Let’s BUIDL!

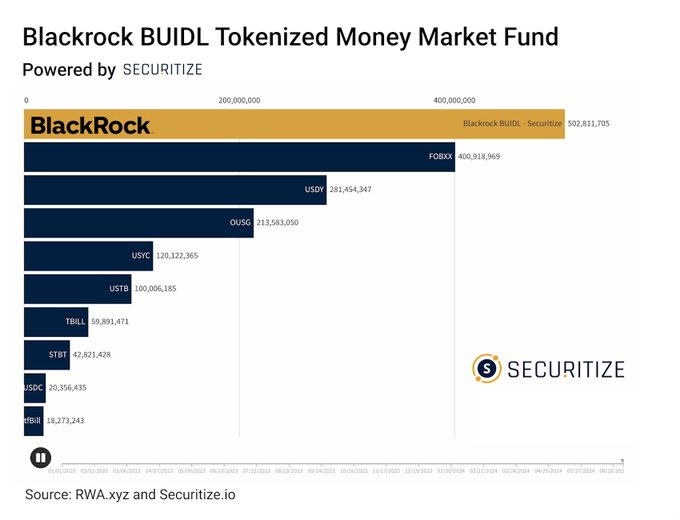

Earlier this week, BlackRock’s BUIDL crossed $500 million — a milestone never before reached by a tokenized money market fund.

Carlos Domingo, CEO of Securitize told me that tokenized funds are a growing trend. We spoke at length about Securitize’s role with BUIDL (basically, qualified investors — meaning those with more than $5 million in assets — can subscribe to the fund through Securitize).

Also, we discussed the possible reasons for this market’s growth.

Domingo stated that Stablecoins’ popularity is certainly a contributing factor. People began to think of other ways tokens could be used.

BUIDL’s tokenized Treasury Market, including BUIDL, is worth $1.8 Billion. Domingo would not be surprised if the tokenized treasury market, which includes BUIDL, topped $2 billion in the near future.

