Bitcoin’s wild value swings have crushed us all into submission.

We naturally anticipate huge corrections to crush hopes, goals and pockets balances, even within the midst of monster bull runs.

So, you’d be forgiven for anticipating a sudden 50% collapse within the value of bitcoin on its method to six figures and past.

Is it warranted?

First, to be clear: bitcoin does have a behavior of tanking by about 80% from bull run peak to bear market trough. It has occurred each cycle going proper again to its first main rally in 2011.

However this column isn’t about bear market drawdowns (right here’s our earlier evaluation on the subject). As an alternative, it’s concerning the corrections that occur particularly throughout bull markets, just like the one we’re in proper now.

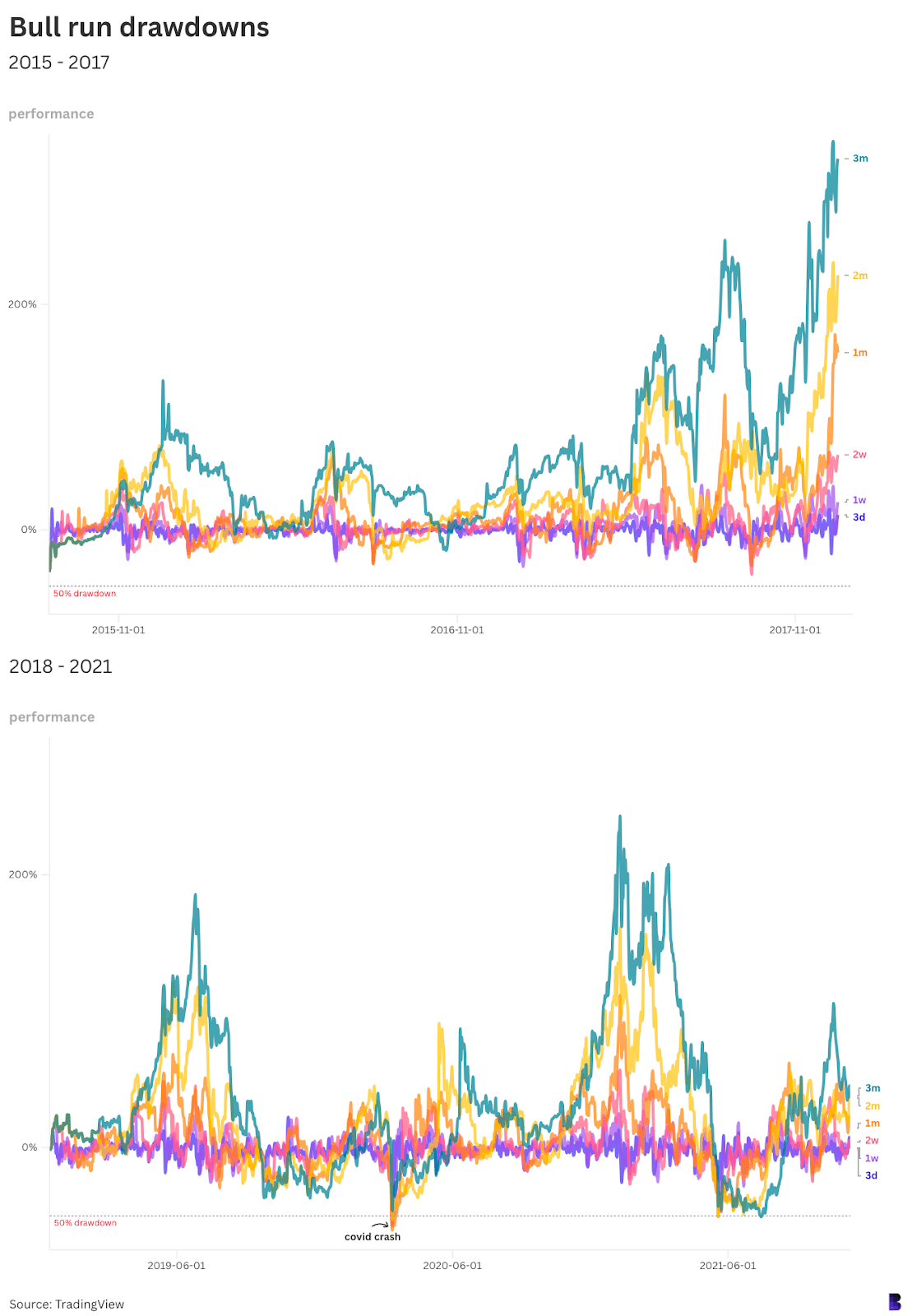

The charts under plot bitcoin’s value efficiency throughout six completely different timeframes, starting from three days to 3 months, on a rolling foundation, beginning when the cycle begins (the trough) to an all-time excessive (the height).

Every line reveals a special timeframe — the darkish purple line reveals the proportion distinction between every every day low and the open three days earlier, as an illustration. Inexperienced does the identical however over three months at a time.

The dotted line on the backside in any other case reveals what a 50% drawdown would appear to be. As you may see, the bull run between August 2015 and December 2017 concerned no drawdowns of that dimension.

