China unleashes a flood of stimulus

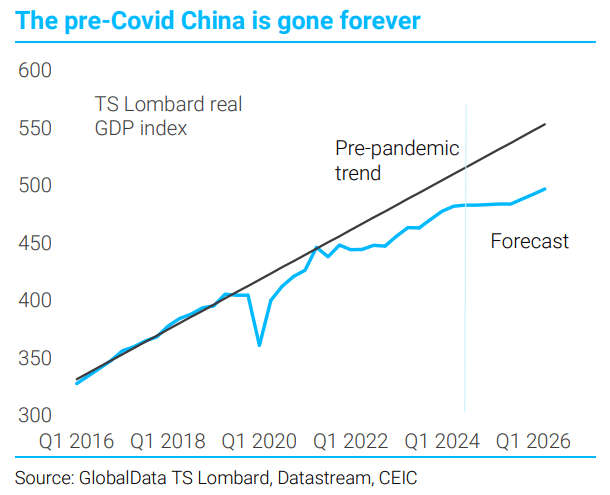

China has stagnated and been bleeding since the COVID outbreak.

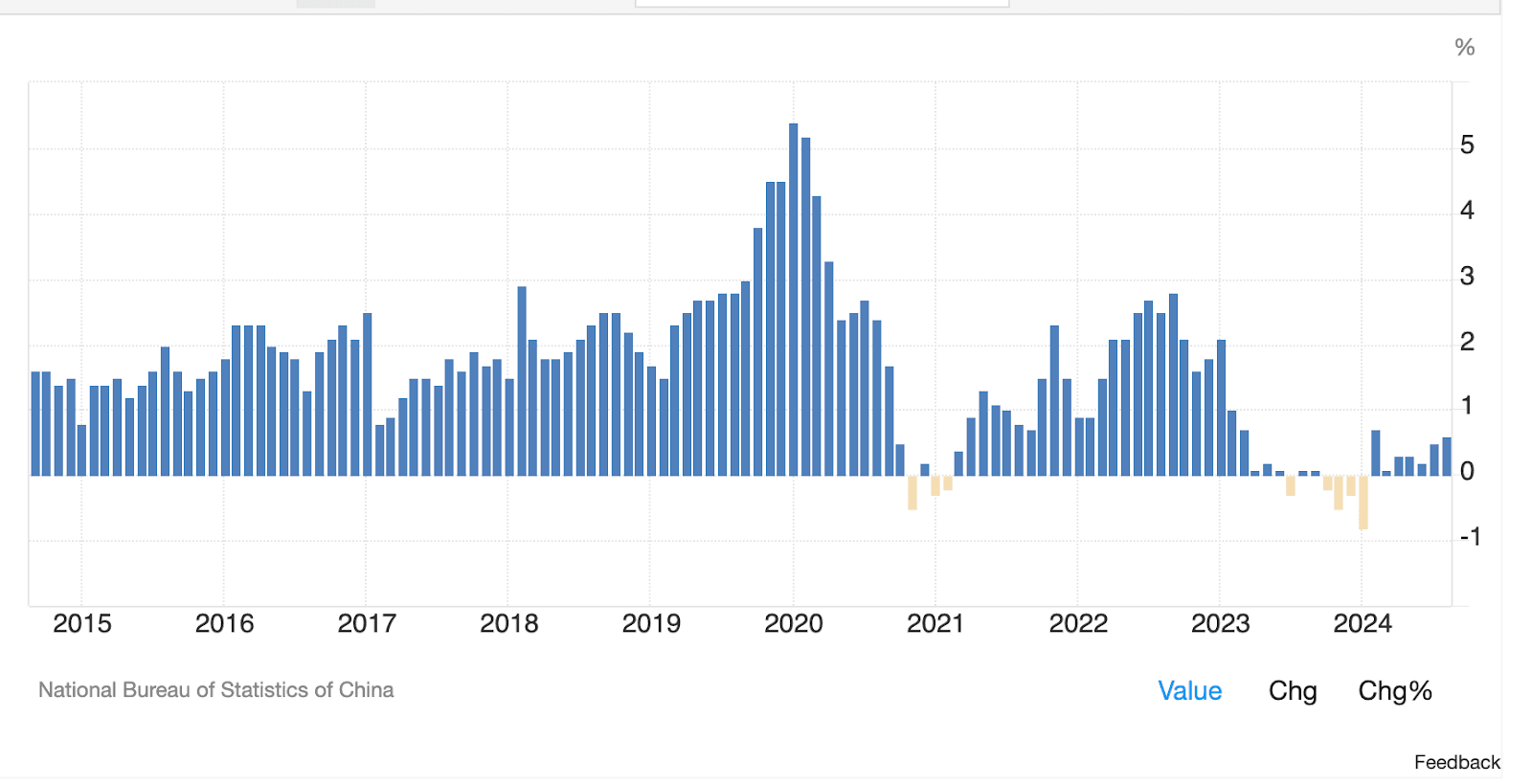

China has had a flat or even deflating inflation rate, compared to what used to be the worldwide powerhouse for economic growth.