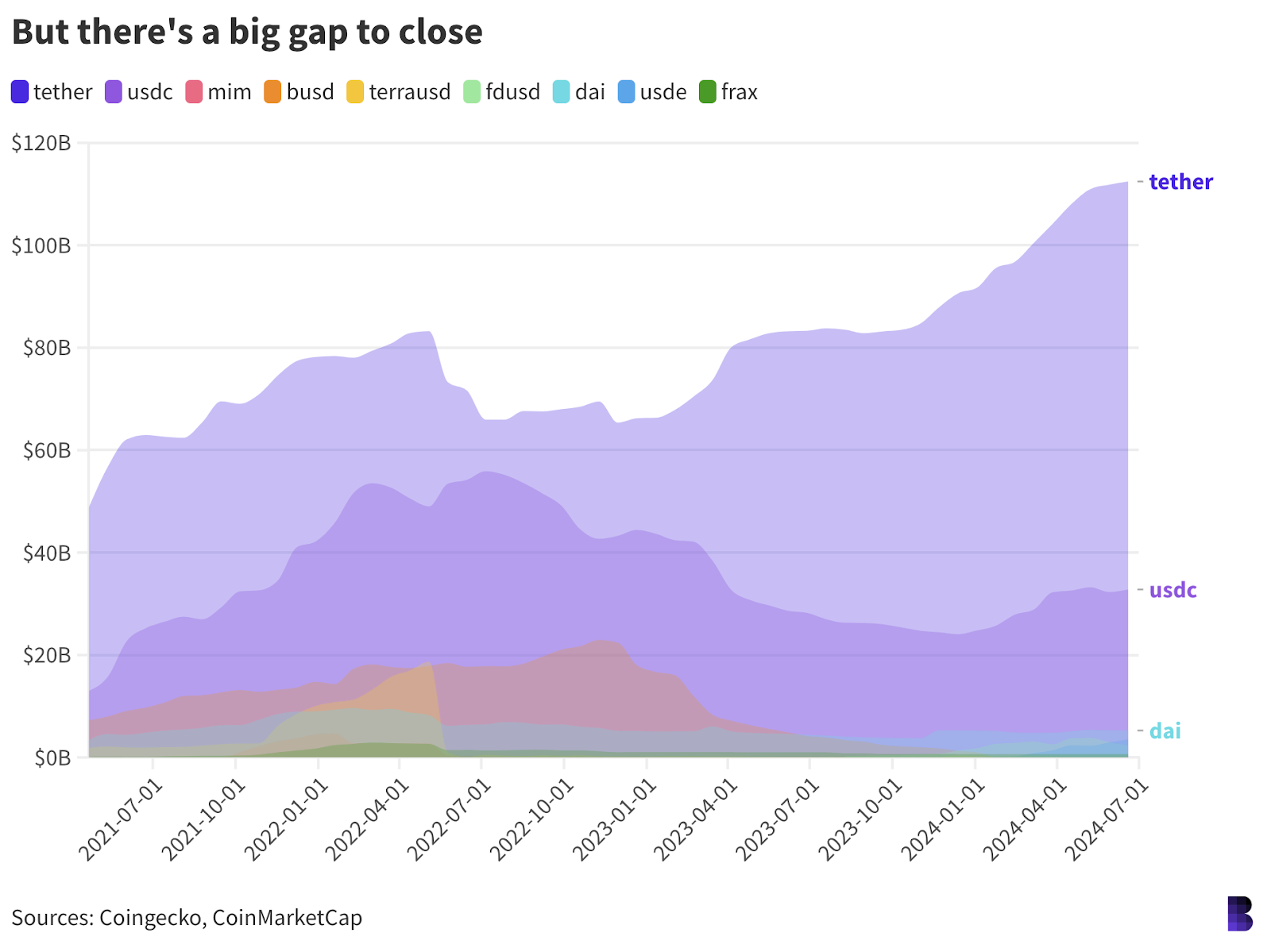

Although the stablecoin market has a market value of $160 billion, the current market size is far less. “it’s definitely growing way faster than stablecoins.”

“Keep in mind, stablecoins are easier to purchase and use because they’re permissionless. While tokenized treasuries are securities. So they have some restrictions in terms of who can purchase them, how you can transfer them, etc. So they’re never going to be, in my opinion, as big as stablecoins…but I think they can easily become 10% to 20% of the market of stablecoins,” He said.

Domingo also told me about his conversations with other people in the field. He said that the conversations have really picked up after BUIDL’s launch.

“Every single asset manager out there is thinking about how they can participate,” He told me. It’s not surprising that BUIDL is so popular. This success doesn’t just belong to BlackRock.

According to rwa.xyz, Franklin Templeton’s fund, FOBXX, which was launched in April of last year, has topped $400 million — a 16% increase over the past 30 days. BUIDL has seen a nearly 10% increase over the same period.

But Domingo thinks that BUIDL’s next $500 million could come even quicker — the fund just launched four months ago. The fund was launched just four months ago. “new features” He teased. He said that some of them will be revealed in a matter of weeks.

It’s possible that the fund is a little slow to process, due to its nature.

Then, he added: “In terms of onboarding entities, which, because these are institutions, it takes time to onboard an entity for them to be able to invest in BUIDL but we have a very big pipeline of entities being onboarded that once they’re on board, they will invest, right?”

As expected, the success of BUIDL led BlackRock and Securitize to discuss future projects. Domingo stated that BlackRock and Securitize are aware of the fact that BUIDL is only four months old, which means that nothing more will be coming.

“So things take a longer time that maybe will take if we were working with a startup, which is fine because also you get the credibility of Blackrock…I think that in the next few months, we’re going to focus more on growing BUIDL in terms of the utility of the token, the functionality, and the integration with all the parts of the ecosystem, rather than launching a new” He said, “It’s a project.”

You know what they say: Just keep building, just keep BUIDLing…

Data Center

- You can also find out more about the following: US treasuries tokenized In just three months the market has grown by half, going from $1.2 billion up to $1.81billion.