Throughout that market cycle, the biggest was a 40% retracement over two weeks towards the top again in September 2017.

There have been, nevertheless, three corrections of greater than half throughout the next bull market between 2018 and 2021.

A type of was the epic covid market crash in March 2020 — which roughly coincided with a sequence of “Black Mondays” for the inventory market.

BTC dove by half or extra throughout each timeframe besides three months, which solely hit about 47%.

The opposite massive drawdowns occurred in Might and July 2021, when bitcoin dove from a then-all-time-high of over $60,000 to $30,000. It could then climb again to virtually $69,000 over the following 4 months.

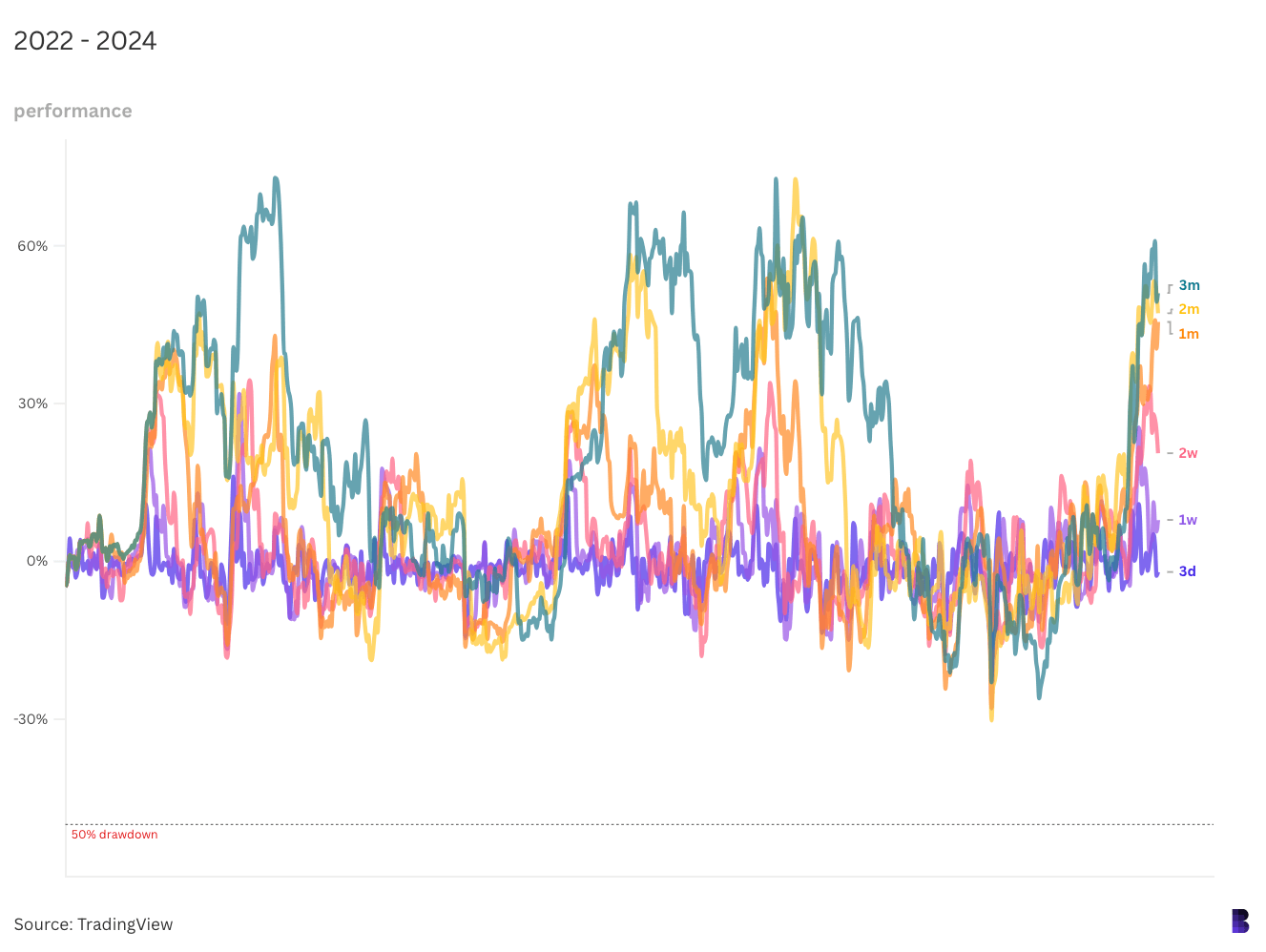

This time round has been a lot tamer, with the worst mid-bull correction coming within the first week of August.

Bitcoin had fallen 30% throughout a number of timeframes, reaching a low of $49,200 from over $70,000 in June.

All this isn’t to say that bitcoin has misplaced its volatility. I might nonetheless anticipate a rocky journey.

What’s good to know, although, is that the majority brutal drawdowns have traditionally occurred on the tail finish of bull runs.

So, the longer we go with out one, the spookier it will get. All a part of the enjoyable.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.