Ethereum (ETH), which has lagged behind Bitcoin in its impressive rise to new highs, has underperformed during this cycle. Bitcoin continues to make headlines for its impressive surge. ETH, on the other hand, struggles to reclaim their yearly highs. Many investors are left wondering what its next move will be.

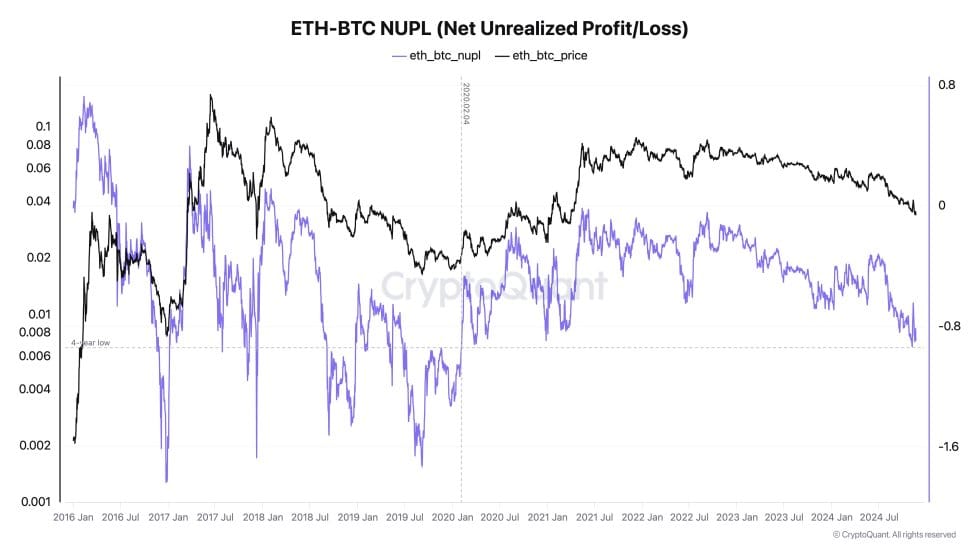

Despite the lackluster market action, CryptoQuant CEO Ki Young Ju’s data reveals a bright spot for ETH investors. Ju says that many ETH investors have unrealized gains, akin to ETH’s low point in early 2020 before its explosive bull market. According to Ju, the current market conditions may offer a unique investment opportunity for ETH long-term investors.

Related Reading: Bitcoin Euphoria Is Here – CryptoQuant CEO Expects A Parabolic Bull Run

Ju’s analysis shows that historically, significant price recoverys have followed phases of unrealized losss. The potential gains for Ethereum if it starts to gain momentum, and closes the gap between Bitcoin and Ethereum, could be huge. This could signal the start of a trend upwards for investors. Those who are patient and remain calm during this period of consolidation will be rewarded.

With market sentiment shifting and historical data supporting a bullish case, ETH’s next move could be pivotal. Investors and analysts are closely watching ETH’s price action in hopes of signs of a breakout which could reignite ETH’s momentum and deliver significant gains.

Last Chance To Purchase Ethereum

In recent weeks, Ethereum’s price has been showing signs of bullish movement despite its underwhelming performance in this cycle. ETH’s price has remained fairly stagnant compared with Bitcoin’s explosive rise. Despite this, there are some optimistic signals that suggest it could be your last chance to buy ETH before its price starts to rise.

CryptoQuant CEO Ki Young Ju’s critical data sheds light on a fascinating development: The ETH-BTC NuPL (Net Unrealized Loss/Profit) has reached a four-year low. This means that despite Ethereum’s lagging against Bitcoin, a large number of ETH holders have unrealized loss.

Source: Ki Young Ju on X| Source: Ki Young Ju on X

Source: Ki Young Ju on X| Source: Ki Young Ju on X

This is similar to Ethereum’s bottom in early 2020 just before its explosive rally. Ju believes this period of underperformance could present an opportunity to long-term ETH Investors, as it may set up a possible surge.

