Babylon sees $1.4 billion in deposits

Babylon, a protocol based on CometBFT’s consensus which was launched in the mainnet last August.

Babylon has now amassed a staggering 23,000 bitcoins ($1.4 billion) from 25.3,000 stakers. It is in the same ballpark as major restaking platforms like Symbiotic ($1.5bn) and EigenLayer($10.7bn).

The sidechain is different from previous versions Babylon is a layer of coordination that does not rely on trust and can be used to bridge bitcoin with smart contracts chains without involving bitcoin.

It is possible to achieve this by using Cosmos’s Inter-Blockchain Communication Protocol (IBC) for communication between networks and a mixture of cryptography tools like “covenants” To lock bitcoin into a self-custodial time-locked vault until certain conditions have been met. In addition, time stamping is also used to sync up a record on PoS chains.

In order to circumvent the incompatibility of Bitcoin’s blockchain with smart contracts, Babylon requires that stakers use their private key to lock and unlock their stake. This stake is then delegated for a small fee to a trustworthy validator.

In the event of malicious behavior, the validator’s private key is revealed and slashed with extractable one-time signatures (EOTS) — a concept that builds on Bitcoin’s Schnorr signatures algorithm.

It allows Bitcoin holders to participate in the blockchain. “bridge” In the future, users will be able to deposit their bitcoins into PoS chains and get a return in tokens of the PoS destination chain.

At the moment, liquid restaking protocol Lombard and Solv Protocol are two of the largest stakers, with a combined total of 7166 bitcoin and 6009 Bitcoin respectively.

Solv Protocol has also released yesterday the Staking Abstraction Layer, or SAL. This is a standardization framework that will be used to create standardized token standards for the ever-growing number of derivative bitcoin tokens.

Bitcoin DeFi is not able to use smart contracts, so it must be cross-chain. It is this need that creates the demand for standard common frameworks.

In order to standardize Ethereum DeFi, various cross-chain standards were used. These include LayerZero’s OFT standard (Omnichain fungible token) and Axelar’s ITS standard (Interchain Token Service).

Chart of the Day

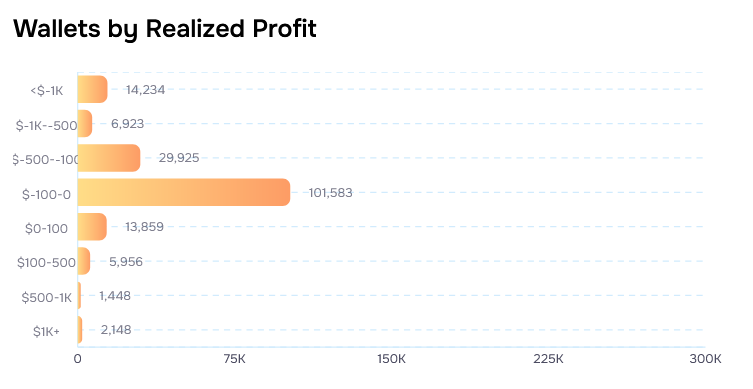

Many Polymarket users are losing money.

Polymarket is not surprising to find that most users have a negative balance. According to Layerhub data, 86.7% users lost bets in the prediction markets. Polymarket has only seen a profit of over $1000 from 2,148 users (1.2%).

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.