Data from the Bitcoin blockchain shows that Bitcoin whales continued to buy more, even at recent highs. This could be a positive sign for the rally.

The netflow of Bitcoin’s large holders has continued to see positive increases in recent months

The number of BTC whales is increasing, according to the data from the market research platform IntoTheBlock. The on-chain metric that is of interest in this case is the “Large Holders Netflow,”The system keeps track the amount of Bitcoin that flows into and out of the wallets of Large Holders.

IntoTheBlock definition “Large Holders” as investors carrying at least 0.1% of the cryptocurrency’s supply. There are currently around 19,8 million tokens in circulation. Therefore, holders who qualify for this cohort must hold at least 19800 BTC.

Quant explains why Bitcoin still has room to rise

The current exchange rate equates this asset to approximately $1.8billion. This would mean that the investors in this category would be very large.

The influence of an investor on the market increases with the number of coins they hold. Thus, the Large holders, who have the largest balances in the network, are the most powerful entities. This group’s behavior is worth watching.

These huge investors will notice that their wallets are flooded with coins when the Large Holders’ Netflow is positive. This buying is bullish for an asset.

The negative indicator indicates that large holders are reducing their holdings. This can cause a bearish movement for cryptocurrency.

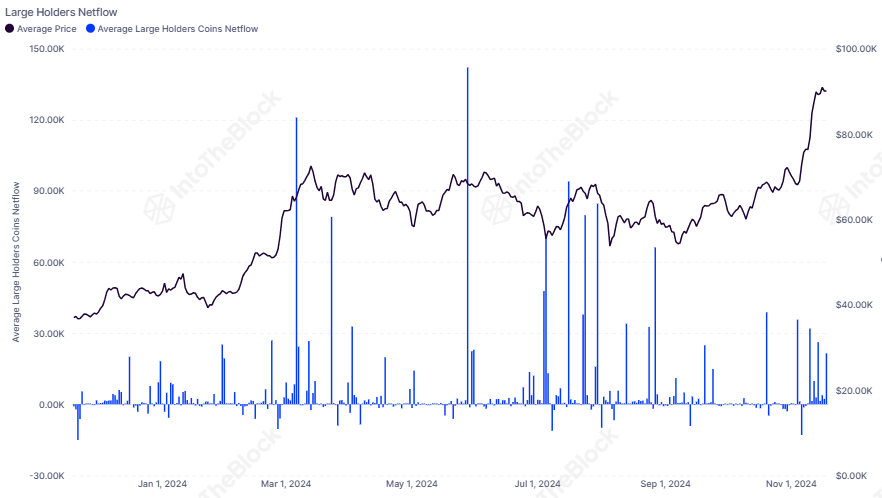

This chart shows the Bitcoin Netflow for Large Holders in the last 12 months:

Source: intotheblock on X| Source: IntoTheBlock on X

The Bitcoin Large Holders Netflow experienced massive spikes in early 2014 as whales were busy accumulating this asset.

Interestingly, as BTC’s latest run to new all-time highs (ATHs) has occurred, the indicator has again seen positive spikes. The scale of these latest net buys has been considerably smaller than the earlier ones, but the fact that these investors haven’t been selling at all is certainly positive for BTC.

Related Readings: Bitcoin Open interest sets another record – a wild week ahead!

The net accumulation naturally reflects the whales’ confidence in the cryptocurrency right now, considering that the buys have come while BTC has already been trading at higher prices than it ever has in history.

The question is whether the Bitcoin Large Holders accumulation will continue to drive the Bitcoin run.

BTC Price

Bitcoin was trading around $92,600 at the time this article was written, an increase of more than 7% in the past week.

TradingView chart, image from IntoTheBlock.com and Dall-E.| Source: BTCUSDT on TradingView Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.