Terra would be a Maelstrom sized whirlpool, if Crypto were an ocean.

When the Maelstrom collapsed, as it did in May of 2022, there was a lot of chaos that sucked all the liquidity from the crypto markets.

Stablecoins, at that time, were cryptocurrency’s main liquidity engine. But a large part of the market pulled the plug.

Tether has survived a $16 billion monthlong attack “bank run” Circle net burnt over $30 billion USDC in the period June 2022-November 2023.

At the same time, Paxos was winding down Binance stablecoin BUSD — redeeming about $20 billion worth of stablecoins over a 12 month period. Coincidentally, this period ended at the same time as bitcoin was gaining momentum in late 2023.

It’s evident that liquid staking, restaking, and resolving tokens helped to plug the leak during the liquidations and bankruptcies.

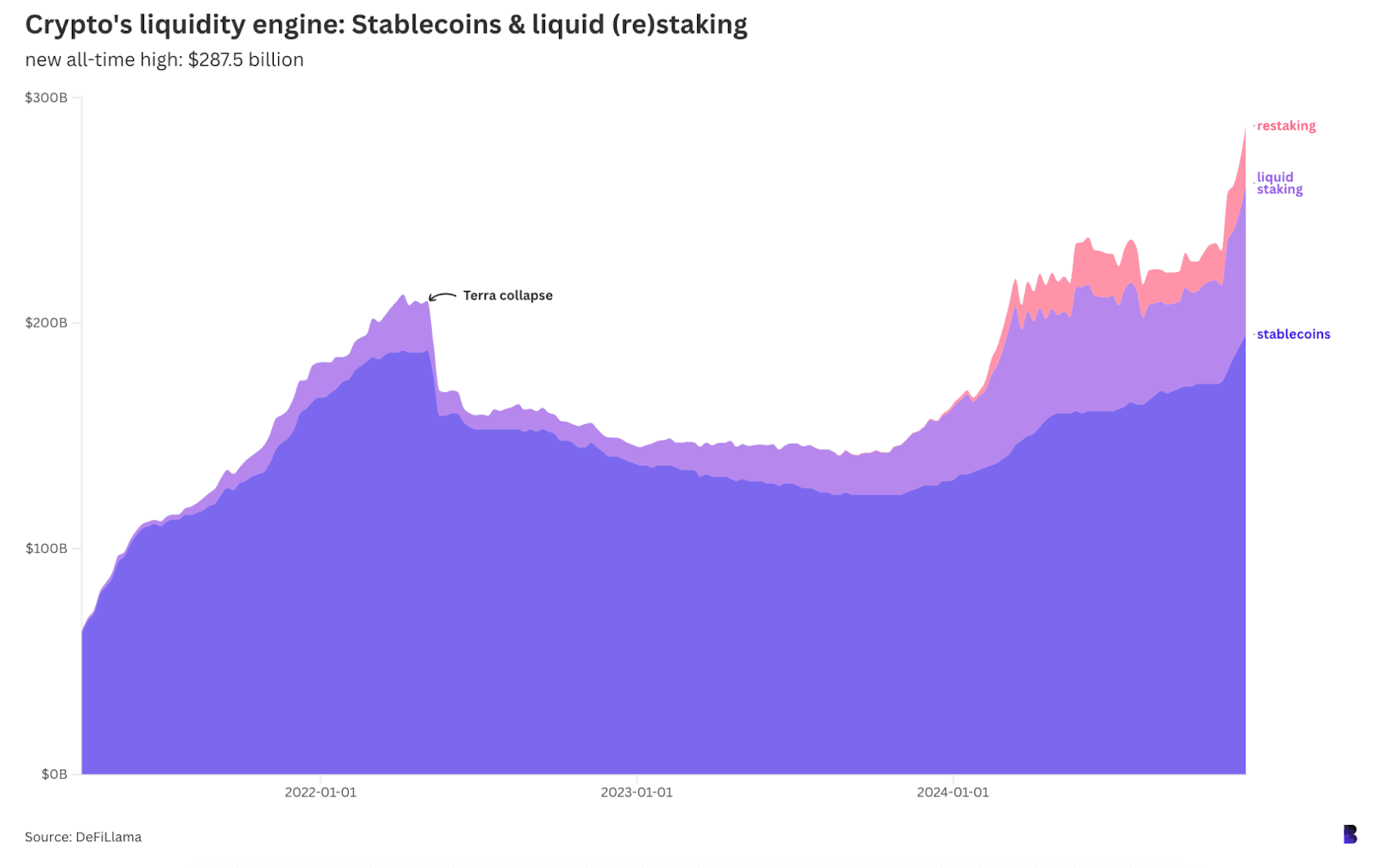

This graph plots the value of stablecoins, (blue), alongside tokens for liquid staking and restaking since Q1-2021.

Crypto’s liquidity engine is formed by combining the three different token classes.

Notice that as tens of billions of dollars were being drained from crypto via stablecoin redemptions — starting with Terra and into the middle of the chart — liquid staking tokens expanded to mitigate those losses.

The stablecoin redemption pattern was reversed at the first sign of it. This triggered the liquid (re-)staking of tokens.

Terra now seems like a mere blip. The supply of stablecoins has just reached a record high, close to $194 Billion (about 6 billion more than before Terra). At the same time, liquid staking tokens and restaking are at an all-time peak combined value of $92.5 Billion.

That makes crypto’s liquidity engine nearly $300 billion deep — with apparently no Maelstrom in sight.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.