The nation’s stagnation can be attributed to a number of factors. China’s primary reason for stagnation is because it is still in its early stages of balance sheet recession. (As was explained in an episode from Forward Guidance).

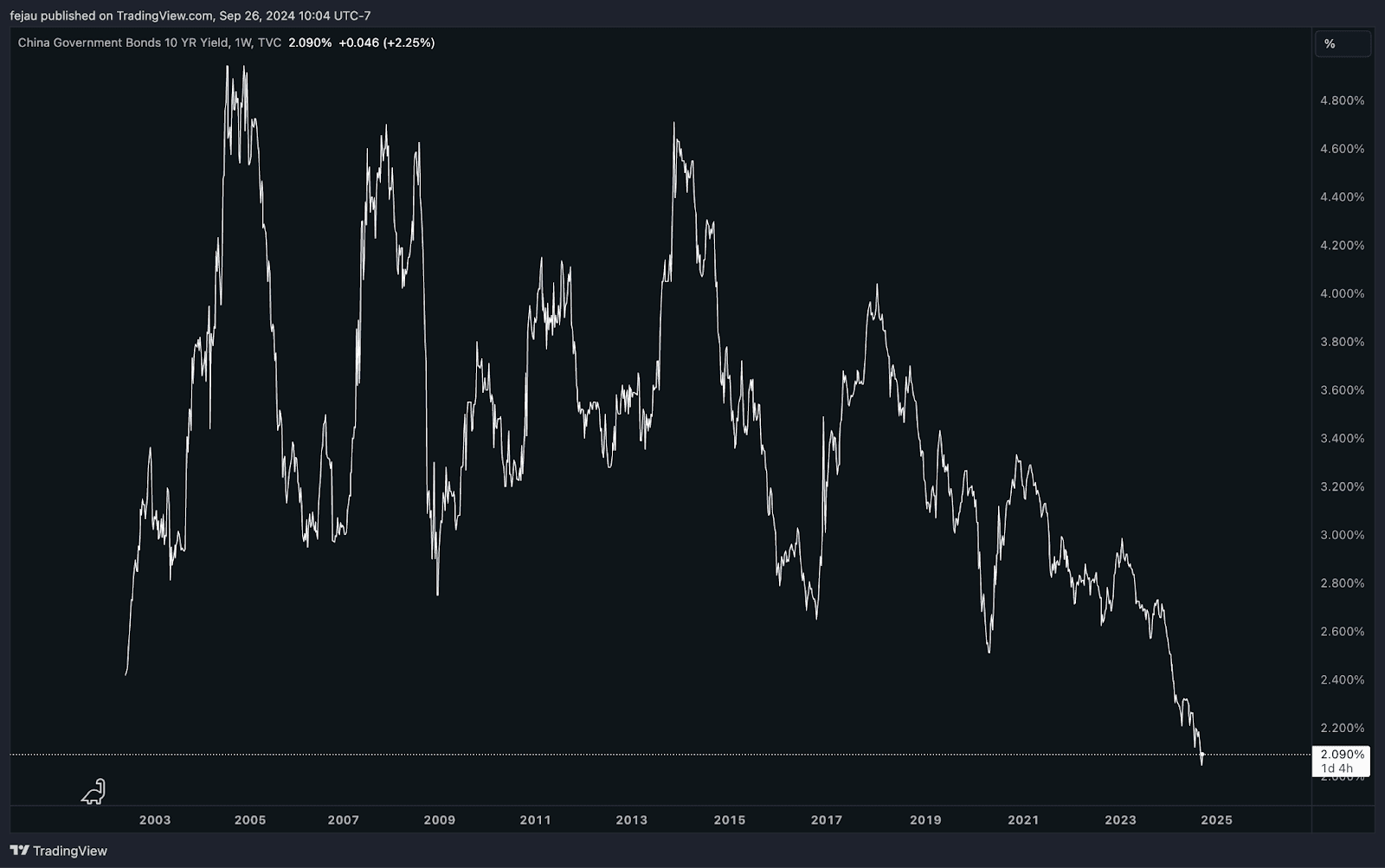

Richard Koo called it a balance sheet recession. This occurs when private sector debt levels are so high that businesses and consumers focus their attention on repayment of debt instead of spending or investing. The result is economic stagnation. The need to fix balance sheets is the hallmark of this recession. Conventional monetary measures like lower interest rates are less likely to be effective and fiscal policies could be more critical for recovery.

