BlackRock’s iShares Bitcoin Belief (IBIT) had greater than $60 billion in belongings beneath administration on Thursday.

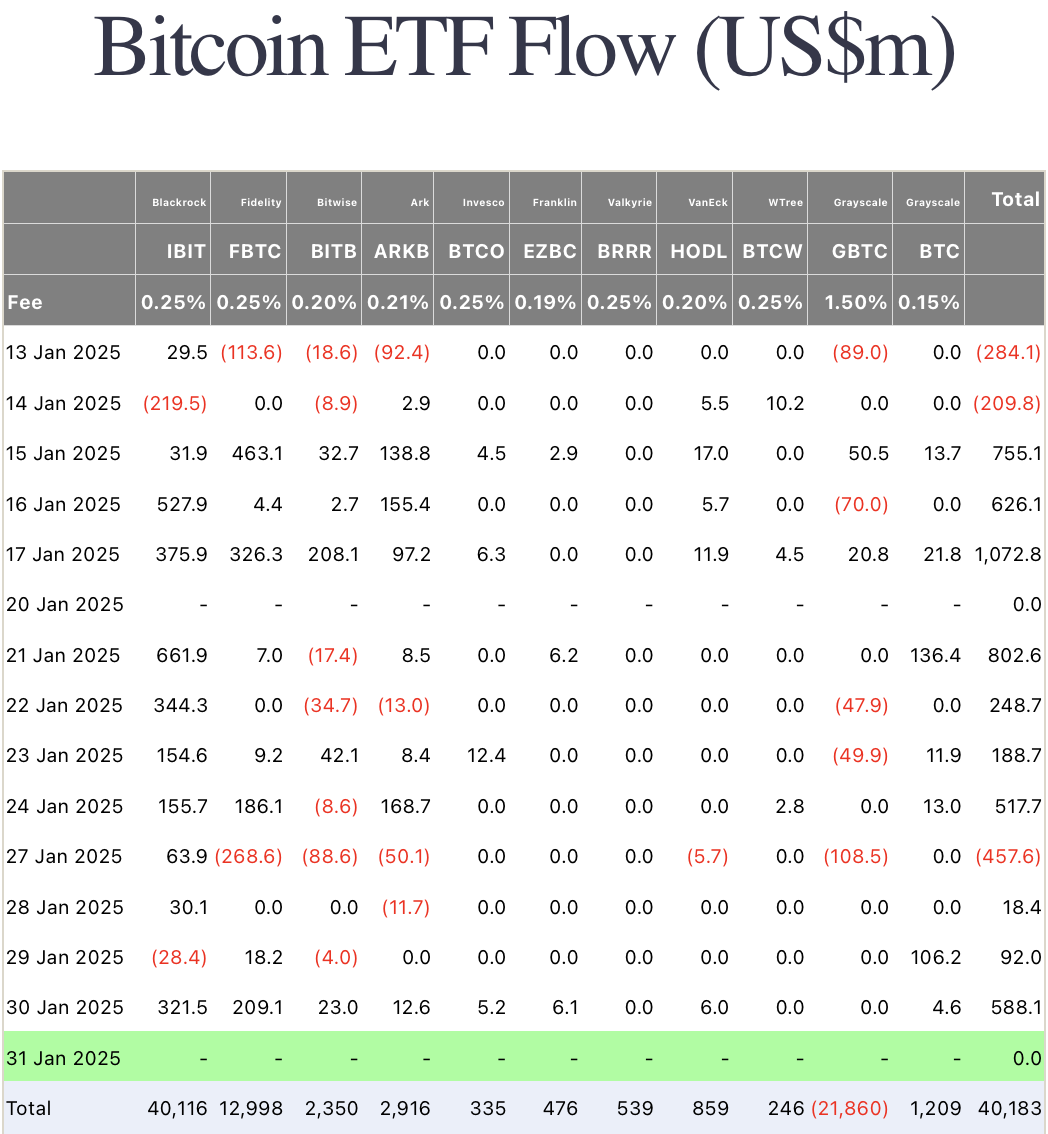

The belief eclipsed $40 billion in web inflows that day — after lower than 13 months available on the market.

You might recall the product’s 71-day web influx streak out of the gate. And that IBIT attracted 21% of BlackRock’s Q1 2024 flows. The ETF’s ~$34 billion of constructive web flows in 2024 made up about 5% of BlackRock’s $641 billion whole over that span.

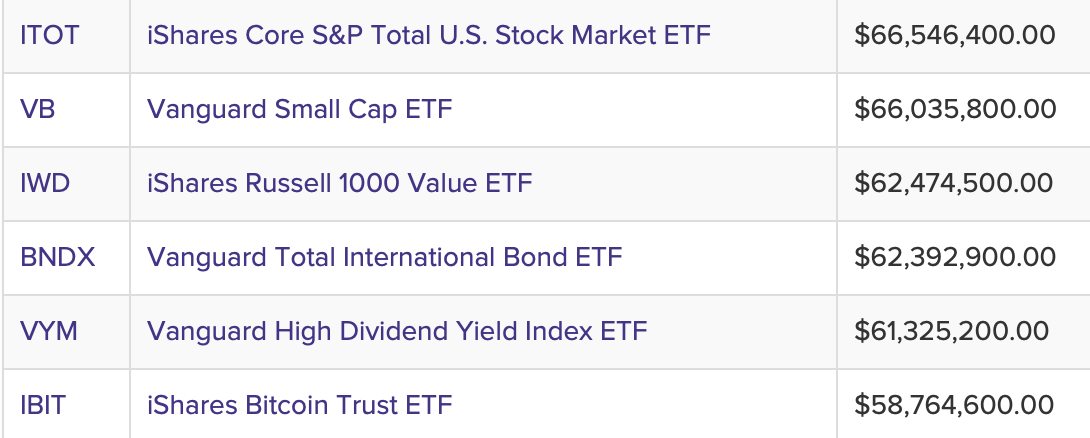

The $60 billion AUM determine places IBIT at No. 31 on VettaFi’s record of the biggest ETFs (albeit with a barely completely different whole).

The 5 ETFs simply forward of it (Nos. 26-30) have been available on the market for a mean of ~19 years — placing in perspective how briskly this product is climbing the charts.

One other stat: IBIT is the Eleventh-largest iShares ETF out of greater than 400. The most important is the iShares Core S&P 500 ETF (IVV), with roughly $600 billion AUM. That’s good for third on VettaFi’s record — behind solely SPY and VOO, which additionally provide S&P 500 publicity.

So IBIT stays about 10 occasions smaller than the world’s three largest ETFs. How excessive on the record may it get? And in what timeframe?

Bitwise analysis head Ryan Rasmussen wished to keep away from naming particular bitcoin ETFs. However he advised me he wouldn’t be shocked to see one such product surpass the biggest gold ETF — State Road’s SPDR Gold Shares (GLD), with ~$76 billion AUM — throughout the subsequent 12 months or two.

IBIT eclipsing GLD would seemingly put it within the high 20.

However a bitcoin ETF climbing above the largest broad-based equities ETFs is a a lot taller process. These are “a staple” in a majority of portfolios (typically commanding an allocation of 20-50%), Rasmussen famous. If included, a bitcoin ETF allocation is often 1-5%.

“It would take a significant increase in bitcoin’s price, increased investor adoption, and upsizing typical bitcoin allocations for a single bitcoin ETF to penetrate the top five or 10 ETFs by AUM,” he stated. “All three of those things are possible, but that would be many years down the road.”

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.