The end is near

Ripple’s fight with the SEC is almost over. It’s real this time.

The reason I said nearly is that although Judge Analisa Tores handed down her final judgement yesterday, both parties still have the right to appeal.

Torres said Ripple must pay $125m in penalties late yesterday. The sum is way below the $2 billion sought by the SEC — and that figure does not include disgorgement or prejudgment interest, of which the SEC sought massive sums of $876 million and $198 million.

Ripple Laboratories demanded $10 million when they retaliated against the agency. Consider this as a success for the crypto company.

One lawyer also told me the SEC would likely appeal the judgement.

If you look at the figures again, RippleLabs would probably be quite happy to pay an amount 94% less than that of multi-billion dollars. This is especially true given that it’s been a costly legal battle for the past several years.

The SEC, however, also believes that it has won a little bit. Email from an SEC spokesperson:

“The Court granted the SEC’s motion for remedies including an injunction barring Ripple from committing additional violations of the securities laws and significant civil monetary penalties totaling more than 12 times the amount Ripple suggested was appropriate.

As the Court found, the fact that Ripple has shown a ‘willingness to push the boundaries of the [Court’s summary judgment] Order evinces a likelihood that it will eventually (if it has not already) cross the line. The Court also addressed ‘the egregiousness of Ripple’s conduct’ and noted that ‘there is no question that the recurrent, highly lucrative violation of Section 5 is a serious offense.’

As court after court has stated, the securities laws apply when firms offer and sell investment contracts, regardless of the technology or labels that they use.”

Stuart Alderoty said, “Ripple Labs’ chief legal officer, Stuart Alderoty has stated that the company is committed to ensuring its customers are protected.” “respect” It is a judgment.

Ripple was banned by the judge. “further violations of the securities laws” The firm was also fined for violating Section 5 of the Securities Act, which deals with institutional sales. Torres, the judge who ruled the case last summer said programmatics sales are not securities. However, she did find that they met Howey criteria.

While the language around the securities violations is admittedly vague, one lawyer told me that it seems to apply only to the institutional sales discussed in the complaint — not to either of the individual sales from Garlinghouse or co-founder Chris Larsen (the SEC dropped its trial against them late last year), or to the programmatic sales or other distributions.

“To be clear, the Court does not today hold that Ripple’s post-Complaint sales have violated Section 5. Rather, the Court finds that Ripple’s willingness to push the boundaries of the Order evinces a likelihood that it will eventually (if it has not already) cross the line. On balance, the Court finds that there is a reasonable probability of future violations, meriting the issuance of an injunction,” “The court said.”

Ripple, therefore, can continue to follow this penalty.

So, one of crypto’s biggest problems may be finally resolved (unless there is a legal challenge).

Data Center

- The XRP currency is a cryptocurrency that can be used to buy and sell goods. The spike in the rate of increase has reached 27% After the news of settlement spread. The price has since fallen to $0.6112, a slight increase of 22 %.

- TAO is next, with an 8.3% gain over the day. Grayscale has announced that it will be releasing a new product. The new Bitsor Trust On Wednesday, along with one sui.

- HNT, FTN The following are some examples of how to get started: XLM Only a few of the 100 top coins gained between 8% to 2% in the week prior.

- The XRPL Ledger has about 300,000 payments per day XRPScan says that XRP is currently at a record low. This time, it recorded roughly half the amount.

- Around a hundred new accounts are opened per day. The network has recently processed tens of thousands. As much as $2.26 Billion in daily volume.

Wave ripple

Finally, the XRP Army can breathe.

Most of the decision was made. Now we are closer than ever – barring future Ripple labs slipups, or potential appeals relating to XRP sale to institutions.

Whether Ripple Labs selling XRP to retail — say via crypto exchanges or other such offerings — constituted investment contracts was the most dangerous question mark looming over the token. This was resolved in June last year (retail sales are not securities).

It was expected that the part of institutional sales would be a simple financial penalty. Ripple can afford to do this without going broke, as Katherine mentioned. It’s hard to argue that the future is bright for Ripple, its founders and XRP.