China’s recent balance sheet recession has accelerated, leading some to conclude that China may not achieve its 5% annual GDP target. As Chinese stocks continued to bleed, this led to Chinese bonds yields crashing in a “flight to safety” trade.

Since the US Fed’s first rate reduction and cutting cycle started, China has been able to increase its stimulus spending. China’s currency risk is reduced as both governments ease simultaneously.

The Chinese government announced two new fiscal and monetary policies in quick succession.

Monetary policy

- Cut Reserve Requirement Rate (RRR): Reduced by 50 basis points to increase lending activity.

- Reduced mortgage rate: reducing interest rates on existing mortgages as well as lowering the down payment to 15% for all home types.

- Pan Gongsheng of the PBOC has announced new lending tools to increase buying pressure in Chinese equities.

Fiscal Policies:

- Plan to issue sovereign bonds worth up to $284 Billion as part fiscal stimulus.

- Budget spending orders: President Xi issued an order to spend enough money on the budget, and details are expected in October.

- A government announcement said that China would distribute an one-time grant to those who are disadvantaged ahead of the national holiday scheduled for next week.

China has made it clear that they will do everything in their power to improve the situation. China is able to cover its currency costs because all global central banks (except Japan) are currently on an easing policy.

What will be the answer to this big question? We don’t really know. The FXI ETF (iShares China Large-Cap) has risen 16% in the last five days. This is a good sign.

— Felix Jauvin

$84.4 Million

Farside Investors data shows the inflows BlackRock’s Bitcoin spot ETF recorded on Tuesday. This figure beats the previous record of daily inflows for a single ETF set back in September.

IBIT’s inflows coincide with a wider trend of spot Bitcoin ETFs being issued in the US. Inflows have been recorded by the 11 products over the past 5 trading days.

Wall Street’s expectations from August PCE Report

Tomorrow morning, the preferred inflation indicator (PCE), which is used by the Fed to gauge inflation trends, will drop.

What are the analysts expecting? And how would we interpret different results?

In August, the headline PCE will be 2.3% more than it was in July. The headline PCE is expected to be 2.3% higher year-over-year in August.

Analysts predict that core PCE, excluding volatile energy and food prices, will increase by 2.7% annually. This is a slight improvement from the 2.6% recorded in July.

Preston Caldwell is a senior US economist with Morningstar. He forecasts a PCE increase of 0.15%. Core PCE is expected to have increased by 1.9% annually over the last three months, and 2.4% in the past six.

Caldwell predicts that if his predictions are correct, the FOMC will be able to make two more 25bps cuts in rates, in November and December.

The latest dot plot indicates that the majority of committee members expect us to end 2024 at a 50bps reduction from where we are now. Fed fund futures market on Thursday set the odds for a 50% cut in November at 53%.

This report will be available at 8:30 AM ET, Friday. On the Margin has a recap of the report.

Harris Democrats silently court crypto industry

Vice President Harris has continued to signal cautiously to voters who are interested in crypto that she will be more supportive than the present administration.

Harris, in a speech delivered Tuesday night at the Economic Club of Pittsburg (Pittsburgh, Pennsylvania), promised to lead the US under her direction. “remain dominant in AI, quantum computing, blockchain and other emerging technologies.”

These comments are part of a larger effort by the Democratic Party, to alter the perceptions about crypto. Elizabeth Warren is a senator who has been a fierce opponent of the crypto industry on Capitol Hill. She told Semafor, she “has no problem with people buying and selling crypto.”

“We need to make sure we have curbs in place, like we do in every other part of our financial system, so that crypto can’t be used by terrorists, drug traffickers and rogue nations,” “She added. Warren is more Warren-like than ever before.

Still, the shift from Dems — slight as it may be — is significant.

Please note that I do not believe that Harris will be the crypto-friendly president. (I did not say that either about Trump). Trump’s effort to attract the industry has, according to me, forced Harris’ camp to discuss the issue. Now, both candidates are talking about digital assets.

Even a year before, I never imagined this.

Although I would not hold my breath, maybe we will see a formal, crypto-based platform now from one or the other.

Bulletin Board

- Worldcoin’s WLD native token has surged in value following reports that OpenAI may be looking at a business model based on profit. Sam Altman is the CEO of OpenAI and also co-founder at Worldcoin. Worldcoin is a cryptocurrency that uses biometrics for identity confirmation. WLD’s price has increased by 4% within the last day and 30% during the week.

- A newly unveiled indictment shows that New York City mayor Eric Adams is facing five federal charges of public corruption. Adams, who was once viewed as a crypto-friendly politician, had promised to receive his first three paychecks in 2022 in cryptocurrency. This plan, however, was foiled by the US Department of Labor.

- Gary Gensler, SEC chair and Mark Cuban, billionaire investor, posed together on the CNBC set for Squawk Box. The photo may have been taken either before or following Cuban’s announcement that he would like Gensler’s position.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.