Howdy!

For some (almost alarming) morning reading, check out this University of Toronto-University of Miami study on the political and psychological makeups crypto users. If you want to read something interesting (and somewhat alarming?) for your morning reading, then check out the University of Toronto-University of Miami study about crypto users’ political and psychological makeup.

Cryptocurrency: Owning it “is more strongly related to experiencing negative emotions…than positive,” The paper says.

It’s not a question! Anyways:

The prediction markets prepare for the post-election slump

Polymarket is a poster child for the app era that Crypto wants to create.

The crypto-based prediction market — which slogged through three years of “meh” volume numbers — has had a banner 2024. Both its users and volume are at an all-time high. Its wunderkind CEO Shayne Cplan revealed that two funding rounds brought in $70 million.

Polymarket reached $400 million trading volume in August from more than 50,000 traders. Platform uses Polygon and Ethereum, but Solana is also gaining some attention. Drift, a derivatives trading exchange launched last week a prediction marketplace that already has more than $2.65 million worth of bets.

Bridget Harris, from Founders Fund, wrote that there are also fiat-based predictions markets, but the crypto technology allows Polymarket (and its ilk) to operate globally, mitigate chargeback risks, and coordinate more easily across different banking regimes and regulating jurisdictions. Polymarket’s website is also prettier and more user-friendly than those of its competitors.

However, these halcyon years may be ending soon, with most of the prediction market’s volume being spent on US presidential elections on Nov. 5th.

“I’m struggling to understand crypto’s obsession with prediction markets,” Nigel Eccles (former co-founder and co-founder BetHog) from Solana, wrote yesterday in X. “We’ve had them for over 20 years and their application beyond elections has been exceptionally limited.”

The problem, from a usership standpoint, is that the election results are the only events in the news that have a high betting value.

Eccles has stated elsewhere that non-election news or sporting events are prone to unpredictable outcomes, or they resolve in “messy” Polymarket’s comments section about the market for RFK Jr. “drop out” The race for the presidency after he “suspended” His campaign)

Other ways of predicting events, such as Fed rate cuts, are also possible. “trade” Buy tech stocks to buy more liquid market shares. Those who are looking to gamble will probably prefer markets with a quicker resolution. “Will the Sonic blockchain launch before 2025?”

Kyle DiPeppe, CEO of Hedgehog Markets and a Solana-based forecasting market was asked by me how he planned to expand his prediction market following the elections in a forthcoming episode of Lightspeed.

DiPeppe Bet, as well as Drift Bet, are both investigating DeFi-based applications for betting on prediction markets. Drift is one example where trades are automatically rewarded while waiting for markets to settle.

DiPeppe agrees that the presidential election cycle tends to be a high-water mark for prediction markets. However, Hedgehog will experiment with various market styles in order to engage users. Markets that are peer-to-peer and “create your own market” Both labels are “coming soon” On the homepage of the platform.

Other people in Solana make even bigger bets as to how prediction market innovation might happen. Paradigm led the $2.2 million round of funding for MetaDAO. This governance platform is experimenting with futarchy or market-based governance. Futarchic entities make decisions based upon what the market thinks will benefit their project token prices.

The idea is still niche. There are less than 30 active proposals on the futarchy platform, with zero currently in use.

All of this may remain niche. It will probably be confined to group chats with nerds and betting on pre-elections. This is not necessarily bad: ABC News, the company that owns FiveThirtyEight (a popular platform for election predictions), recently updated its model without disclosing the changes to its method.

Polymarket takes the guesswork out of it. It’s possible to see the opinions of a group of people who have a stake in the outcome of an election. It’s not a very interesting use of prediction markets. But if CNN were to show how the odds for Polymarket changed in real-time during and after a presidential debate, then that could be an application that even your grandmother would understand.

Zero In

$5 million

This is the current market cap of Ethena USDe, just a few weeks after its launch. DeFiLlama’s data shows that the so-called “synthetic dollar” is the 6th-largest stabilcoin, but the dashboard does not yet track USDe. This figure used to be closer to $6.55 million but dropped by $2 million in the last 24 hours.

Ethena offered rewards in the form of points to Orca, Drift and Kamino as a way to promote its stablecoin. Kamino received $4.1 million USDe.

Ethena has also stated that they would be open to adding Solana’s name to the list of assets to support governance. However, a formal proposal is yet to come.

The Pulse

We’re trying out a brand new format in this edition. “Bullish or Bearish?”We examine the opposing views of members of our community.

As traders leap between chains, the Memecoin Wars escalate.

Pump.fun by Solana, a memecoin leader, saw a dramatic drop in recent activity. In the last two week, there has been a 47% drop in daily launches. Tron SunPump is gaining momentum, led by Justin Sun. This change raises the following question: is competition good for blockchain, or does Tron just clone successful markets without adding real innovation?

