Final week, the U.S. Securities and Trade Fee's (SEC) permitted the record of of bodily settled choices tied to BlackRock's spot Bitcoin ETF, the iShares Bitcoin Belief (IBIT).

- Options tied to BlackRock’s spot bitcoin ETF (IBIT) might set the stage for a GME-like gamma squeeze-led upside volatility in BTC.

- Amberdata says over the long term, establishments’ bias for yield-generating methods might dampen volatility.

One of many thrilling developments from final week was the U.S. Securities and Trade Fee’s (SEC) nod for approval and itemizing of bodily settled choices tied to BlackRock’s spot bitcoin (BTC) ETF, the iShares Bitcoin Belief (IBIT).

There may be consensus that the IBIT choices, which nonetheless must be greenlighted by the Options Clearing Company (OCC) and the Commodity Futures Buying and selling Fee (CFTC), will additional assist draw establishments to the crypto market. The crypto group, nevertheless, appears break up on how it will have an effect on the bitcoin market volatility.

Per Bitwise Asset Administration, gamma squeeze, a fast worth rally catalyzed by choices market dynamics, might develop into a characteristic of the bitcoin market following the debut of IBIT choices.

Gamma squeeze

To know the gamma squeeze, readers should understand how choices work. Options are derivatives that enable the customer the correct to purchase or promote the underlying asset at a predetermined worth on or earlier than a particular date. A name possibility provides the correct to purchase and represents a bullish wager in the marketplace, whereas a put possibility represents a bearish wager.

Options gamma is a metric that gauges how an possibility’s delta, or the sensitivity of an possibility’s worth to actions within the underlying asset, modifications for each $1 transfer within the underlying asset’s worth.

When traders purchase numerous name choices, anticipating a worth rally, market makers, who’re mandated to keep up a web market-neutral publicity, find yourself on the opposite aspect of the commerce, holding giant quantities of brief name positions, typically known as brief gamma publicity. As such, they buy the underlying asset because the market rallies as a result of they’re obligated to ship the underlying asset to the decision possibility purchaser.

The hedging exercise places upward strain on the spot worth, inflicting a pointy rally, just like the one in shares of American online game retailer GameStop (GME) in 2021.

Per Jeff Park, head of alpha methods and portfolio supervisor at Bitwise Asset Administration, IBIT choices, providing regulated leverage on a supply-constrained BTC, will draw stable institutional demand for calls, setting the stage for a gamma squeeze.

“Bitcoin options have negative vanna: as spot goes up, so does volatility, meaning delta increases even faster. When dealers [market makers] who are short gamma hedge this (gamma squeeze), bitcoin’s case becomes explosively recursive. More upside leads to even more upside as dealers are forced to keep buying at higher prices. A negative vanna gamma squeeze acts like a refueling rocket,” Park mentioned on X.

Park defined that IBIT choices will eradicate the “jump-to-default (JTD) risk” that has stored establishments at bay, permitting bitcoin artificial notional publicity to develop exponentially. JTD refers back to the danger of a difficulty or counterpart defaulting immediately earlier than the market can alter for the elevated danger.

He expects a robust investor bias for longer-duration out-of-the-money (greater strike) calls as soon as the choices go reside.

“With bitcoin options, investors can now make duration-based portfolio allocation bets, especially for long-term horizons. There’s a good chance that owning long-dated OTM calls as premium spend will give investors more bang for their buck than a fully-collateralized position that could drop by 80% over the same period,” Park mentioned.

Throughout an interview with CoinDesk, Bitwise Asset Administration’s head of analysis Europe, André Dragosch, voiced the same opinion, saying, “The consequence of this would be a price spike similar to what we have seen with GME, which is akin to a “brief squeeze” in futures.”

Dragosch added that the upside volatility from the so-called gamma squeeze might be extra pronounced resulting from the truth that bitcoin’s provide is capped at 21 million BTC.

The opposite aspect of the story

Per Greg Magadini, director of derivatives at Amberdata, the gamma squeeze might be seen if an ideal bullish storm, characterised by Republican candidate Donald Trump’s victory within the upcoming U.S. elections and Fed charge cuts, grips markets. Nevertheless, over the long-run, elevated institutional participation by way of the ETF and ETF choices is more likely to dampen volatility.

“Institutional flows, in particular, are counter-cyclical. Portfolio managers tend to trim exposure through quarterly rebalancing, selling appreciating assets when bitcoin rallies too much,” Magadini mentioned within the weekly publication shared with CoinDesk.

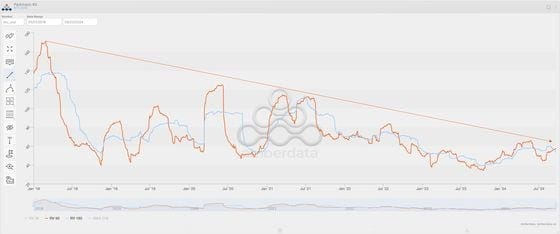

Bitcoin’s realized or historic volatility has been trending decrease for the reason that Chicago Mercantile Trade listed bitcoin futures in December 2017, opening doorways for conventional establishments to take publicity to the cryptocurrency.

Moreover, institutional flows by way of IBIT choices might mood Bitcoin’s upside-implied or anticipated volatility, in response to Magadini.

“Another well-known effect of these flows is their impact on implied volatility. Institutions buy protective puts and sell covered calls, which dampens upside implied volatility,” Magadini famous.

Implied volatility, or traders’ expectations for the diploma of worth turbulence over a particular interval, is influenced by demand for choices. Upside implied volatility picks up when traders purchase calls and vice versa.

Subtle traders use the lined name technique to generate further earnings on prime of their ETF holdings, as noticed within the gold market. The technique entails promoting the next strike ETF name possibility and pocketing the premium (possibility’s worth) whereas holding an extended place within the ETF. The brief leg places downward strain on the implied volatility.

Crypto merchants have been organising lined calls by means of Deribit’s bitcoin choices, resulting in decrease implied volatility over the previous few years.

“As institutional ownership grows, their behavior has a greater impact. This means that, ultimately, institutional adoption leads to lower volatility in Bitcoin. This is merely a continuation of the clear structural decline in Bitcoin’s volatility,” Magadini summed up.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.