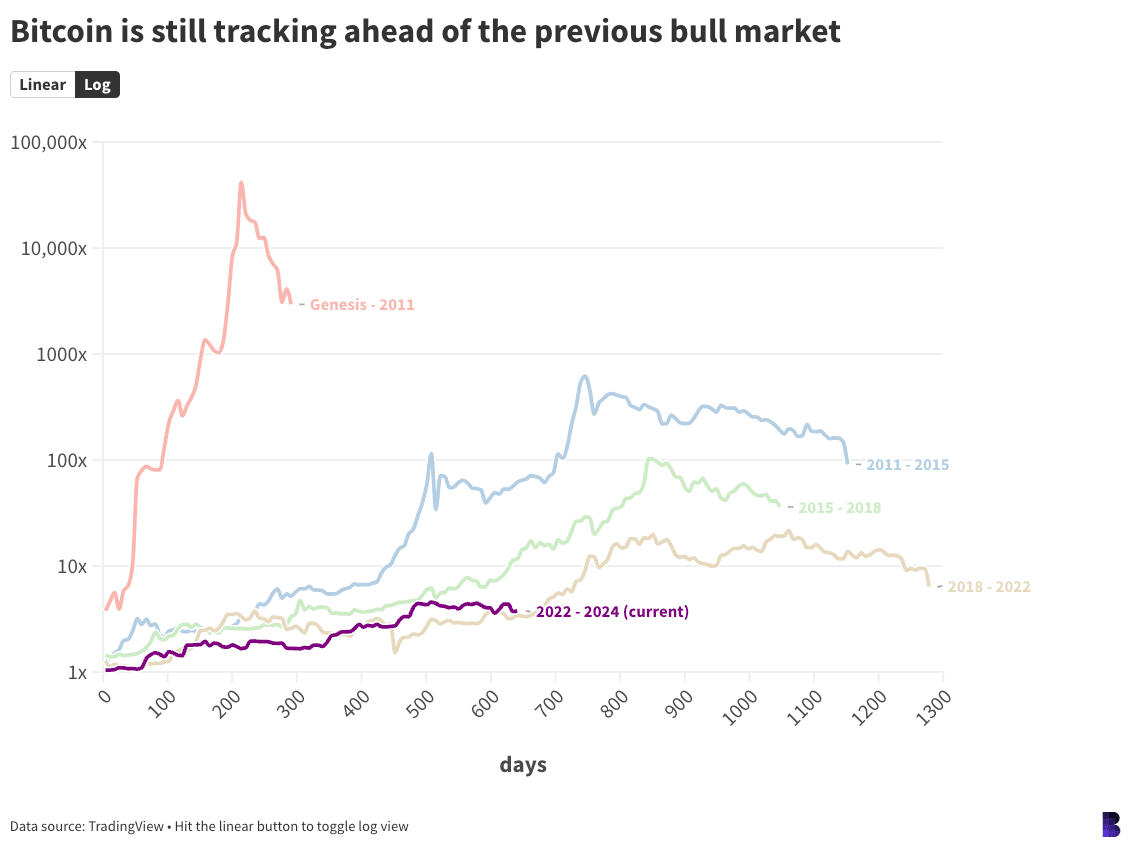

Bitcoin is now over 640 days right into a bull market, in case you imagine we’re nonetheless in a single.

A pair hundred days in the past again in January, bitcoin’s bull market efficiency so far had roughly tracked between the earlier two cycles: slightly below 4.5x returns.

Bitcoin at this level within the 2015 to 2018 cycle was nonetheless shortly heating up. Between January and July 2017, bitcoin exploded from $800 to over $2,800.

It will definitely carried onto almost $20,000 by the tip of the 2017, setting an all-time excessive that wouldn’t be damaged for 3 years.

Bitcoin at this time is extra intently monitoring the latest cycle, between 2018 and 2022, as proven by the brown line on the chart above. It’s posted 278% market-to-date returns in comparison with 244%.