Bull Take

Competition drives progress. Although Tron has a historically dubious image, competition between SunPump & Solana’s Pump.fun may drive both platforms towards innovation and improvement. This is seen by some as a positive development that could push both platforms forward. As @kevmeta_x noted, “There’s money to be made on both chains; Tron is pushing hard right now, to be honest.”

According to @YamiYugiAlpha “I think having these chains compete for investors to use their chain for memecoin trading is good for the whole market. It forces them to work hard to make sure their chain is top notch for trading these coins.”

The posting by @A1wordsmith highlights the competition. “SunPump just knocked Pump(.)fun off its pedestal in the memecoin space. Now, that’s some healthy competition!”

Bear Take

Tron has a long history of problematic moves, which makes many community members wary about its sudden growth in the memecoin industry. Justin Sun’s long history of questionable moves has led to skepticism regarding SunPump’s legitimacy and longevity. @PsychedelicBart stated it bluntly. “Justin Sun is one of the worst scammers in the industry. He steals ideas, rebrands them, and dumps on retail. These are simple facts.”

Jayde Herrick, @JaydeHerrick_, expressed concern about this change, saying: “It’s just the so-called influencers and all the scammers moving hype to a new chain so they can continue to rug liquidity from everyone.”

The question was asked in a pointed manner by @notmissing_ “Are we just going to move from chain to chain on a never-ending memecoin carousel? Solana, Base, Telegram, TRON. In my opinion, this won’t bring growth to the space.”

One Good DM

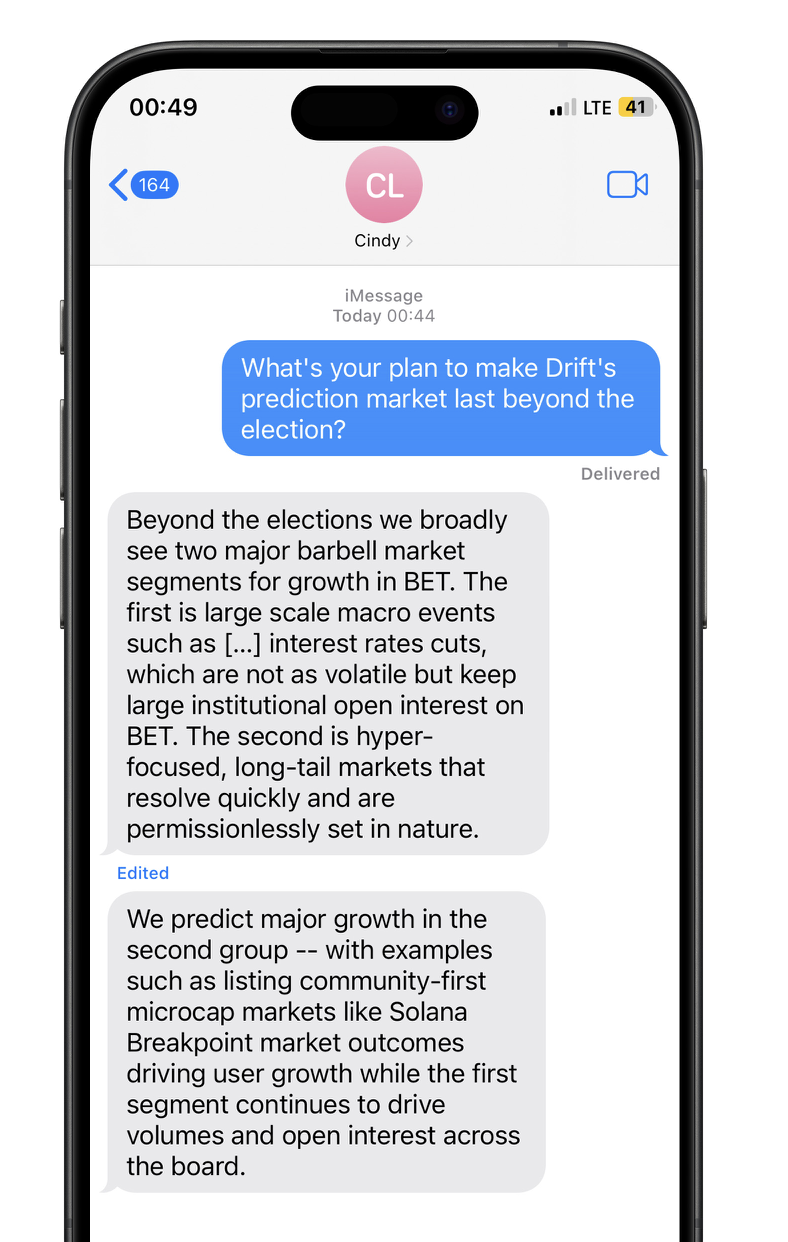

You have received a message Cindy LeowCo-founder and co-founder The Drift:

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.