Fidelity Digital Assets’ 2025 outlook report addressed a common question from investors: “Is it too late?”

It’s not absurd, considering BTC recently reached an all-time record high over $108,000. It’s always more exciting to buy before the big move.

Chris Kuiper, Fidelity Digital Assets’ research director, mentions that he is starting to see the effects of digital assets. “early signs of mass diffusion and adoption.”

“He adds” “Although this process will likely take decades, 2025 has the potential to be the year that is looked back on as the pivotal time where the ‘chasm was crossed’ as digital assets begin to take root and embed themselves into multiple fields and industries.”

Kuiper points to the existing and discussed adoption of crypto by nation-states and corporations, as we have been tracking here over recent weeks.

“Therefore, it may be too late for the speculators that want another frenzy,” He explained. “However, we believe we are still incredibly early in terms of this new era of sustainable adoption, diffusion and integration.”

You can also find out more about this by clicking here. “Am I too late?” The question brought back memories of my last-month conversation with Roger Bayston, a Franklin Templeton executive. This was also something that institutions were thinking about.

“We’ve seen this price run up and now I’m going to buy it?” he imitated an investor, who was questioning the logic of that statement and wishing to purchase cheaply.

There’s a positive regulatory atmosphere in the US. “plenty of run room,” Bayston added. Prices for BTC 2025 are expected to rise from $125,000 up to $200,000.

Kuiper wrote, “Beyond the possible regulatory catalysts,” that inflation may return in a new wave. (Given the resistance of inflation measures to returning to the 2% goal, large budget deficits and Fed’s rate cutting cycle)

“If a recession does occur, it will likely be responded to with additional monetary and fiscal stimulus, which historically has been good for bitcoin,” Earlier, he had noted. “If risk assets continue to appreciate and inflation continues to run above the 2% target, bitcoin will also likely do well.”

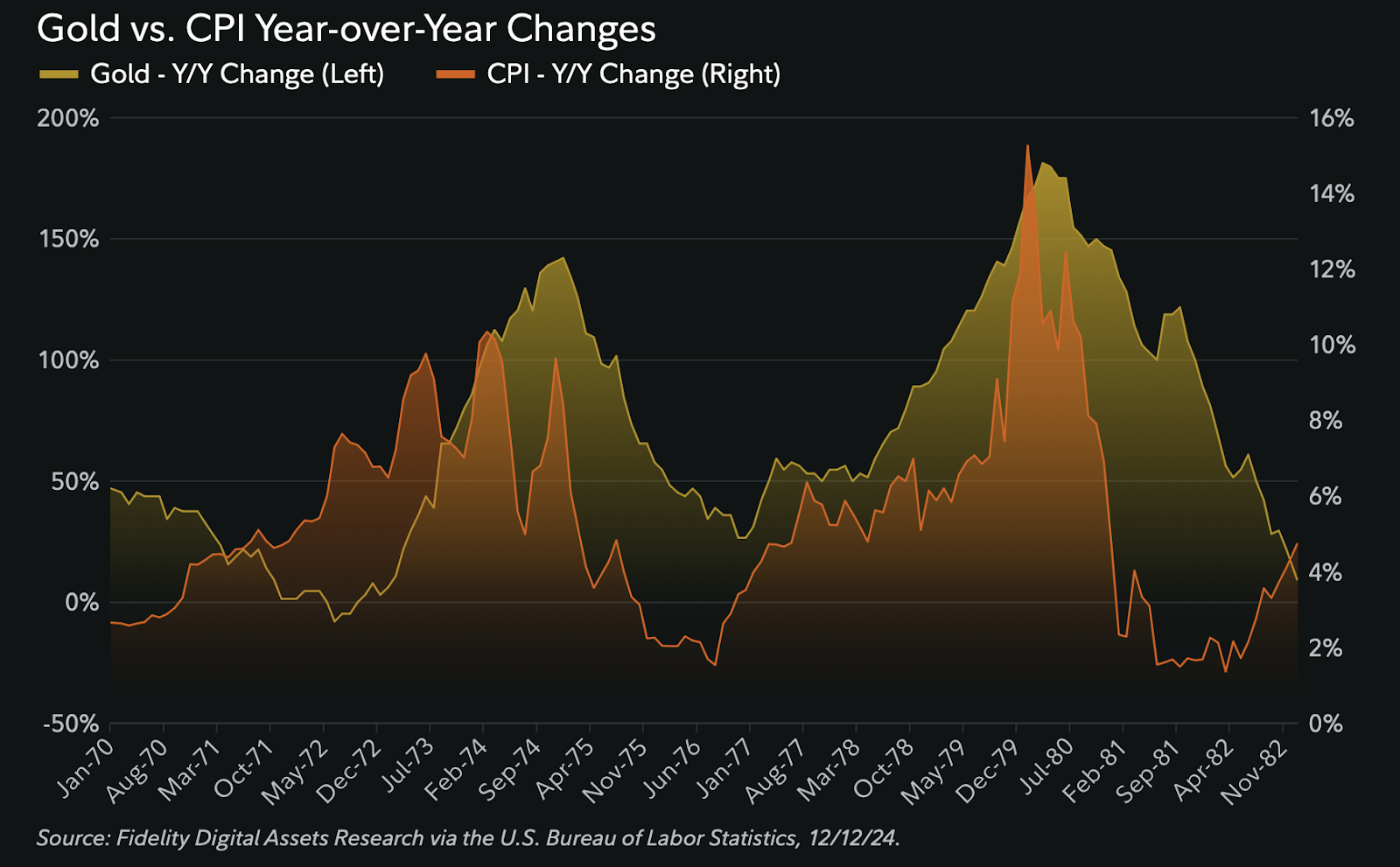

Kuiper also says that BTC never really experienced a stagflationary situation. Fidelity Digital Assets has a chart that shows the performance of gold during the period of stagflation in the early 1980s. The chart shows that gold rallied most in the second inflation wave, which could be a good indicator of how bitcoin will behave.

BTC currently sits 13% lower than its previous high. Future corrections could provide additional opportunities to buy.

Brady Swenson of Swan Bitcoin said the market appears to have priced in largely the creation soon after Trump assumes office of a Bitcoin reserve.

In an email, he added: “If that does not happen quickly, the inauguration could actually be a ‘buy the rumor, sell the news’ event, which would send bitcoin price temporarily downward.”

This is not investment advice. You don’t need me to tell you that none of this is investment advice.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.