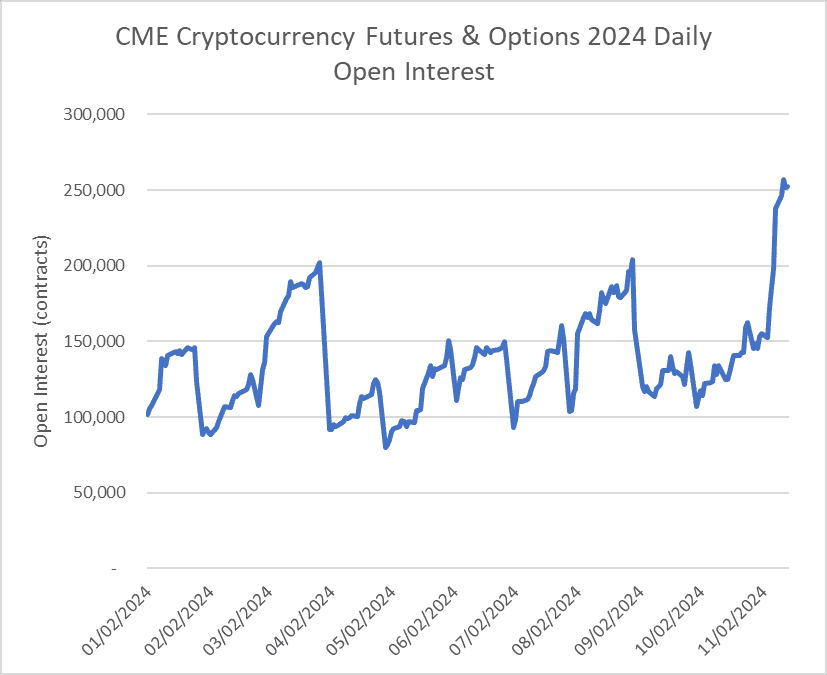

CME’s Crypto unit has barely reached the halfway point of this month, but it is already enjoying its best performance since it first launched Bitcoin futures contracts in 2017.

CME data is something I look up to find out where traders, institutions and banks are investing.

Gio VIcioso is the head of CME Crypto. It turns out that the company is averaging “a little bit over $10 billion a day across our futures suite.”

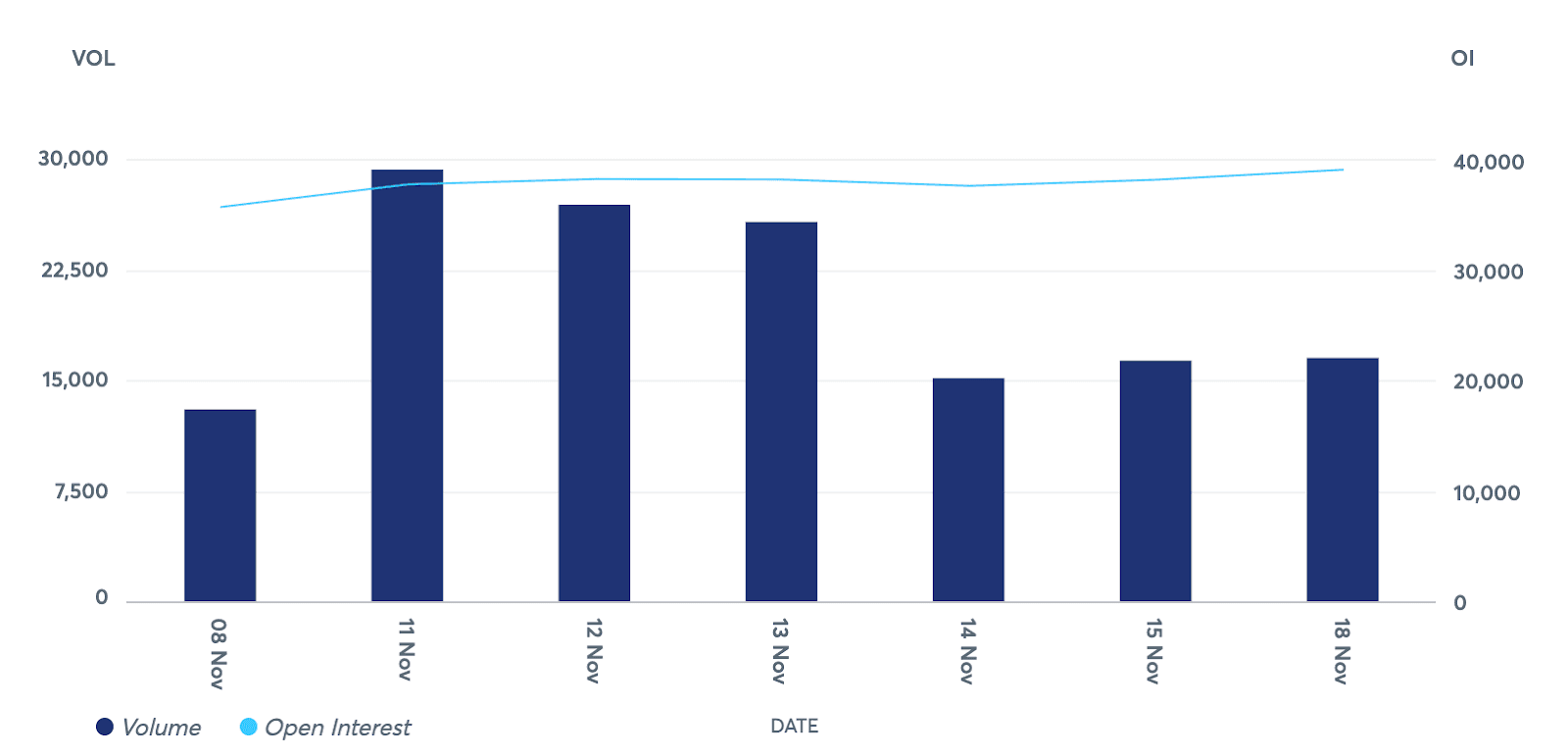

“Just comparing November this year to last, our volume and contract terms are up more than 5x … and then we’re also seeing increases or records in terms of open interest, where November is also the record month, averaging more than 166,000 contracts. And that’s up 60% compared to October, and up over 3x compared to November 2023,” Vicioso said.

The large bitcoin contracts offered by CME are becoming so big that investors — primarily retail — are turning to CME’s micro bitcoin contracts.

“Now we’re seeing an increase in volume in terms of our micro contracts, where those contracts, over the last couple weeks, have been averaging more than a billion dollars a day. When we look at the year, our micro bitcoin contract was averaging between $200 to $300 million per day, and we’re also seeing an uptick in terms of the representation of that smaller contract to the larger contract, whereas for the year, micro bitcoin futures volume represented roughly 6% of bitcoin volumes,” He said.

“Over the past few trading sessions, we’ve seen a micro contract represent now north of 15% or so of the large bitcoin contracts. We’ve really seen increases across the board.”

Vicioso said that the participants are mixed. The distribution of buyers for micro contracts is fairly equal between retail and institution, given the higher margins. “manageable” number. In this case, the institutions could test out new strategies or fine-tune their exposure.

There is an increase in volatility for both bitcoin and ether. Vicioso said it’s “par for the course” And isn’t very worried. The momentum that we have seen with bitcoin this year has been a consistent trend.

Large Open Interest Holders — which means any entity holding over 25 contracts — is soaring. CME has recorded around 600 “large open interest” holders for their contracts as of last Friday.

“So both our standard BTC and ETH contracts, as well as our micro BTC and ETH contracts, all achieved records in terms of the number of large open interest holders holding those contracts,” Vicioso said.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.