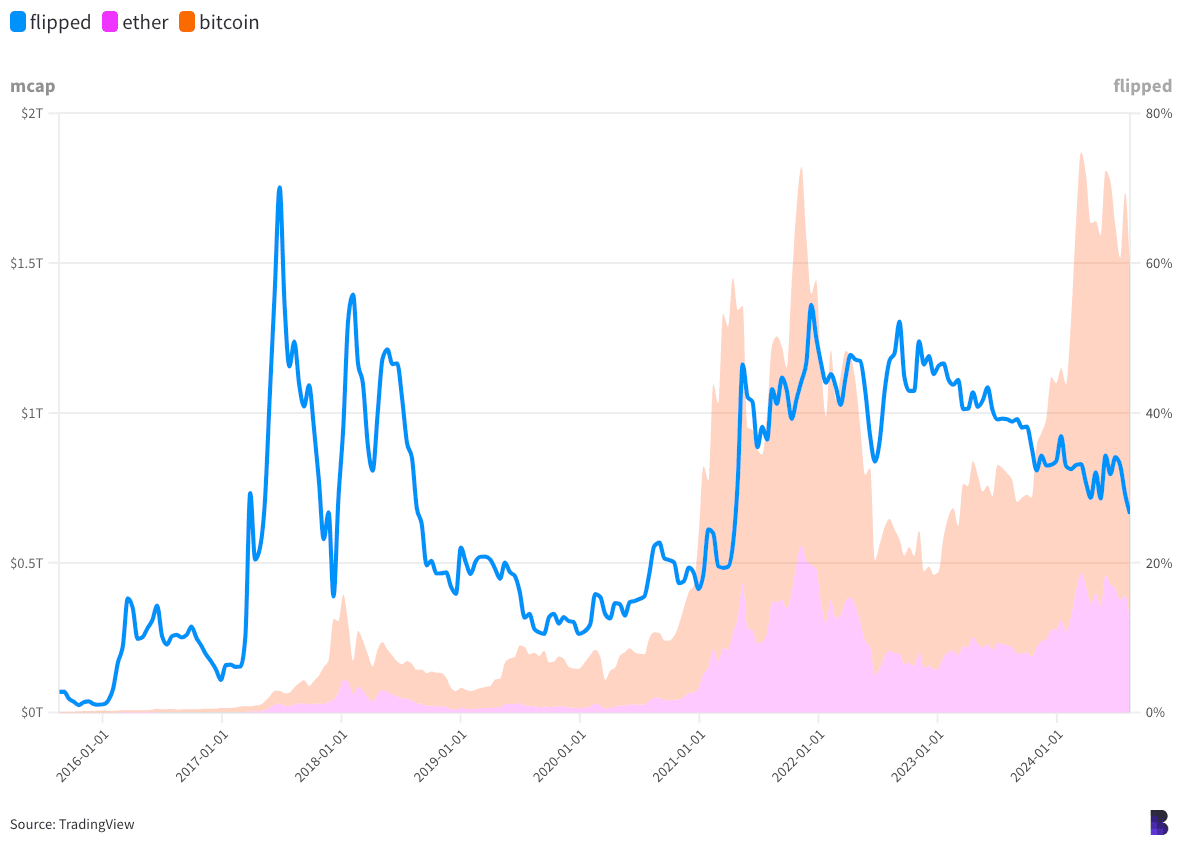

Not all cryptocurrencies have been as bullish as bitcoin.

Ether, for one, hasn’t been this removed from flipping bitcoin in virtually three and a half years.

On the chart under, the orange and pink shaded areas within the background present bitcoin and ether’s market cap, respectively.

The areas are stacked, so a flippening can be when the smaller one takes up greater than half of the mixed house.

The blue line tracks the progress — and it’s been steadily retreating because the peak of 2021’s bull market.

