Money and finance are big business. Business is good.

SEC filings will tell you how much money is being made in the cryptocurrency revolution.

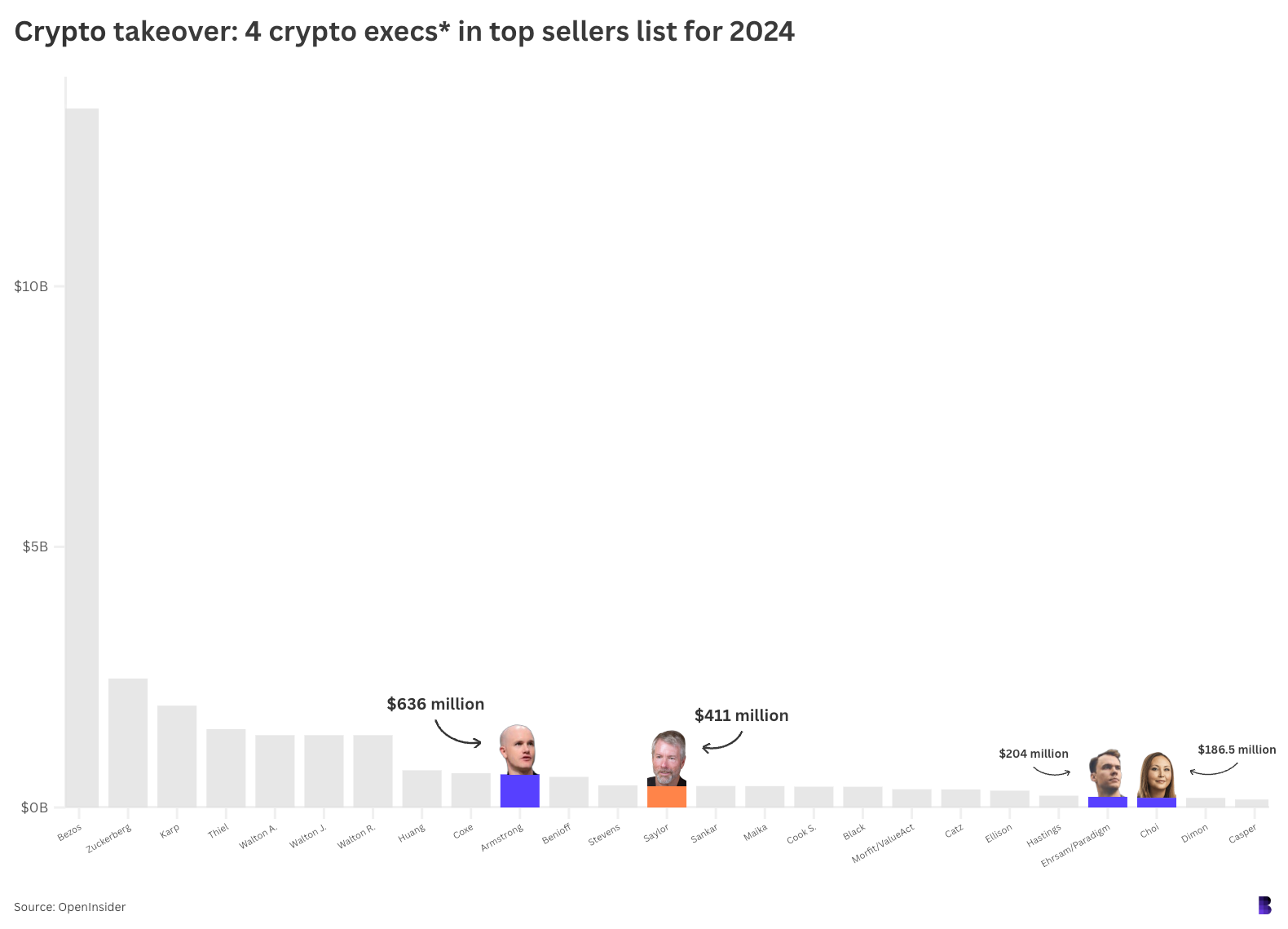

I spent the morning compiling 2024 insider stock sales for the top 60 or so companies in the S&P 500 (as well as a few other notables) and compared them to Coinbase and MicroStrategy.

From those firms — ranging from Apple and Nvidia to Costco and Walmart, to Palantir and Morgan Stanley — about 500 insiders, executives, investors and other major shareholders reported selling a combined $36.9 billion in company stock.

Jeff Bezos, the Amazon CEO and chairman was directly responsible for 13.4 billion dollars or more than a third of this total.

Mark Zuckerberg of Meta and Palantir, who founded the company, earned $2.5 Billion, while Alexander Karp, Peter Thiel, and Peter Thiel, co-founders, each received $1.9 Billion and $1.5 Billion, whether they did it directly themselves or by using trusts, funds, etc.

Even so, four cryptocurrency executives found themselves among the top 25. Coinbase’s Brian Armstrong came in eighth place with $636.8 million. MicroStrategy Alpha Bull Michael Saylor was 13th at $410.8 millions.

Fred Ehrsam, co-founder of Coinbase, came in 22nd with $203.8 millions. This includes COIN shares that were sold through his trust and his Paradigm fund.

Emiliechoi, Coinbase’s Chief operating officer and former LinkedIn employee who joined in 2018 with 186.4 million dollars was the next highest earner after Ehrsam.

This is $3.4M more than Jamie Dimon of JPMorgan, and $22.6M more than Apple CEO Tim Cook or Alphabet’s Sundar Pichai.

Coinbase ranked seventh in insider sales last year for the companies that were analyzed (at least).

- Amazon: $13.5 billion.

- Walmart: $4.84 billion.

- Palantir: $4.14 billion.

- Meta: $2.72 billion.

- Nvidia: $2 billion.

- Salesforce: $1.27 billion.

- Coinbase: $1.25 billion.

- Oracle: $842 million.

- Apollo: $630.6 million.

- Intuit: $593.9 million.

- MicroStrategy: $567.8 million.

- Netflix: $528.3 million.

As for this year, I’d watch for MicroStrategy to flip Coinbase — should Saylor’s bitcoin plan really start to pay off.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.