Bitcoin’s drop beneath $91,000 yesterday (these phrases would have spurred a double-take a month in the past) felt fairly substantial.

Maybe due to the anticipation of BTC hitting the six-figure mark for the primary time — adopted by a dip after falling simply quick (round $99,800).

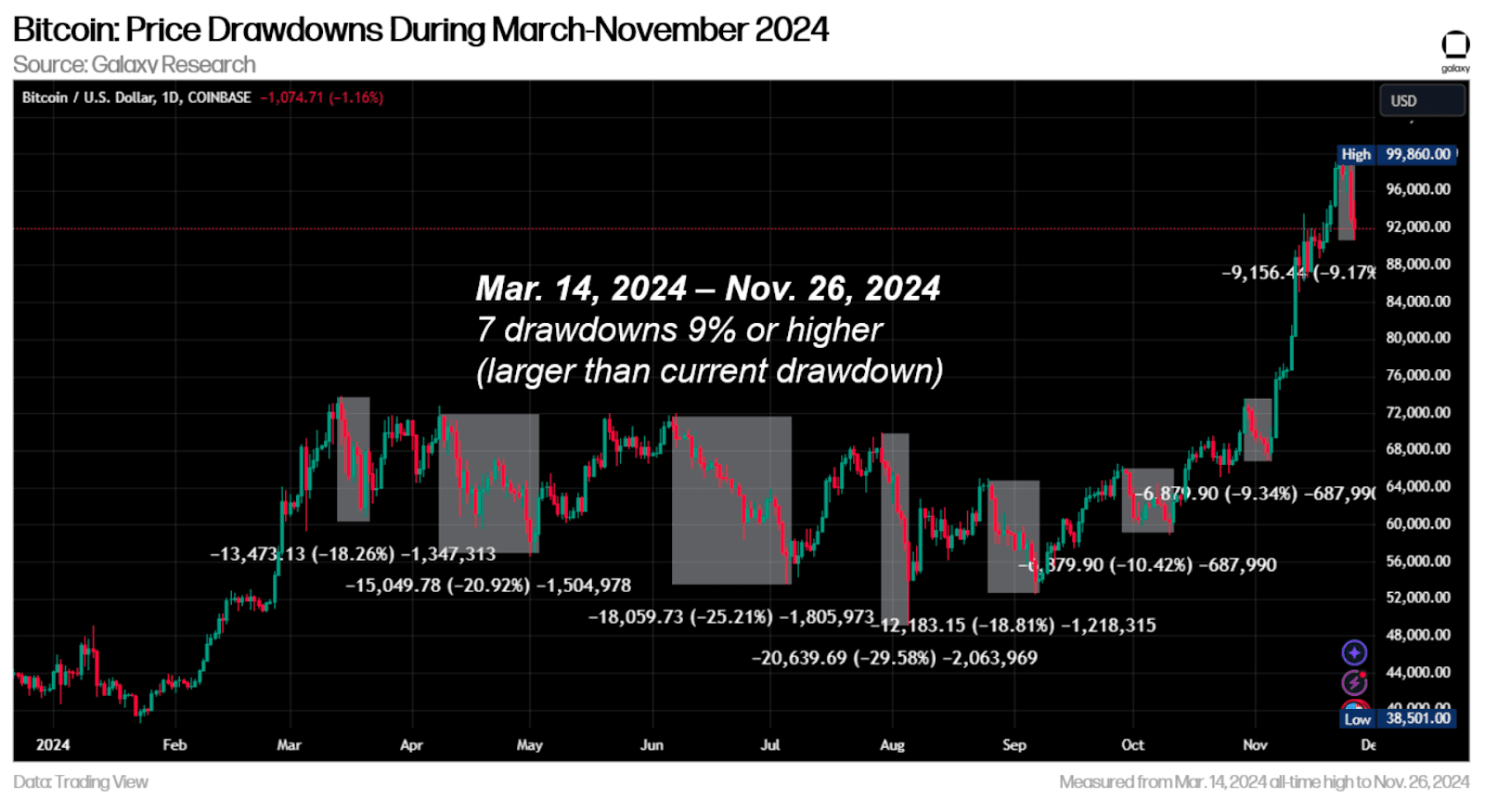

“However, bitcoin’s -8% dip over the last week barely rates when compared to the volatility during the 237 days of downward channel chop between Mar. 14, 2024 and Nov. 6, 2024,” Galaxy Digital analysis head Alex Thorn identified in a Tuesday observe.

Over that span, there have been at the least seven drawdowns bigger than that, and 5 of 15% or extra, Thorn discovered.

Most up-to-date BTC actions have concerned cash created (through the so-called unspent transaction output metric) between $56,000 and $72,000, Galaxy knowledge signifies.

“Rather than whales from eons ago dumping coins, the sell pressure appears to be coming primarily from 2024 buyers taking profits off the back of this move towards $100k,” Thorn wrote.

The Galaxy analysis head went so far as to say corrections are “healthy.” Whereas the worldwide charges setting and cash provide might current headwinds for danger belongings, Thorn added, there are additionally loads of catalysts.

In reality, there have been experiences yesterday that the Trump Administration might look to present extra crypto regulatory energy to the CFTC, doubtlessly decreasing the SEC’s affect within the phase. An SEC spokesperson declined to remark.

“This move…involves expanding the CFTC’s role to include oversight of digital assets, regulating crypto exchanges and spot markets as commodities — potentially creating a supportive framework for the industry’s growth in the US,” Wintermute OTC Dealer Jake O. mentioned in an e mail. “Sea change.”

BTC’s value was roughly $96,270 at 2 pm ET Wednesday — up 4.7% from 24 hours prior. We’ve talked right here in regards to the different obvious tailwinds for BTC heading into 2025, whether or not it’s better regulatory readability, institutional adoption or a potential US strategic bitcoin reserve.

All is to say, buckle up.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.