oneshot1/Shutterstock modified by Blockworks

It is a section from the Empire publication. To learn full editions, subscribe.

Trump’s win might have you ever cooking up all kinds of worthwhile buying and selling methods.

It’s solely pure, contemplating it seems like we’re on the cusp of a brand new paradigm: for arguably the primary time ever, US regulators may take it simple on crypto and let innovation flourish.

And so the subject of danger urge for food got here up on in the present day’s Empire podcast episode.

Yano requested Eric Peters, CEO and CIO of each Coinbase Asset Management and One River, what he’d prescribe for a 30-40-year-old first-time crypto investor who has 1,000,000 {dollars} to allocate and a robust urge for food for danger.

“I would advocate for them to be overweighted to bitcoin and ether but have some exposure to solana. Maybe 50/35/15 [percent], something like that,” Peters stated. “[But] I think if you’re right on that trade, you’re gonna, at least for a period of time, wish you’d had a million bucks in solana.”

The query was actually posed inside the speedy context. Nonetheless, we are able to backtest Peters’ suggestion.

And even higher, plot it alongside Coinbase’s new benchmark crypto index COIN50, which is at the moment weighted 51.5% BTC, 23.4% ETH, 7% SOL with the remaining 18% or so unfold throughout 47 different altcoins together with DOGE, XRP, BCH and BONK.

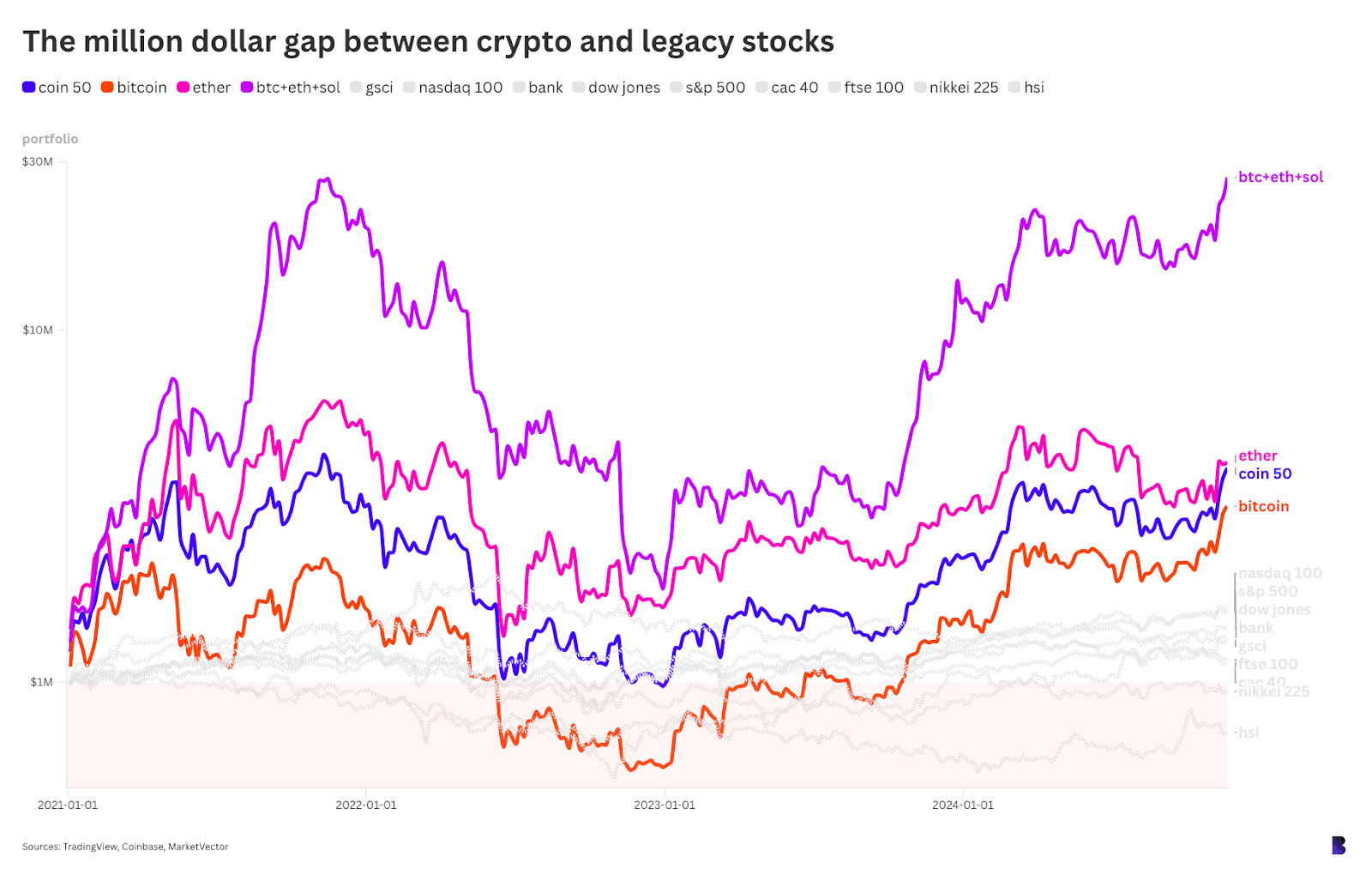

The above, in log view, plots the worth of that $1 million allocation from the tip of 2020, which is when COIN50’s efficiency information begins.

There’s certainly a component of time bias. The interval begins within the leadup to the epic 2021 bull run when SOL’s market cap was below $100 million (now $117 billion).

So, again then, it could be questionable simply how seemingly it could be to separate a million-dollar allocation between BTC, ETH, and a token so small in relative phrases.

In any case, the purple reveals the break up highlighted by Peters, which turned $1 million into $27 million and would now be at all-time highs for greenback worth.

ETH maxis had been second finest with $4.2 million. And whereas there are at the moment no ETPs monitoring COIN50, if there have been, that automobile would’ve transformed to a $3.8 million portfolio.

Somebody who aped 1,000,000 {dollars} in BTC in the meantime could be holding $3.15 million proper now.

For scale: Anybody who purchased an index fund monitoring any main benchmark from legacy finance would, at finest, be sitting on $1.64 million, through the Nasdaq 100.

That’s a minimal $1.5 million distinction between shares and crypto. It’s arduous to place a precise worth on danger urge for food, however that’s as stable a quantity as any.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.