Key Takeaways

- According to former Coinbase Policy Head, the Biden administration’s roadmap shows how much the US desires to lead in digital assets.

- This executive order requires “placing urgency” The article focuses on research and development for a possible US CBDC but doesn’t mention stablecoins

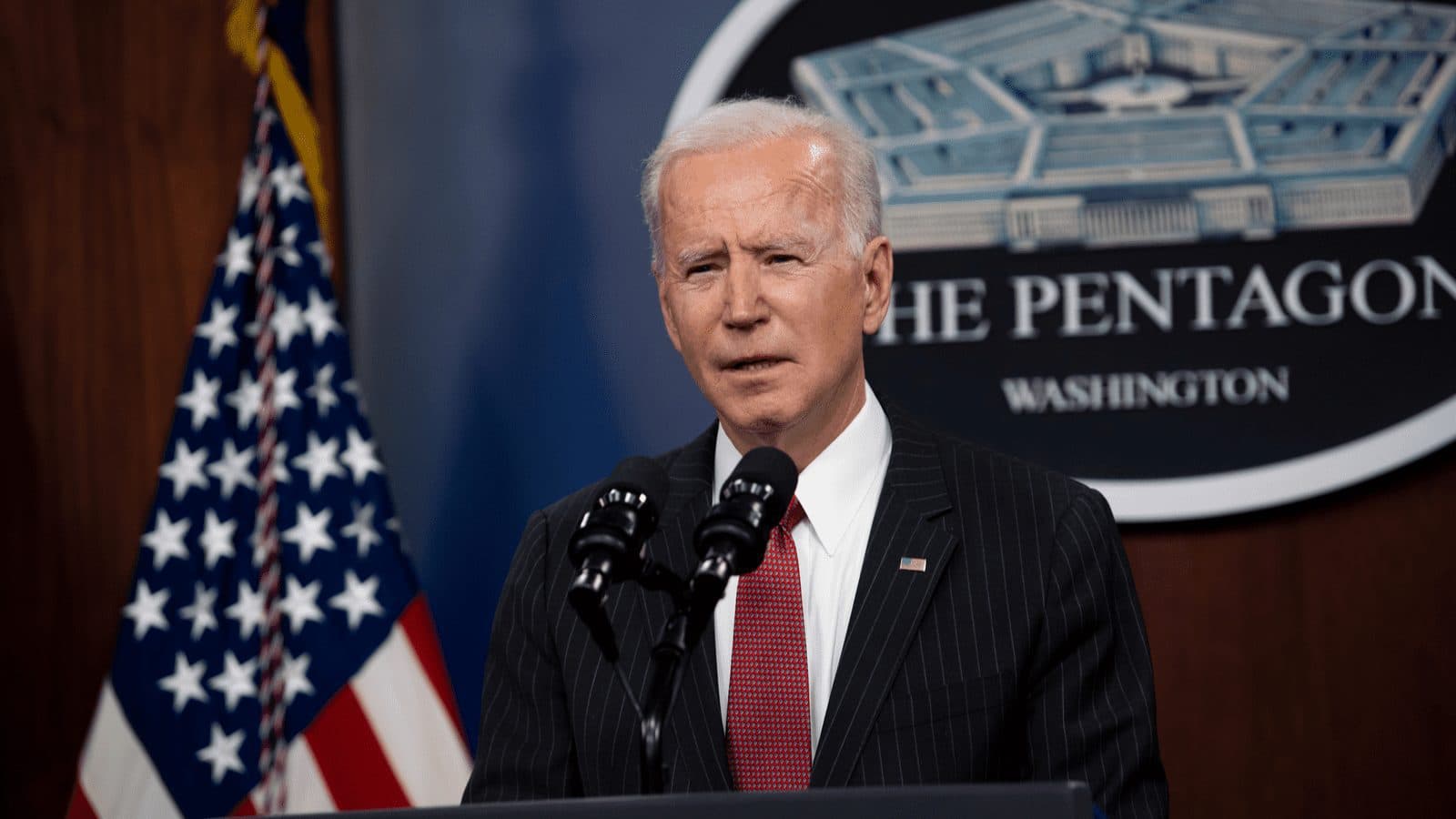

According to observers in the industry, President Biden’s new executive order regarding digital assets is an important step forward, even though it could be years before concrete legislation becomes law.

