You’ll find all kinds of interesting things on the charts for crypto prices if you stare long enough.

Trading volume patterns and fractal candlesticks that predict major pumping. Inverted cup and handle patterns hover over your trades like a bad luck omen.

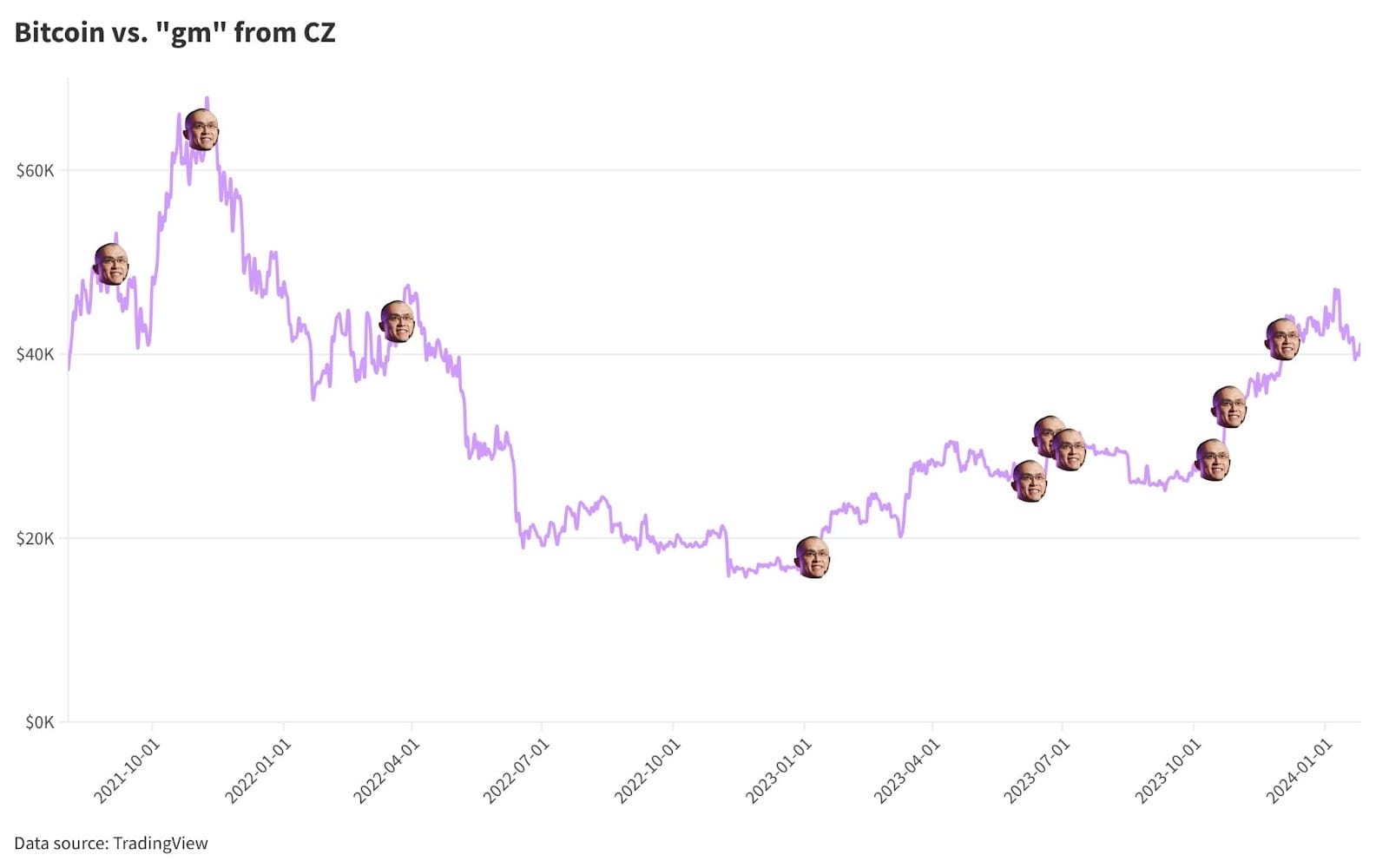

The odd correlation between the price of bitcoin and the X posts made by Binance’s co-founder Changpeng Zhao is also evident.

Zhao’s tweets tend to boost bitcoin prices “gm.” The rallies usually last only a short time.

Five or six years back, the Good Morning (gm), posts spread like wildfire. They were so popular on WhatsApp in India that one-in-three local smartphone users — many of which had only recently gained access to the internet — were running out of space on their devices every day, on account of the fact that each “gm” It was often accompanied by an image of roses, beaches or sunrises on mountain ranges.

Zhao, who has been sharing posts with wholesome engagement bait in the crypto world for some time now, has continued to share posts containing this habit. “gm” Over the past couple of years, I have done this 10 times.

- Bitcoin rose between 3 and 40% the day after each gm.

- Last July, I wrote a post about Meta’s answer for X (which started with). “GM” It is so far, the only one.

- Bitcoin fell about 1% a few days later, but rose more than 3 percent in the next two days.

Zhao’s correlation to the correlation of Zhao “gm” The price of bitcoin has been so high, that it is possible to create a dollar-cost-averaging strategy using the Twitter timelines of the former Binance chief executive.

Imagine buying $1,000 worth bitcoin each time Zhao tweeted “gm” would’ve accumulated 0.31 BTC ($13,000) for $10,000 — almost 25% unrealized profit.

Bitcoin has declined by over 20% in the same period. So, Zhao’s “gms” The price of bitcoin has nearly doubled.

Zhao’s strategy of buying alongside sats was marginally better than stacking them at the end every month. “gms,” Approximately 0.346 BTC worth of $14,500.