- In the private credit market for crypto, $8.04billion is a 10% increase over the same time period. Nearly 90% is via Figur.

- BTC The goal is to reach $60,000, which has not been seen since the 4th of July. It is currently $58,700, and the trading day has been about average.

- TIA You can also find out more about the following: It is not a good idea to use the word “Youthfulness” CoinGecko says that 34% of the 100 top weekly performers have seen gains.

- Solana had its second-largest day ever for stablecoin inflows earlier this Week: $161.94 billionThe peak for May 2022 was $272.16million.

Stable Relationship

Stablecoins have a self-fulfilling nature. The demand for crypto dollar increases as the markets increase.

Many stablecoins are able to mint and burn coins according to demand. Circle will exchange USDC for hard currency if the bitcoin price increases.

Circle would send me USDC in the same amount as I sent and deposit it into my wallet.

Circle will pay you an amount equivalent to US dollars, plus burn any remaining stock, when I decide I want to sell my USDC at the end bull market.

Stablecoins do not all follow the same process (some like DAI are controlled by smart contracts and not a central entity).

Tether is a larger company than Circle and may decide to not burn its supply but rather to continue to distribute to other clients upon their request.

Is stablecoin supply an indicator of the market’s sentiment? Sometimes.

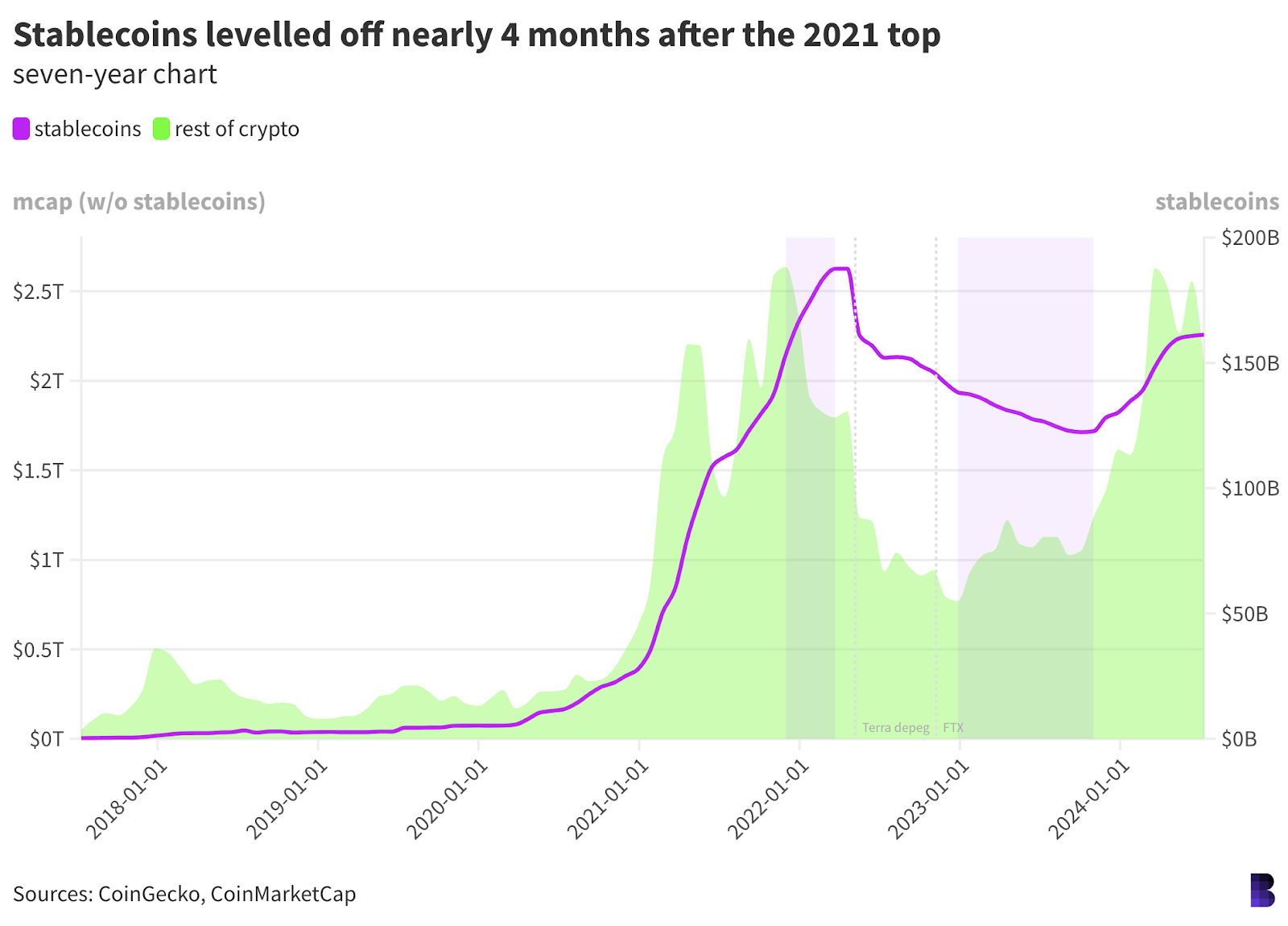

Imagine the crypto market’s big run up in early 2021. As shown in the chart, the stablecoins supply, which is the purple line, almost exactly tracked the overall cryptospace’s market cap.

And even when markets hit their first peak in April — the first top in green around the middle of the chart — stablecoin supplies kept growing even through the correction, indicating belief among stablecoin buyers that the market would continue going up.