Ju notes, however, that Ethereum’s success is heavily dependent on revenue generated through Web3 apps, and in particular stablecoins. The ecosystem is still promising but it feels highly leveraged. It’s also not likely to be resolved anytime soon.

Related Reading: Excess Global Liquidity Fuels Bitcoin Growth – Key Data Reveals M2 Is Rising

Over a one-year timeframe, Ju finds ETH less appealing than BTC, although regulatory clarity in the future could change the dynamics and enhance Ethereum’s appeal. For now, the period of consolidation offers ETH enthusiasts a chance to take a position before price fluctuations.

Testing ETH is a Crucial Demand

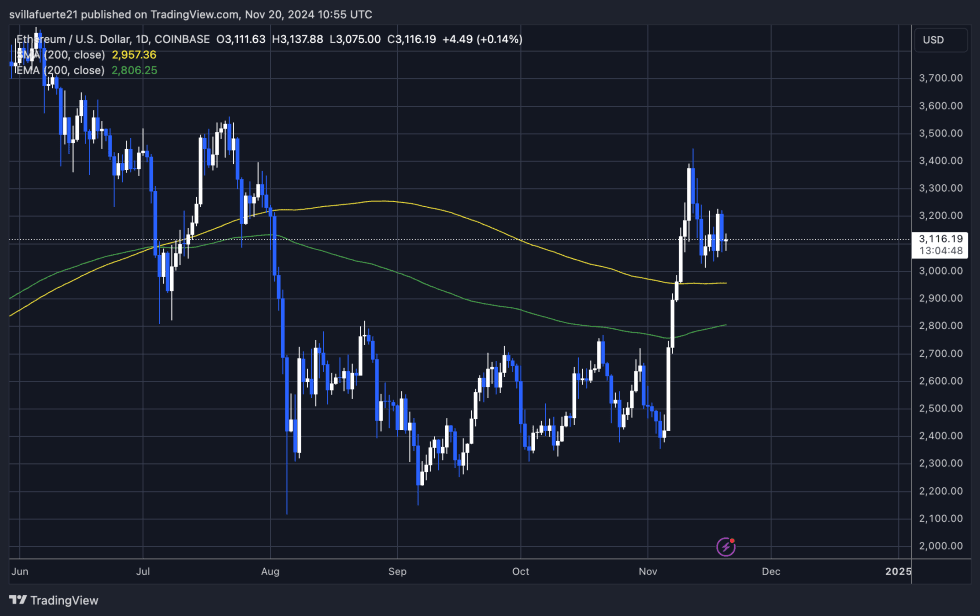

After several days of consolidation in a sideways direction, Ethereum has traded at $3.120, just below its $3.446 local high. This consolidation indicates that ETH may be preparing to break out, especially after its recent surge over the 200-day moving median at $2,957. It is crucial to maintain bullish momentum by holding above this important support level.

TradingView: Chart of ETHUSDT above $30,000 and 200 day MA| Source: ETHUSDT chart on TradingView

TradingView: Chart of ETHUSDT above $30,000 and 200 day MA| Source: ETHUSDT chart on TradingView

If Ethereum remains above the 200-day moving median and continues on its upward trajectory then the next major resistance area will be the local maximum at $3,446. If ETH is able to break out above this level, it could challenge its yearly highests and potentially reach the $4,000 mark.

Related Reading: Bitcoin Surpasses $1.79 Trillion Oil Giant Saudi Aramco – Can BTC Climb Up And Pass Gold?

The current price movement indicates a strong demand foundation above $3,000. If ETH can sustain this level, a bullish rally could be triggered. Failure to hold above this 200-day average could result in a return to lower support levels like $2,900, or even $2,500.

As of right now, ETH is poised to move higher. Traders are closely watching for confirmation of a break out of new highs.

Chart from TradingView, Featured Image from Dall-E

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.