You probably know that ETH was cursed. Doomed.

Maybe you’ve read tweets that say Ethereum is destined to go the way of Intel — a stock that has collapsed in value by two-thirds over the past five years while competitors (Nvidia and AMD) have thrived by comparison.

The take only works when you concentrate solely on the price, and disregard how much Ethereum activity continues and is spread across its web of layer-2s or layer-3s.

Ether only gained 30 percent in the last 12 months, but its main rival SOL nearly doubled.

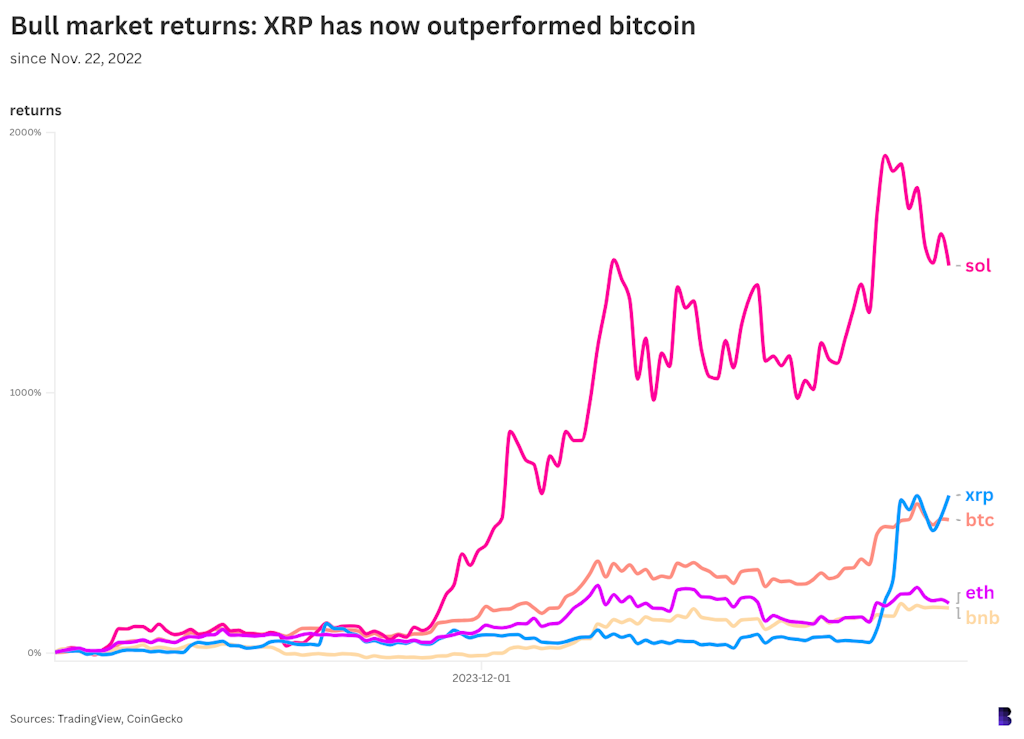

Even XRP is easily ahead of ETH on the bull-market to date. Since the end of the bear market, in November 20,22, XRP has risen more than 600%.

BTC, on the other hand, has gained around 500%. SOL is up almost 1500%. ETH looks a lot duller in comparison.

This is an alternative explanation: It’s not ETH that drives the relative performance of SOL, XRP and other coins.

Start with XRP. Ripple’s ongoing battle with the SEC, which began in December 2020, has kept XRP on the sidelines for this market cycle.

XRP has made gains since Trump won in November, but they are more due to the fact that it is catching up on the market rather than any special features of the asset.

When it comes to SOL, you should look at the history of the crypto-top end.

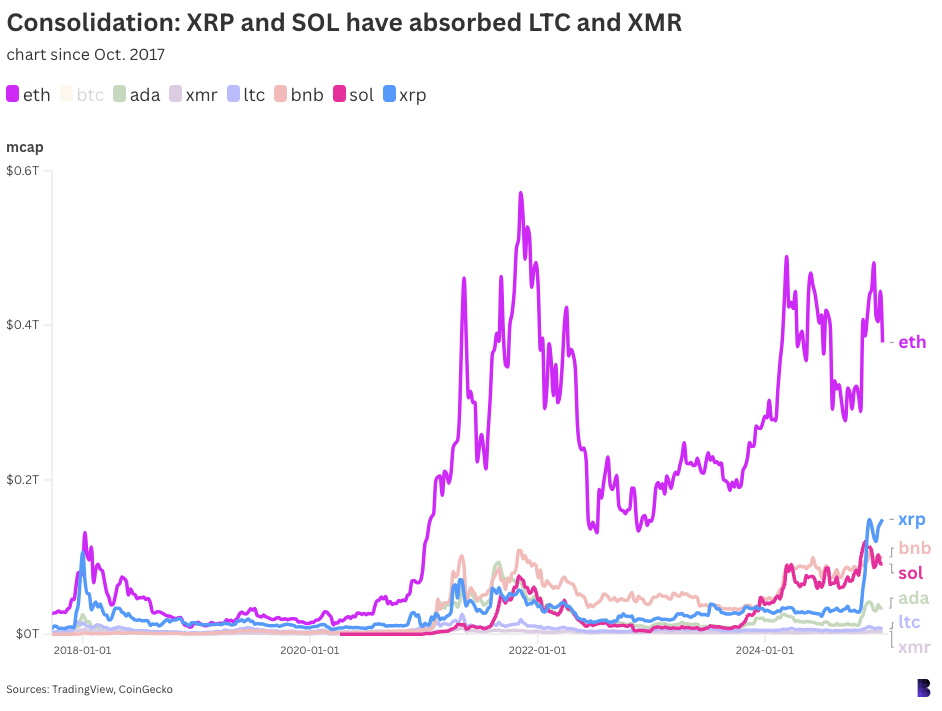

In general, since 2016, the three top coins are BTC, ETH, and XRP.

In 2017, litecoins (LTC), and monero(XMR) were the second most valued cryptocurrencies. These, as well as bitcoin cash and cardano in 2018, EOS in 2019, BNB in 2021.

LTC is now in 27th place — much further down in the market — while monero in 37th and bitcoin cash 23rd.

Compare this chart with the one above, which was a simple price-based graph. It tracks the market caps of the top end of the market — and it makes clear just how much smaller all those coins are to ETH.

At certain points in the cycle, it’s not surprising that ETH outperforms them. Liquidity doesn’t always correlate with market capitalization. However, small assets need less new capital to get the ball rolling.

The fact that LTC, XMR, and BCH, which are all Bitcoin alternatives, dropped so drastically between cycles is also no coincidence.

Bitcoin won as the best store of value, and stablecoins have emerged that better serve the use cases for digital payments than litecoin.

Whatever mind and market share the major coins from yesteryear — the ones that never found product-market-fit at scale — may have simply been transferred to Solana.

The Solana Renaissance is less about the impending demise of Ethereum and more about the diminishing importance of older coins.

Ethereum could also be added to the list. “much older coins” sometime down the line — handwaiving that concern requires entirely different cope. Please let me return to you.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.