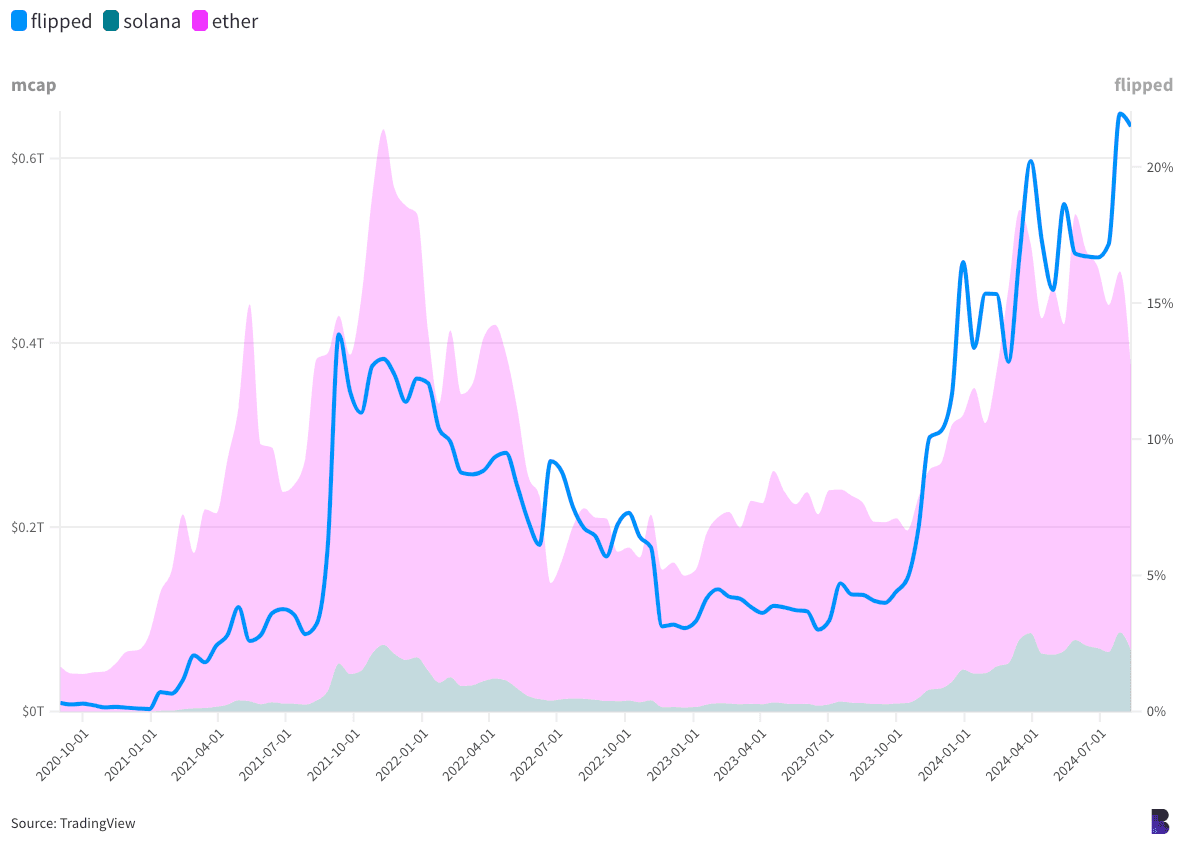

Solana has in the meantime by no means been nearer to flipping ether. This time final 12 months, solana’s market cap was solely 4% that of ether’s — or $9.3 billion to $217.2 billion. Now, it’s at 22%, valued at $66 billion to $307.6 billion.

However how lengthy does this bull market have left to go? All we will do is evaluate the lengths of the earlier ones, and that differs throughout varied fashions.

The best technique begins bull markets when bitcoin bottoms out and ends as soon as a downward development has been totally confirmed.

Based mostly on that strategy:

- Our present bull market began on Nov. 9, 2022 when bitcoin bottomed out under $15,670 after FTX shut withdrawals — 642 days in the past.

- The earlier three bull markets lasted between 1,047 days (2015 to 2018) and 1,278 days (2018 to 2022).

- If bitcoin have been certainly destined to map to these four-year cycles (no ensures there), then we’re over midway by way of our present interval.

Within the case that the bull market was already over, it might’ve been the shortest in bitcoin historical past — not counting the preliminary worth discovery within the two years after the genesis block.

After all, previous efficiency doesn’t point out future outcomes. However that shouldn’t cease us from having enjoyable. If the bull market remains to be ongoing, and bitcoin worth motion is certainly nonetheless cyclical, then we’ll should go larger from right here to map to these patterns.

So, primarily based on the size of the earlier three markets, bitcoin would nonetheless be bullish even till half manner by way of subsequent 12 months — which does align with some analyst outlooks.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.