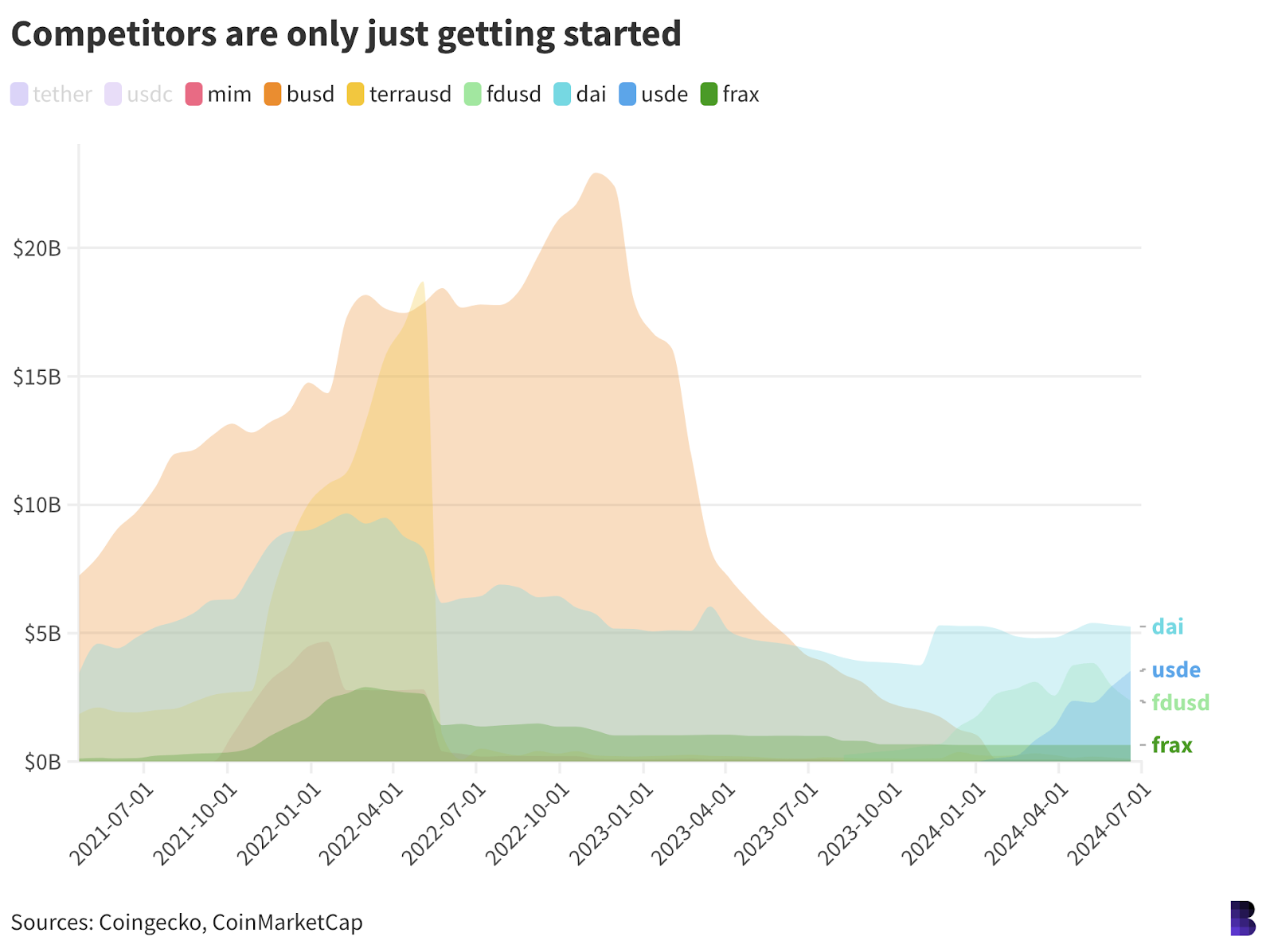

TerraUSD, a doomed algorithmic stabilcoin, was responsible at that time for much of this growth in supply. However, it crashed spectacularly four months after the top of crypto’s cycle.

It took a while for stablecoins to reach their maximum, even though the markets peaked in 2021. This was just before Terra’s explosion. Many predicted that it would occur while others were completely blindsided.

The global stablecoin supply shrank from about $156 billion directly following Terra’s demise to $137 billion as crypto bottomed when FTX went kaput six months later, a period which included Tether’s historic $16 billion ‘bank run.’

But as crypto started its recovery — one that eventually transformed into our most recent bull market — stablecoin supplies continued to fall for another year, slipping another 10% to $122 billion.

The total crypto market capital had almost doubled in the meantime (see the shaded areas on the first graph).

Stablecoin supply is currently trending downwards, as it has been for the past month, due to crypto consolidation.

What can you tell about the sentiment behind this statement?

“Let’s wait and see.”

The Works

- BitMEX Department of Justice revealed Wednesday that a bank had admitted it violated the US Bank Secrecy Act.

- Scammers are using a new online marketplace in South East Asia to target victims. Cambodian ruling familyElliptic implied in a recent blog.

- MoonPay Bloomberg reports that the company is planning to expand into the United Kingdom.

- In the bankruptcy estate, Ftx Tai Mo Shan, a subsidiary of Jump Trading, has filed a multi-million dollar lawsuit.

- MicroStrategy Announced a 10-for-1 Stock Splitting

The Riff

Donald Trump, the presidential hopeful and crypto enthusiast who has reborn his passion for the digital currency will make a speech at the Bitcoin 2024 Conference in Nashville on the first of next month.

Rumours about Trump’s appearance have been around for some time. It’s the latest step in Trump’s very successful efforts to court the checkbooks — and votes, one assumes — of the American crypto industry.

It is unclear at this stage if these remarks are more than victory laps. Trump just needs to point out the section of the GOP Platform that supports crypto and call it day. Joe Biden’s presidential campaign has collapsed and US Crypto companies are committed to the Washington money games.

The moment remains unquestionably historic. Trump, who has been vying for the White House for the past two years (albeit in a different way), is the first US presidential candidate to actually have the chance.

What if the cryptocurrency industry had not been so enthusiastic about supporting Trump? Who can say?

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.