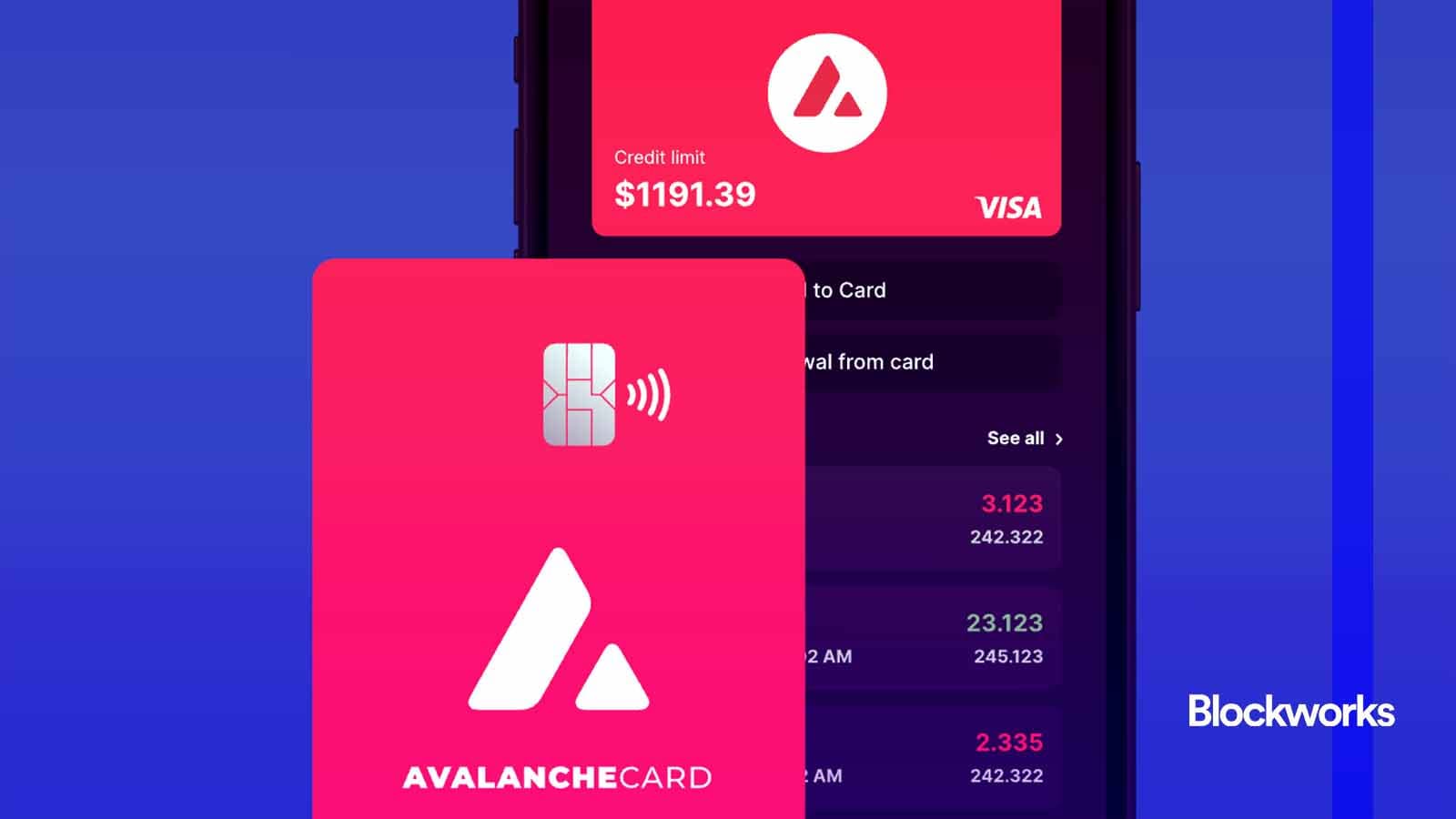

Avalanche Foundation unveiled the Avalanche Card – a card that allows you to spend cryptos at merchants who only accept fiat.

Crypto-currency isn’t just magic online money any more!

Eric Kang from Ava Labs, the company’s head of DeFi, and Business Development, helped me understand exactly how this card functions. Since you aren’t directly paying the merchants, this card can be used wherever Visa is accepted. The crypto will be sold by Avalanche using its C-Chain system to cover transactions already made with fiat.

“It took us a while to get this out,” Kang tells me. Kang sees this as a way that people can easily sell their crypto or use it without needing to go to a DeFi or crypto exchange.

This is a hybrid between a credit card and a prepaid one. You load it up with crypto — USDC, USDT, and AVAX are accepted, with plans to accept bridged bitcoin and potentially other tokens in the future.

The limit will be half the US dollar amount of these cryptocurrencies, in order to cushion for fluctuations in crypto prices. Use the card anywhere Visa is accepted. Charges are recorded like credit cards.

You don’t sell your crypto immediately when you purchase it. Crypto is sold every morning at around 9 am ET based on previous charges.

You’ll have to provide some information to obtain the credit card. This includes your name, email address, and Social Security Number or any other government-issued ID.

You can also set spending alerts, freeze the card and change its PIN. Your credit balance may fluctuate because of the crypto currency.

If you make a lot purchases, it could be difficult to sort out your tax situation with the card. Currently, the sale of crypto, even to pay for a purchase (except stablecoins or USDC), is a taxable event. This could cause a problem for users who want to use their tokens as cash.

“We recommend that you speak with a tax professional regarding circumstances with the Avalanche Card,” The card site is written as follows: “Spending against other crypto assets may involve selling your assets. Selling crypto assets can be a taxable event.”

It’s possible that you don’t have to worry if your accountant is crypto-savvy.

Rain Liquidity facilitates the card. Your card becomes a hot wallet when you add tokens.

It is only available in 35 US state, as the other 15 are not included due to legal reasons. Also available is the card in Latin America, Caribbean and Caribbean.

If you’re a resident or citizen of any US-sanctioned country, however, you won’t be able to get the card — because it’s powered by Visa.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.