When analyzing crypto shares, chatting with a co-portfolio supervisor of the long-running blockchain-focused Amplify Transformational Information Sharing ETF (BLOK) makes for an excellent convo.

Dan Weiskopf instructed me he’s extra optimistic about 2025 now than he was about this yr on the finish of 2023.

A predominant cause? The “crazy opportunity” for BLOK buyers that’s set to come back as extra pure-play crypto corporations go public.

Some anticipate stablecoin issuer Circle could possibly be among the many subsequent to take action. Weiskopf additionally has his eye on Determine Applied sciences.

Whereas a number of extra bitcoin miners might additionally go public, that’s a crowded discipline, Weiskopf famous. However BLOK would contemplate holding cloud-computing agency CoreWeave — considered one of mining big Core Scientific’s largest purchasers.

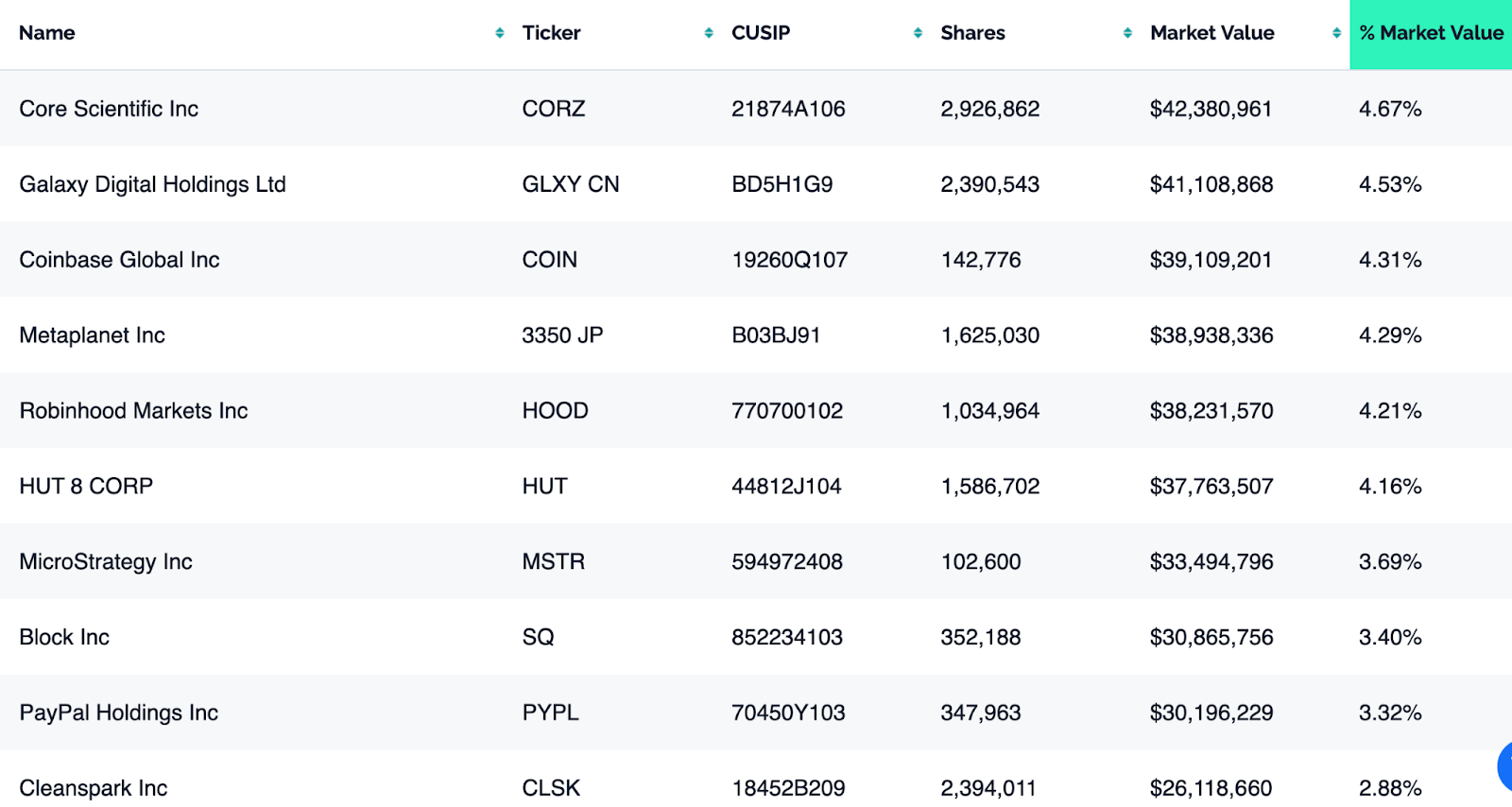

Talking of Core Scientific, that inventory — up ~320% yr so far — is BLOK’s No. 1 holding (4.67%). One other attention-grabbing miner to Weiskopf is Hut 8 — the ETF’s sixth-largest holding, at 4.16%.

“I think we did a really good job repositioning and recalibrating amongst the miners in capturing the diversification into the AI side of things,” the PM stated.

Hut 8 is weighted barely above MicroStrategy — a inventory set to enter the Nasdaq 100 index subsequent week (I’ll write extra about that on Monday). BLOK began shopping for MSTR in August 2020 (when it was $14), Weiskopf and co-PM Mike Venuto famous.

MSTR shares had been buying and selling round $350 this afternoon (up greater than 400% YTD). Benchmark analysts on Monday upped their value goal for the inventory to $650 after MicroStrategy elevated its bitcoin holdings to 439,000 BTC.

That stated, Weiskopf and Venuto not too long ago decreased BLOK’s publicity to MSTR and CORZ because the shares “rallied past our weighting limits,” they added. In different phrases, they’re trimming the winners in hopes of transferring into different successes.

On that diversification level: Because the BLOK cash managers await extra IPOs in 2025, they began shopping for Japan-based Metaplanet final month.

Whereas extra corporations are including BTC to their treasuries (~60 by Weiskopf’s depend), many are small. So-called “zombie companies” aren’t more likely to bounce again simply because they’ve purchased the crypto asset, he stated.

“They make a headline, but do they have a real strategy?” Weiskopf added about evaluating these BTC purchasers.

He argued that Metaplanet, which in April unveiled its intent to emulate MicroStrategy’s efforts, is one dedicated to those BTC buys. The corporate stated this week it might situation 5 billion yen in bizarre bonds to speed up bitcoin purchases.

So, for these monitoring crypto shares, BLOK holdings seem value peeking at. After which there’re the yet-to-arise alternatives throughout what could possibly be a transformative yr for the phase.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.