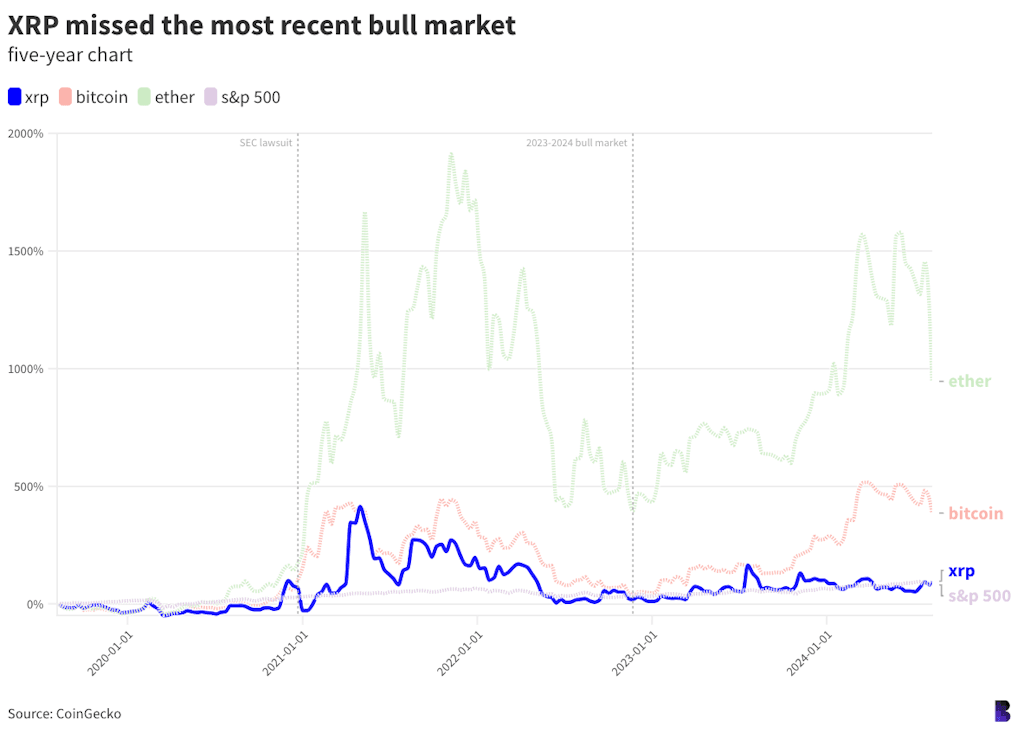

The relief couldn’t come soon enough. XRP missed the latest bull market even if they were able to capture the previous one.

XRP tracked bitcoin’s returns during the first half of the 2021 cycle — both went over 400% between August 2019 and May 2021.

It’s not so in our current bull-market, which, depending on your perspective, began after the worst part of the FTX crises passed, way back in 2022.

Notice that the charts above show bitcoin and Ethereum both increasing by hundreds percentage points during 2023, and in the first half 2024.

XRP has managed to achieve maximum returns of 150%. Its five-year performance to date has practically matched the five-year returns of the S&P 500, about 90%.

The reasons why XRP isn’t booming as much as other cryptocurrencies are many, but it still ranks seventh in terms of market capitalization at $34.5billion.

One reason could be that it is an old project amongst all the shiny, new protocols and networks. Another could be that stablecoins have made its primary value proposition — cross-border remittances — obsolete.

The current lore says that the institutions were also responsible for driving the bull market. How could these institutions drive XRP up if they made direct purchases of unregistered security?

