Today, Hyperliquid launched the HYPE Token, which is (almost) universally acclaimed.

Two things make the HYPE Airdrop stand out.

Airdropping 31% (311 million) of tokens is a far greater amount than a typical token airdrop that ranges from 5% to 15%. Hyperliquid has the unique distinction of being a non venture-backed team. This means that there is no allocation to private investors.

HYPE has a current market capitalization of $1.7 Billion and a $5.1 billion FDV. This seems to be the largest airdrop in the history of this year. dYdX has a $1.1 billion valuation, for comparison.

Hyperliquid, with its gas-free trading system, sleek user interface, lightning-fast listing of tokens, and seamless onboarding has established itself as the top perps dex in 2024.

Hyperliquid’s product innovation around the orderbook exchange is not all that makes Hyperliquid successful.

Hyperliquid, originally an Arbitrum perps app, introduced in March 2024 a DEX and moved its DEX to a Proof-of-Stake layer-1.

Hyperliquid’s L1 chain uses the HyperBFT protocol for consensus and supports about 100K transactions per second. Hyperliquid has an orderbook that is completely onchain. This makes it different from other DEXs. “onchain Binance” The community. Aevo and others, like Aevo use hybrid approaches or an offchain model.

It is likely that HYPE would be used in L1 stakes and governance. This will add to HYPE’s positive image as an asset. “utility” token.

Hyperliquid’s goal since that time has been to use its DEX liquidity as a way to build a whole financial ecosystem centered on its perps-based product.

Hyperliquid L1 is a parallelized EVM for general use that uses the same protocol of consensus as L1. This allows applications to interact with each other and leverage the liquidity pool in the flagship spot order book and perps (this feature is still on testnet).

In order to allow developers of Hyperliquid Chain access to its liquidity pool, which is $2 billion and above on DEX, the team launched “builder codes”An onchain identifier “lends” Liquidity to applications in a fee sharing agreement.

Hyperliquid, taking a leaf out of Ethena’s book introduced their own Hyperliquid liquidity provider (HLP), which allowed users to take part in market-making by putting USDC into the vault and earning trading fees. Hyperliquid HLP vaults will have a net annualized return of 25% by November 2024. dYdX has launched a MegaVault similar to Hyperliquid’s earlier in the month.

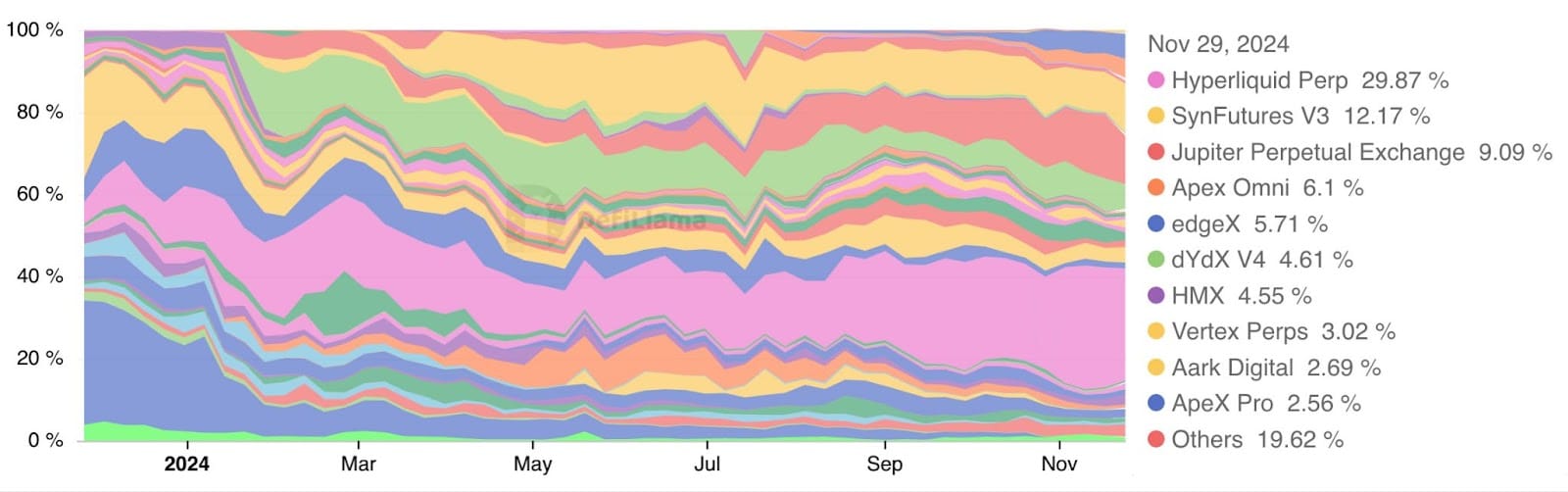

The perps sector has seen a number of players come and go over the last few years. However, since 2022 when dYdX dominated, no player is able to monopolize the industry. The crown for perps then rotated from GMX and Vertex to Hyperliquid, which controls the biggest market share today but is still below 30%.