Biden has signed Wednesday the Executive Order, which details the approach of the federal government to digital assets.

John Collins, former head of policy at Coinbase and partner at FS Vectors, says that while Biden’s executive order was not surprising, it is a positive step by the government to intervene.

Collins likened the Executive Order to that of the Clinton administration “Framework for Global Electronic Commerce” The 1990s saw the release of a report that looked at the future of internet.

“It’s clear that the administration realizes that this is not going away and that they really stress the critical importance of the technology in various applications to the benefit of the financial system going forward,” Collins said. “They want to make sure that the US is ahead of it.”

The price of bitcoin was roughly $41,840 at 4 pm ET — up 8.6% in 24 hours.

“An effort to establish more clarity to the regulatory framework will definitely bring more confidence to investors and welcome more Americans to the crypto ecosystem,” Thomas Hook is Bitstamp’s US Chief Compliance Officer. “While crypto markets may continue to be volatile, today’s news shows that recognition from the Biden administration is encouraging to the market.”

What’s next?

The order details its emphasis on cryptoregulation around consumer protection and financial stability. It also highlights risk mitigation.

Collins stated that there will be roundtables, requests for information and the formation of working groups in the coming months. However, concrete action will not happen until then.

“Throughout there’s a recognition that there needs to be more clarity,” He said. “Maybe it’ll be on securities issues, maybe it’ll be on illicit finance, maybe it’ll be on other things — probably all of them, and I think that’s good.”

Kristin Smith is the executive director at the lobbying group Blockchain Association. She told Blockworks that the research and fact-finding around this topic has begun. “a really healthy first step in a policymaking process.”

In the order, the agency must submit its report within six months. Then lawmakers and the general public will have the opportunity to comment.

“Obviously we’ve got a lot of work ahead of us, and we may not like every single policy proposal that’s put forth six months from now, but at least we can think methodically about this and engage with the government,” Smith remarked:

CBDCs: A Call for Further Study

Smith remarked that the emphasis on digital currency (CBDCs) by central banks was one of the most surprising aspects of the order.

The call for “placing urgency” on the research and development of a US CBDC — though that’s not a guarantee it would ever be rolled out — as well as assessing requisite technology.

The Federal Reserve has declined to offer any policy recommendations in its report on Central Bank Digital Currency, published by the Federal Reserve Bank of January.

Blockchain Association has no political affiliation.

“I think the important thing for us is we want the ability of private organizations and individuals to build technology around the dollar, and that’s what we’ve seen with dollar-backed stablecoins,” Smith remarked:

The executive order is conspicuously devoid of stablecoins. Treasury Secretary Janet Yellen, and Federal Reserve Chairman Jerome Powell both expressed concerns over the safety and security of their coins.

“It’s not surprising that stablecoins are not mentioned, because Yellen is already working on it in detail,” John Belizaire said that Soluna Computing’s founder and CEO, John Belizaire. “Also, a US digital currency is a competitor to stablecoins.”

Stablecoins are under scrutiny by Congress. Blockworks said that US legislators are likely to introduce similar bills later in the month.

Jeremy Allaire is the CEO of Circle and the company behind USD Coin, which has the most stablecoin. “watershed moment.”

“The US government now has a whole-of-government approach for supporting the open, internet-native economic infrastructure ushered in by new Web3 technologies — bringing the country a step closer to ensuring the US dollar remains the currency of the internet and that the US remains the home of principled innovation and competition,” Allaire said.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.