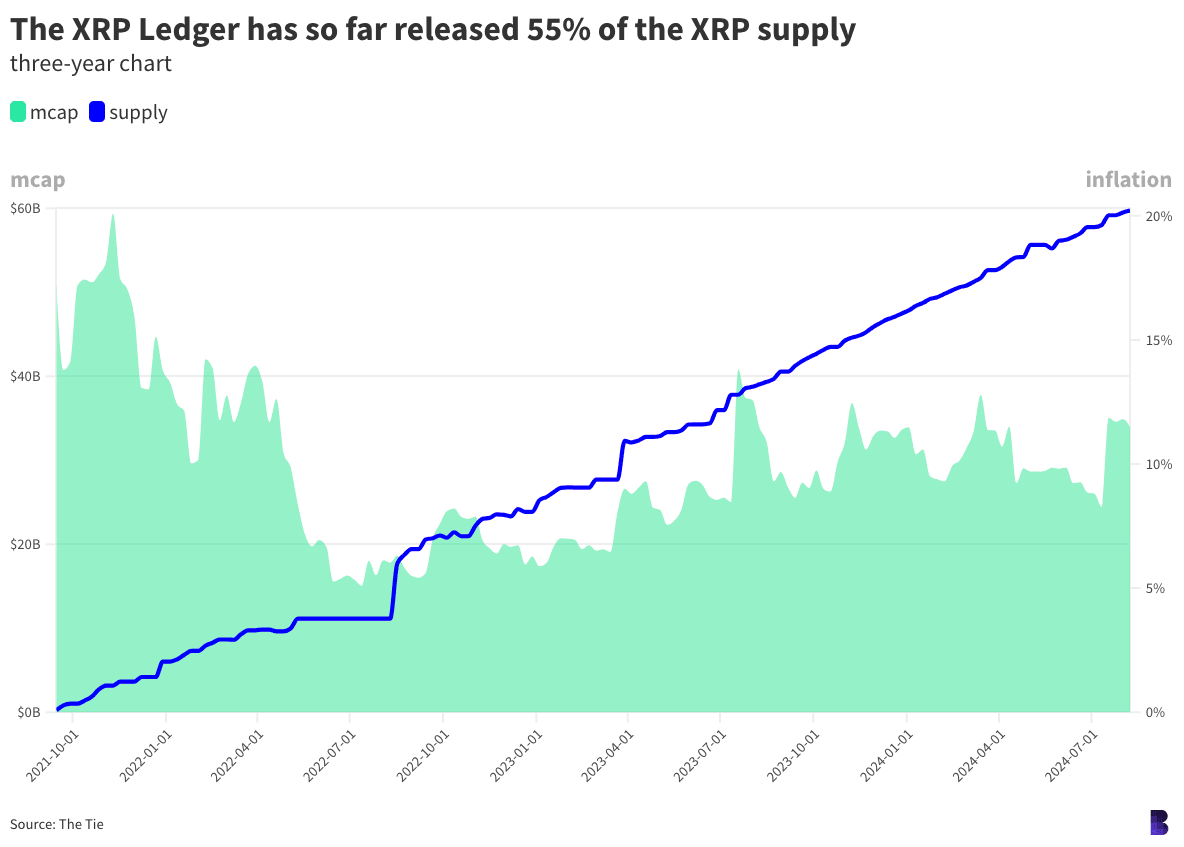

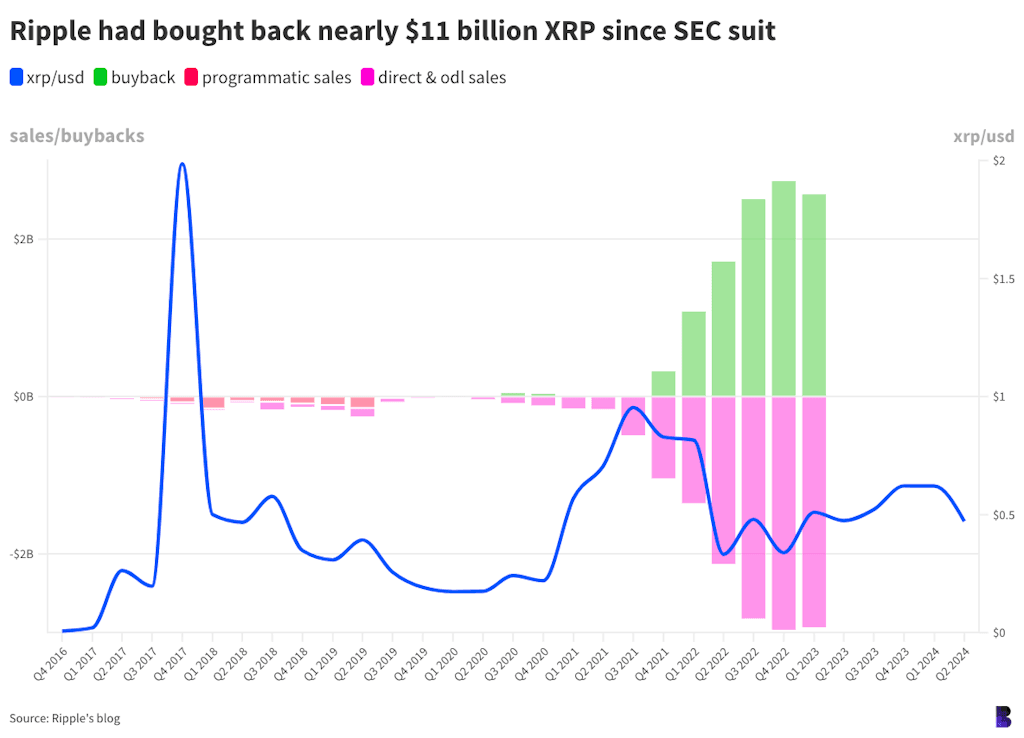

According to Ripple’s quarterly blog posts (and to other users of the ledger), the company has sold 14 billion dollars worth of XRP to institutional investors since the SEC lawsuit was filed.

Ripple Labs used $10.9 billion to buy XRP on cryptocurrency exchanges programmatically. Ripple spent 78% of its revenue on XRP market participation.

“Since 2020, Ripple has sourced XRP from the open market to ensure there is a sufficient supply of XRP available for our growing ODL business,” Ripple stated in an announcement a few decades ago.

“We continually strive to minimize undue market impact with our purchases by, for example, limiting how much and from whom we purchase XRP.” Initial descriptions of the firm’s buybacks were that they would be a method to “support healthy markets.”

Maybe sales, institutional adoption, and buybacks will flow more freely now that Ripple has its own mix of regulatory clarity. Enjoy the day.

The Works

- The judge has approved a $12.7 billion settlement. The FTX, Alameda Then, there is the CFTC According to a court document filed on Wednesday.

- Robinhood’s Crypto-revenue The company reported that sales grew 161%, to $81 million in the last quarter.

- Meltem DemirorsFortune reports that. formerly with CoinShares is seeking to raise $75m for a new venture fund.

- After the sanctioning, cooperation is required. Tornado Cash The effectiveness of the product was not very high. “mixed,” The New York Federal Reserve has found.

- MicroStrategy’s Michael Saylor Bloomberg reports that the man owns about $1 billion of Bitcoin.

The Riff

What is the future of crypto?

Crypto leads you to ask a lot of questions.

The threat of a $125-million fine out of the billions of dollars in revenue that could be generated is it a good deterrent for companies?

How many wins — either literal or spiritual — does it take for crypto to start ignoring the SEC all over again?

It is still a lot more than the $24 million Block.one spent on EOS’s initial coin offering.

Does this regulation provide clarity?

Ripple decentralizes itself?

It feels both like the end and the beginning of the XRP litigation.

I’m sure it moved the needle — we just might not find out in what direction we’re going until the next few cases are done, too.

Anywhere, everywhere!

The verdict is not only a great decision, but it also sets the standard for how cryptos will approach the SEC through their enforcement. This is a major case, even without considering the possibility of an appeal.

Coinbase, Binance and other companies will study this case to prepare themselves for their own fights.

The crypto community can now sleep well tonight. The court did not make any surprises in its ruling, but it stayed true to what was decided last summer. No doubt, $125 million was a large amount, but multimillion sounds better to me than multibilllion.

Then you will grow. This could prove to be a catalyst in the XRP market.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.