This shows how easily a market prediction can go wrong, regardless of whether it’s based on superstition, a technical analysis or another method.

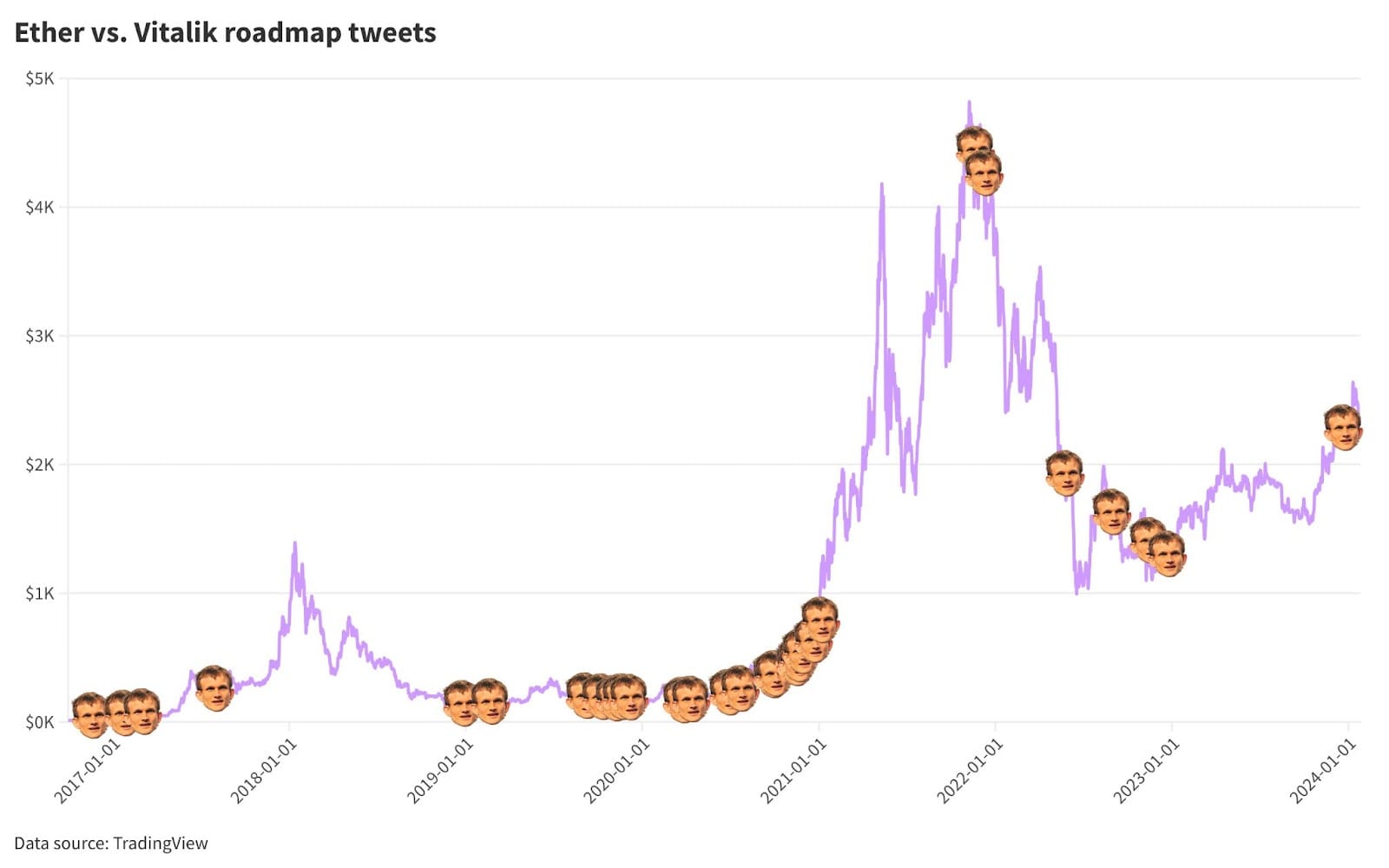

Vitalik tweeted a lot on Ethereum’s roadmap

It would have been a good idea to buy $10,000 of ether (ETH), shortly after Vitalik Buterin tweeted about Ethereum roadmap.

Ethereum’s roadmap has become a meme due to the long delays in the switch from proof-of stake to blockchain and the voluminous diagrams that Buterin shared.

Buterin has tweeted 29 times (excluding any deleted posts) about Ethereum’s roadmap.

Buying $10,000 worth of ether shortly after his first roadmap post would’ve got you about 888 ETH — now worth $2 million with unrealized gains of 20,000%.

Though it was probably more luck than timing, but there is no doubt that the time on the market played a role.

The dollar cost of converting the same amount each time Buterin tweeted the roadmap into ETH would otherwise have returned 2,500%.

If you repeated this at the end each month since 2016, about two-thirds would be gained.

Buterin has tweeted about the value of his tweet “gm” Only once in March 2021, with an image of a “beautiful field full of flowers.”

The post was published in the midst an aggressive bull market that ETH has yet to reverse.

These are all fun scenarios that show correlation is not the same as causation.

Investment decisions should not be based on the content of social media messages. This is just for entertainment. Sometimes dumb strategies pay off — a dart-throwing chimpanzee, a camel and other primates have previously beaten swathes of US funds for returns.

There is no real correlation between Zhao’s gms and bitcoin prices.

Buterin’s roadmap posts may contribute to the transparency of Ethereum development — boosting value proposition in some tangential way — but any effect is practically unmeasurable.

Check out these academic reports or these reports by major investment banks to learn more about the debate over dollar-cost-averaging versus lump-sum investing.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.