It has been a few minutes since we last checked in with the tokenized fund world.

Late Friday, UBS — the Swiss bank with $5.7 trillion in assets under management — announced that it was launching uMINT, or the UBS USD Investment Fund built on Ethereum.

“Tokenholders can now access UBS Asset Management’s institutional grade cash management solutions underpinned by high quality money market instruments based on a conservative, risk-managed framework,” According to the press release, It’s not clear what instruments will be used to make the fund. Other popular funds currently hold US Treasurys.

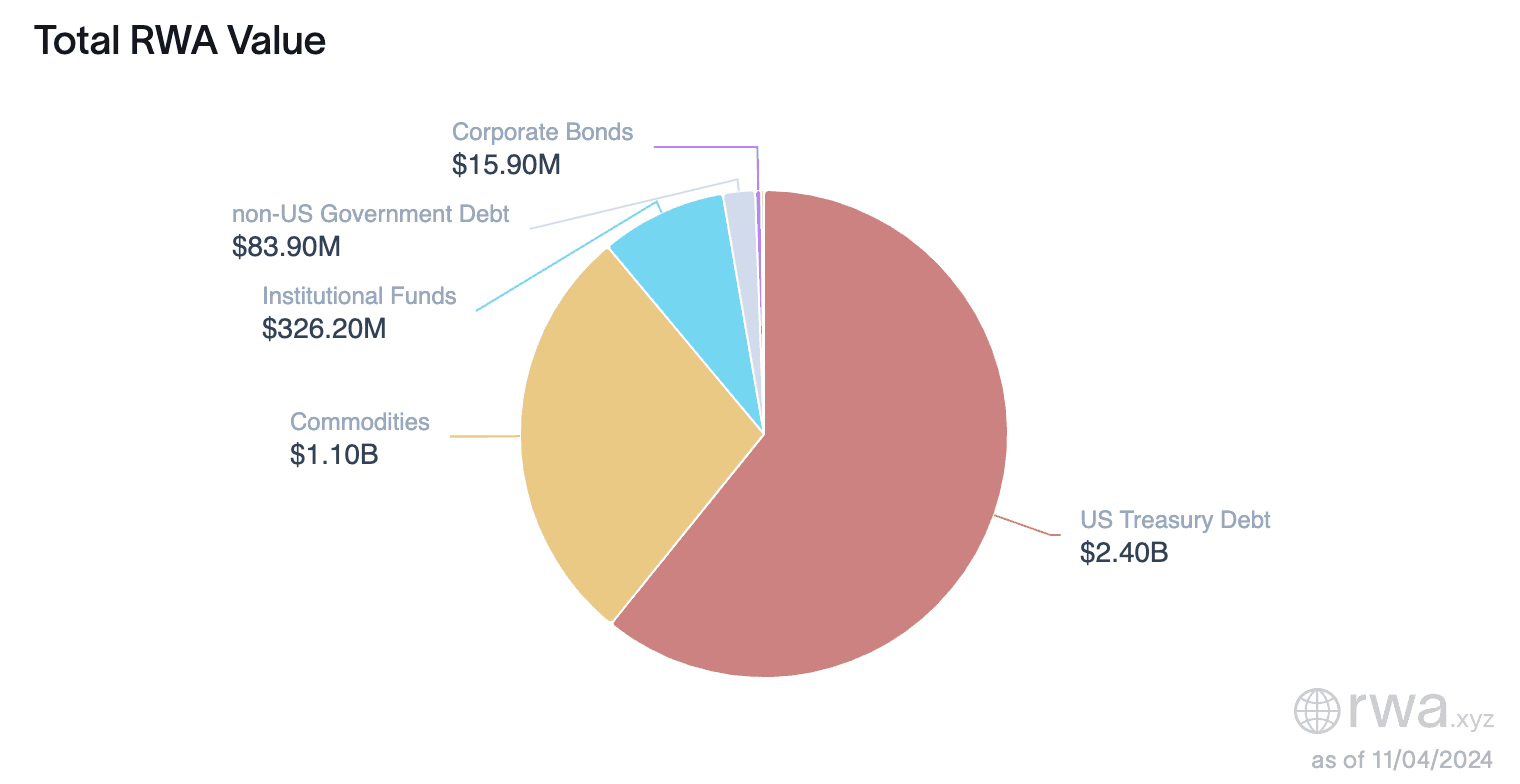

RWA.xyz data shows that US Treasury debt accounts for $2.4 billion in total real-world assets, while commodities are second with $1.1 billion. The chart below does not include Treasurys held by stablecoins like Circle and Tether.

