Bitcoin’s recent rally is a result of two bullish narratives: in less than eight week’s time, halving the new coin supply will reduce it by half. Meanwhile, spot funds are already consuming coins faster than mined.

Aside from new-found demand by spot ETFs and halvings in general, the price of bitcoin is expected to grow dramatically as a result.

Crypto, not Bitcoin, has been the biggest winner over the two previous cycles. From one year to the previous half-doubling, Bitcoin’s peak was:

- After 2012’s halving, 50,000% in one year.

- 8500% almost one-and-a-half years after the halving of 2016.

- After 2020, the halving will be 1,000%.

If you are interested in fractals, it is interesting to note that bitcoin peaks vary between six and eight times per cycle. If that repeats, the peak for bitcoin this time around would be less than 170% — with bitcoin already securing most of those gains.)

This is not surprising, given that bitcoin has a market capitalization of more than $1 trillion. Bitcoin’s value is unlikely to have increased 500-fold in just two years as it did in 2012, when the capitalization of bitcoin was less than $200 million.

Bitcoin (BTC), which makes up half of the crypto market, is currently on a bull run. But there are many other coins that also tend to follow suit when bitcoin’s price increases.

The bull run in bitcoin will actually benefit more than Bitcoin itself.

Before the 2016 half-off, crypto excluding Bitcoin was worth $64.9 millions.

The figure was $421 Billion a year later, during the peak bull market of 2017-2018. It had increased by more than 6,000 folds, largely because of the success of XRP. Ethereum. and Bitcoin Cash.

In the previous crypto cycle between 2019-2021, cryptocurrency outside of Bitcoin was valued at $71.6 Billion one year prior to 2020’s halving.

A year and a half later, when bitcoin was near record highs, all other crypto was worth $1.7 trillion — growth of more than 2,000% to bitcoin’s 1,000%.

Bitcoin’s four year cycle isn’t the only one that exists

The sample size of three halves is way too small to make any kind of analysis.

The small sample size suggests that factors other than the halving are likely to have played a part in creating what appears to be Bitcoin’s four-year unstoppable market cycles.

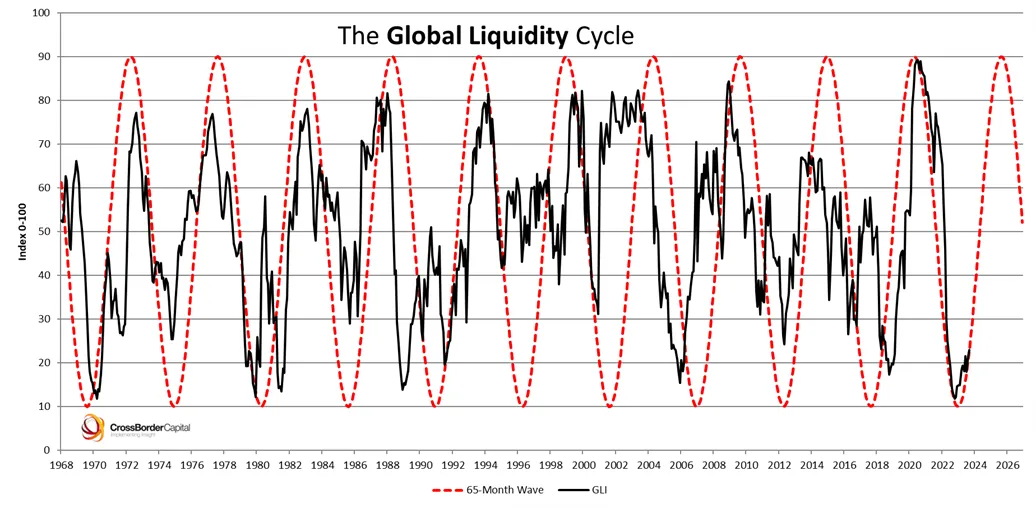

One correlation is the global liquidity cycles, which track how much cash moves around within an economy.

Global liquidity is also based on four-year cycles.

Proving waves of global liquidity caused bitcoin’s explosive growth is still practically impossible — same with halvings.

Demand is likely to be a mix of the two: As global liquidity increases, it will spill over into asset classes that are speculative like cryptocurrency.

Including the one day in which spot ETFs net sold, physical-backed bitcoin funds have on average bought 6,350 BTC (or $362 million) during each trading session.

Bitcoin miners find 147 blocks on average per day. Each block comes with 6.25 BTC (about $356,600), the way that the network distributes new coins.

The miners extract less than 52.5 M$ (920 BTC) from the Blockchain per day. Bitcoin funds buy up almost six times this amount for shareholders. BlackRock Fidelity Ark-21Shares are the leaders.

Bitcoin supply is outpaced by several aspects of the market. Around 35,000 BTC (about $2 billion) flowed in to crypto exchanges on average every day during this year. This indicates potential bitcoin sales of up 37 times what is being mined.

The supply of bitcoin that is available to match demand can be met even with the recent price increase.

Still, with the halving around the corner — expected on April 19 or 20 — it’s easy to see how they’ve captured imaginations across the market. Bitwise Bitfinex CoinShares and other crypto native companies have tried to unpack their mystique.

CoinShares believes that several large operators will struggle to survive if the price of bitcoin does not stay at or above $40.000 (so, far).

Standard Chartered is known in the past for making wildly optimistic crypto-price predictions. It now maintains a $100,000 price per coin for the year. This, partly, due to the possibility that the halving of the supply might sway demand in favor of the former.

The temptation is to chart bitcoin’s price after previous halvings. The biggest bitcoin bull runs peak between a month and a quarter after the halving.

Anyone can guess why this time will be different, except to prove the point. “past performance does not guarantee future results.”

The data show that halvings (or not) have little impact on bitcoin prices. This, despite huge capital injections each four years.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.