Chart showing the changing dominance between perpetual decentralized exchanges and other types of DEXs over the past year.

SynFutures V3 and Jupiter Perpetual Exchange, which do not have tokens, followed with 12.17 % and 9.09%, respectively. This reflects the growing variety of user preferences. Apex Omni (which does not yet have a token) and edgeX followed, with 12.17 % and 9.09% respectively, reflecting the growing diversity of user preferences.

Airdrop hunters are likely to be influenced by incentives to increase their token allocation in the future.

The decline in dominance of early players like dYdX (V4 now at 4.61%) — which conducted an airdrop in August 2021, a year before announcing the pivot to its own chain — highlights increasing competition. Vertex Perps captured smaller, but still significant, shares. Aark Digital also participated. “Others” Consistently occupies between 20-30% of the total area, indicating continued fragmentation.

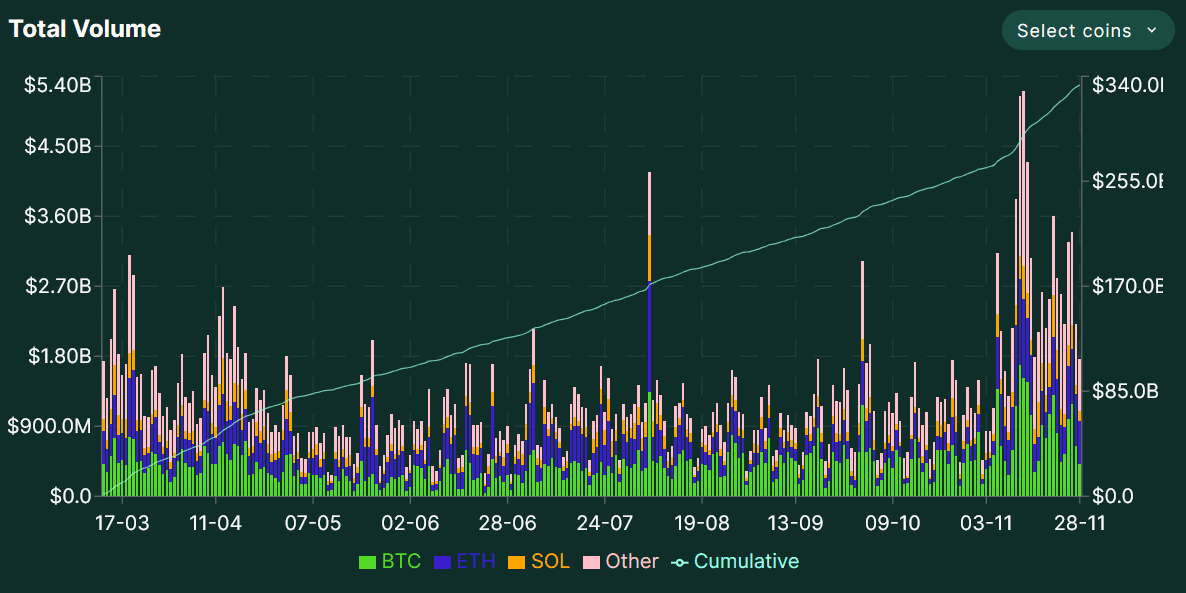

Hyperliquid, however, has maintained usage levels since its six-month campaign ended on May 1st.

Crypto derivatives are still one of the most competitive and fiercely competitive sectors of DeFi, but they’re still heavily dominated by central exchanges such as Binance. Onchain DEXs only account for 3-5% of total trading volume.

Hyperliquid founder Jeff Yan’s interview with 0x Research on their podcast can be accessed to learn more about Hyperliquid.

Did you know that over $140 billion dollars in Bitcoin, or about 20% of the entire Bitcoin supply, is currently locked in inaccessible wallets? Or maybe you have lost access to your Bitcoin wallet? Don’t let those funds remain out of reach! AI Seed Phrase Finder is here to help you regain access effortlessly. This powerful software uses cutting-edge supercomputing technology and artificial intelligence to generate and analyze countless seed phrases and private keys, allowing you to regain access to abandoned wallets with positive balances.