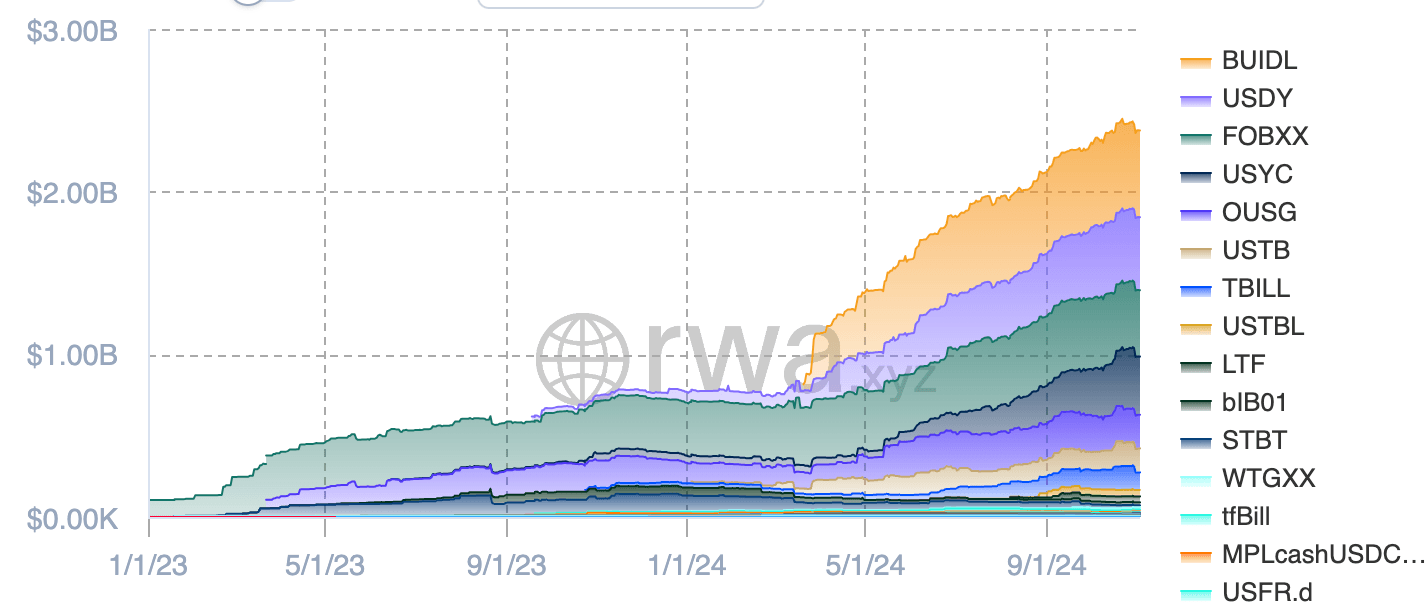

Thomas Kaegi, co-head of UBS Asset Management APAC acknowledged the “growing investor appetite” In the space. Three firms currently dominate the tokenized-fund space: BlackRock via its Securitize partner, Franklin Templeton, Ondo.

Ondo, with a market cap of $655 million, is the largest fund. Securitize, which is only $533m short of BUIDL’s total market capitalization (which is $655m), is about 100m away. Franklin Templeton’s market cap is approximately $408 million.

UBS acknowledged this launch as a sign of its seriousness about tokenization. It’s not a surprise, since it is also a participant of Project Guardian (the Monetary Authority of Singapore’s tokenization trial) and had previously partnered in China to issue tokenized bills.

It’s also worth noting, outside of UBS that Securitize has surpassed $1 billion tokenized RWA onchain in the past week. BlackRock has had success with its tokenized fund, which I have already mentioned. Franklin Templeton has launched its OnChain US Government Money Market Fund.

The tokenization space is certainly a hot topic.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.