There is only one more milestone before Bitcoin officially enters the price discovery mode.

There is no doubt that the price of bitcoin in US dollars has reached an all-time record. BTC was trading at $98,000 in the morning, giving it a market capitalization of close to $1.94 billion (fully diluted: $2.06 billion).

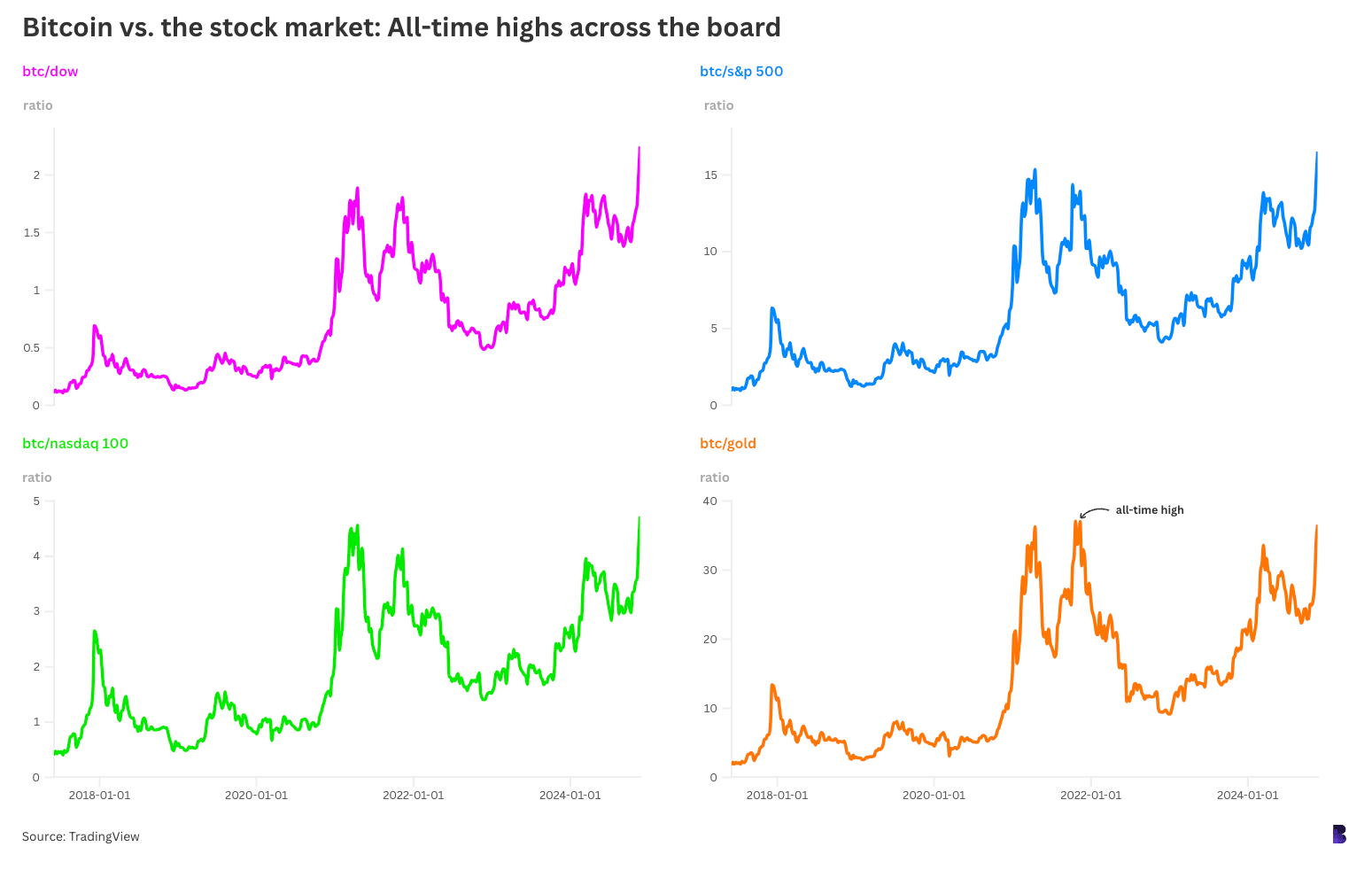

Bitcoin’s price has also formally broken 2021 records against all three major US benchmark stock indexes: the Dow Jones, S&P 500 and Nasdaq 100.

Gold, though, had outperformed bitcoin following crypto’s peak in November 2021 — until this past week. As of this morning bitcoin is up 55% compared to 46% for gold since the crypto’s peak in November 2021.

Bitcoin is still lagging behind gold. This lag can be seen in the ratios between BTC and its US Dollar, stock market, or gold high.

The bitcoin-to gold ratio was slightly below 36.83 on Thursday morning. BTC reached its highest level in November 2021 at 37.05 – a small difference of less that half a percentage.

If gold remains steady, it would only take a small move from here to reach $98,500, or even less if the price of gold drops slightly. (Current Bitcoin price: $97.845.)

There’s likely to be some other annoying technicality at that point. It may be that it is still below the all-time gold high after inflation has been adjusted. Whatever.

The Feds are probably also locked in to the bitcoin chart for a long time.

The US government crypto stash — seized in a variety of criminal cases — has now ballooned to almost $21 billion, over 98% of it bitcoin. The rest of the crypto stash is made up mainly of ETH and BNB.

Arkham Intelligence data shows that this is up from under $10 billion just at the beginning of the year. It’s hard to know the exact value of crypto held by the US government because agencies move it around between unmarked wallets.

We can, however, zoom in on 3,999 BTC which were sold by the Feds between June and July. At the time of transfer to Coinbase prime, these coins were valued at an average of $61,300. They likely generated over $245 million in government coffers.

If sold today, the net value would have been closer to $392 millions, leaving $147million on the table.

The German state Saxony fared much worse. It dumped a total of almost 50,000 BTC onto a number of exchanges at around the same times as the US and made the equivalent of 2,78 billion Euros.

Had Saxony held, it would’ve had almost $4.9 billion — converting to over $2.1 billion in lost potential revenue. This is equal to 1,7% of Saxony’s GDP for 2018.

The combined value of the identified government treasuries is $28.5 billion. They belong to the US and UK as well as Bhutan and El Salvador.

Now that bitcoin is in its proper price discovery mode, the real test for their hands will be when they are able to hold it.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.